Exploring 3 Undiscovered Gems in the Australian Stock Market

As the Australian stock market approaches the holiday season, it is experiencing a slight dip, attributed to profit-taking and influenced by Wall Street's recent highs. Amidst this backdrop of fluctuating indices and vibrant commodities markets, identifying promising small-cap stocks requires a keen understanding of their potential for growth and resilience in diverse economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Argosy Minerals | NA | -12.81% | -19.89% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Diversified United Investment (ASX:DUI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Diversified United Investment Limited is a publicly owned investment manager with a market cap of A$1.15 billion.

Operations: DUI generates revenue primarily from its investment company segment, amounting to A$46.71 million.

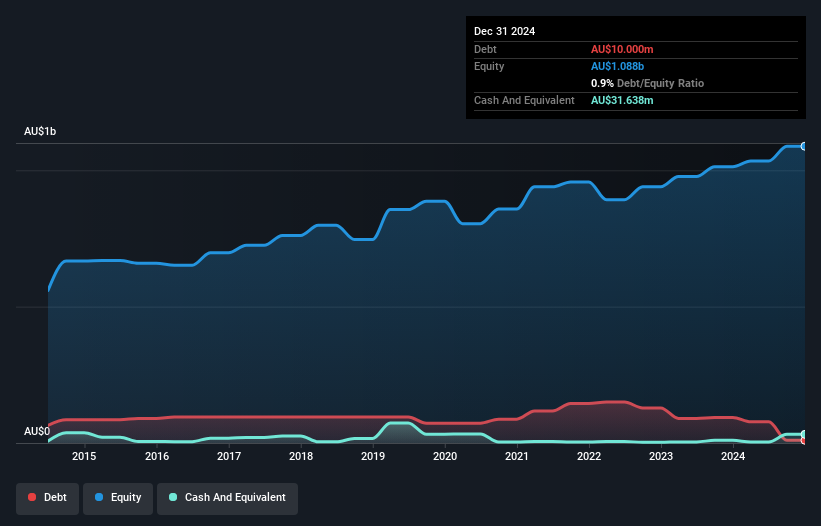

Diversified United Investment, with its high-quality earnings, presents a unique profile in the Australian market. Over the past five years, earnings have grown at 5% annually, showcasing consistent performance despite not outpacing industry growth of 12.7% last year. The company is debt-free now compared to a 9% debt-to-equity ratio five years ago, eliminating concerns over interest coverage and signaling prudent financial management. However, significant insider selling in recent months might raise some eyebrows among investors. With a levered free cash flow of A$39 million as of June 2025 and no debt burden, DUI remains financially robust and poised for future opportunities.

Focus Minerals (ASX:FML)

Simply Wall St Value Rating: ★★★★★★

Overview: Focus Minerals Limited is involved in the exploration and development of gold properties in Western Australia, with a market capitalization of approximately A$1.01 billion.

Operations: Focus Minerals Limited generates revenue primarily from its Coolgardie segment, amounting to A$151.74 million. The company's market capitalization stands at approximately A$1.01 billion.

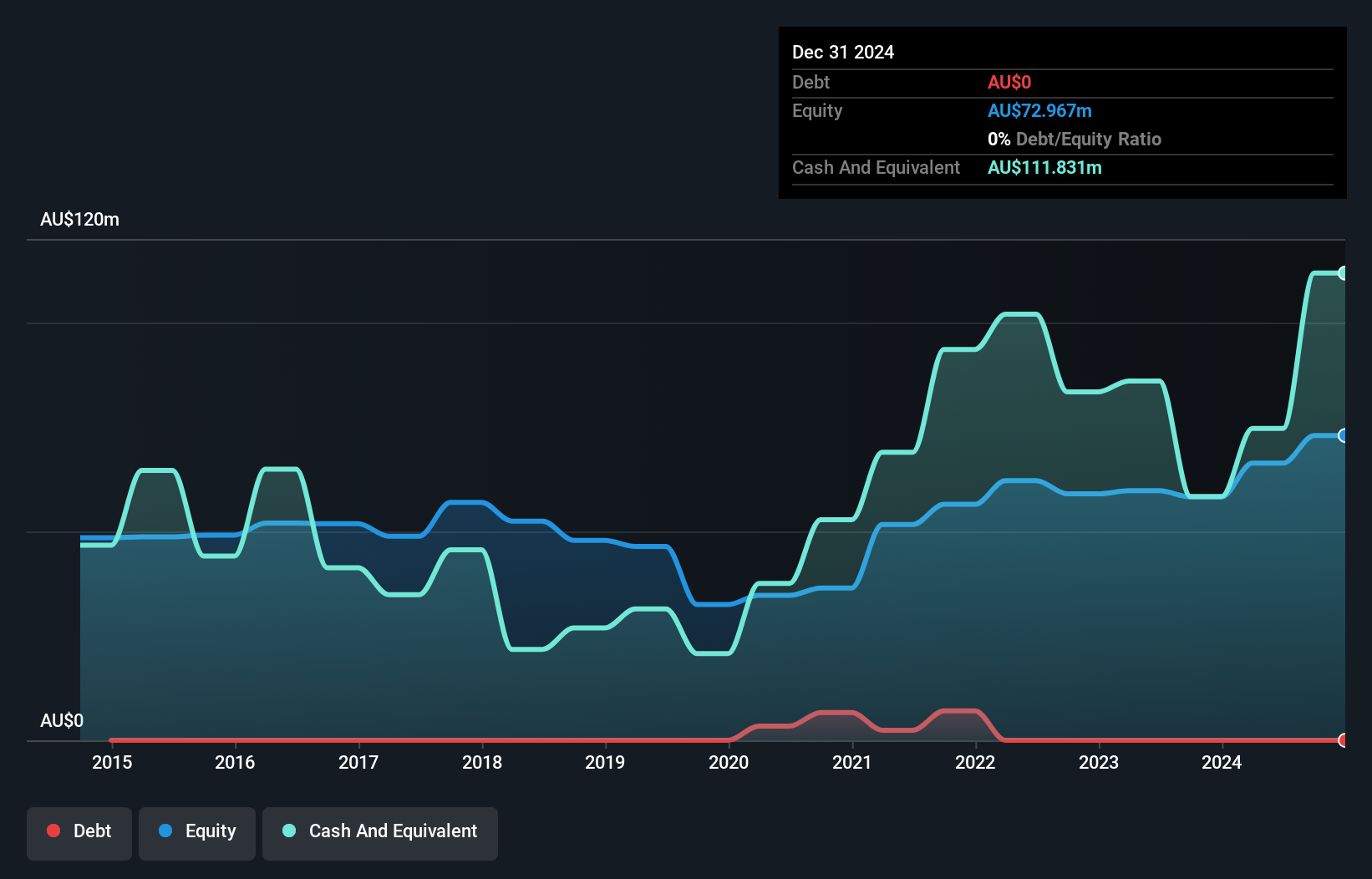

In the dynamic landscape of Australia's mining sector, Focus Minerals stands out with its robust earnings growth of 136% over the past year, surpassing the industry average of 10%. Despite a volatile share price in recent months, FML remains debt-free and boasts high-quality earnings. The company has no concerns about cash runway due to its profitability. However, free cash flow remains negative at A$6.21 million as of June 2024, influenced by significant capital expenditures totaling A$22.7 million. These figures suggest that while operationally strong, financial management and expenditure control could be areas for improvement moving forward.

- Click here and access our complete health analysis report to understand the dynamics of Focus Minerals.

Explore historical data to track Focus Minerals' performance over time in our Past section.

GR Engineering Services (ASX:GNG)

Simply Wall St Value Rating: ★★★★★★

Overview: GR Engineering Services Limited offers engineering, process control, automation, and construction services primarily to the mining and mineral processing industries globally, with a market capitalization of approximately A$731.73 million.

Operations: GR Engineering Services Limited generates revenue primarily from its Mineral Processing segment, contributing A$383.09 million, and its Oil and Gas segment, which adds A$95.93 million.

GR Engineering Services, a nimble player in Australia, offers an intriguing profile with its debt-free balance sheet and impressive earnings growth of 21.8% annually over the past five years. Trading at a significant 41.5% below estimated fair value, this company presents potential upside for investors seeking undervalued opportunities. Despite recent insider selling activity over the last quarter, GR Engineering remains free cash flow positive, underscoring its robust financial health. The company's revenue is expected to grow by 7.8% per year, providing a solid foundation for future expansion within the competitive engineering services sector in Australia.

- Unlock comprehensive insights into our analysis of GR Engineering Services stock in this health report.

Assess GR Engineering Services' past performance with our detailed historical performance reports.

Key Takeaways

- Delve into our full catalog of 59 ASX Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal