Vertex Pharmaceuticals (VRTX): Reassessing Valuation After Positive CASGEVY Pediatric Data and Kidney Drug Breakthrough Status

Vertex Pharmaceuticals (VRTX) just delivered a busy update, with encouraging pediatric CASGEVY data, progress toward global filings, and an FDA Breakthrough Therapy nod for kidney drug candidate povetacicept, all underscoring its expanding pipeline.

See our latest analysis for Vertex Pharmaceuticals.

Those updates are landing against a strong backdrop, with the share price at $462.99 after a 30 day share price return of about 9 percent and a 62 percent three year total shareholder return. This suggests momentum is still building rather than fading.

If Vertex’s story has you thinking more broadly about biotech, this could be a good moment to explore other healthcare stocks that might fit your portfolio’s risk and growth profile.

With shares already up strongly and the stock trading only modestly below analyst targets, the key question now is whether Vertex’s accelerating pipeline still leaves upside on the table or if the market is already pricing in that growth.

Most Popular Narrative Narrative: 5% Undervalued

With Vertex closing at $462.99 versus a narrative fair value near $485, the gap is modest but meaningful, anchored in compounding earnings assumptions.

Commercial success and broad payer coverage for recent launches, particularly JOURNAVX and CASGEVY, are setting the stage for larger market uptake and eventual margin improvement as early launch support programs unwind and operational leverage is realized, positively impacting net margins and earnings.

Curious how steady, mid single digit top line expansion, widening margins and a rerated earnings multiple combine to support this valuation view? The full narrative walks through the earnings trajectory, margin build and future PE logic that underpin this fair value call without assuming runaway growth.

Result: Fair Value of $485.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on cystic fibrosis therapies and uncertain outcomes in newer kidney and gene editing programs could quickly challenge this constructive valuation picture.

Find out about the key risks to this Vertex Pharmaceuticals narrative.

Another Angle on Value

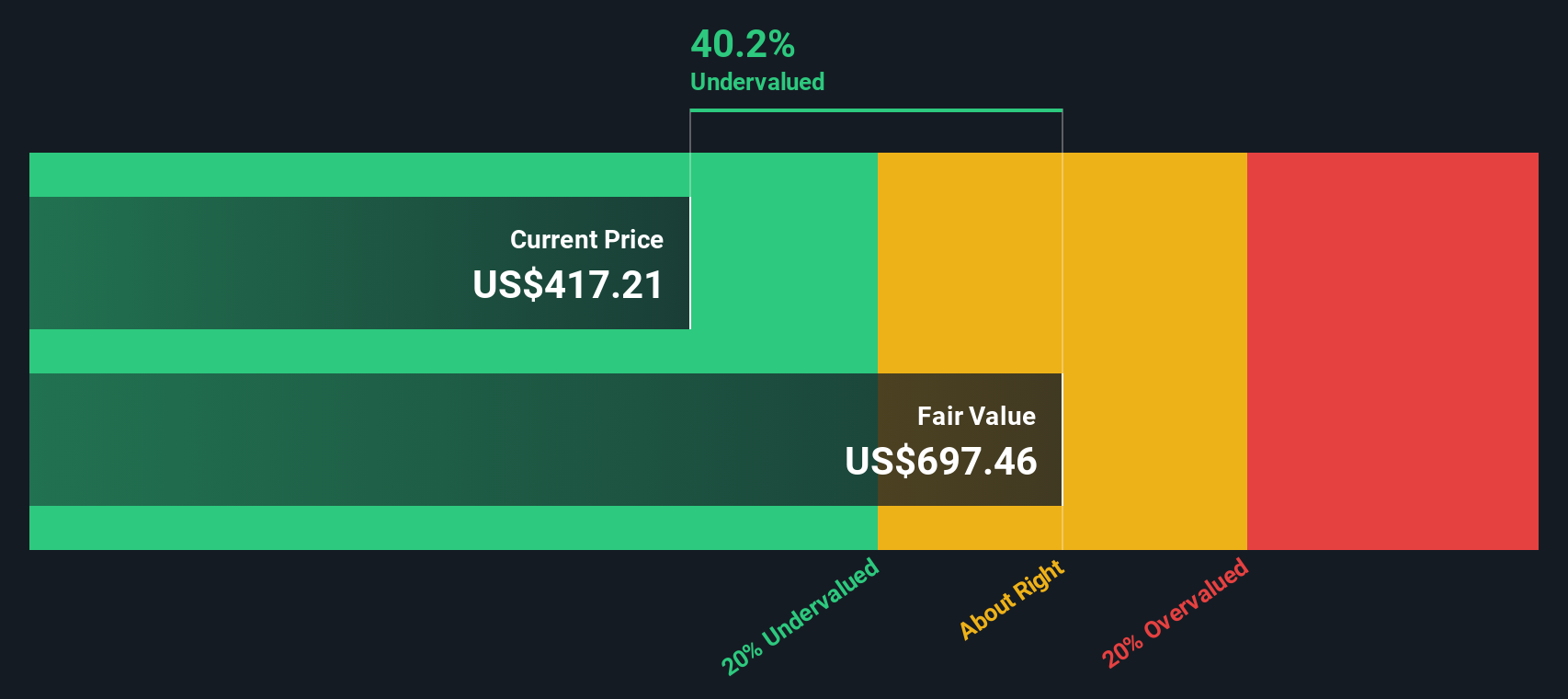

That 5 percent undervalued narrative looks modest next to our SWS DCF model, which pegs fair value near $712 per share, implying the stock could be roughly 35 percent below intrinsic value. If the cash flows play out, is the market being too cautious on Vertex’s pipeline risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Vertex Pharmaceuticals Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertex Pharmaceuticals.

Ready for more actionable investment ideas?

Use the Simply Wall Street Screener now to uncover fresh stock opportunities that fit your strategy, or you risk watching the next big winners pass you by.

- Capture potential mispricings early by scanning these 904 undervalued stocks based on cash flows that the market may be overlooking despite strong fundamentals and attractive cash flow profiles.

- Tap into the next wave of innovation by targeting these 24 AI penny stocks positioned to benefit from rapid advances in artificial intelligence across multiple industries.

- Strengthen your income stream by focusing on these 10 dividend stocks with yields > 3% that can help balance growth ambitions with reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal