European Growth Companies With High Insider Ownership In December 2025

As of December 2025, the European market has shown resilience, with the pan-European STOXX Europe 600 Index rising by 1.60%, supported by steady economic growth and looser monetary policy. With the European Central Bank maintaining a stable interest rate environment and signs of economic stability across major indices, investors are increasingly focusing on companies with strong insider ownership as they often align management interests with shareholder value, making them attractive in today's market landscape.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Skolon (OM:SKOLON) | 32.3% | 126.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Let's explore several standout options from the results in the screener.

CapMan Oyj (HLSE:CAPMAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CapMan Oyj is a Nordic private assets management and investment firm specializing in growth capital, industry consolidation, special situations, and various other investment strategies with a market cap of €341.32 million.

Operations: CapMan Oyj generates revenue through its private equity and venture capital activities, focusing on growth capital investments, industry consolidation, special situations, and real estate investments in value-add and income-focused properties.

Insider Ownership: 14.6%

CapMan Oyj, with substantial insider ownership, is experiencing significant earnings growth, forecasted at 28.3% annually over the next three years, outpacing the Finnish market. Despite a revenue growth rate of 11.2%, which is slower than optimal for high-growth companies, recent financial results show improvement; Q3 revenue rose to €15.42 million from €12.81 million year-on-year and net income turned positive at €5.44 million from a prior loss.

- Get an in-depth perspective on CapMan Oyj's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that CapMan Oyj is priced higher than what may be justified by its financials.

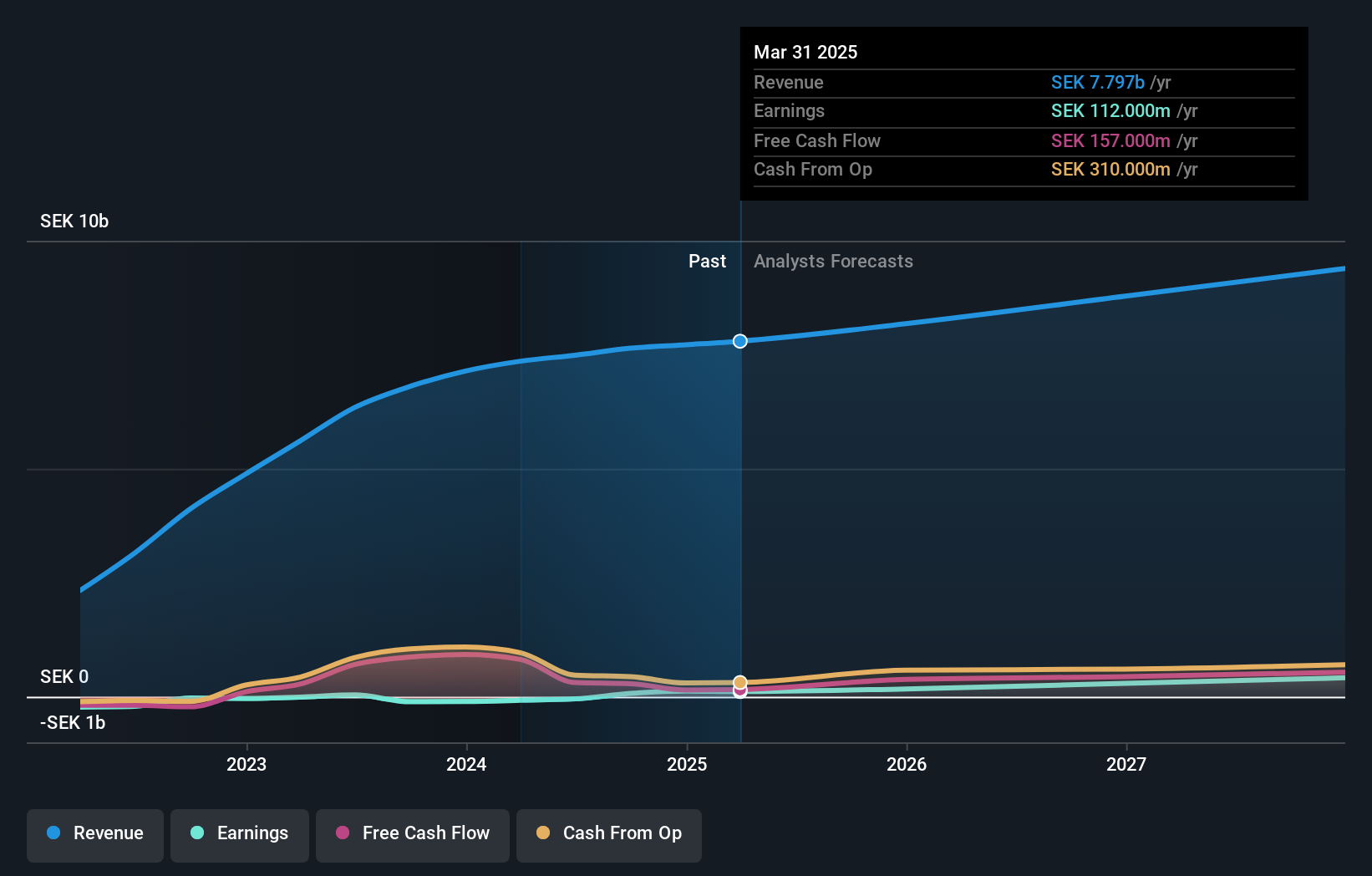

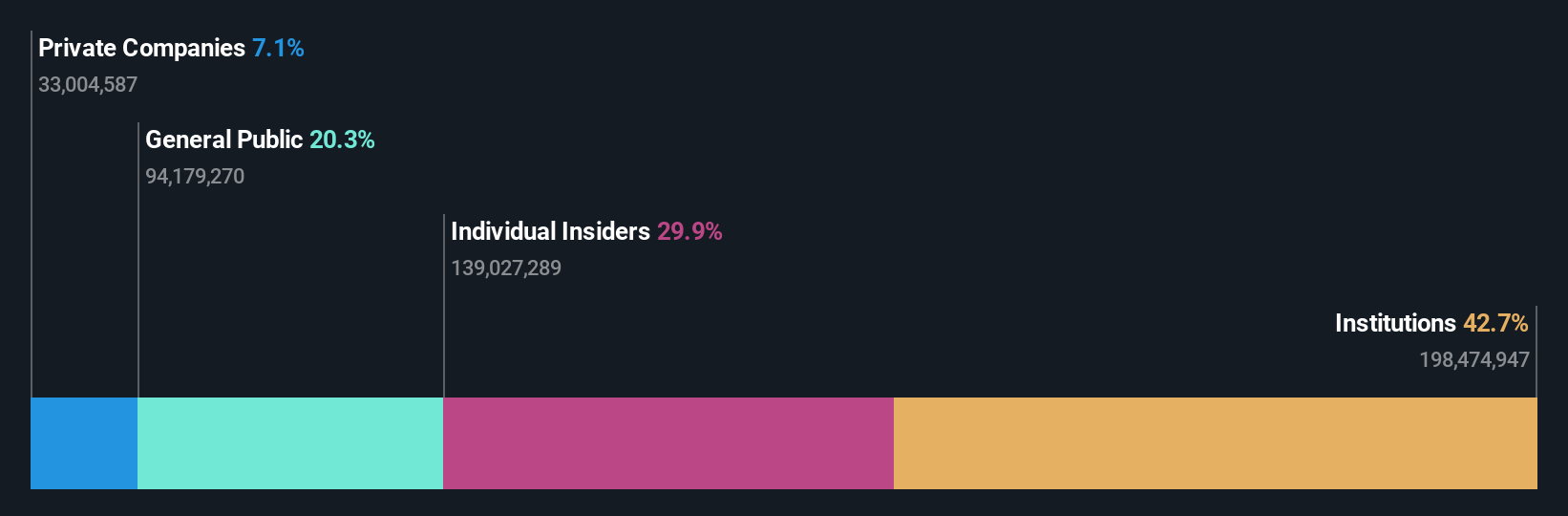

Humble Group (OM:HUMBLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Humble Group AB (publ) is involved in the development, refinement, and distribution of fast-moving consumer products both in Sweden and internationally, with a market cap of SEK3.40 billion.

Operations: The company's revenue segments include Future Snacking at SEK1.12 billion, Sustainable Care at SEK2.37 billion, Quality Nutrition at SEK1.55 billion, and Nordic Distribution at SEK3.03 billion.

Insider Ownership: 19.6%

Humble Group, with substantial insider buying recently, is positioned for significant earnings growth at 84% annually over the next three years, surpassing the Swedish market. Despite this, revenue growth of 5.9% per year lags behind typical high-growth benchmarks and recent financials show a net loss of SEK 15 million for Q3. The acting CEO transition may impact strategic direction as the company trades significantly below its estimated fair value.

- Click here and access our complete growth analysis report to understand the dynamics of Humble Group.

- Our expertly prepared valuation report Humble Group implies its share price may be too high.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax is a property company that owns and manages a diverse portfolio across several European countries, with a market cap of SEK70.42 billion.

Operations: The company's revenue from real estate rental amounts to SEK5.30 billion.

Insider Ownership: 28.7%

AB Sagax is poised for significant earnings growth at 23.9% annually, outpacing the Swedish market. Despite slower revenue growth of 7.7% per year, recent acquisitions totaling SEK 1,180 million across Europe enhance its asset base with a strong occupancy rate and long lease terms. However, net income has declined compared to last year due to large one-off items affecting financial results. Debt coverage by operating cash flow remains a concern despite reliable dividend payments.

- Delve into the full analysis future growth report here for a deeper understanding of AB Sagax.

- In light of our recent valuation report, it seems possible that AB Sagax is trading beyond its estimated value.

Seize The Opportunity

- Click here to access our complete index of 211 Fast Growing European Companies With High Insider Ownership.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal