Undervalued Small Caps With Insider Action To Consider In December 2025

As the U.S. stock market reaches new heights with the S&P 500 closing at a record high, small-cap stocks are gaining attention amidst a robust economic backdrop marked by stronger-than-expected GDP growth. In this thriving environment, identifying small-cap companies with potential insider action can offer intriguing opportunities for investors looking to diversify their portfolios.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Merchants Bancorp | 7.7x | 2.6x | 48.96% | ★★★★★★ |

| Wolverine World Wide | 16.5x | 0.8x | 39.98% | ★★★★★☆ |

| MVB Financial | 10.2x | 2.0x | -9.92% | ★★★★☆☆ |

| Angel Oak Mortgage REIT | 12.3x | 6.2x | 44.17% | ★★★★☆☆ |

| Farmland Partners | 6.4x | 7.9x | -88.63% | ★★★★☆☆ |

| Auburn National Bancorporation | 12.7x | 2.8x | 20.31% | ★★★☆☆☆ |

| Metropolitan Bank Holding | 12.7x | 3.1x | 30.16% | ★★★☆☆☆ |

| Omega Flex | 17.8x | 2.9x | 4.18% | ★★★☆☆☆ |

| Infinity Natural Resources | NA | 0.7x | -7.71% | ★★★☆☆☆ |

| Vestis | NA | 0.3x | -6.89% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

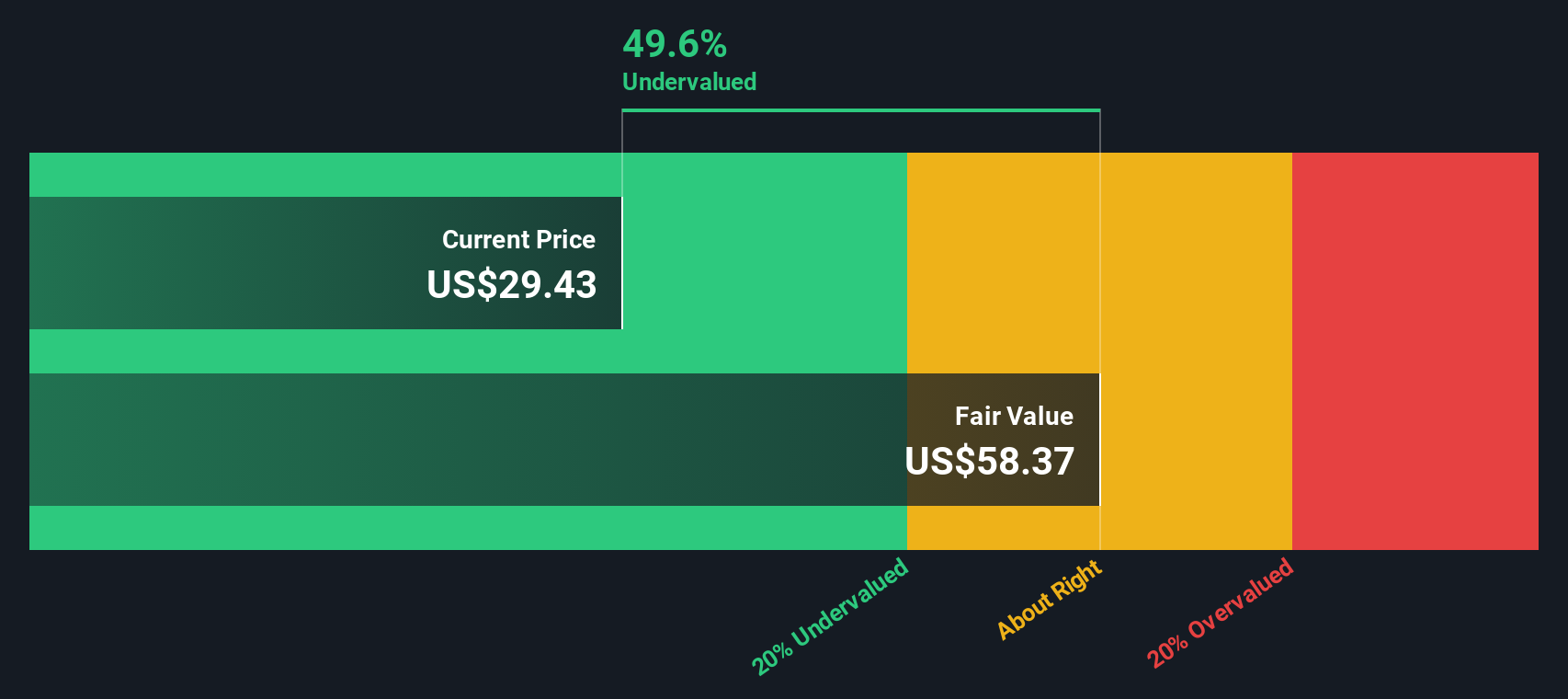

Clearfield (CLFD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Clearfield focuses on designing and manufacturing fiber management and connectivity products for communication networks, with a market cap of approximately $0.53 billion.

Operations: Clearfield's revenue model is primarily driven by its sales, with a recent revenue figure of $150.13 million. The company experienced fluctuations in gross profit margin, which was last recorded at 33.66%. Operating expenses are a significant cost factor, recently reported at $48.42 million.

PE: 65.0x

Clearfield's recent financial performance highlights its potential as an undervalued opportunity in the small-cap sector. For the year ending September 2025, sales grew to US$150.13 million from US$125.57 million, while net loss narrowed to US$8.05 million from US$12.45 million previously, indicating operational improvement. The company anticipates fiscal 2026 sales between US$160 and US$170 million with earnings per share ranging from $0.48 to $0.62, suggesting optimism for future growth despite reliance on external borrowing for funding needs and no insider confidence through share purchases recently observed.

- Delve into the full analysis valuation report here for a deeper understanding of Clearfield.

Review our historical performance report to gain insights into Clearfield's's past performance.

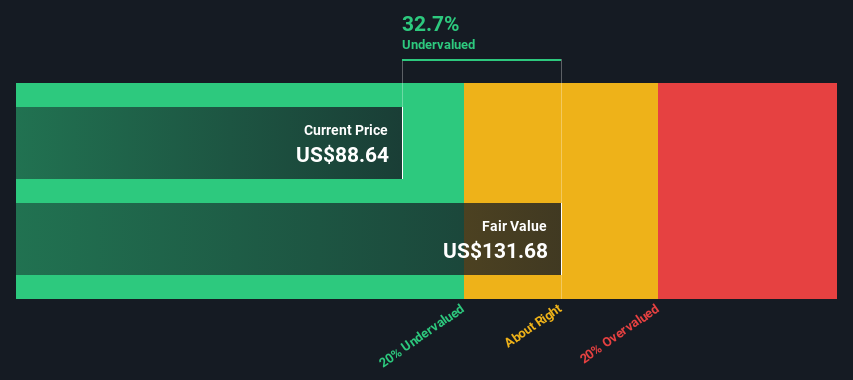

Cross Country Healthcare (CCRN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cross Country Healthcare is a workforce solutions and healthcare staffing services provider, with operations primarily focused on nurse and allied staffing, as well as physician staffing, and has a market capitalization of approximately $0.97 billion.

Operations: The company generates revenue primarily from Nurse and Allied Staffing, which accounts for a significant portion of its total income. Gross profit margin has shown variability, reaching 26.68% in Q3 2016 before declining to 20.19% by Q3 2025. Operating expenses are a major cost component, consistently comprising a large part of the company's financial structure over time.

PE: -16.7x

Cross Country Healthcare, a company in the healthcare staffing sector, recently saw its CEO replaced by co-founder Kevin C. Clark, who has a strong track record in the industry. Despite reporting a net loss of US$4.77 million for Q3 2025, insider confidence is evident as they have been purchasing shares since early 2025. The cancellation of an acquisition deal with Aya Healthcare on December 3, 2025 adds uncertainty but also potential for strategic realignment under Clark's leadership.

Northrim BanCorp (NRIM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Northrim BanCorp is a financial services company primarily engaged in community banking, home mortgage lending, and specialty finance with a market capitalization of $0.23 billion.

Operations: Northrim BanCorp's revenue is primarily driven by Community Banking, contributing $141.80 million, and Home Mortgage Lending at $36.89 million. The company consistently reports a gross profit margin of 100%, indicative of no direct costs associated with its revenue streams in the provided data. Operating expenses are significant, with General & Administrative Expenses being the largest component, reaching up to $101.70 million in recent periods. The net income margin shows variability but has reached as high as 31.31% in certain quarters, reflecting fluctuations in profitability relative to total revenue over time.

PE: 9.7x

Northrim BanCorp, a smaller financial entity in the U.S., recently declared a quarterly dividend of US$0.16 per share, signaling stable shareholder returns. Their completion of a US$60 million private placement in subordinated notes at 6.875% interest shows strategic capital management for growth initiatives. The company reported significant earnings growth for Q3 2025, with net income rising to US$27.07 million from US$8.83 million year-on-year, highlighting its potential for continued performance improvements amidst insider confidence through stock purchases earlier this year.

- Get an in-depth perspective on Northrim BanCorp's performance by reading our valuation report here.

Evaluate Northrim BanCorp's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 81 companies within our Undervalued US Small Caps With Insider Buying screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal