Blue Owl Capital (OWL): Assessing Valuation After a Recent Share Price Rebound

Blue Owl Capital (OWL) has been grinding through a rough stretch, but its recent bounce over the past month has some investors asking whether the selloff has finally gone too far.

See our latest analysis for Blue Owl Capital.

At around $15.46, Blue Owl’s recent 1 month share price return of just over 9 percent comes after a much tougher stretch, with year to date share price performance still deeply negative even as its 3 year total shareholder return remains strongly positive. This suggests longer term momentum is intact, while near term sentiment is still rebuilding.

If Blue Owl’s swingy ride has you reassessing your watchlist, it could be a smart moment to broaden your search and explore fast growing stocks with high insider ownership.

With shares down sharply this year yet still boasting strong multi year returns and solid growth, the key question now is whether Blue Owl is trading below its true value or if the market already reflects its future expansion.

Most Popular Narrative: 25.7% Undervalued

Based on the most followed valuation narrative, Blue Owl’s fair value sits notably above the recent 15.46 share price, framing a potential disconnect between fundamentals and sentiment.

Exceptional long term opportunities in digital infrastructure, fueled by generational investment in data centers/AI related assets where Blue Owl has industry leadership, are catalyzing large scale fundraising and deployment, supporting robust growth in management fees and recurring revenues over the next several years.

Curious how aggressive revenue compounding, margin expansion, and a compressed future earnings multiple can still add up to upside from here? The narrative’s model leans on bold growth, powerful operating leverage, and a surprisingly modest valuation benchmark. Want to see the exact financial path it expects Blue Owl to follow and how that aligns with a premium to today’s price? Read on to unpack the full playbook behind this fair value estimate.

Result: Fair Value of $20.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on acquisitions and non linear fundraising means that integration missteps or weaker inflows could curb margins and stall the growth story.

Find out about the key risks to this Blue Owl Capital narrative.

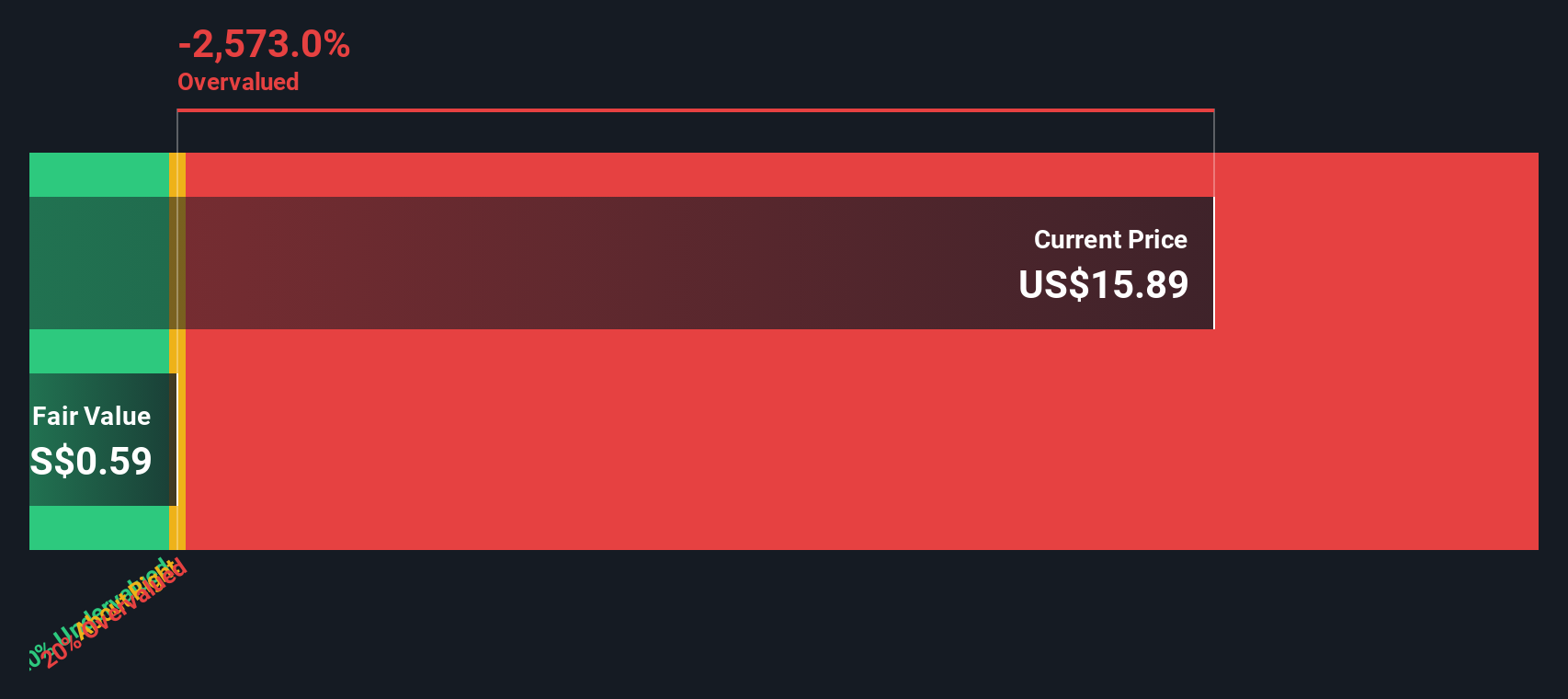

Another View: Caution From Our DCF Model

While the narrative and analyst targets imply Blue Owl is roughly 25 percent undervalued, our DCF model paints a much harsher picture, suggesting the stock trades far above an estimated fair value of about 0.54 per share. That is a wide gap in expectations. Which story do you trust when real money is on the line?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Blue Owl Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Blue Owl Capital Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view of Blue Owl in minutes: Do it your way.

A great starting point for your Blue Owl Capital research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Shift from watching to acting by using the Simply Wall St screener to uncover focused stock ideas that could sharpen your next move and help refine your portfolio.

- Explore potential mispriced opportunities by targeting companies flagged as undervalued through these 904 undervalued stocks based on cash flows that may offer returns aligned with their cash flow potential.

- Position yourself at the frontier of innovation by scanning these 24 AI penny stocks for businesses developing artificial intelligence from concept into scalable earnings power.

- Review these 10 dividend stocks with yields > 3% for companies that combine dividend yields with the financial strength needed to support ongoing payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal