Assessing IMAX After a 50% Rally and Strong Premium Theater Expansion in 2025

- If you are wondering whether IMAX is still a smart buy after its big run, or if most of the easy gains are already gone, this breakdown is for you.

- The stock has climbed to around $37.72, adding 0.8% over the last week, 4.8% over the past month, and 50.2% year to date, with a 49.3% gain over 1 year and 169.4% over 3 years, which points to a strong rerating story.

- Recent headlines have focused on IMAX's expanding footprint in premium large format theaters globally and a steady pipeline of blockbuster releases that continue to lean on the brand to drive higher ticket sales. At the same time, renewed interest in experiential entertainment and cinema as a post-lockdown leisure activity has helped shift sentiment back in favor of the big screen experience.

- Despite that backdrop, IMAX only scores a 2 out of 6 on our valuation checks, which suggests that some metrics flag it as undervalued while others look more fully priced. Next, we will walk through those valuation approaches in detail, before circling back to a broader way of thinking about IMAX's worth beyond just the numbers.

IMAX scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: IMAX Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to the present.

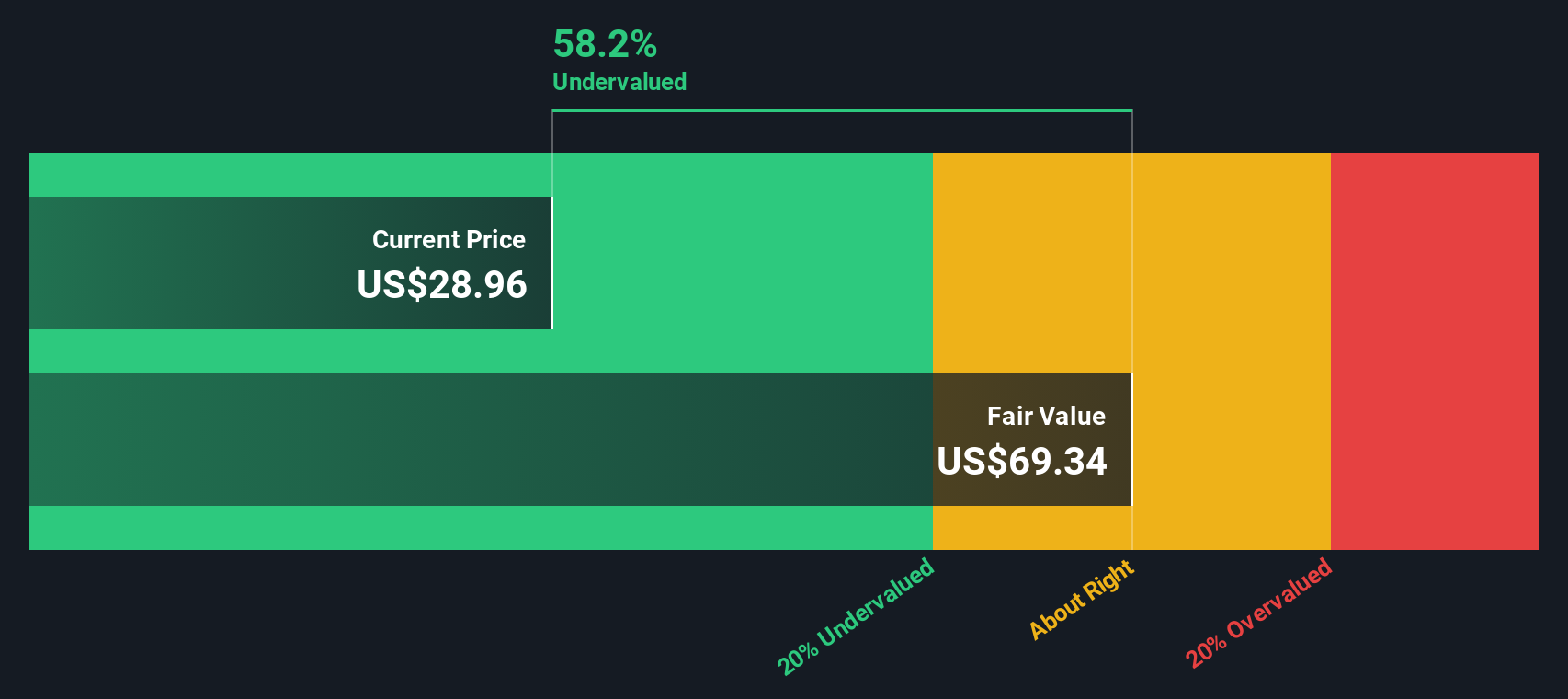

For IMAX, the model uses a 2 Stage Free Cash Flow to Equity approach. The company has generated trailing twelve month free cash flow of about $68.9 Million, and analysts expect this to rise steadily as the business scales. Simply Wall St combines analyst forecasts for the next few years with its own extrapolated projections, with free cash flow expected to reach roughly $259.3 Million by 2035.

On this basis, the DCF model arrives at an estimated intrinsic value of about $60.62 per share, implying the stock is trading at a 37.8% discount to this value. With the current price around $37.72, the model identifies IMAX as notably undervalued, assuming the cash flow trajectory is broadly accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests IMAX is undervalued by 37.8%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: IMAX Price vs Earnings

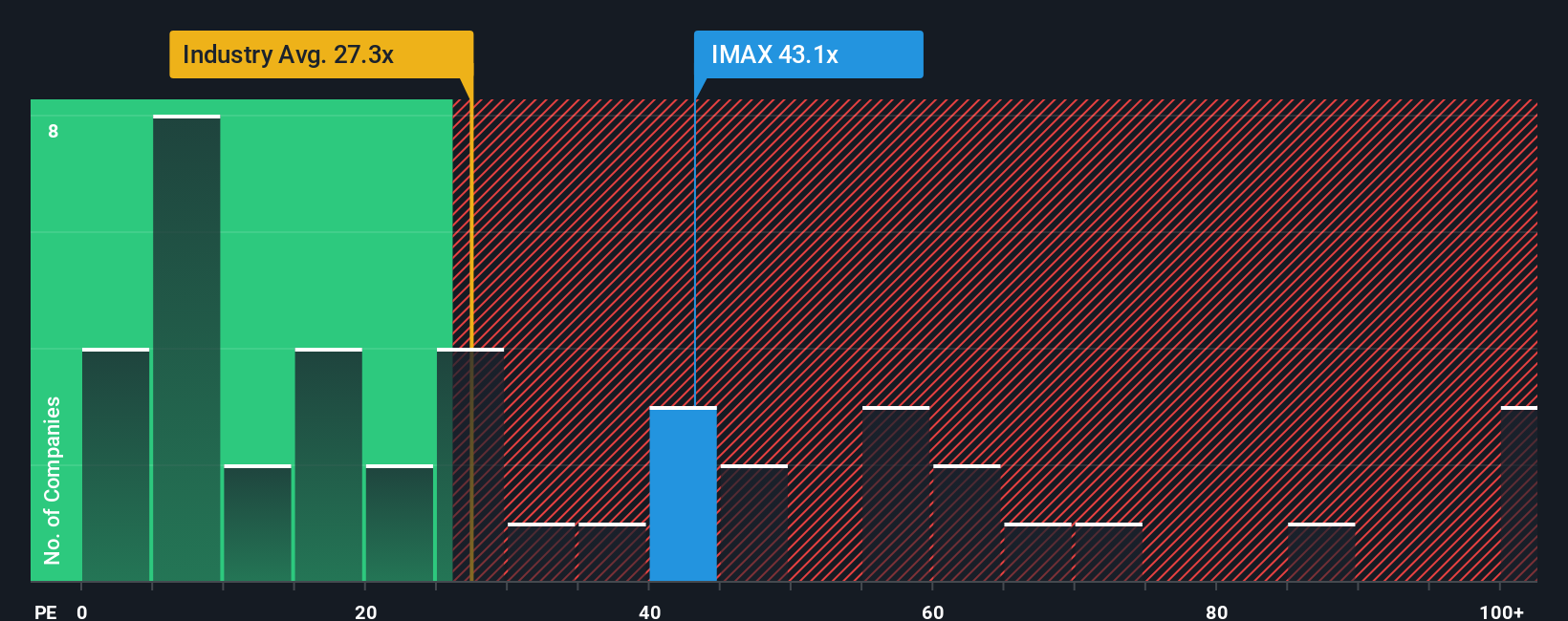

For profitable companies like IMAX, the price to earnings ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. It naturally connects the share price to the bottom line, which is what ultimately supports long term returns.

What counts as a normal or fair PE depends heavily on how fast earnings are expected to grow and how risky those earnings are. Higher growth and more predictable profits usually justify a higher multiple, while slower or more volatile earnings should trade on a lower one.

IMAX currently trades on a PE of about 51.32x, just above its peer average of roughly 50.57x and well above the wider entertainment industry average of around 20.77x. Simply Wall St also calculates a Fair Ratio of 22.05x, a proprietary estimate of the PE you would expect given IMAX's earnings growth outlook, industry, margins, size and risk profile. This Fair Ratio can be more insightful than simple peer or industry comparisons because it adjusts for the specific characteristics of IMAX rather than treating all entertainment stocks as alike. With the current PE sitting far above the 22.05x Fair Ratio, the multiple suggests the shares look expensive on an earnings basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your IMAX Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way for you to write the story behind your numbers by linking your view of IMAX’s future revenues, earnings and margins to a financial forecast and then to a Fair Value that you can directly compare to today’s price.

On Simply Wall St’s Community page, used by millions of investors, Narratives turn this story plus forecast into an accessible tool that helps you assess IMAX by flagging whether your Fair Value sits above or below the current share price, and then dynamically updates that view whenever fresh information like earnings, news or new film slate announcements arrive.

For example, one IMAX Narrative might lean bullish, assuming its expanding premium screen network and strong content pipeline justify a Fair Value near the upper end of recent analyst targets around $39. A more cautious Narrative might focus on content and capital risks and land closer to the lower end near $18. Seeing these side by side makes it easier to choose which story you believe and what that means for your next move.

Do you think there's more to the story for IMAX? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal