Has Albemarle’s 74% Rally in 2025 Already Priced In Its Lithium Recovery Story?

- If you are wondering whether Albemarle is a bargain or a value trap at today’s price, you are not alone. This piece will walk through what the current market is really baking in.

- After a tough few years, the stock has bounced hard, climbing 10.2% over the last week, 28.2% over the past month, and an impressive 74.2% year to date, although the 3 year return is still down 27.5% with just 5.5% over 5 years.

- That swingy profile has been driven by shifting expectations around long term lithium demand and evolving policy support for electric vehicles, along with capital allocation debates and changing sentiment toward cyclical commodities. Investors are trying to reconcile Albemarle’s strategic role in the battery supply chain with concerns about supply expansions, pricing power, and the timing of the next upcycle.

- Despite all that excitement, Albemarle currently scores 0 out of 6 on our valuation checks, as shown in our valuation score. We will first break down what different valuation methods say, then circle back at the end to a more practical way of thinking about what the stock is really worth.

Albemarle scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Albemarle Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it could generate in the future and discounting those cash flows back to today’s dollars.

For Albemarle, the model uses a 2 Stage Free Cash Flow to Equity approach in $. The latest twelve month free cash flow is roughly negative $189.8 Million, reflecting heavy investment and cyclicality. Analysts then expect free cash flow to recover to about $155.2 Million in 2026 and $301.5 Million by 2027. Simply Wall St extrapolates further growth to around $1.1 Billion of free cash flow by 2035 as lithium markets normalize and scale benefits are realized.

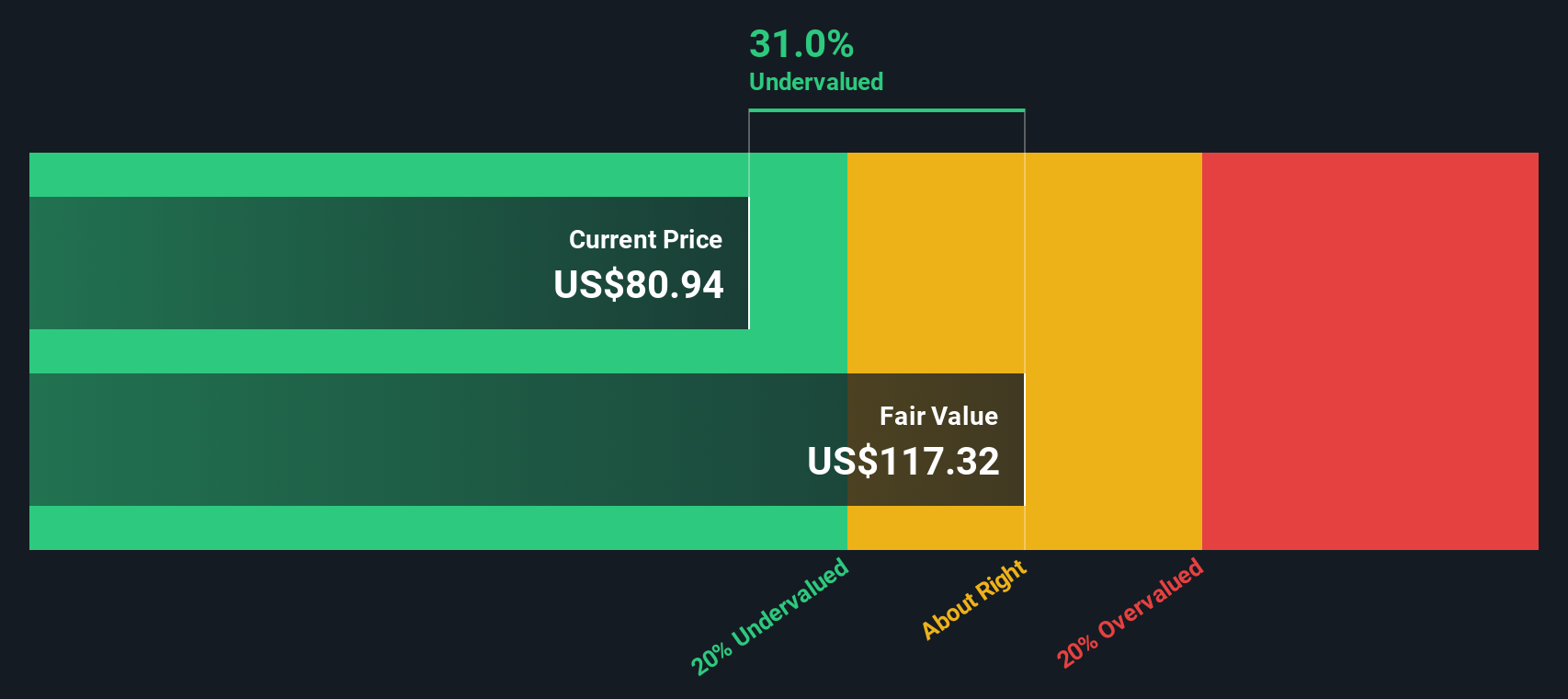

When all of those projected cash flows are discounted back, the estimated intrinsic value comes out at about $141.66 per share. That figure suggests Albemarle is roughly 4.8% overvalued relative to its current share price, which is a very small gap in the context of normal market volatility.

Result: ABOUT RIGHT

Albemarle is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Albemarle Price vs Sales

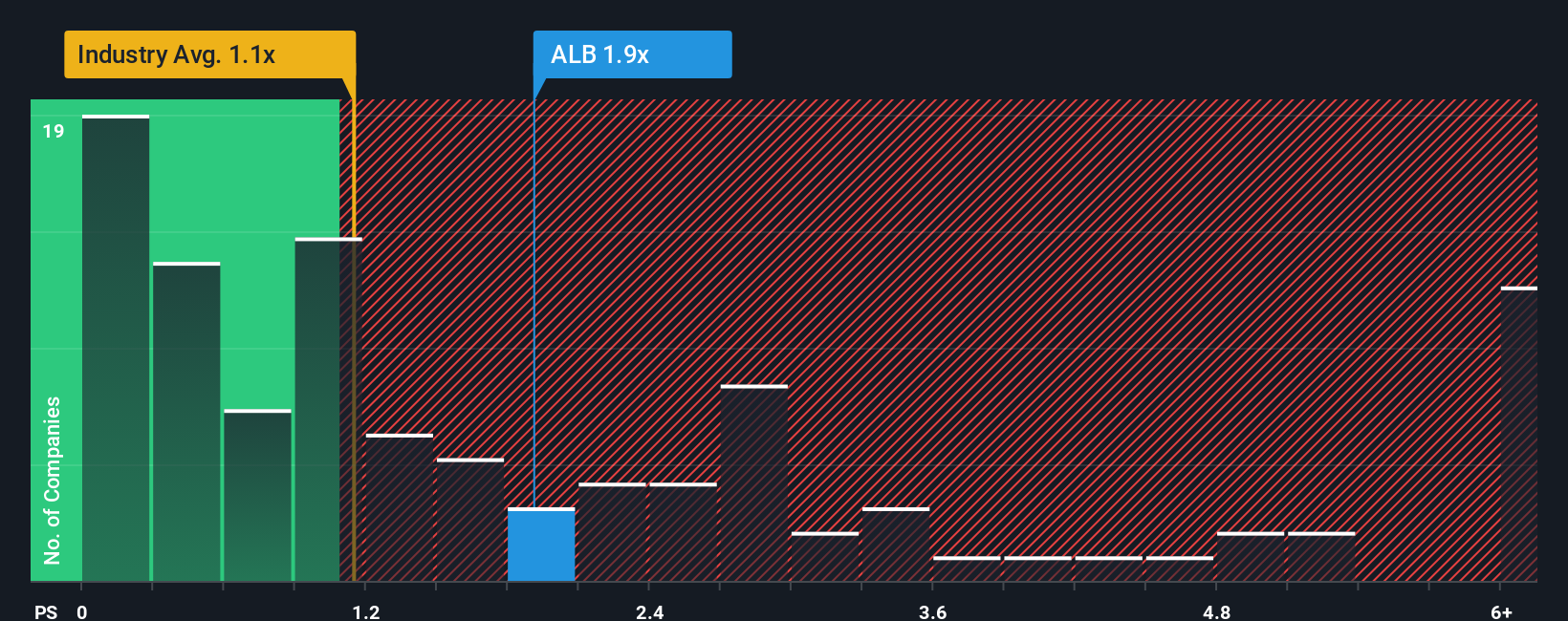

For a cyclical business like Albemarle, where accounting earnings can swing sharply from year to year, the price to sales ratio is often a cleaner yardstick because it focuses on the scale of the revenue engine rather than short term profit noise.

In general, a higher growth, higher margin, lower risk company should justify a higher price to sales multiple, while slower growth or riskier names deserve a lower one. Albemarle currently trades at about 3.53x sales, which is well above both the Chemicals industry average of roughly 1.13x and the peer group average of about 1.54x. This implies the market is already baking in superior growth and returns.

Simply Wall St takes this a step further with its Fair Ratio, a proprietary estimate of what Albemarle’s price to sales multiple should be once you factor in its specific growth outlook, profitability profile, industry, market cap, and risk. For Albemarle, that Fair Ratio is around 1.28x, noticeably below the current 3.53x. On this framework, the stock screens as meaningfully more expensive than what its fundamentals alone would justify.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Albemarle Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Albemarle’s future with the numbers behind a fair value estimate. A Narrative is your story about a company, translated into concrete assumptions for revenue growth, margins, and valuation multiples, so that the journey from business thesis, to financial forecast, to fair value is completely transparent. On Simply Wall St, Narratives live in the Community page and are used by millions of investors as an easy, accessible tool to decide whether to buy, hold, or sell by comparing each Narrative’s Fair Value to today’s share price. They also update dynamically as fresh news, earnings, or guidance change the outlook, so your thesis is never static. For Albemarle, one investor might build a bullish Narrative anchored on faster lithium price recovery and a fair value closer to 200 dollars, while another might take a more cautious stance around prolonged oversupply and assign a fair value nearer 58 dollars. The platform then lets you see, compare, and refine both views in real time.

Do you think there's more to the story for Albemarle? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal