Occidental Petroleum (OXY): Reassessing Valuation After Recent Share Price Weakness

Occidental Petroleum (OXY) has been grinding lower, with shares down about 3% over the past month and roughly 15% in the past 3 months, even as longer term returns remain positive.

See our latest analysis for Occidental Petroleum.

Zooming out, the 1 year total shareholder return of negative 15 percent and a year to date share price return near negative 20 percent suggest momentum has clearly been fading, even after a strong 5 year total shareholder return.

If this pullback has you reassessing your energy exposure, it might be worth comparing OXY with other aerospace and defense stocks that could offer different risk and growth profiles.

With Occidental now trading at a steep discount to both analyst targets and some estimates of intrinsic value, despite sliding earnings, investors face a key question: is this a contrarian entry point, or is the market correctly pricing in weaker growth?

Most Popular Narrative Narrative: 19.9% Undervalued

With Occidental Petroleum closing at $40.00 against a narrative fair value near $49.92, the current gap reflects a materially more optimistic long term view.

The analysts have a consensus price target of $50.652 for Occidental Petroleum based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $64.0, and the most bearish reporting a price target of just $40.0.

Want to see what justifies paying up from here? The narrative leans on improving margins, rising earnings power and a richer future profit multiple. Curious which assumptions really move the fair value needle?

Result: Fair Value of $49.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat case still hinges on stable oil markets and successful carbon capture execution, both of which could disappoint and limit potential valuation gains.

Find out about the key risks to this Occidental Petroleum narrative.

Another Angle on Valuation

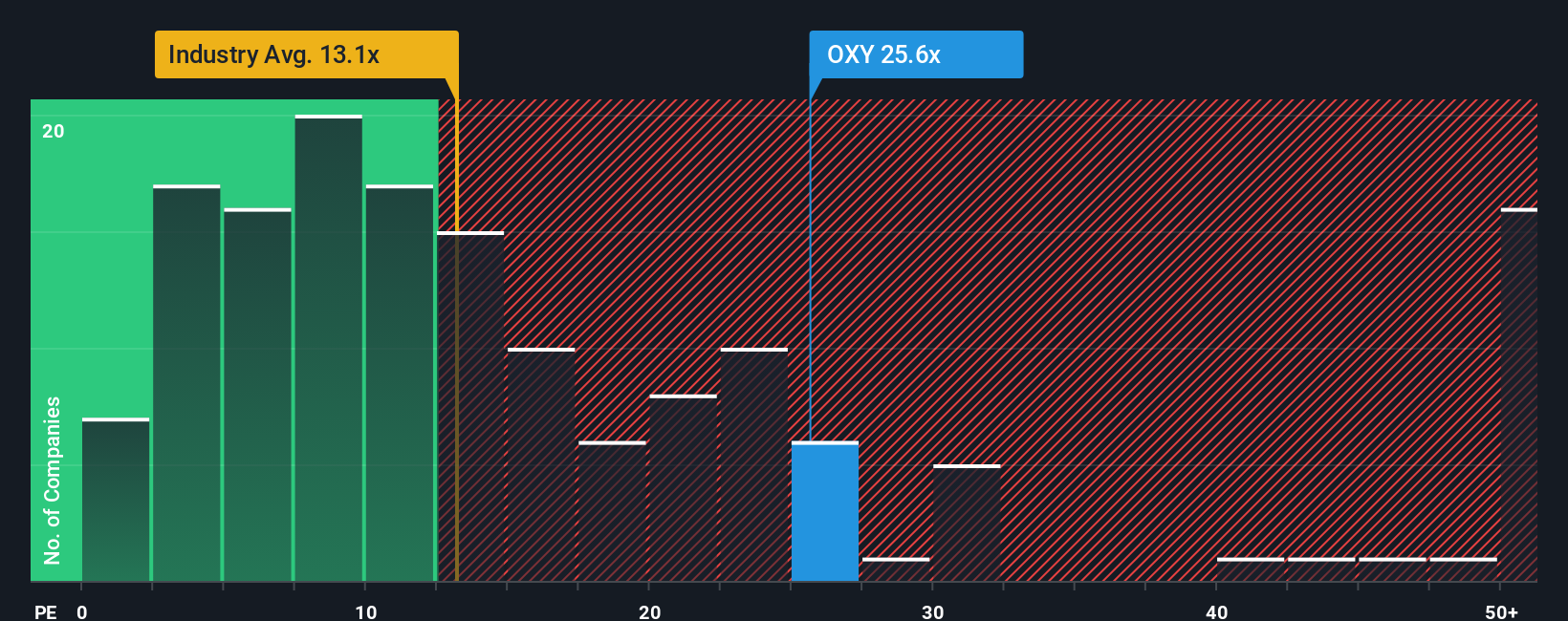

On simple earnings metrics, the story looks very different. Occidental trades on about 27 times earnings, versus a fair ratio of 16.7 times, a US oil and gas average of 12.9 times and a peer average of 24.6 times. That premium suggests there may be downside risk if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Occidental Petroleum Narrative

If you see things differently or would rather dig into the numbers yourself, you can build a custom view in just minutes. Do it your way.

A great starting point for your Occidental Petroleum research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, use the Simply Wall Street Screener to uncover fresh opportunities that match your strategy so you are not stuck watching others get ahead.

- Capture mispriced opportunities early by scanning these 905 undervalued stocks based on cash flows that may offer long term upside compared to widely followed names.

- Explore the next wave of technological change by targeting these 24 AI penny stocks that are exposed to the adoption of artificial intelligence.

- Strengthen your income stream by focusing on these 10 dividend stocks with yields > 3% that may help support both yield and capital preservation through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal