Taking a Fresh Look at Ramaco Resources (METC) Valuation After Its New $100 Million Share Buyback Program

Ramaco Resources (METC) just put real money behind its optimism, rolling out a $100 million share repurchase program over the next two years after completing sizable capital raises earlier this year.

See our latest analysis for Ramaco Resources.

The buyback news lands as the share price has rebounded to $18.18, with a 7 day share price return of 30.04 percent and a year to date share price return of 69.75 percent. A 1 year total shareholder return of 82.68 percent and 5 year total shareholder return of 810.85 percent show that, despite a volatile recent 90 day share price return of negative 44.88 percent, long term momentum and confidence in Ramaco’s shift from pure metallurgical coal toward rare earths and strategic partnerships like the Mulberry Industries memorandum of understanding are still very much intact.

If this kind of value unlock story has your attention, it could be worth seeing what else is out there by exploring fast growing stocks with high insider ownership.

Yet with the stock already up sharply and trading near analysts’ targets, the key question now is whether Ramaco is still mispriced by a market that is skeptical of its rare earth pivot, or whether future growth is already fully reflected in the share price.

Most Popular Narrative Narrative: 53.6% Undervalued

With Ramaco Resources last closing at $18.18 against a most popular narrative fair value of about $39.14, the valuation debate is shifting toward how much rare earths could reshape the story.

The analysts have a consensus price target of $21.667 for Ramaco Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.0, and the most bearish reporting a price target of just $14.0.

Curious why a coal producer is getting a valuation normally reserved for high growth stories. Revenue, margins, and earnings are all being stretched far into the future. Want to see which growth levers and future profit multiple need to click perfectly for that upside to make sense.

Result: Fair Value of $39.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution setbacks at Brook Mine or weaker than expected policy support for U.S. critical minerals could quickly erode the upside implied by current narratives.

Find out about the key risks to this Ramaco Resources narrative.

Another Angle on Valuation

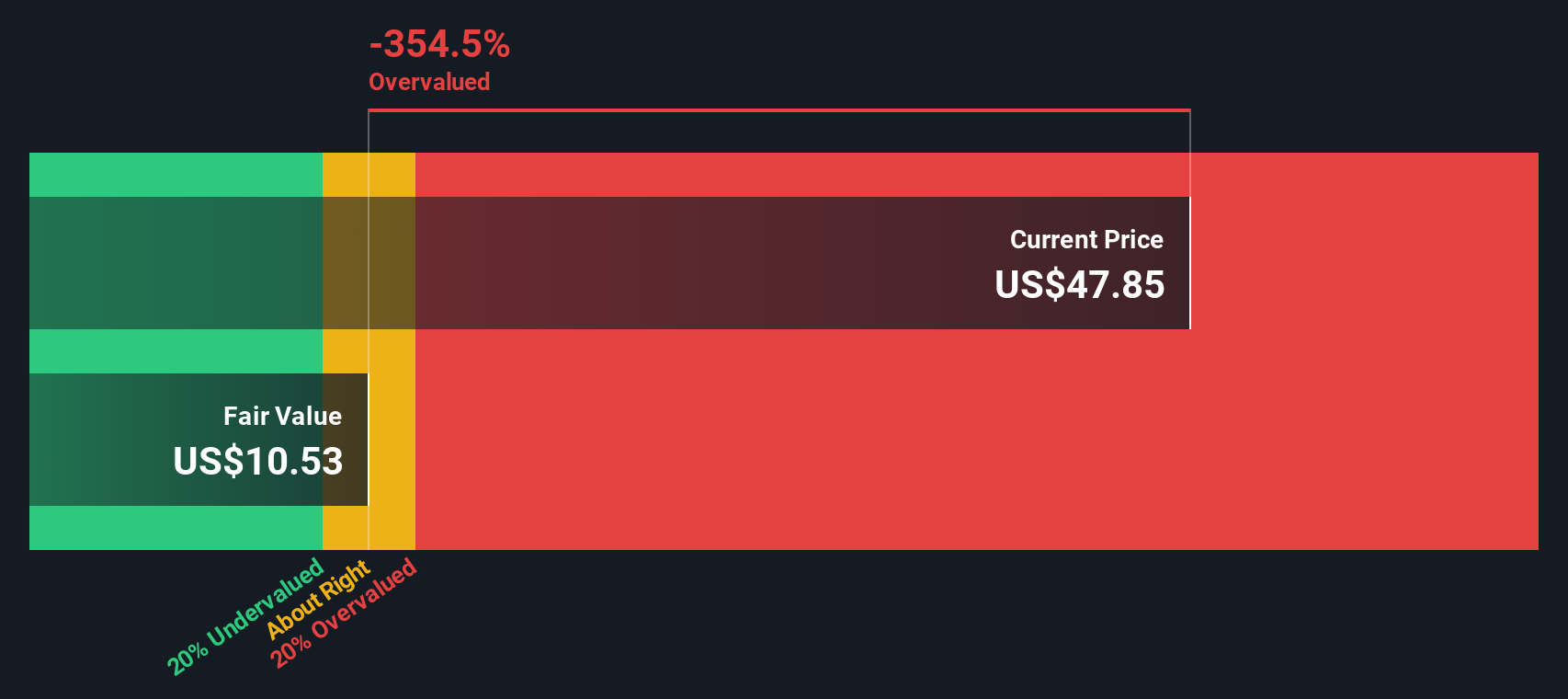

Our SWS DCF model actually lands close to the market, with Ramaco trading slightly above its DCF fair value of about 18.12 dollars per share, implying it is marginally overvalued rather than deeply undervalued. If cash flows are fairly priced already, it is worth asking how much upside is really left.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ramaco Resources Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a complete narrative in just minutes: Do it your way.

A great starting point for your Ramaco Resources research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas

Do not stop at a single opportunity. Use the Simply Wall St screener to uncover fresh, data backed ideas before the crowd catches on.

- Capture powerful income potential by scanning these 10 dividend stocks with yields > 3% that could strengthen your portfolio with reliable cash returns.

- Capitalize on market mispricings by targeting these 904 undervalued stocks based on cash flows where cash flow strength is not yet fully recognized in the share price.

- Ride the next wave of intelligent automation by focusing on these 29 healthcare AI stocks at the intersection of medicine, software, and long term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal