Reddit (RDDT): Revisiting Valuation After a 16% One-Month Share Price Climb

Reddit (RDDT) has quietly outperformed over the past month, climbing roughly 16% while still giving back some gains over the past 3 months. This setup has investors reassessing its valuation.

See our latest analysis for Reddit.

That 15.8% 1 month share price return has come after a choppy few months, leaving Reddit still up strongly on a year to date share price basis as investors weigh its growth narrative against a richer valuation and shifting risk appetite.

If Reddit has caught your attention, it is also a good moment to see what else is gaining traction in tech and digital platforms by exploring high growth tech and AI stocks.

With shares still up more than 36% year to date and trading only modestly below analyst targets, investors are asking whether Reddit’s rapid growth and improving profitability leave upside ahead or if the market has already priced in its future.

Most Popular Narrative Narrative: 5.8% Undervalued

With Reddit closing at 225.85 dollars against a narrative fair value near 239.76 dollars, the story leans toward modest upside grounded in fast improving fundamentals.

The value of Reddit's data for AI/LLM training is gaining wider recognition, as demonstrated by their data licensing deals and status as a top-cited source for LLMs; Reddit's growing corpus and unique conversation base position the company to expand high-margin data licensing revenues in the years ahead.

Want to see why this narrative leans into accelerating revenue, rising margins, and a punchy future earnings multiple to back that fair value? The full breakdown reveals the core growth assumptions, the profit step change, and the valuation bridge that ties them together, but keeps one crucial expectation hidden unless you read on.

Result: Fair Value of $239.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer user engagement trends, along with uncertainty around the durability of AI data licensing revenues, could quickly challenge the upside implied by this narrative.

Find out about the key risks to this Reddit narrative.

Another View: Rich Multiples Cloud the Picture

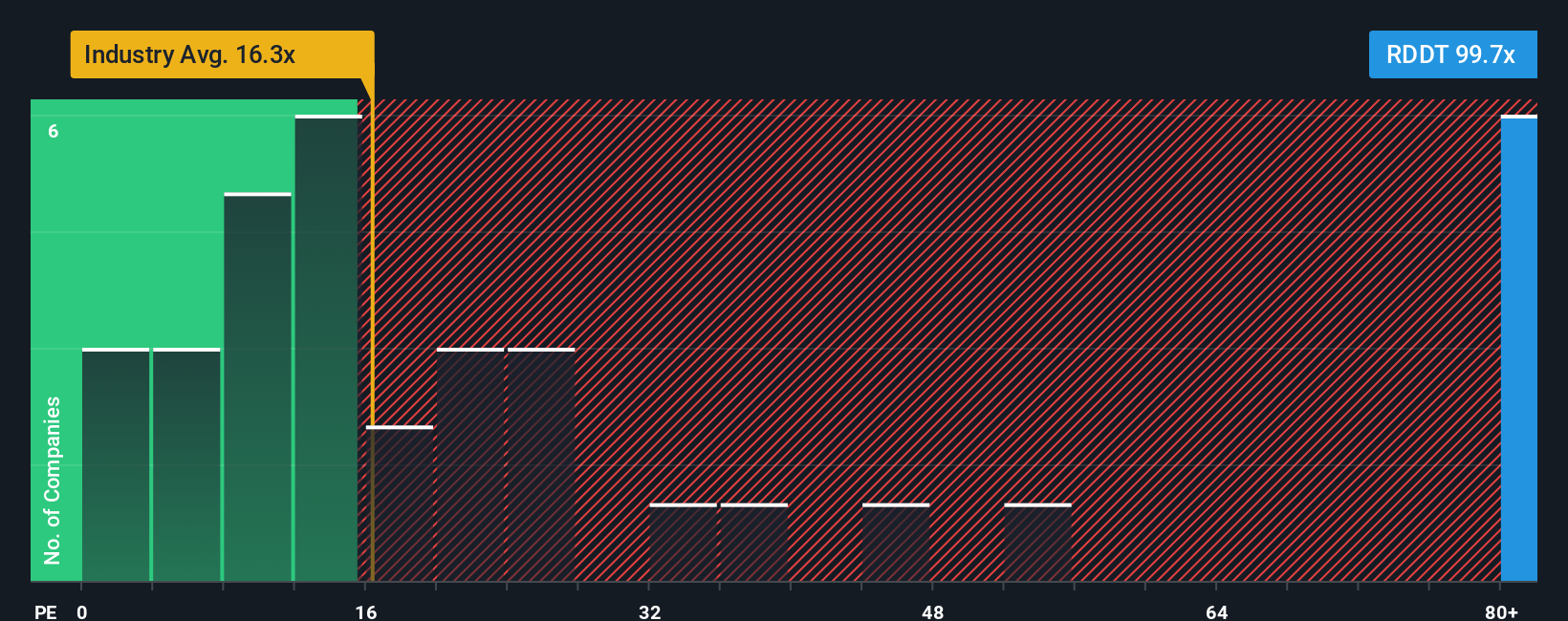

Our fair value work suggests Reddit is 33.1 percent undervalued, yet its 122.6 times price to earnings ratio towers over both the 37.7 times fair ratio and peers at about 38 times. If sentiment cools, could that valuation premium unwind faster than the growth delivers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Reddit Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a complete Reddit story in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Reddit.

Ready to uncover your next opportunity?

Reddit is just one chapter in today’s market story, and you will miss real potential if you stop here instead of scanning fresh ideas with Simply Wall St’s powerful screener.

- Capture potential big movers early by checking out these 3630 penny stocks with strong financials that already back their story with solid financial strength.

- Position your portfolio for tomorrow’s breakthroughs by targeting these 24 AI penny stocks shaping the next wave of intelligent technology.

- Lock in quality at a sensible price through these 904 undervalued stocks based on cash flows that still trade below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal