BrightSpring Health Services (BTSG): Assessing Valuation After a Strong 90-Day Share Price Rally

BrightSpring Health Services (BTSG) has been quietly rewarding patient shareholders, with the stock climbing about 41% over the past 3 months and more than doubling year to date. This performance is prompting closer attention to what is driving the move.

See our latest analysis for BrightSpring Health Services.

With the share price now at $37.73 and a 90 day share price return of about 41%, the momentum behind BrightSpring looks firmly upward. This reinforces a strong year to date share price performance and signals improving sentiment toward its growth story.

If BrightSpring’s run has you rethinking your healthcare exposure, this could be a good moment to scan other potential leaders using our healthcare stocks.

Now, with the stock still trading at a modest discount to analyst targets but already up sharply this year, the key question is whether BrightSpring remains undervalued or if the market is already pricing in its future growth.

Most Popular Narrative: 10% Undervalued

BrightSpring’s most followed narrative sees fair value modestly above the recent $37.73 close, pointing to further upside if its growth path materialises.

The analysts have a consensus price target of $28.708 for BrightSpring Health Services based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $41.0, and the most bearish reporting a price target of just $25.0.

Want to see what kind of revenue surge, margin lift, and profit multiple might justify this higher fair value estimate? The full narrative unpacks the numbers driving that call, and the assumptions that need to hold for BrightSpring’s valuation story to keep working.

Result: Fair Value of $41.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case still hinges on managing labor and wage pressures and avoiding disruptive reimbursement or regulatory shifts in government funded programs.

Find out about the key risks to this BrightSpring Health Services narrative.

Another Way To Look At Value

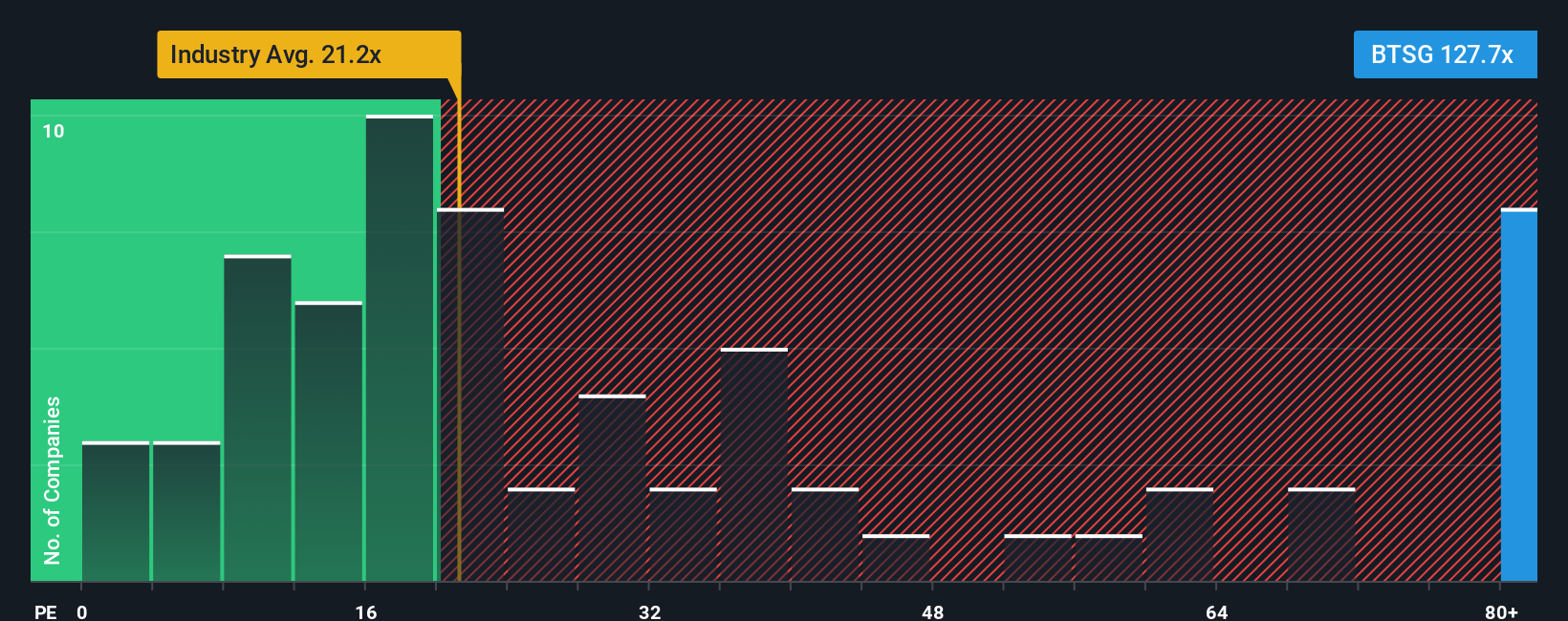

On earnings, BrightSpring looks anything but cheap, trading on a P/E of about 70.6x versus 23.3x for the US healthcare sector and a 29x peer average. Our fair ratio of 38.1x suggests the market may be running ahead of fundamentals. Is this a momentum story now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BrightSpring Health Services Narrative

If you see the story differently or simply prefer running your own numbers, you can spin up a personalised view in just minutes: Do it your way.

A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity. Use the Simply Wall St screener to spot fresh stocks before the crowd and keep your portfolio ideas flowing.

- Capture potential mispricings by targeting companies trading below intrinsic value with these 904 undervalued stocks based on cash flows tailored to cash flow strength.

- Ride powerful megatrends by focusing on innovators shaping automation and data intelligence through these 24 AI penny stocks.

- Seek reliable cash returns by zeroing in on income opportunities using these 10 dividend stocks with yields > 3% that clear a 3% yield hurdle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal