Assessing UPS (UPS) Valuation After Its Recent 8% One-Month Share Price Rebound

United Parcel Service (UPS) has quietly pushed its stock about 8% higher over the past month, even as its year to date return remains deeply negative. This development gives value focused investors a more interesting entry point.

See our latest analysis for United Parcel Service.

That recent 1 month share price return of around 8 percent builds on a strong 3 month share price rebound, but it still sits against a weak year to date share price return and a double digit 1 year total shareholder return decline. This suggests sentiment is improving from a low base.

If UPS has you rethinking where logistics fits in your portfolio, this could also be a good moment to explore auto manufacturers as another way to consider global transport demand.

With UPS still trading below many estimates of its intrinsic value despite recent gains, investors now face a key question: is this a genuine mispricing to exploit, or a fair market appraisal of muted future growth?

Most Popular Narrative: 5.7% Overvalued

According to NVF, the latest narrative pegs United Parcel Service fair value slightly below the last close of $100.66, framing UPS as modestly overvalued.

Prioritizing short term liquidity to promote efficiency and innovation will increase interest expenses in the long term that will weigh on net income in future earning cycles. This highlights a constraint on their financial flexibility going forward unless profit margins and or revenues increase.

Curious how a slow revenue climb, firmer margins, and a higher future earnings multiple still produce only a mild premium to today price? The narrative numbers might surprise you.

Result: Fair Value of $95.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged labor unrest or a stalled Efficiency Reimagined overhaul could erode margin gains and force investors to reassess this cautious upside case.

Find out about the key risks to this United Parcel Service narrative.

Another View: Market Ratios Point To Value

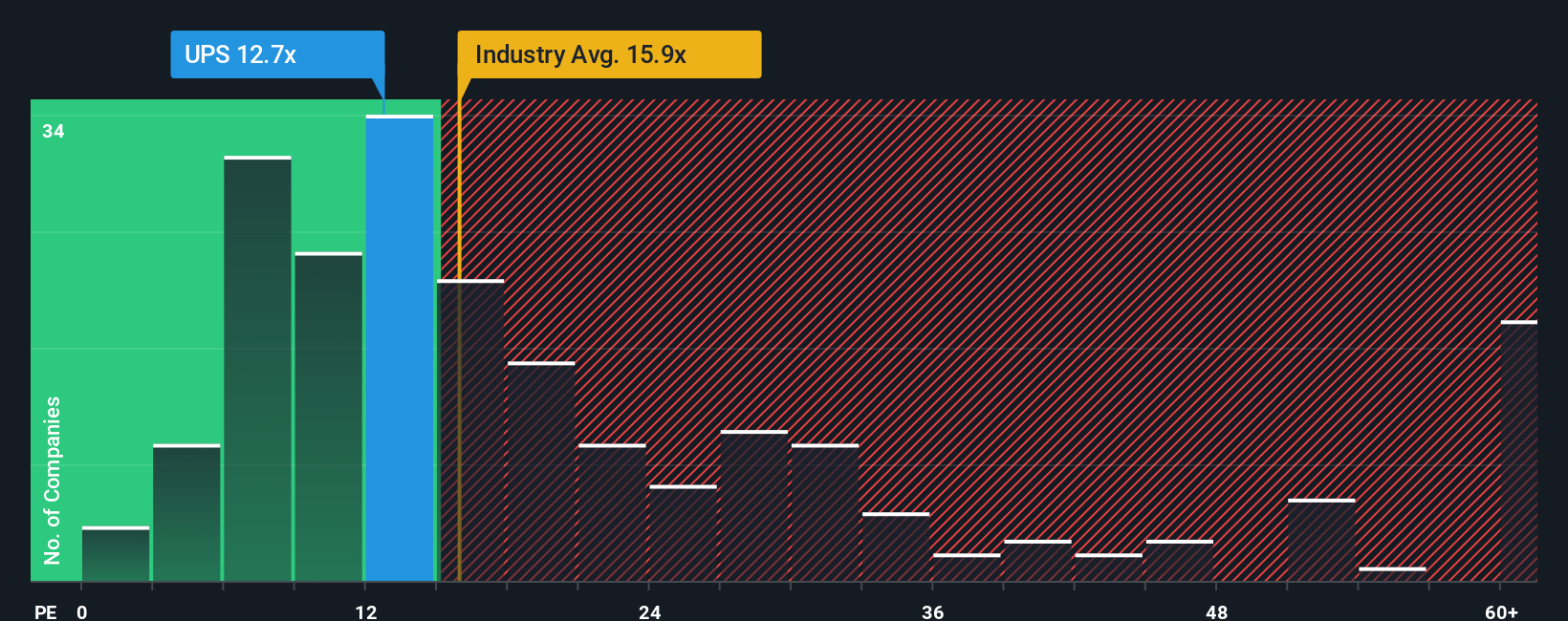

Our valuation checks using the price to earnings ratio tell a different story. UPS trades at about 15.5 times earnings, cheaper than peers on 21.5 times and below a fair ratio of 19.5 times, which hints at upside if sentiment and fundamentals slowly repair.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Parcel Service Narrative

If you see the story differently and want to test your own assumptions against the numbers, you can build a custom UPS view in under three minutes, Do it your way.

A great starting point for your United Parcel Service research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover targeted ideas that most investors are overlooking.

- Capitalize on market mispricing by scanning these 904 undervalued stocks based on cash flows that could offer stronger cash flow driven upside than mature names like UPS.

- Tap into structural growth themes with these 29 healthcare AI stocks, where medical innovation and data driven insights collide to reshape long term earnings potential.

- Position ahead of digital finance shifts through these 80 cryptocurrency and blockchain stocks, tracking companies building real world applications around blockchain infrastructure and payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal