Exploring 3 Undiscovered European Stocks with Promising Potential

As European markets show signs of steady economic growth, with the STOXX Europe 600 Index rising by 1.60% and key indices like Italy's FTSE MIB and the UK's FTSE 100 posting gains, investors are increasingly optimistic about opportunities in this region. In this environment of looser monetary policy and stable growth forecasts, identifying stocks with strong fundamentals and innovative potential becomes crucial for those looking to capitalize on hidden opportunities within Europe's diverse market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

RCS MediaGroup (BIT:RCS)

Simply Wall St Value Rating: ★★★★★☆

Overview: RCS MediaGroup S.p.A. is a multimedia publishing company operating in Italy, Spain, and internationally, with a market capitalization of approximately €496.17 million.

Operations: RCS MediaGroup generates revenue primarily from segments including Newspapers Italy (€358.60 million), Advertising and Sport (€280.10 million), Unidad Editorial (€208.80 million), Magazines Italy (€63.30 million), and Corporate and Other Activities (€80.50 million).

RCS MediaGroup, a smaller player in the media sector, showcases some compelling financial traits. Its interest payments are well covered by EBIT at 22.2 times, indicating solid financial health. Over the past five years, debt to equity has significantly decreased from 51.1% to 7.4%, reflecting prudent management of liabilities. Despite recent shareholder dilution and a slight dip in sales to €234 million for the nine months ending September 2025, RCS's earnings growth of 0.3% outpaced the industry's -2.3%. Trading at a substantial discount of 73% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in Europe.

ASBISc Enterprises (WSE:ASB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ASBISc Enterprises Plc is a global trader and distributor of computer hardware and software, operating in regions including the Former Soviet Union, Central Eastern Europe, Western Europe, the Middle East, Africa, and beyond; it has a market cap of PLN1.75 billion.

Operations: ASBISc Enterprises generates revenue primarily from its role as a distributor of IT products, with reported sales of $3.54 billion. The company's financial performance is influenced by its gross profit margin, which provides insight into profitability trends over time.

ASBISc Enterprises, a smaller player in the electronics distribution sector, has demonstrated robust earnings growth of 75.9% over the past year, outpacing its industry peers. Despite a high net debt to equity ratio of 67.7%, their interest payments are well covered with an EBIT coverage of 4.3x. The company is trading at approximately 13.7% below its estimated fair value, suggesting potential undervaluation. Recent financial results show Q3 sales at US$929 million and net income at US$11.85 million, reflecting strong performance compared to last year’s figures and signaling positive momentum moving forward with revenue guidance indicating continued growth.

- Unlock comprehensive insights into our analysis of ASBISc Enterprises stock in this health report.

Understand ASBISc Enterprises' track record by examining our Past report.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Eckert & Ziegler SE is a company that specializes in manufacturing and selling isotope technology components globally, with a market capitalization of approximately €936.73 million.

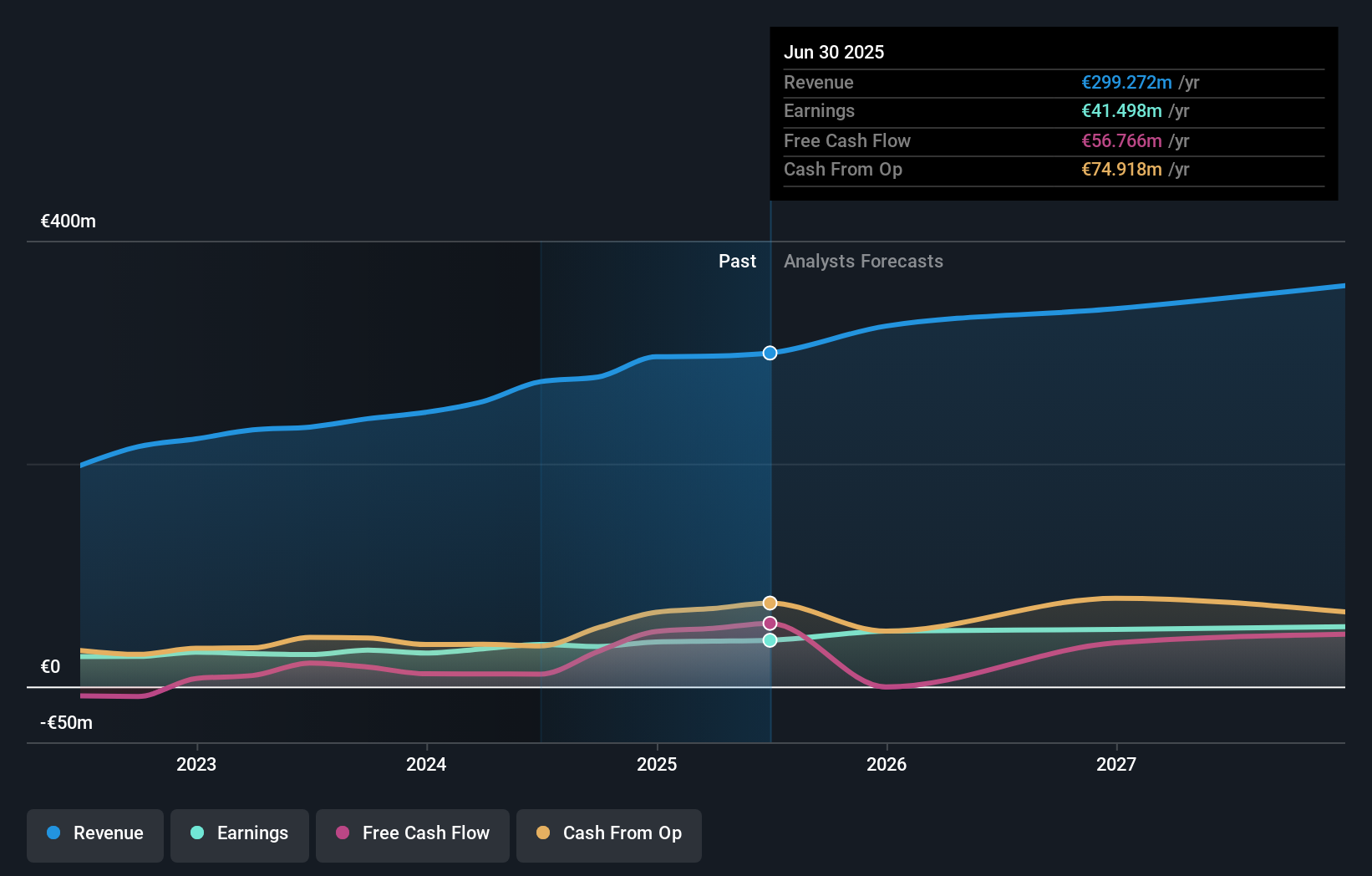

Operations: Eckert & Ziegler SE generates revenue primarily from two segments: Medical (€163.74 million) and Isotope Products (€151.65 million). The company faces a revenue reduction due to eliminations amounting to -€10.92 million.

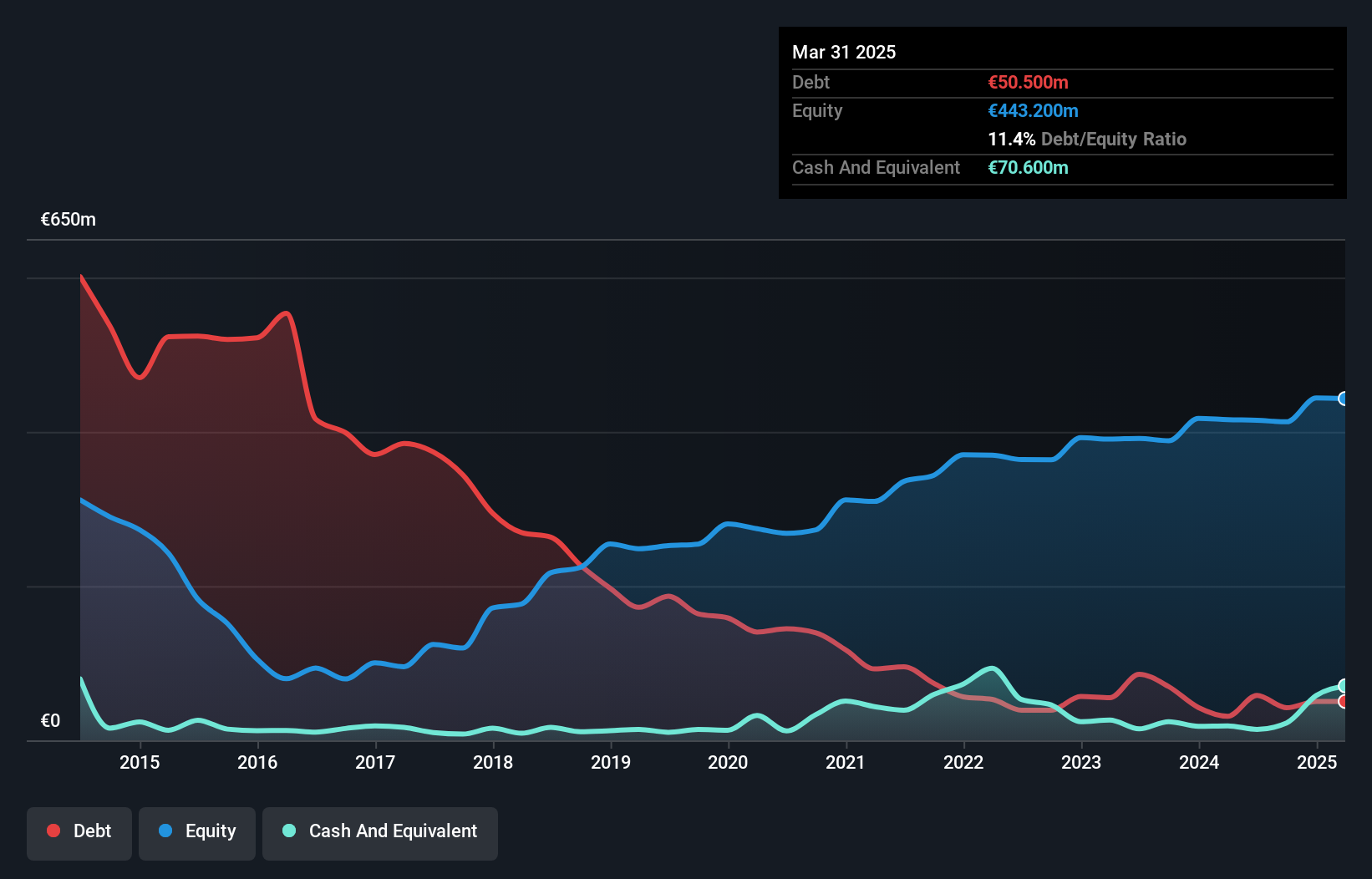

Eckert & Ziegler, a nimble player in the medical equipment sector, shows promise with its earnings growing 13% last year, outpacing industry averages. The company's debt to equity ratio has risen from 0.01% to 6.4% over five years, yet it holds more cash than total debt and boasts strong interest coverage at 61 times EBIT. Recent deals like supplying Actinium-225 to SK Biopharmaceuticals underline its strategic growth moves in radiopharmaceuticals. With sales forecasted at €320 million for 2025 and trading significantly below estimated fair value, Eckert & Ziegler presents an intriguing opportunity for investors seeking growth potential.

- Dive into the specifics of Eckert & Ziegler here with our thorough health report.

Explore historical data to track Eckert & Ziegler's performance over time in our Past section.

Summing It All Up

- Dive into all 306 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal