Evaluating Waste Management (WM)’s Valuation After Its 2026 Dividend Hike and New $3 Billion Buyback Program

Waste Management (WM) just doubled down on being a shareholder friendly utility-like stock by rolling out a 14.5% dividend hike for 2026 alongside a fresh $3 billion buyback authorization.

See our latest analysis for Waste Management.

The shareholder friendly playbook appears to be resonating, with the stock’s recent 1 month share price return of 4.5 percent building on a solid 10.4 percent year to date share price gain and a 5 year total shareholder return above 100 percent. This suggests momentum is still quietly in WM’s favor as it couples higher payouts with ongoing debt reduction and recognition for its sustainability leadership.

If WM’s mix of dependable cash flows and rising payouts appeals to you, this could be a good moment to scan for other steady compounders using fast growing stocks with high insider ownership.

But with WM now trading near all time highs, while still sitting about 9 percent below some intrinsic value estimates and roughly 11 percent under analyst targets, is this a buying window or is future growth already priced in?

Most Popular Narrative Narrative: 10.2% Undervalued

At a last close of 221.36 dollars versus a narrative fair value near 246.52 dollars, the widely followed view sees more upside in WM’s cash flows.

The analysts have a consensus price target of $257.3 for Waste Management based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $277.0, and the most bearish reporting a price target of just $198.0.

Want to see the math behind this premium price tag? The story leans on steady revenue compounding, expanding margins and a punchy future earnings multiple. Curious which assumptions really move the dial?

Result: Fair Value of $246.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, alternative fuel tax credit changes and integration challenges from the Stericycle deal could pressure margins and derail the anticipated earnings and valuation uplift.

Find out about the key risks to this Waste Management narrative.

Another Take On Value

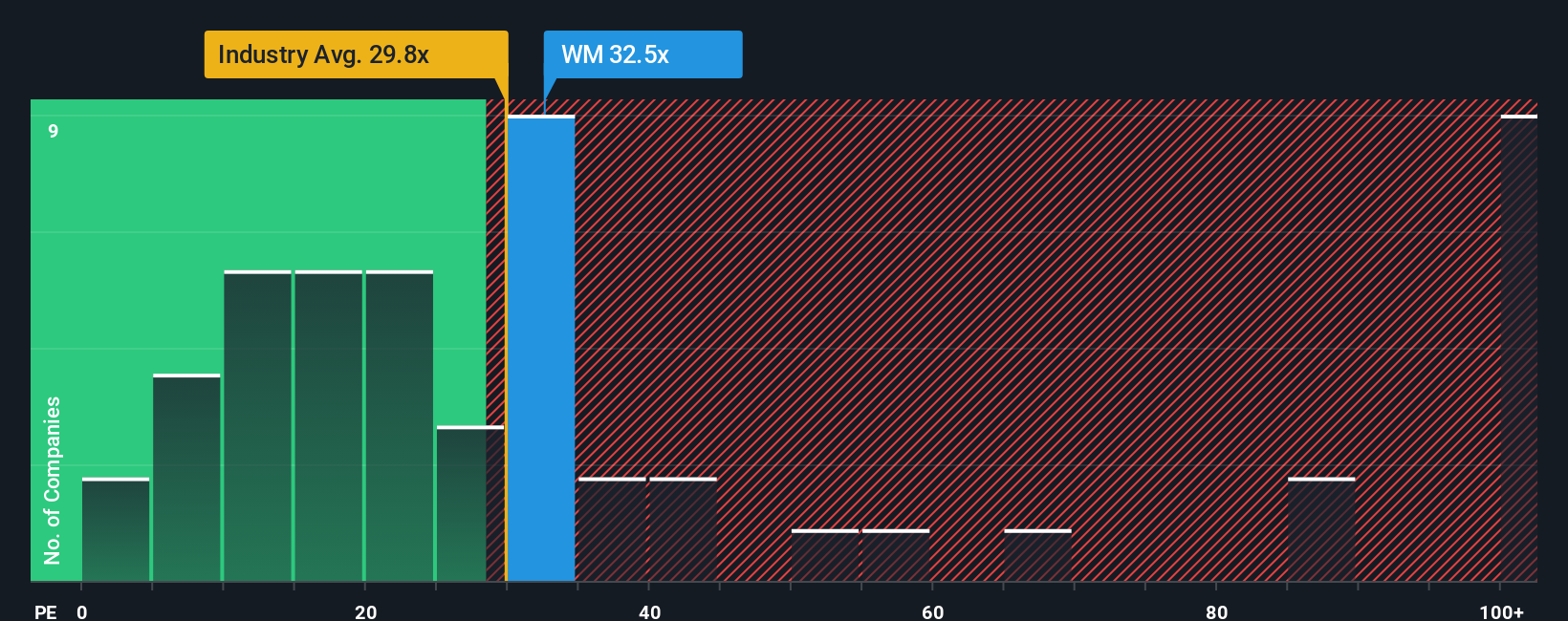

Looking through the earnings multiple lens, WM trades at 34.8 times earnings versus 24 times for the wider Commercial Services industry and 47.2 times for peers, while our fair ratio sits near 35.5 times. That leaves only a sliver of upside and raises the question of how much execution risk investors are really being paid for.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waste Management Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Waste Management research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready for your next smart move? Use the Simply Wall St Screener to uncover fresh, data driven stock ideas before the crowd catches on and prices them in.

- Unlock potential long term winners by scanning these 904 undervalued stocks based on cash flows that the market may be mispricing today but cash flows suggest could rerate tomorrow.

- Capture cutting edge growth by targeting these 24 AI penny stocks that are building real products and revenues around artificial intelligence, not just hype.

- Strengthen your income strategy by focusing on these 10 dividend stocks with yields > 3% that can support attractive yields while still passing key fundamental checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal