Carrier Global (CARR): Assessing Valuation After a 22% Share Price Slide

Carrier Global (CARR) has quietly slipped about 22% over the past year even as revenue and net income continue to grow, creating an interesting setup for investors watching climate and energy solutions demand.

See our latest analysis for Carrier Global.

That slide contrasts with a solid three year total shareholder return of about 36%, suggesting the recent weakness in the share price, now around $53.50, reflects a reset in sentiment rather than a broken long term story.

If Carrier’s mix of climate tech and cyclical demand has your attention, it might be a good moment to broaden the search and explore fast growing stocks with high insider ownership.

With earnings still climbing and the stock trading at a notable discount to analyst targets, investors face a key question: is Carrier now undervalued, or already reflecting all the growth the market expects?

Most Popular Narrative: 25.8% Undervalued

With Carrier Global closing at $53.50 against a most popular narrative fair value in the low $70s, the gap hinges on ambitious profitability and growth assumptions.

The company's efforts in operational efficiency, such as using Carrier Excellence to enhance productivity and mitigate tariff impacts through cost containment and supply chain adjustments, are likely to support margin expansion and improved earnings per share.

Want to see what powers that higher fair value? The narrative leans on faster earnings growth, rising margins, and a richer future earnings multiple. Curious which assumptions really move the needle here? Dive in to see the exact combination driving that upside case.

Result: Fair Value of $72.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer demand in key regions and lingering tariff exposure could easily pressure margins and derail the upbeat earnings and valuation narrative.

Find out about the key risks to this Carrier Global narrative.

Another Angle On Value

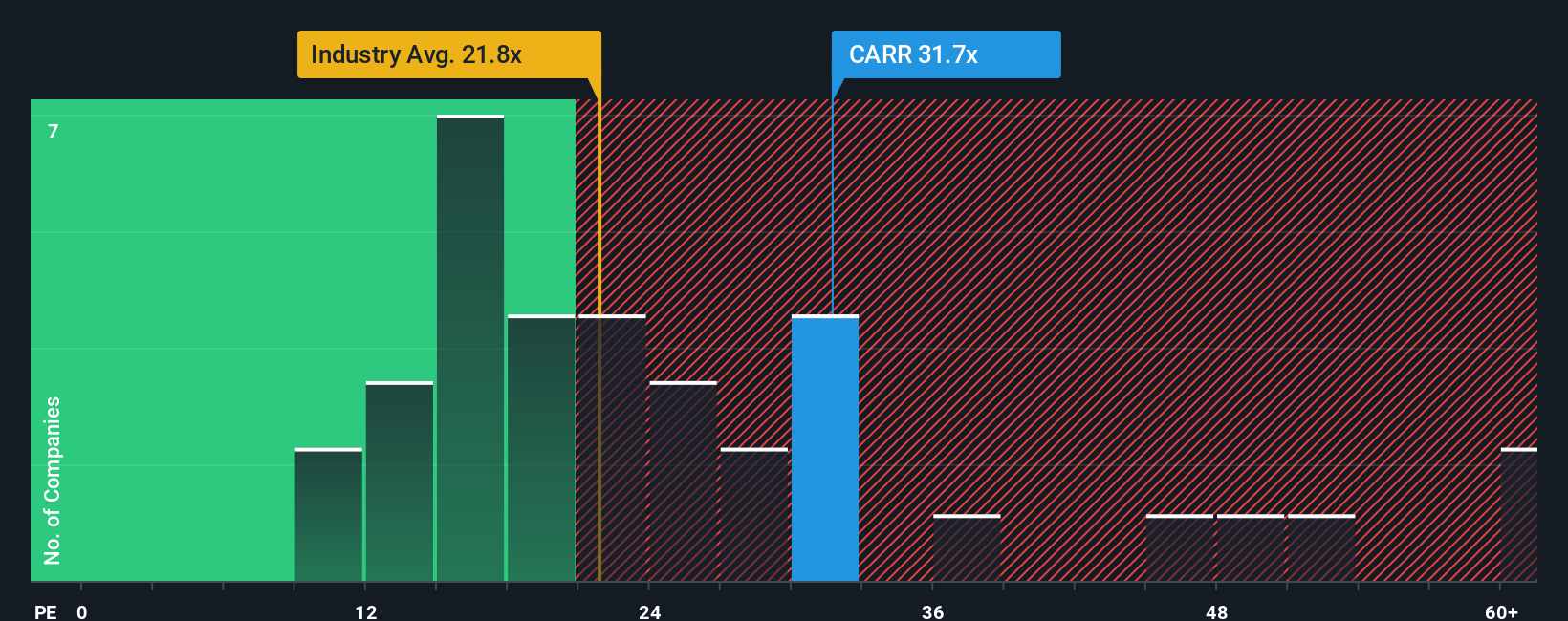

While the narrative points to upside from earnings growth and a richer future multiple, today’s valuation already looks demanding on earnings: Carrier trades at about 32.7 times earnings versus 19.1 times for the US Building industry and 28.7 times for peers, even if that is below a fair ratio of 38.2 times.

That mix of premium pricing, relative to sector and peers, but still below the fair ratio, suggests both room for rerating and real downside risk if growth disappoints. This leaves investors to decide whether to view the current setup as a stretch valuation or an early entry point.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carrier Global Narrative

If this perspective does not fully align with your own view or you prefer to dig into the numbers yourself, you can easily build a personalized narrative in just a few minutes, Do it your way.

A great starting point for your Carrier Global research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next smart opportunity by using the Simply Wall Street Screener to uncover focused stock ideas beyond Carrier Global today.

- Capture potential mispricings by scanning these 904 undervalued stocks based on cash flows that the market may be overlooking right now.

- Supercharge your growth watchlist with these 24 AI penny stocks at the forefront of artificial intelligence breakthroughs.

- Strengthen your income strategy by targeting these 10 dividend stocks with yields > 3% that can help support reliable cash flow from your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal