Is HSBC (LSE:HSBA) Overvalued After Its Recent Share Price Rally?

HSBC Holdings (LSE:HSBA) has quietly pulled off a strong run lately, with the share price gaining about 12% over the past month and roughly 15% in the past 3 months.

See our latest analysis for HSBC Holdings.

That recent surge sits on top of a much bigger move, with the share price now at $11.754 and a year to date share price return of around 50 percent. The one year total shareholder return of roughly 61 percent suggests momentum is still firmly building as investors reassess HSBCs earnings power and risk profile.

If HSBCs strong run has you thinking about what else could surprise to the upside, it might be worth exploring fast growing stocks with high insider ownership as potential next candidates for your watchlist.

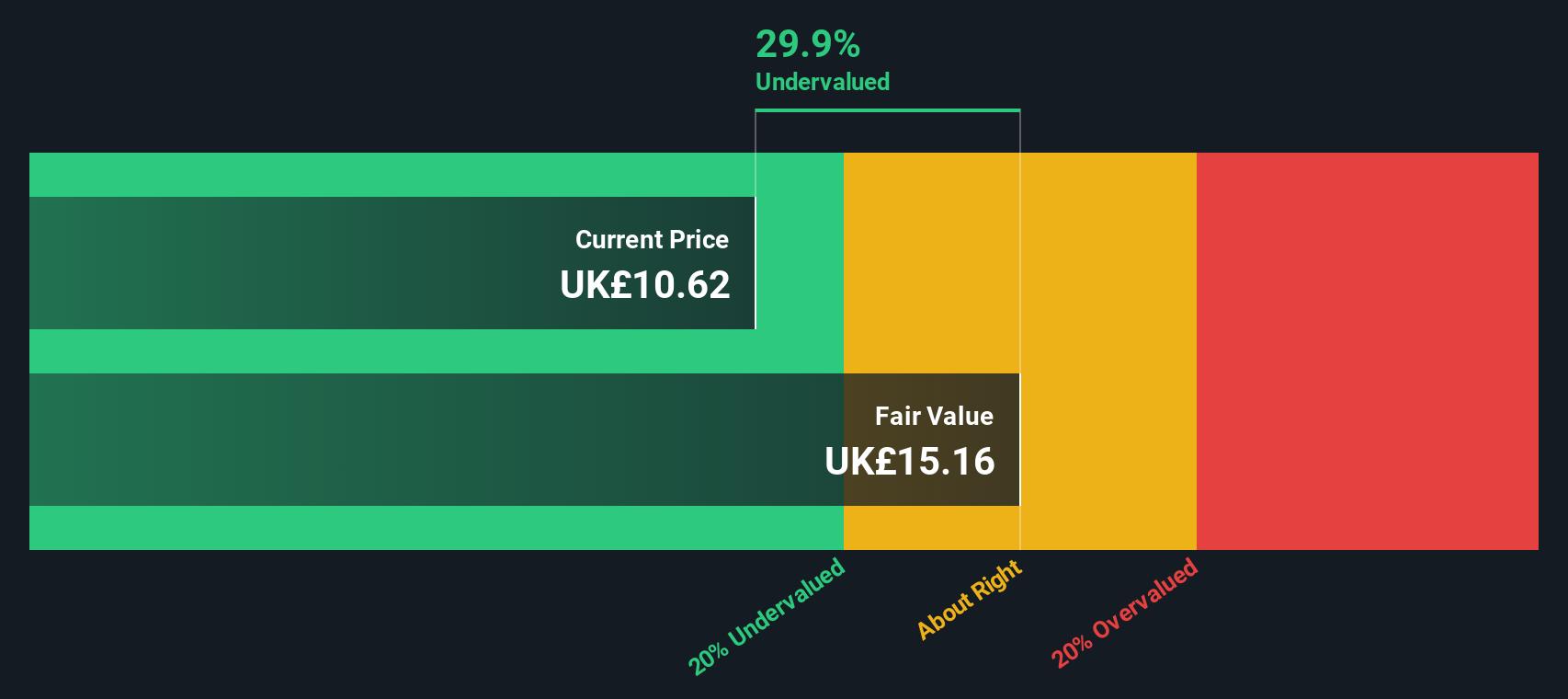

With the shares already rallying hard and even nudging past the average analyst target, the key question now is whether HSBC remains undervalued on its fundamentals or if the market is already pricing in its future growth.

Most Popular Narrative: 8% Overvalued

With HSBC Holdings last closing at $11.754 against a narrative fair value of about $10.88, the prevailing view implies the shares have run ahead of fundamentals for now.

The strategic shift away from underperforming and non core businesses in Europe and the Americas, and redeployment of capital into high return businesses in Asia and the Middle East, is expected to improve overall net interest margins and boost group return on equity through better allocation of resources. Disproportionate investment in digital transformation, including AI driven efficiency gains and digital onboarding, will generate structural cost reductions (organizational simplification savings), directly improving the cost to income ratio and lifting long term operating leverage and net margins.

To see the full financial playbook behind this valuation call, from revenue assumptions to margin upgrades and future earnings power, explore the complete narrative and review the numbers driving that fair value line.

Result: Fair Value of $10.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering concerns around Hong Kong commercial real estate losses and HSBCs heavy reliance on Asian growth could still derail these earnings and valuation assumptions.

Find out about the key risks to this HSBC Holdings narrative.

Another Angle On Value

While the narrative based fair value of about $10.88 suggests HSBC is 8 percent overvalued, our SWS DCF model paints a different picture, indicating fair value nearer £16.42, around 28 percent above today’s £11.75 price. Is the market underestimating long term cash generation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HSBC Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HSBC Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your HSBC Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at HSBC. Use the Simply Wall St screener now to spot the next wave of compelling opportunities before everyone else catches on.

- Target reliable income streams by reviewing these 10 dividend stocks with yields > 3% that could strengthen the cash flow backbone of your portfolio.

- Capitalize on rapid innovation trends through these 24 AI penny stocks positioned to benefit from surging demand for intelligent automation.

- Secure potential bargains with these 904 undervalued stocks based on cash flows that may offer strong upside if the market closes the valuation gap.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal