Has the ING Rally Gone Too Far After Its 57.7% Surge in 2025?

- If you are wondering whether ING Groep is still a smart buy after such a huge run up, or if you are late to the party, this breakdown will help you decide whether the current price still makes sense.

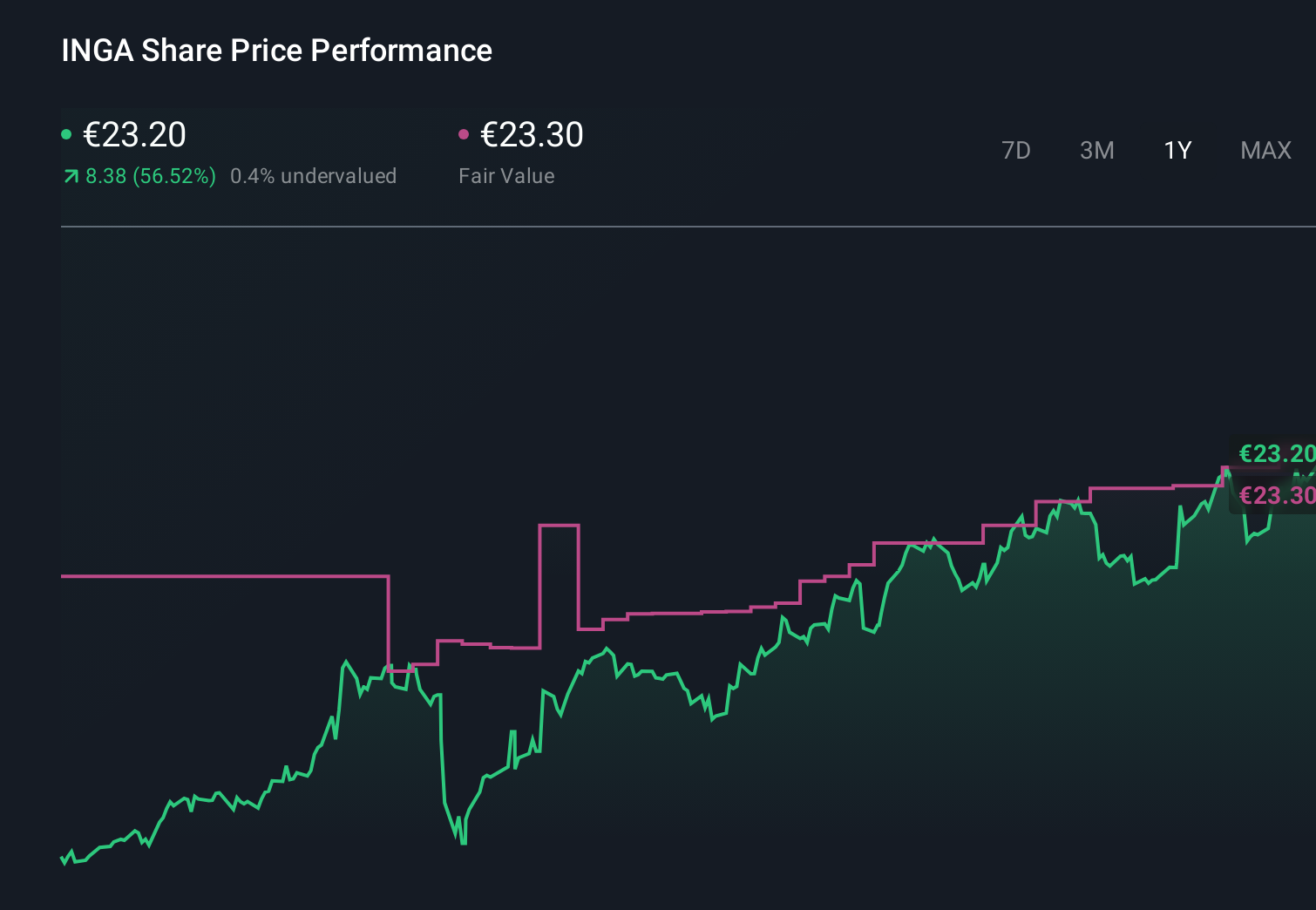

- ING Groep has quietly delivered a 2.2% gain over the last week, 10.6% over the past month, and is up an eye catching 57.7% year to date, with an impressive 73.1% return over the last year and 341.6% over five years.

- Those moves have come as investors have increasingly rewarded European banks that are returning capital to shareholders, tightening costs, and benefiting from higher interest rate environments. ING has been part of that narrative, with ongoing capital return programs and strategic simplification themes helping to underpin sentiment around the stock.

- Despite that backdrop, ING Groep only scores 2/6 on our undervaluation checks. This suggests the story is more nuanced than price strength alone. Next we will unpack what different valuation approaches are signalling today and hint at an even better way to frame value at the end of this article.

ING Groep scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ING Groep Excess Returns Analysis

The Excess Returns model looks at how much profit a bank can generate above the return that shareholders require, then capitalizes those extra profits into an intrinsic value per share.

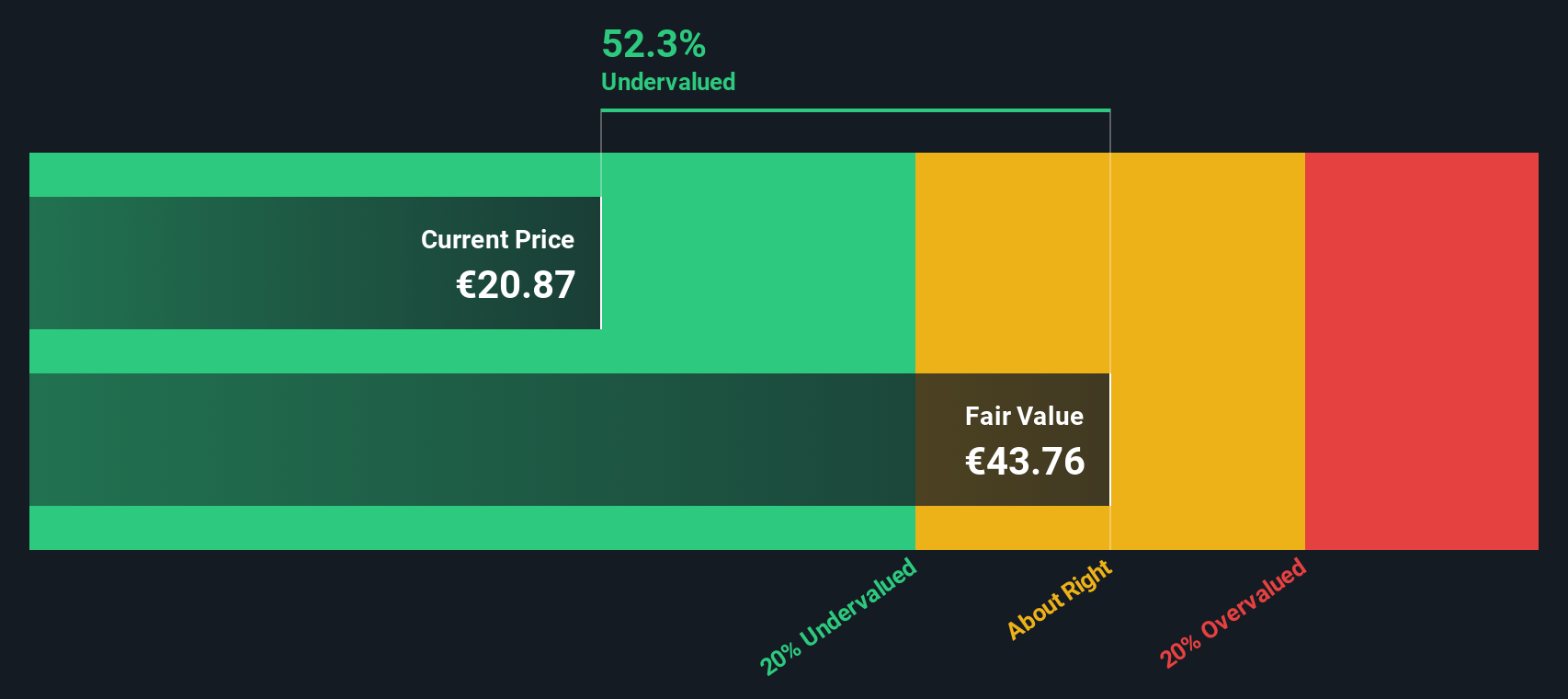

For ING Groep, the starting point is a Book Value of €16.84 per share and a Stable EPS of €2.41 per share, based on weighted future Return on Equity estimates from 15 analysts. With an Average Return on Equity of 13.42%, the bank is expected to earn more than its Cost of Equity, which is estimated at €1.13 per share.

The difference between what ING earns and what investors require, its Excess Return, is €1.27 per share. As this is earned on a Stable Book Value of €17.93 per share, based on estimates from 9 analysts, the model assigns ING a fair value of about €46.17 per share.

Compared with the current market price, this implies the shares are roughly 48.2% undervalued, which indicates investors may not be fully pricing in ING's ability to generate attractive returns on equity.

Result: UNDERVALUED

Our Excess Returns analysis suggests ING Groep is undervalued by 48.2%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

Approach 2: ING Groep Price vs Earnings

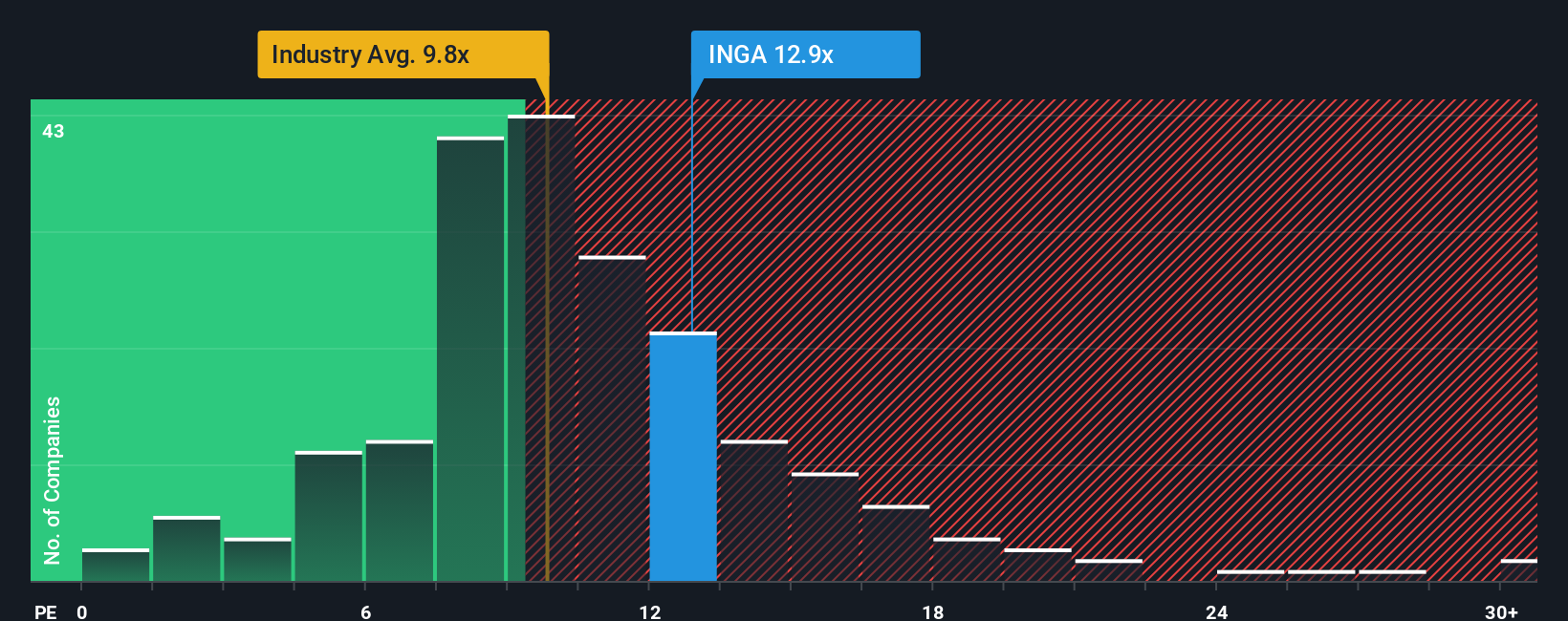

For profitable banks like ING Groep, the price to earnings ratio is a practical way to gauge what investors are willing to pay today for each euro of current earnings. It ties valuation directly to the bottom line that ultimately funds dividends and buybacks.

What counts as a normal or fair PE ratio depends on how quickly earnings are expected to grow and how risky those earnings are. Faster, more predictable growth can justify a higher multiple, while slower or more volatile profits usually command a discount. ING currently trades on a PE of about 13.9x, which is above the broader Banks industry average of roughly 10.9x and also higher than the peer group average of about 12.5x. This suggests investors already ascribe it a quality or growth premium.

Simply Wall St's Fair Ratio of around 13.0x is a proprietary estimate of the PE investors should reasonably pay for ING once its earnings growth outlook, profitability, risk profile, industry and market cap are all factored in. Because it blends these company specific drivers, it is more informative than a simple comparison with peers or the sector. With the market PE modestly above the Fair Ratio, ING looks slightly expensive on this lens, but not dramatically so.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ING Groep Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of ING Groep’s story with a set of numbers like future revenue, earnings, margins and a fair value estimate.

A Narrative on Simply Wall St is your own investing storyline, where you spell out what you think will drive ING’s business, link that to a financial forecast, and see what fair value those assumptions imply, rather than relying only on static multiples like PE.

Because Narratives live inside the Simply Wall St Community page, they are easy to create, compare and refine, and they can help inform your decision making by showing how your Fair Value stacks up against today’s share price.

They also update dynamically as new information such as earnings releases, macro news or regulatory changes comes in, so your Narrative can evolve instead of going stale.

For example, one ING Narrative might see fair value near €27.92 with faster revenue growth and higher margins, while another pegs it closer to about €23.30 with more conservative assumptions. Comparing these views side by side can clarify which story you find more compelling and what price levels you consider attractive.

For ING Groep, however, we will make it really easy for you with previews of two leading ING Groep Narratives:

Fair value: €27.92

Implied undervaluation: -1.2%

Revenue growth assumption: 9.0%

- Expects EU wide public infrastructure investment to spur loan demand, steepen the yield curve and support stronger net interest income for ING.

- Highlights ING's strategic pivot toward higher fee based income in areas like wealth management, M&A and debt underwriting to reduce reliance on net interest income.

- Sees further upside and attractive dividends despite past share price gains, while noting higher required returns given elevated geopolitical and macro risk.

Fair value: €23.30

Implied overvaluation: 2.7%

Revenue growth assumption: 9.9%

- Credits ING with strong digital banking investments, rising fee income and sustainable finance growth, which together improve resilience and margins.

- Assumes solid earnings and capital returns but flags macro uncertainty, regulatory frictions, margin pressure and funding cost risks as constraints on long term profitability.

- Views the current share price as close to consensus fair value, which implies only modest upside from here unless ING outperforms already optimistic earnings and ROE expectations.

Do you think there's more to the story for ING Groep? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal