Western Digital (WDC) Is Up 8.0% After Nasdaq-100 Addition And AI Storage Pivot - Has The Bull Case Changed?

- Western Digital Corporation was added to the Nasdaq-100 index on December 22, 2025, following its spin-off of the Flash business into a separate SanDisk entity and renewed focus on high-capacity hard disk drives for AI and cloud data centers.

- This combination of index inclusion and a sharpened AI-centric storage model is reshaping Western Digital’s role in large-scale data infrastructure and how investors view its long-term earnings power, capital returns, and risk profile.

- Next, we’ll examine how Western Digital’s Nasdaq-100 entry and pure-play AI storage focus could reshape its investment narrative and outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Western Digital Investment Narrative Recap

To own Western Digital today, you need to believe that AI and cloud data centers will keep driving demand for high-capacity HDDs, and that the company can convert that demand into durable margins despite its heavy reliance on a handful of hyperscale customers. Nasdaq 100 inclusion and the recent rally may amplify short term volatility around index flows, but they do not materially change the core catalyst of AI driven hyperscale orders or the key risk of customer concentration.

The most relevant recent announcement here is Western Digital’s addition to the Nasdaq 100, which is expected to boost visibility and liquidity as passive and benchmarked funds adjust positions. That index entry arrives just as the company leans harder into AI centric storage, potentially reinforcing the earnings impact of hyperscaler purchase commitments while leaving investors more exposed if those same large customers ever rethink their storage roadmaps.

Yet behind the index headlines, the concentration of 90% plus of revenue in a few hyperscale buyers is something investors should be aware of...

Read the full narrative on Western Digital (it's free!)

Western Digital’s narrative projects $11.9 billion revenue and $2.2 billion earnings by 2028. This requires 7.6% yearly revenue growth and a roughly $0.6 billion earnings increase from $1.6 billion today.

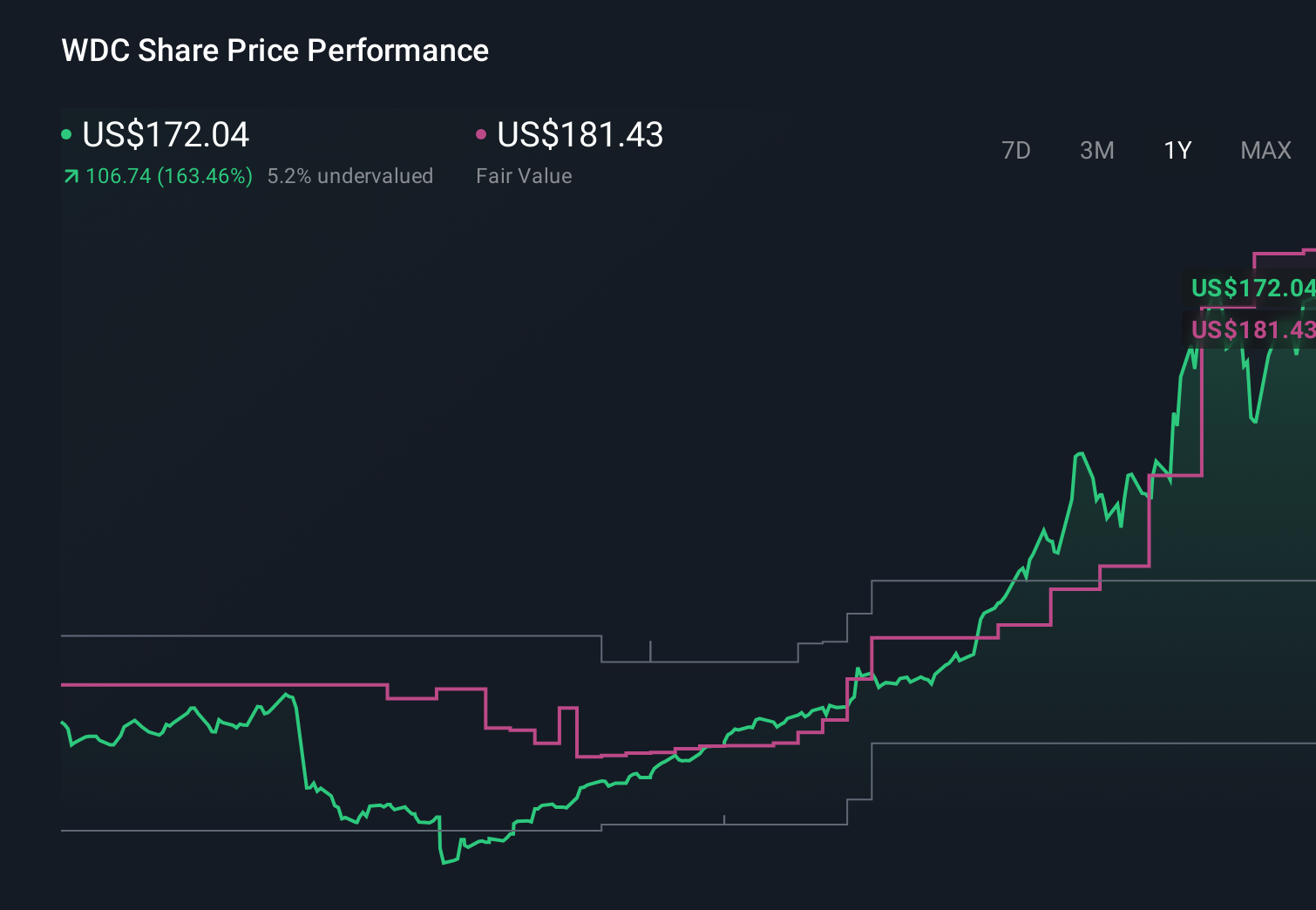

Uncover how Western Digital's forecasts yield a $186.96 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently peg Western Digital’s fair value between US$85 and about US$229.97, highlighting how far apart individual views can be. You can weigh those against the bullish AI driven HDD demand story that underpins the stock’s current catalyst profile and decide which risk reward balance fits your own expectations.

Explore 4 other fair value estimates on Western Digital - why the stock might be worth less than half the current price!

Build Your Own Western Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Digital research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Western Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Digital's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal