ASX Growth Leaders With High Insider Stakes

As the Australian stock market approaches the end of the year, it is experiencing a slight downturn, likely due to profit-taking before the holiday break, despite global markets nearing record highs. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.2% | 96.3% |

| Titomic (ASX:TTT) | 15% | 74.9% |

| Sea Forest (ASX:SEA) | 15.1% | 92.6% |

| Pure One (ASX:P1E) | 10.4% | 114.6% |

| Polymetals Resources (ASX:POL) | 32.9% | 108% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| BlinkLab (ASX:BB1) | 35.3% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Let's uncover some gems from our specialized screener.

Polymetals Resources (ASX:POL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Polymetals Resources Ltd focuses on the exploration and development of gold projects in West Africa, with a market cap of A$391.88 million.

Operations: The company's revenue segments include silver-zinc-lead, generating A$0.0013 million.

Insider Ownership: 32.9%

Earnings Growth Forecast: 108% p.a.

Polymetals Resources is positioned for significant growth, with revenue expected to rise 83.2% annually, outpacing the Australian market. Despite this potential, the company faces challenges such as a recent net loss of A$47.85 million and auditor concerns about its viability as a going concern. Insider ownership remains high; however, substantial shareholder dilution occurred recently through equity offerings totaling A$35.615 million to support operations and future profitability goals.

- Click here and access our complete growth analysis report to understand the dynamics of Polymetals Resources.

- Insights from our recent valuation report point to the potential overvaluation of Polymetals Resources shares in the market.

PWR Holdings (ASX:PWH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PWR Holdings Limited specializes in the design, prototyping, production, testing, validation, and sale of cooling products and solutions across various international markets with a market cap of A$775.43 million.

Operations: The company's revenue segments include PWR C&R generating A$42.33 million and PWR Performance Products contributing A$101.83 million.

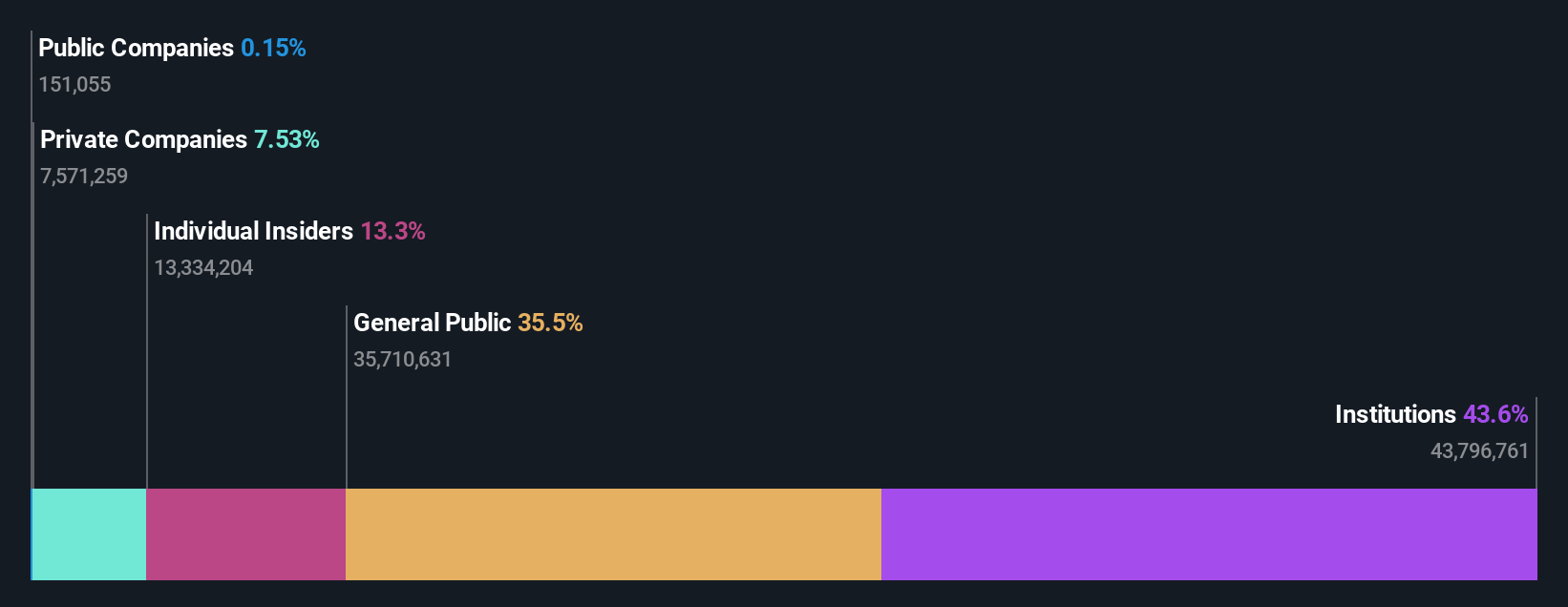

Insider Ownership: 13.4%

Earnings Growth Forecast: 26.9% p.a.

PWR Holdings demonstrates potential for growth with earnings forecasted to grow 26.9% annually, outpacing the Australian market. However, profit margins have decreased from last year. Recent board changes include Mr. Kees Weel's transition to Chairman and Ms. Kristen Podagiel's appointment as Lead Independent Director, reflecting strategic leadership shifts. Despite trading below estimated fair value and having high insider ownership, revenue growth is expected at a moderate pace of 13.8% annually compared to market averages.

- Get an in-depth perspective on PWR Holdings' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that PWR Holdings' share price might be on the expensive side.

Telix Pharmaceuticals (ASX:TLX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Telix Pharmaceuticals Limited is a commercial-stage biopharmaceutical company that develops and commercializes therapeutic and diagnostic radiopharmaceuticals, with a market cap of A$4.03 billion.

Operations: Telix Pharmaceuticals generates revenue through its segments in therapeutics ($7.29 million), precision medicine ($575.13 million), and manufacturing solutions ($115.57 million).

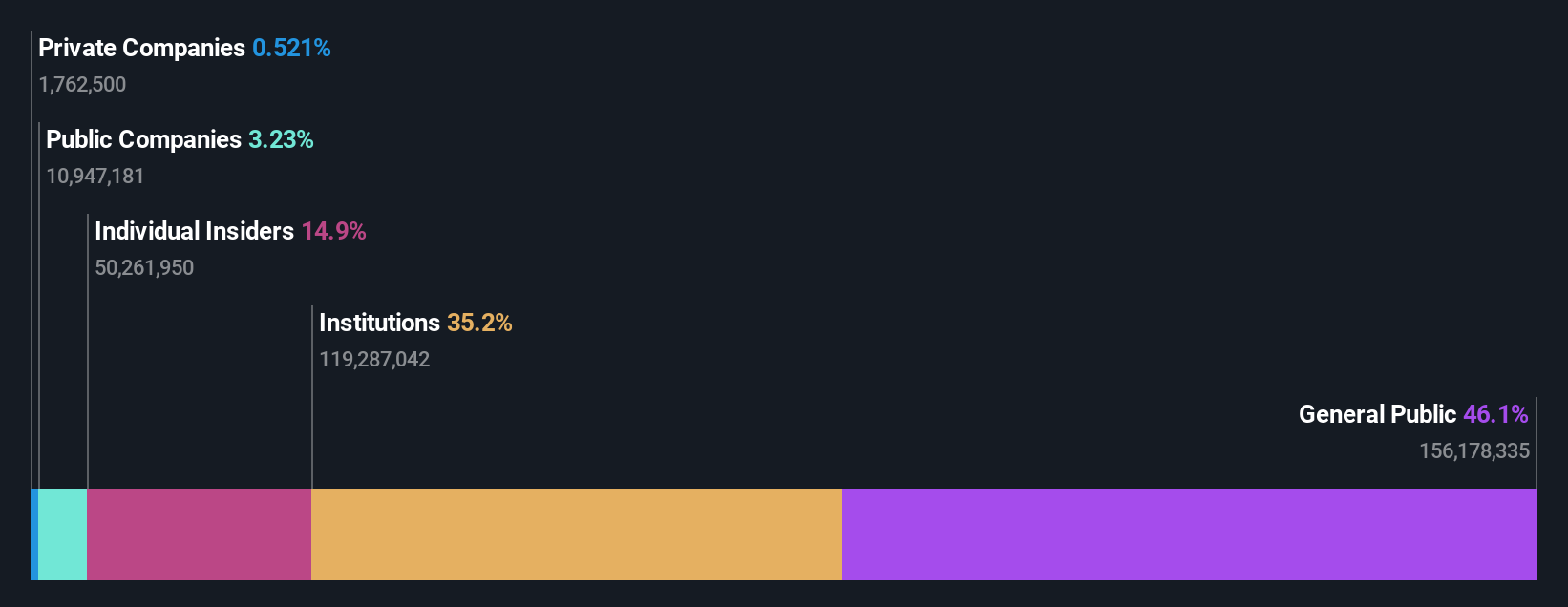

Insider Ownership: 14.9%

Earnings Growth Forecast: 46.9% p.a.

Telix Pharmaceuticals is experiencing robust growth, with earnings projected to rise 47% annually, surpassing the Australian market's average. Despite lower profit margins compared to last year, Telix's strategic alliances and ongoing global trials in prostate cancer therapies highlight its innovative edge. The company's revenue is expected to grow faster than the market at 17.1% per year, supported by recent financial guidance upgrades projecting revenues up to A$820 million for 2025. Insider ownership remains significant, indicating strong internal confidence.

- Dive into the specifics of Telix Pharmaceuticals here with our thorough growth forecast report.

- Our valuation report unveils the possibility Telix Pharmaceuticals' shares may be trading at a discount.

Turning Ideas Into Actions

- Embark on your investment journey to our 112 Fast Growing ASX Companies With High Insider Ownership selection here.

- Curious About Other Options? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal