Luckin Coffee (OTCPK:LKNC.Y): Revisiting Valuation After Aggressive Expansion and Prospective U.S. Relisting

Luckin Coffee (OTCPK:LKNC.Y) is back in the spotlight after its aggressive expansion into North America and new Asian markets, as well as plans for a U.S. relisting that could reshape how investors value the stock.

See our latest analysis for Luckin Coffee.

Even with the latest share price at $34.25 and a softer 30 day share price return of negative 6.88 percent, Luckin Coffee’s three year total shareholder return of 60.12 percent and five year total shareholder return above 300 percent suggest momentum is still firmly positive as investors weigh its turnaround alongside fresh growth ambitions.

If Luckin’s resurgence has you watching the consumer space more closely, this could be a good moment to explore fast growing stocks with high insider ownership for other fast growing opportunities with skin in the game.

With analysts seeing nearly 45 percent upside to their price target and earnings still compounding at a healthy clip, the key question now is whether Luckin remains undervalued or if the market already reflects its next growth chapter.

Most Popular Narrative Narrative: 31% Undervalued

With the narrative fair value set near $49.63 against Luckin Coffee's $34.25 last close, the valuation case leans heavily on sustained growth and only modest margin erosion.

Analysts expect earnings to reach CN¥6.9 billion (and earnings per share of CN¥19.18) by about September 2028, up from CN¥3.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CN¥5.5 billion.

Want to see how ambitious growth, slightly slimmer margins, and a lower future earnings multiple can still justify a higher value than today? The narrative spells it out.

Result: Fair Value of $49.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Luckin's rapid store expansion and heavy reliance on subsidized delivery could pressure margins and undermine the growth assumptions behind this undervaluation case.

Find out about the key risks to this Luckin Coffee narrative.

Another View: Market Multiple Sends A Different Signal

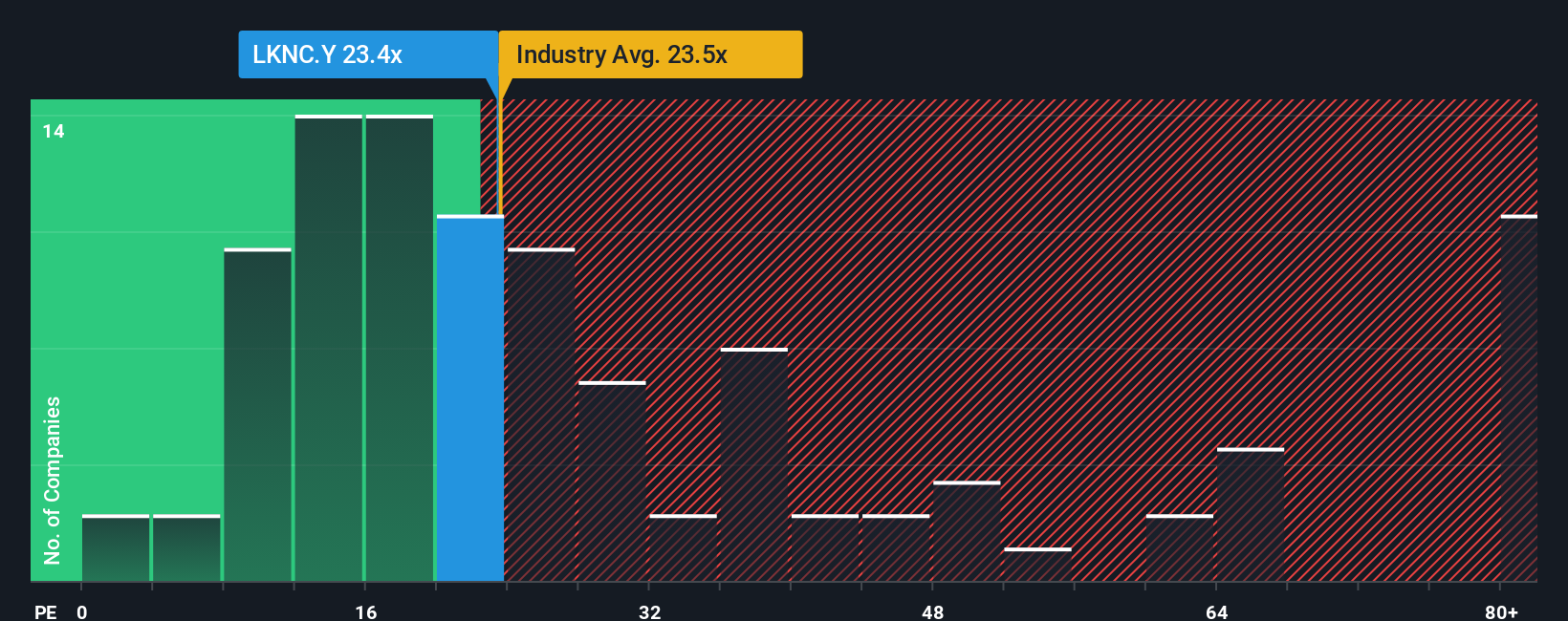

Our price to earnings lens tells a cooler story. At 19.7 times earnings, Luckin trades not just below US hospitality peers on 22 times but also below its own 26.5 times fair ratio benchmark, implying the market is still discounting execution risk despite fast growth and high returns on equity. Is that caution misplaced or just sensible?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Luckin Coffee for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Luckin Coffee Narrative

If you see the story differently or want to test your own assumptions using the numbers, you can craft a personalized view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Luckin Coffee.

Ready for more investing ideas?

Before you move on, give yourself the edge by lining up your next opportunities with a curated set of stocks built around specific themes and strengths.

- Capture potential multi baggers early by scanning these 3630 penny stocks with strong financials that already show strong balance sheets and improving fundamentals.

- Ride structural growth in automation and algorithms by tapping into these 24 AI penny stocks positioned at the heart of the AI acceleration.

- Lock in compelling value by zeroing in on these 904 undervalued stocks based on cash flows where cash flow strength points to mispriced long term opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal