How Investors May Respond To Lundin Mining (TSX:LUN) Authorizing a 7.9% Share Buyback Program

- Earlier in December 2025, Lundin Mining Corporation (TSX:LUN) announced a normal course issuer bid to repurchase up to 67,723,868 common shares, 7.91% of its issued capital, by December 15, 2026, with all repurchased shares to be cancelled.

- By targeting a meaningful reduction in its 855,770,029 outstanding shares, the company is signaling a focus on enhancing per‑share ownership for remaining investors.

- We’ll now examine how this sizable share repurchase authorization could reshape Lundin Mining’s investment narrative around capital allocation and future returns.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Lundin Mining Investment Narrative Recap

To own Lundin Mining today, you need to believe in its copper focused South American portfolio and the successful ramp up of capital intensive growth projects, despite region specific and execution risks. The new normal course issuer bid does not materially change the near term operational catalyst, which remains delivery on production and project timelines, while the biggest immediate risk still lies in concentrated exposure to Chile and broader copper price volatility.

The most closely connected recent development is the Supreme Court of Canada’s decision allowing a proposed securities class action related to the 2017 Candelaria pit wall instability to proceed. While no judgment on the merits has been made, this adds a legal and reputational layer to the existing concentration risk around Candelaria and Caserones, which many investors will weigh against the potential benefits of the new buyback authorization.

But against these potential rewards, the unresolved Candelaria related legal proceedings are a risk investors should be aware of because...

Read the full narrative on Lundin Mining (it's free!)

Lundin Mining’s narrative projects $3.6 billion revenue and $364.3 million earnings by 2028. This assumes revenue remains flat with a 0.0% yearly change and requires an earnings increase of about $211.8 million from $152.5 million today.

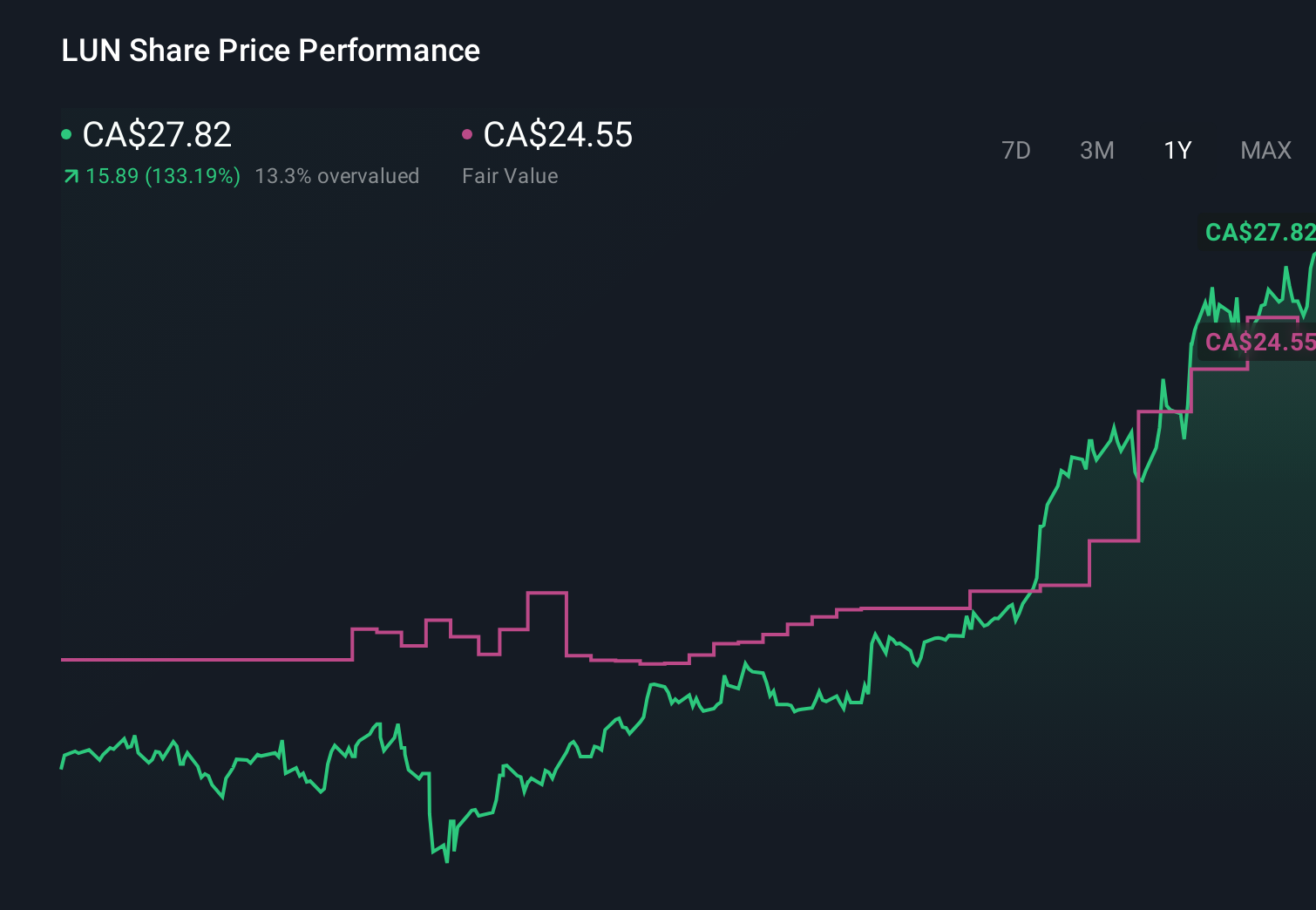

Uncover how Lundin Mining's forecasts yield a CA$27.52 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span a wide CA$1.81 to CA$27.95 range, with opinions spread across all ten valuation buckets. You are seeing these diverse views set against a business where concentrated copper exposure and South American operating risk could have a meaningful impact on future performance, so it is worth considering several perspectives before forming your own.

Explore 6 other fair value estimates on Lundin Mining - why the stock might be worth less than half the current price!

Build Your Own Lundin Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lundin Mining research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Lundin Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lundin Mining's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal