Fluence Energy (FLNC): Reassessing Valuation After Downgrades, Revenue Miss, and Record Orders

Fluence Energy (FLNC) just saw its share price drop about 22% in a week after analyst downgrades collided with a mixed quarter, softer revenue, record orders, and better margins.

See our latest analysis for Fluence Energy.

Stepping back, the stock has actually been in a strong upswing, with a 90 day share price return of 69.05% and a 1 year total shareholder return of 22.94%. This latest pullback looks more like momentum cooling than a full reset in expectations.

If Fluence’s volatility has you thinking more broadly about the energy transition, it could be a good moment to scout other renewables and grid tech names via high growth tech and AI stocks.

So with revenue momentum slowing but orders, margins, and AI-driven signals all pointing up, is Fluence finally trading at a sensible discount, or are investors still paying today for growth that is already priced in?

Most Popular Narrative: 32.4% Overvalued

With Fluence Energy last closing at $19.83 against a narrative fair value of $14.97, the market appears to be leaning well ahead of the long run model.

The growing backlog exceeding $4.9 billion, expanding international pipeline, and initial traction for next generation products (e.g., Smartstack) set the stage for an eventual rebound in order volumes, margin expansion from operational efficiencies, and a path back to positive free cash flow as uncertainty recedes and the storage market resumes robust growth.

Curious what kind of revenue climb, margin lift, and earnings power this storyline is baking in, and how it all gets discounted back to today? The full narrative unpacks the step by step financial path behind that valuation call, including how future profitability and capital intensity could reshape Fluence’s long term multiple.

Result: Fair Value of $14.97 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff uncertainty and prolonged project delays could still derail backlog conversion, compress margins, and challenge the optimism baked into current estimates.

Find out about the key risks to this Fluence Energy narrative.

Another Angle on Value

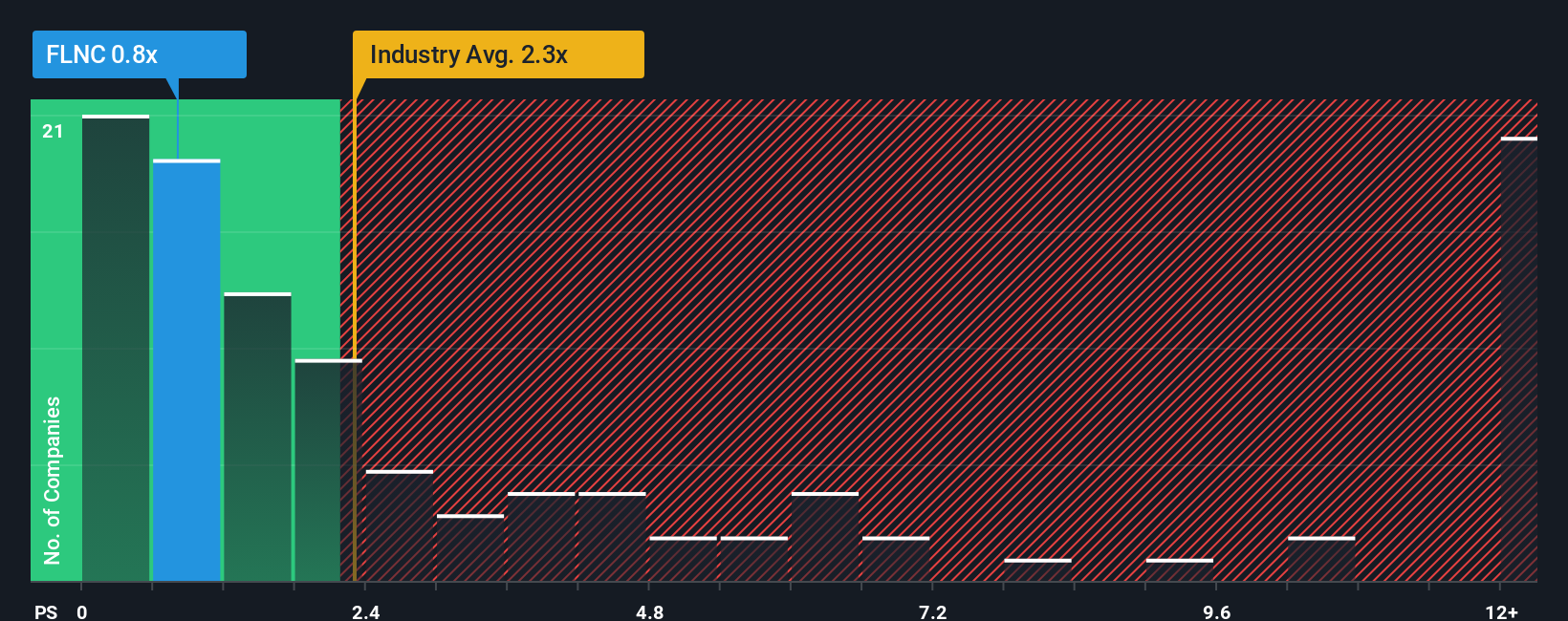

While the narrative model sees Fluence as 32.4% overvalued, its 1.2x price to sales ratio tells a calmer story. It looks cheap versus peers at 5.2x, the US Electrical industry at 2.2x, and even a 2.0x fair ratio. Is the market underpricing execution risk or future upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fluence Energy Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom view in minutes: Do it your way.

A great starting point for your Fluence Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with one stock. Use the Simply Wall Street Screener to quickly surface high conviction ideas tailored to your strategy before the crowd catches on.

- Capture potential mispricing by scanning these 904 undervalued stocks based on cash flows that strong cash flow analysis suggests the market is still overlooking.

- Position ahead of the next tech wave by targeting these 24 AI penny stocks that are building real businesses around artificial intelligence, not just hype.

- Strengthen your income stream by focusing on these 10 dividend stocks with yields > 3% that aim to balance attractive yields with sustainable payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal