Is It Too Late to Consider Subsea 7 After Its Strong Multi Year Share Price Rally?

- If you are wondering whether Subsea 7 is still good value after its big run, you are not alone. This stock has been catching more eyes on the Oslo market lately.

- The share price has climbed 5.6% over the last week, 4.2% over the past month and is now up 24.3% in the last year, with longer term holders sitting on gains of 108.9% over 3 years and 178.8% over 5 years.

- Behind these moves, investors have been reacting to a stronger offshore project pipeline and ongoing contract wins in subsea installation and maintenance, which support expectations for more stable cash flows. At the same time, broader energy transition spending and offshore activity have improved sentiment towards specialist engineering names like Subsea 7, helping re rate the stock.

- Even after this rally, Subsea 7 only scores 2 out of 6 on our undervaluation checks. In this article we will unpack what different valuation approaches say about that score and hint at a more holistic way to think about value that we will come back to at the end.

Subsea 7 scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Subsea 7 Discounted Cash Flow (DCF) Analysis

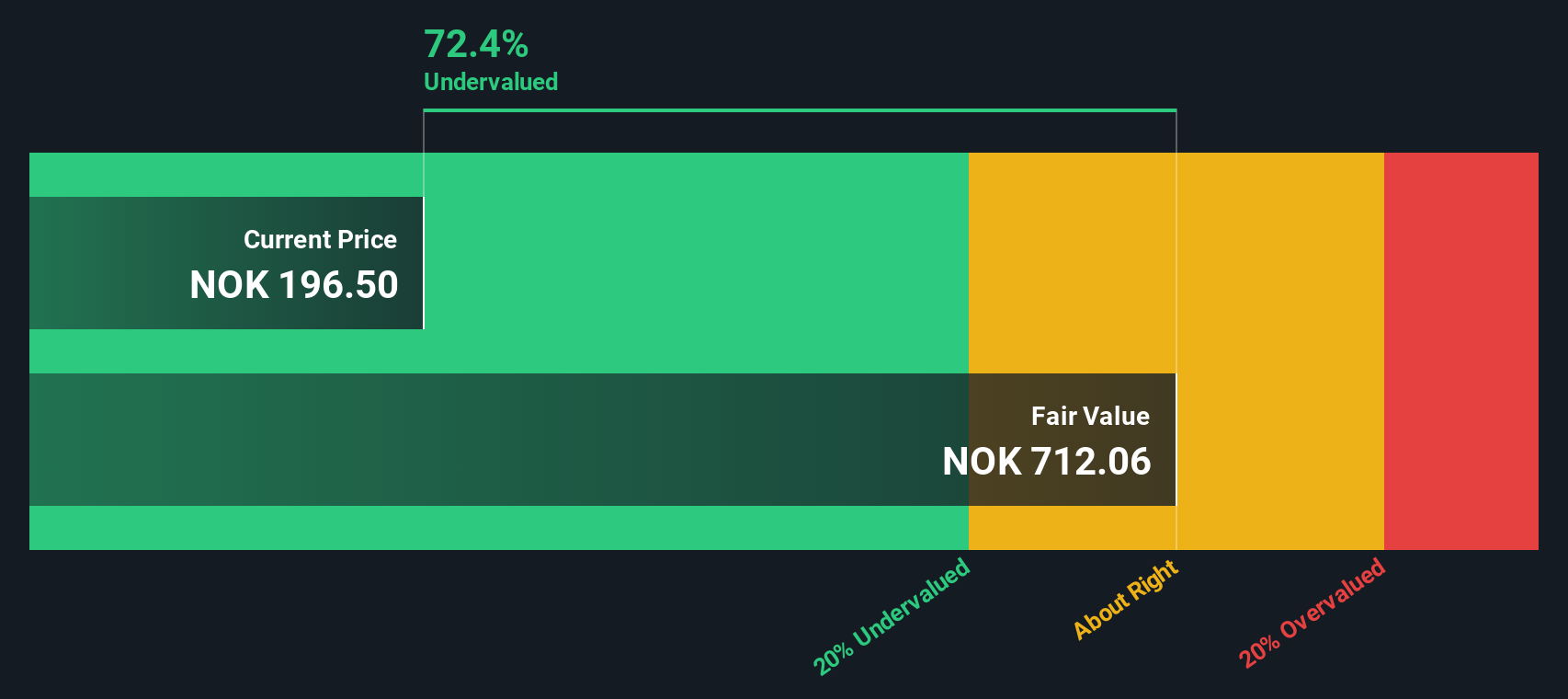

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting those back to a present value. For Subsea 7, the model uses a 2 Stage Free Cash Flow to Equity approach based on cash flow projections.

The company generated last twelve month free cash flow of around $722.4 Million. Analyst estimates and subsequent extrapolations by Simply Wall St see this rising gradually, with projected free cash flow of about $1.01 Billion in 2035 as offshore project activity continues to support the business. Each of these future cash flows is discounted back to today using an appropriate rate to reflect risk and the time value of money.

Adding those discounted streams together results in an estimated intrinsic value of roughly $708.9 per share. Based on this DCF, Subsea 7 screens as about 71.1% undervalued relative to its current market price, which suggests investors may still be heavily discounting its future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Subsea 7 is undervalued by 71.1%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: Subsea 7 Price vs Earnings

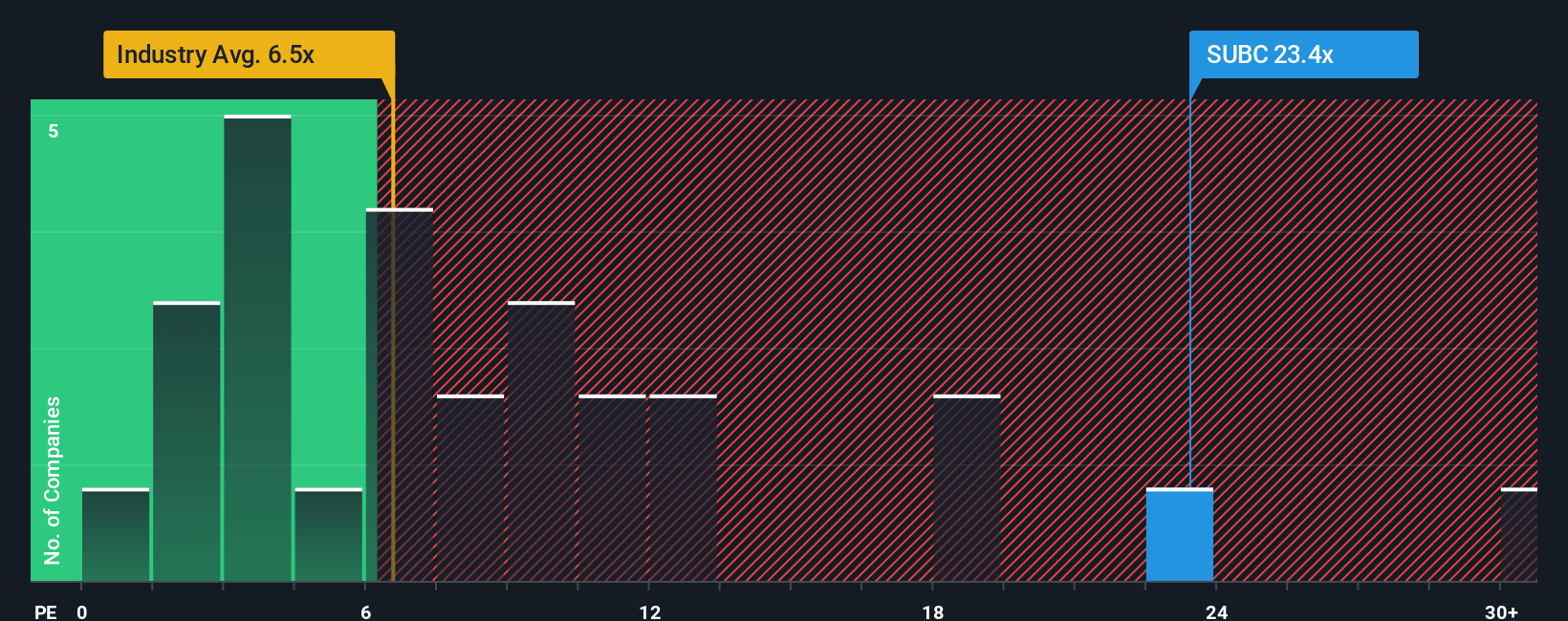

For profitable companies like Subsea 7, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay today for each unit of current earnings. A higher PE can be justified when a business is expected to grow faster or is seen as lower risk. In contrast, slower growth or higher uncertainty usually calls for a lower, more conservative multiple.

Subsea 7 currently trades on a PE of around 21.1x. That is well above the Energy Services industry average of about 5.9x and also richer than the peer group average near 12.5x. This suggests the market is already baking in stronger prospects than for many rivals. To refine this view, Simply Wall St uses a proprietary Fair Ratio, which estimates what PE might be appropriate after factoring in elements like earnings growth, margins, industry dynamics, company size and specific risks.

This Fair Ratio for Subsea 7 is 10.5x, materially below the current PE of 21.1x. On this basis, even allowing for its quality and growth profile, the shares look expensive relative to what would typically be warranted.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Subsea 7 Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company with the numbers behind its valuation. A Narrative is your story about a business, expressed through assumptions about its future revenue, earnings and margins, which then flows through to a financial forecast and a clear Fair Value estimate. On Simply Wall St, millions of investors build and share Narratives on the Community page, making it an easy, accessible tool you can use without needing to be a spreadsheet expert. Once you have a Narrative, you can quickly compare its Fair Value to the current share price to consider whether Subsea 7 may be a buy, hold or sell for your own situation. Narratives are also dynamic. They automatically update when fresh information such as earnings, guidance or major contract news is released, so your Fair Value stays relevant. For Subsea 7, for example, one Narrative might see fair value near NOK 156 if growth and margins disappoint, while another could justify around NOK 290 if offshore demand, merger synergies and profitability all play out more strongly.

Do you think there's more to the story for Subsea 7? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal