Nu Holdings (NYSE:NU): Revisiting Valuation After Rapid Customer Growth and New Banking Licenses

Nu Holdings (NYSE:NU) is back in the spotlight after fresh data underscored just how deeply it has penetrated Brazil’s banking market, and how aggressively it is pursuing full banking licenses across multiple countries.

See our latest analysis for Nu Holdings.

Those licensing moves are helping to support a strong run in the stock, with Nu Holdings’ share price at $16.74 and a powerful year to date share price return of around 57%. Its three year total shareholder return above 300% shows that momentum has been building for some time rather than fading.

If Nu’s rise has you thinking about where the next wave of fintech style growth could come from, it might be worth exploring fast growing stocks with high insider ownership.

With revenue still growing near 40 percent and the share price already up more than 300 percent in three years, the key question now is whether Nu remains undervalued or if the market is already pricing in that future growth.

Most Popular Narrative Narrative: 9.2% Undervalued

Based on the most followed narrative, Nu Holdings’ inferred fair value of $18.43 sits above the last close of $16.74, framing the stock as modestly mispriced and setting up a valuation built on aggressive growth and margin shifts.

Introduction and scaling of new financial products, such as personal loans, insurance, crypto, and investments, are driving higher ARPU and fee-based revenue. Operating leverage from Nu's efficient tech-driven platform is likely boosting profitability and net income as mature cohorts monetize.

Want to see what powers this upside call? The narrative leans on breakneck top line growth, slimmer margins, and a future earnings multiple that could surprise traditional bank investors.

Result: Fair Value of $18.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and heavier exposure to less mature credit segments could pressure Nu’s loan quality, which may force higher loss provisions and squeeze those projected margins.

Find out about the key risks to this Nu Holdings narrative.

Another Angle On Valuation

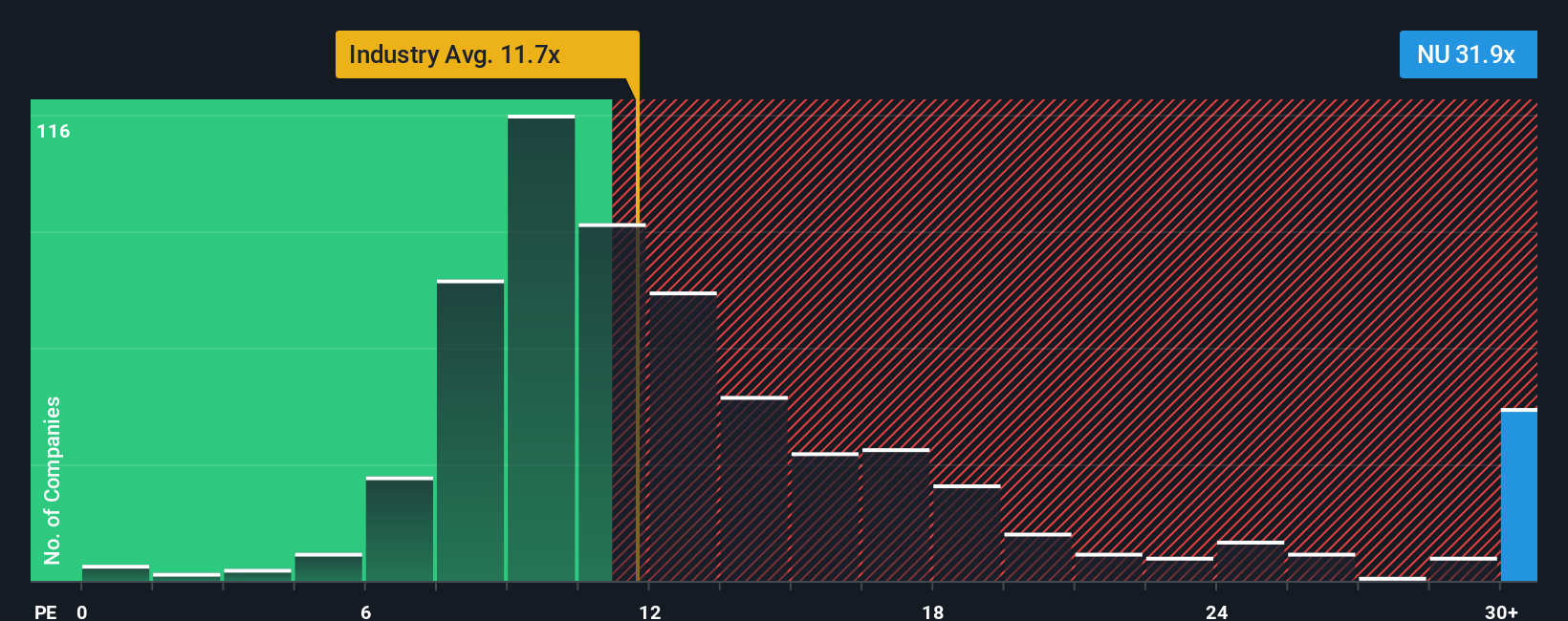

While the narrative points to Nu as around 9 percent undervalued, a simple earnings based lens tells a tougher story. At roughly 32 times earnings versus 11.9 times for US banks and a fair ratio of 22.6 times, Nu screens expensive and raises the question of how much good news is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nu Holdings Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can build a fresh narrative in just minutes: Do it your way.

A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Nu’s story is compelling, but you will miss some of the market’s most exciting opportunities if you stop here instead of scanning other smart prospects on Simply Wall Street.

- Capture potential deep value opportunities by targeting companies that look cheap on cash flow with these 904 undervalued stocks based on cash flows.

- Ride powerful secular themes in automation and data by focusing on innovators highlighted in these 24 AI penny stocks.

- Lock in reliable income potential by zeroing in on quality payers featured in these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal