Corteva (CTVA) Valuation Check After New AI‑Driven Crop Protection Partnership With Hexagon Bio

Corteva (CTVA) just teamed up with Hexagon Bio in a multi million dollar joint venture that leans hard into nature inspired, AI driven crop protection, a move that also nudges Corteva toward human health applications.

See our latest analysis for Corteva.

That backdrop helps explain why investors have quietly rewarded Corteva, with a roughly 19.5 percent year to date share price return and an 18.3 percent one year total shareholder return signaling steady, rather than explosive, momentum as the Hexagon Bio deal adds a new growth angle.

If this kind of science driven growth story interests you, it may be a good time to explore other innovative agriculture and materials names alongside Corteva by screening for fast growing stocks with high insider ownership.

With shares hovering below analyst targets and growth shifting from steady to innovation fueled, is Corteva still trading at a discount to its future pipeline, or are markets already pricing in the next leg of expansion?

Most Popular Narrative: 13.4% Undervalued

With Corteva last closing at $67.33 against a narrative fair value near the high $70s, the story centers on durable, compounding earnings power rather than a quick re rating.

Advancements in Corteva's innovation pipeline including premium trait launches (Vorceed, PowerCore), expansion of biological products, and gene editing enable premium pricing, secure market share, and improve product mix, translating into higher gross margins and earnings growth.

Curious how steady, mid single digit sales expectations still underpin a much richer profit profile and elevated future multiple projections? The narrative leans on a powerful mix of margin expansion, disciplined share count reduction, and a higher than average required return to justify that gap. Want to see exactly how those moving parts combine into today’s fair value call and where the earnings line is projected to land a few years out? Read on to unpack the full set of assumptions driving this view.

Result: Fair Value of $77.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent crop protection price pressure and tougher environmental regulation could slow margin expansion and challenge the premium multiple underpinning today’s undervaluation case.

Find out about the key risks to this Corteva narrative.

Another Angle on Value

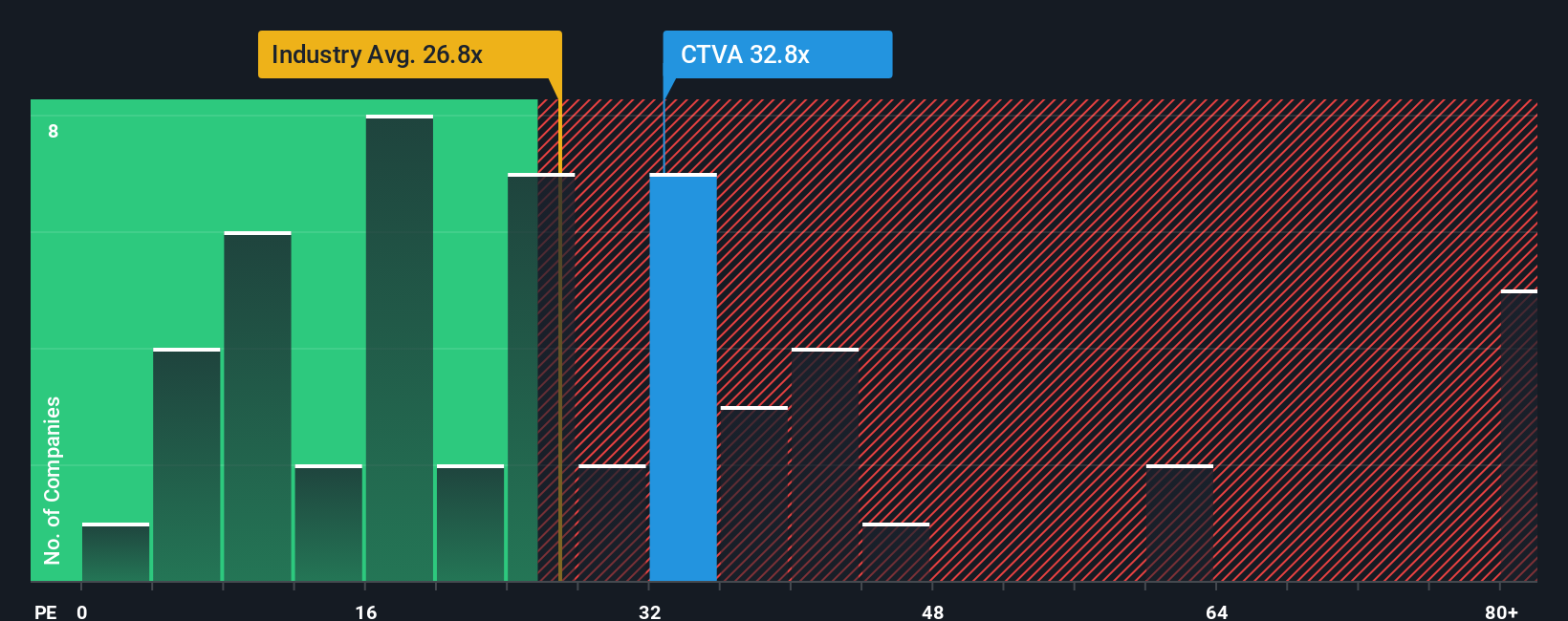

On simple earnings multiples, Corteva looks anything but cheap. The shares trade on about 27.1 times earnings versus 23.6 times for the US Chemicals industry and a 24.9 times fair ratio, suggesting investors are already paying up for quality and execution. If growth or margins disappoint, how much air is left in that premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corteva Narrative

If you would rather dig into the numbers yourself and challenge this view, you can build a full narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Corteva.

Looking for more high impact investment ideas?

Before markets move on without you, put Simply Wall St to work and line up your next opportunities with targeted stock lists built around real fundamentals.

- Capitalize on overlooked growth potential by scanning these 905 undervalued stocks based on cash flows that strong cash flow math suggests the market has not fully appreciated yet.

- Ride structural technology shifts by focusing on these 24 AI penny stocks positioned to benefit from accelerating adoption of machine learning and automation.

- Strengthen your portfolio income by zeroing in on these 10 dividend stocks with yields > 3% that can boost yield while still keeping quality in focus.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal