UiPath (PATH) Valuation Check as S&P MidCap 400 Inclusion Fuels Momentum and Investor Attention

UiPath NYSE:PATH is back in focus after being tapped to join the S&P MidCap 400, a step up that can reshape who owns the stock and how it trades heading into 2026.

See our latest analysis for UiPath.

The index news caps a strong run, with a 1 month share price return of roughly 29 percent and a 3 month share price return above 40 percent. The 3 year total shareholder return of about 42 percent suggests momentum has been rebuilding after earlier volatility.

If UiPath’s surge has you rethinking where automation and AI fit in your portfolio, this is a good moment to explore other high growth tech and AI stocks that could benefit from the same structural tailwinds.

Yet with shares now trading slightly above the average analyst target and growth still in the single digits, investors have to ask: Is UiPath a misunderstood AI compounder at a modest discount, or is the market already baking in its next growth leg?

Most Popular Narrative: 4.6% Overvalued

UiPath’s narrative fair value of $16.40 sits a touch below the $17.16 last close. This frames a debate around modest growth and premium expectations.

The analysts have a consensus price target of $14.147 for UiPath based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $11.71.

Want to know what justifies paying up for slower top line growth and a richer future profit multiple, even as margins drift lower in the model? The answer lies in a specific blend of revenue compounding, margin repair and valuation compression that underpins this fair value. Curious how those moving pieces add up to a premium price despite only incremental upgrades to the outlook? Read on to see the assumptions doing the heavy lifting behind that target.

Result: Fair Value of $16.40 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that premium rests on shaky ground if geopolitical deal delays persist or if SaaS transition headwinds keep revenue and margin progress behind expectations.

Find out about the key risks to this UiPath narrative.

Another View: Market Ratios Tell a Tougher Story

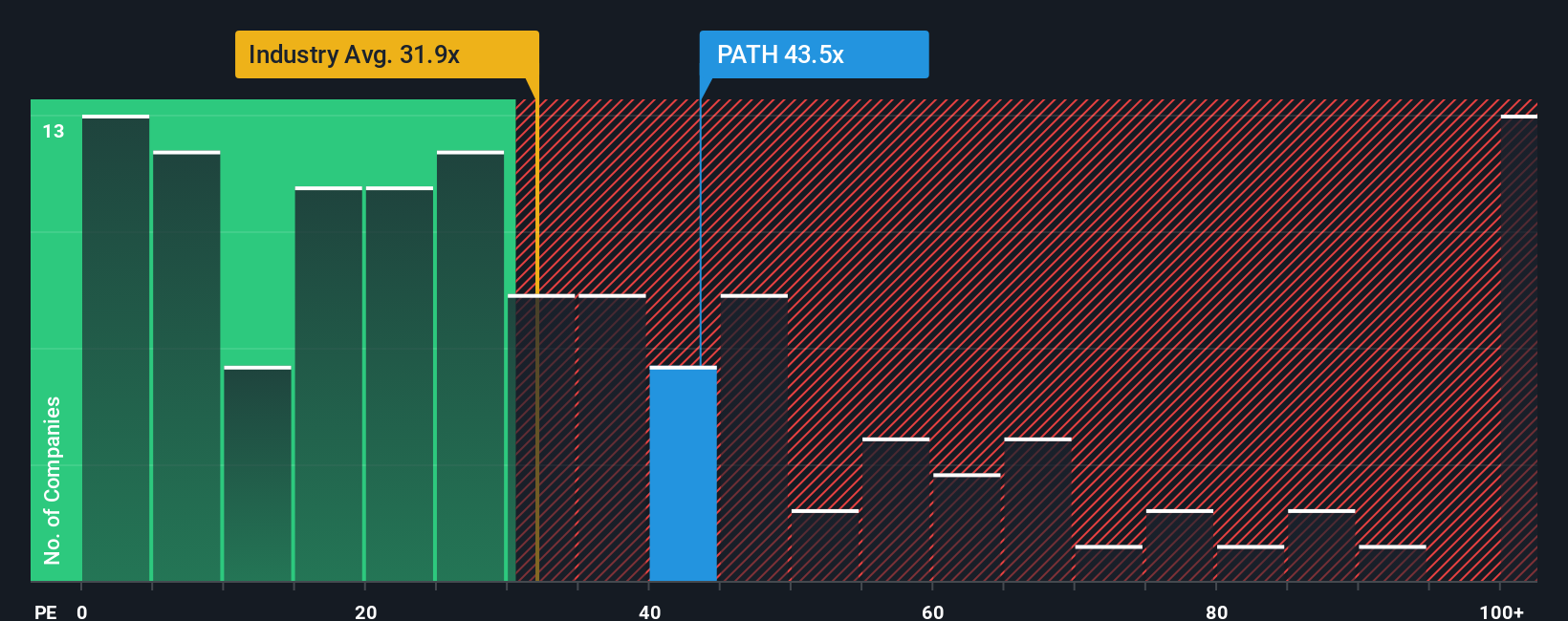

Step away from narrative fair value and the picture looks harsher. UiPath trades on a 40 times price to earnings ratio, richer than the US software average at 31.9 times, and far above its 14.6 times fair ratio, implying meaningful downside if sentiment cools.

That spread can stay wide for a popular AI name, but if growth underwhelms, the share price may need to shrink to meet the ratio rather than the other way around. Is this a momentum story you ride, or a valuation gap you wait to close?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UiPath Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a fresh narrative in just minutes: Do it your way.

A great starting point for your UiPath research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, make sure you are lining up your next opportunities with focused screens that surface quality, momentum and durability in today’s market.

- Capture potential breakout names early by scanning these 3628 penny stocks with strong financials that already back their stories with stronger balance sheets and fundamentals than typical micro caps.

- Position yourself at the heart of the automation wave by targeting these 24 AI penny stocks that pair revenue traction with scalable technology, not just hype.

- Find candidates for long-term growth potential by tracking these 904 undervalued stocks based on cash flows where current prices do not fully reflect the strength of their projected cash flows and business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal