Is Zebra Technologies Now an Opportunity After a 36% Slide in the Share Price?

- If you are wondering whether Zebra Technologies is starting to look like a bargain again after a rough stretch, you are not alone. This is exactly the kind of stock where valuation work can really pay off.

- The share price is down 3.3% over the last week and 1.4% over the last month, but the bigger story is the steep slide of 35.9% year to date and 37.8% over the past year, which has reset expectations and risk perceptions in a significant way.

- Investors have been digesting a mix of macro driven worries about enterprise spending, shifting views on industrial and logistics automation demand, and ongoing debate about how fast customers will refresh barcode and data capture hardware. Together, those narratives have pressured sentiment, even as Zebra continues to lean into software, analytics, and broader automation solutions to diversify its growth engine.

- Against that backdrop, Zebra scores a strong 6 out of 6 on our valuation checks, suggesting the market may be too pessimistic. Next, we will walk through what different valuation approaches say about the stock, and then finish with a more holistic way to think about its true worth beyond simple multiples and models.

Find out why Zebra Technologies's -37.8% return over the last year is lagging behind its peers.

Approach 1: Zebra Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms.

For Zebra Technologies, the 2 Stage Free Cash Flow to Equity model starts with last twelve months Free Cash Flow of about $786.8 million and then applies analyst forecasts and extrapolated growth. Analyst estimates and Simply Wall St projections suggest Free Cash Flow could rise to roughly $1.06 billion by 2029, with continued moderate growth in the years that follow as the business scales.

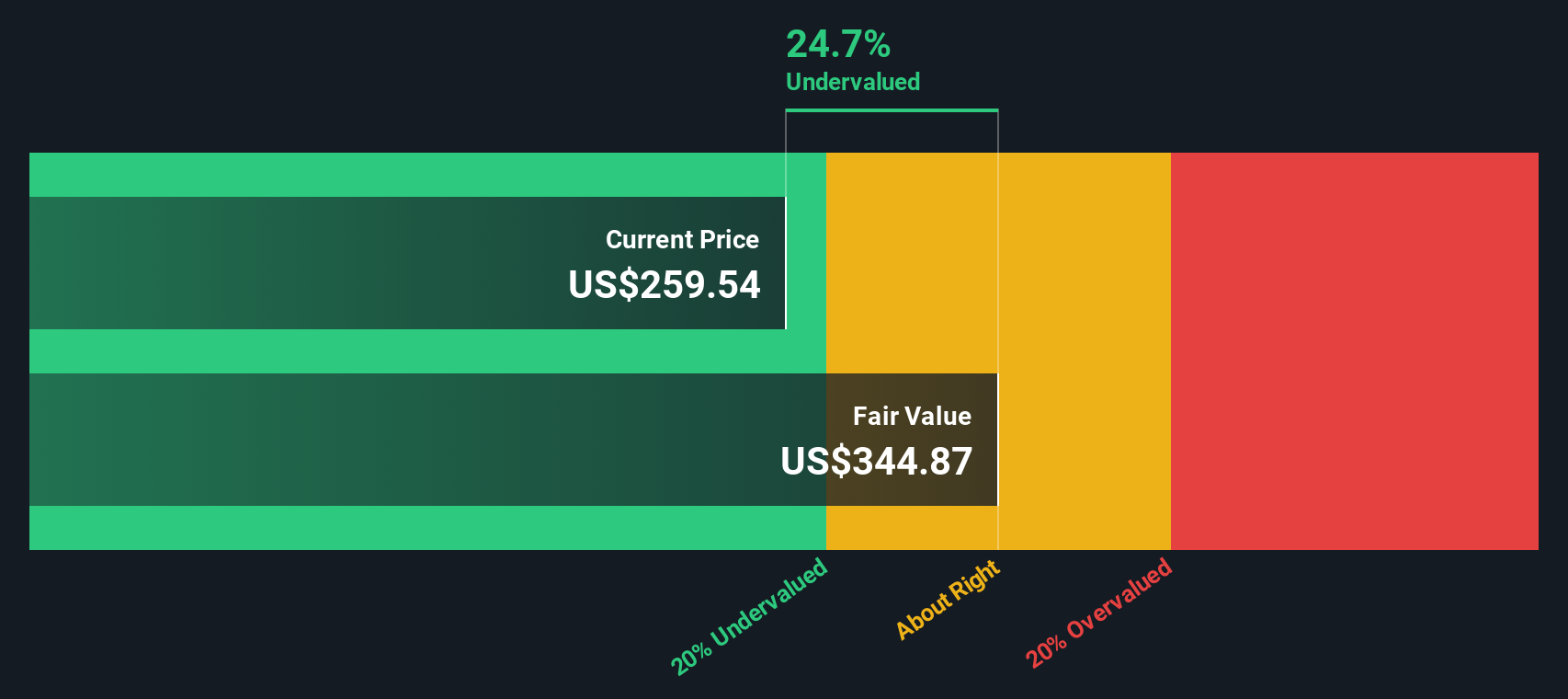

Aggregating and discounting these future cash flows results in an estimated intrinsic value of about $342.40 per share. Compared with the current share price, this indicates the stock is trading at roughly a 28.2% discount to its DCF based fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zebra Technologies is undervalued by 28.2%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: Zebra Technologies Price vs Earnings

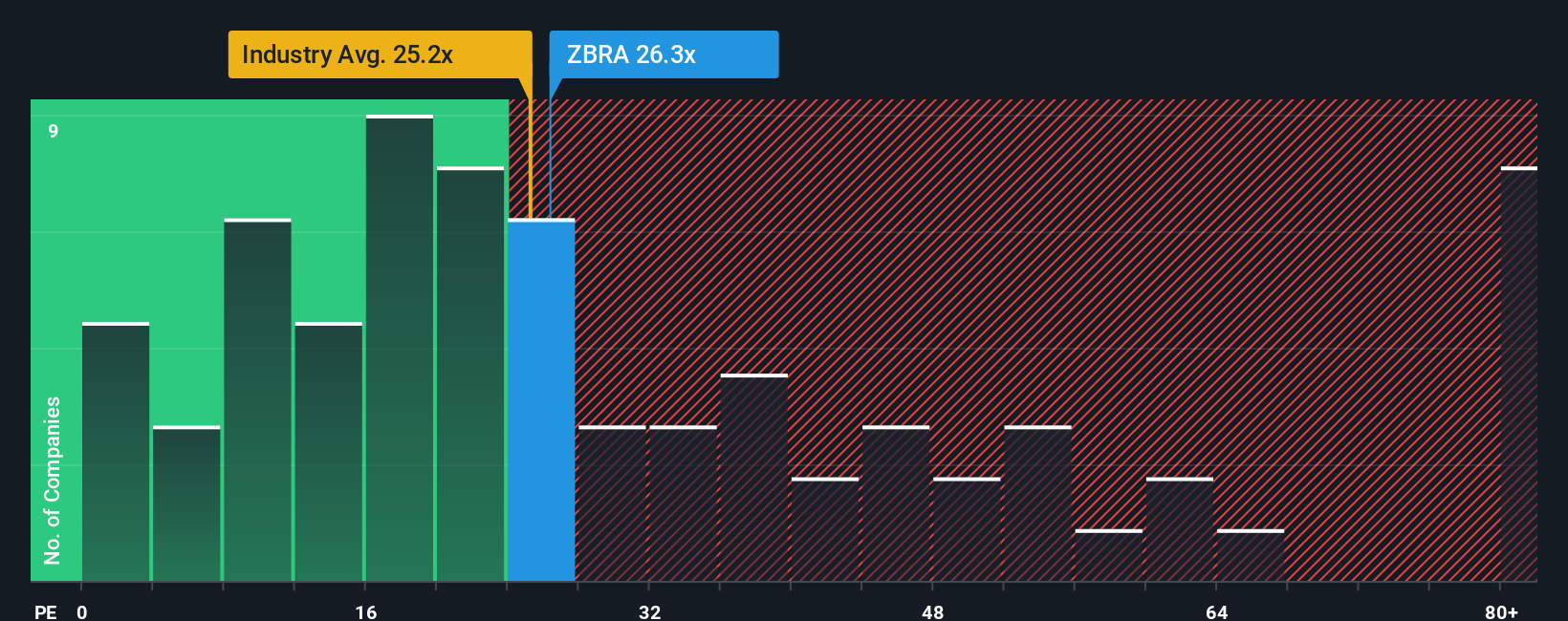

For a profitable, established business like Zebra Technologies, the price to earnings (PE) ratio is a practical way to gauge what investors are willing to pay for each dollar of current earnings. In general, companies with stronger and more reliable growth prospects and lower perceived risk tend to justify a higher, normal PE, while slower or more volatile earners tend to have a lower multiple.

Zebra currently trades on a PE of about 24.3x, which is roughly in line with the broader electronic industry average of about 24.9x, but well below the 48.8x average of its higher growth peers. Simply Wall St’s Fair Ratio framework refines this comparison by estimating the PE Zebra could trade on, given its specific earnings growth outlook, profitability, industry positioning, size, and risk profile.

On this basis, Zebra’s Fair Ratio comes out at around 28.8x, which indicates the market is not fully crediting its fundamentals and growth potential. Because this Fair Ratio incorporates factors that simple peer and industry comparisons miss, it offers a more tailored view of value and suggests that, on earnings, Zebra’s shares may be trading at a discount.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zebra Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with the numbers you think it can deliver, from future revenue and earnings to margins and fair value.

A Narrative on Simply Wall St is your own storyline for a company, where you spell out what you believe will drive the business, translate that into a financial forecast, and end up with a Fair Value that you can directly compare with today’s share price to help inform a decision to buy, hold, or sell.

These Narratives live inside the Community page on Simply Wall St, used by millions of investors, and they update dynamically as new information arrives. When news, earnings, or guidance change the outlook, your Narrative and the company’s Fair Value move with it instead of going stale.

For Zebra Technologies, for example, a bullish Narrative might assume tariffs ease after 2025, automation demand accelerates, and the stock is worth closer to the high analyst target of about 421 dollars. A more cautious Narrative might focus on slower hardware refresh cycles, tougher competition, and a fair value near the low target of 300 dollars, giving you a clear, numbers backed way to act on your own perspective.

Do you think there's more to the story for Zebra Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal