CoreWeave (CRWV): Revisiting Valuation After a Volatile Week and Steep Share Price Pullback

CoreWeave (CRWV) continues to attract attention after another choppy week, with shares down about 2% on the day but still up roughly 22% over the past week, inviting fresh questions around sustainability.

See our latest analysis for CoreWeave.

That jumpy trading pattern fits a much bigger story, with CoreWeave’s year to date share price return of roughly 97 percent showing strong momentum despite a sharp 90 day share price pullback and today’s close at 78.87 dollars.

If you like the growth narrative around CoreWeave, it could be worth seeing what else is shaping the AI infrastructure space through high growth tech and AI stocks.

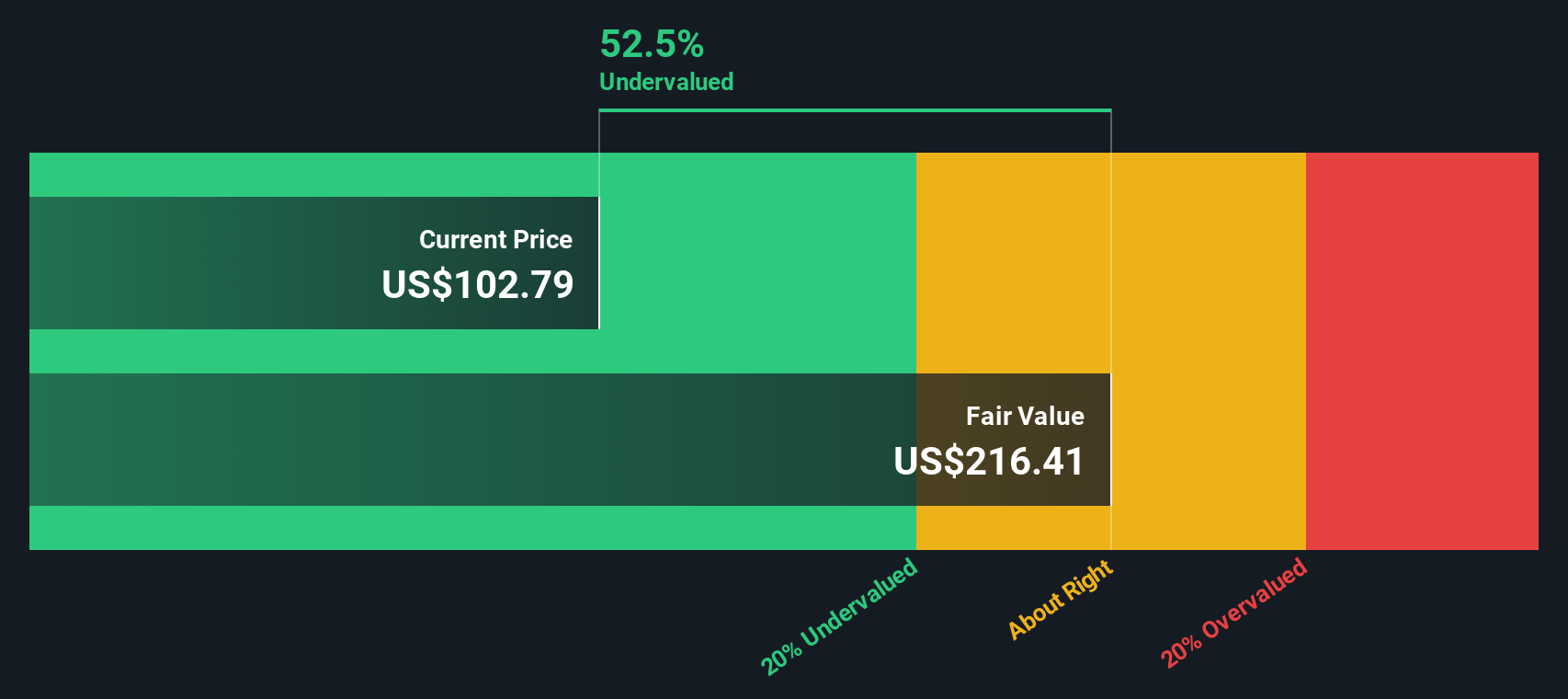

With CoreWeave posting rapid revenue growth but still running losses, and the stock trading well below analyst targets after a steep pullback, investors face a key question: is this a mispriced growth engine, or has the market already discounted its future?

Price-to-Sales of 9.1x: Is it justified?

On a price-to-sales basis, CoreWeave looks cheap versus close peers but expensive against the broader US IT sector at its 78.87 dollar closing price.

The price to sales ratio compares the company’s market value to its annual revenue. This can be a useful lens for fast growing, loss making software and cloud infrastructure businesses where earnings are not yet a reliable guide.

Relative to similar high growth names, CoreWeave’s 9.1 times sales looks restrained in the context of its reported top line expansion and forecasts for earnings to grow more than 70 percent annually. The estimated fair price to sales ratio of 27.7 times suggests the market could be assigning a far lower multiple than its growth profile might eventually command.

Set against the wider US IT industry, where the average price to sales multiple sits near 2.2 times, CoreWeave trades at a rich premium. This signals that investors are already paying up heavily for anticipated future revenue and margin gains, with the fair ratio implying substantial headroom if sentiment and execution stay aligned.

Explore the SWS fair ratio for CoreWeave

Result: Price-to-Sales of 9.1x (UNDERVALUED)

However, investors still face key risks, including CoreWeave’s ongoing losses and intense AI infrastructure competition that could squeeze margins and stall the growth story.

Find out about the key risks to this CoreWeave narrative.

Another View: Our DCF Signals Caution

While the price to sales lens points to upside, our DCF model paints a far harsher picture, suggesting fair value is close to 0.01 dollars and that CoreWeave looks heavily overvalued at 78.87 dollars. Is the market right about long term cash flows, or is sentiment running ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoreWeave for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoreWeave Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a complete CoreWeave view in minutes, Do it your way.

A great starting point for your CoreWeave research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before the next move in CoreWeave plays out, give yourself an edge by scanning fresh opportunities across themes and sectors that most investors are still overlooking.

- Capture potential multi baggers early by reviewing these 3628 penny stocks with strong financials that pair tiny market caps with balance sheets and growth profiles that can support a serious rerating.

- Target tomorrow’s software and hardware leaders by using these 24 AI penny stocks to focus on companies building real revenue around machine learning, automation, and intelligent infrastructure.

- Lock in more attractive entry points by filtering for these 904 undervalued stocks based on cash flows where cash flow fundamentals point to mispricing, not hype, as the core of the opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal