Reassessing Canopy Growth (TSX:WEED) Valuation After U.S. Cannabis Reclassification and Turnaround Progress

U.S. President Donald Trump’s executive order moving cannabis to Schedule III has completely changed the backdrop for Canopy Growth (TSX:WEED), reshaping expectations around taxes, banking access, and the company’s already improving turnaround story.

See our latest analysis for Canopy Growth.

Despite the upbeat narrative around Schedule III and Canopy’s cost cuts, momentum has been choppy. A recent 7 day share price return of minus 32.83 percent has offset a 30 day share price return of 9.2 percent and left long term total shareholder returns deeply negative, which suggests that sentiment is improving in bursts rather than in a sustained trend.

If this regulatory shift has you rethinking where growth could come from next, it might be worth exploring fast growing stocks with high insider ownership as a way to uncover other potential turnaround or momentum stories.

With the stock still trading well below analysts’ targets despite narrowing losses and a friendlier regulatory landscape, is Canopy Growth quietly undervalued, or is the market already factoring in the next leg of its recovery?

Most Popular Narrative: 52.7% Undervalued

With Canopy Growth last closing at CA$1.78 against a narrative fair value of CA$3.76, the valuation framework implies a sizable upside if its roadmap plays out.

Analysts are assuming Canopy Growth's revenue will grow by 7.7% annually over the next 3 years.

Analysts are not forecasting that Canopy Growth will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Canopy Growth's profit margin will increase from -187.9% to the average CA Pharmaceuticals industry of 1.2% in 3 years.

Curious how a still unprofitable cannabis company can justify a rich future earnings multiple, rising margins, and steady top line growth all at once? The narrative hinges on a detailed earnings makeover, ambitious revenue expansion, and a valuation framework more often linked to high conviction growth names. Want to see the exact profit transformation and multiple assumptions that underpin that fair value jump? Dive into the full story to unpack the numbers behind this bold upside case.

Result: Fair Value of $3.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and ongoing operating losses could still derail the turnaround, forcing further dilution and delaying the path to sustainable profitability.

Find out about the key risks to this Canopy Growth narrative.

Another View: Market Ratios Flash Caution

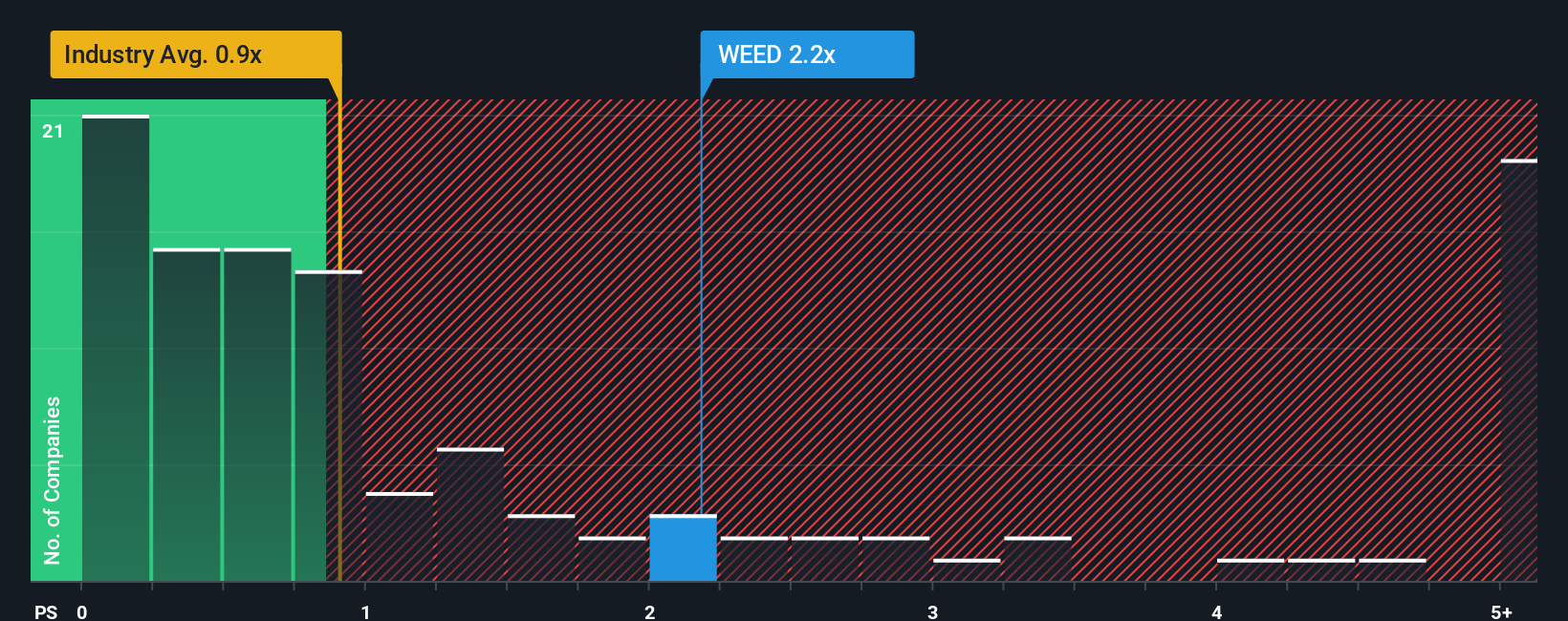

While the narrative fair value points to upside, the current price to sales ratio of 2.2 times looks stretched versus the Canadian pharmaceuticals average of 1 times, a 1.5 times peer average, and a fair ratio of 1 times. This raises real questions about downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Canopy Growth Narrative

If you see the story differently or want to stress test the assumptions with your own numbers, you can build a fresh narrative in minutes using Do it your way.

A great starting point for your Canopy Growth research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before the market moves on without you, use the Simply Wall St Screener to uncover focused opportunities that match your strategy and sharpen your next move.

- Capture potential mispricings by targeting companies trading below their estimated worth through these 904 undervalued stocks based on cash flows, and position yourself early in the re rating story.

- Ride structural growth trends by zeroing in on innovators shaping tomorrow’s technology with these 24 AI penny stocks, where earnings momentum can shift sentiment fast.

- Strengthen your income stream by finding reliable cash generators offering attractive yields via these 10 dividend stocks with yields > 3%, so your portfolio keeps working even when prices stall.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal