IPO News | Xinji Pharmaceuticals Announces HKEx Core Product XJN010 Has Entered Phase II Clinical Trials in China

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 24, Guangzhou Xinji Pharmaceutical Co., Ltd. (abbreviation: Xinji Pharmaceutical) submitted a listing application to the main board of the Hong Kong Stock Exchange, and Cathay Pacific Haitong is its sole sponsor.

Company profile

According to the prospectus, Xinji Pharmaceutical was founded in 2007 and is a clinical-stage innovation-driven pharmaceutical technology enterprise headquartered in Guangzhou, China. The company has developed two core technology platforms internally: (i) a technology platform for soluble microneedle formulations, and (ii) a technology platform for nasal inhalation formulations. Using these two platforms, the company has developed two core products and three other pipeline products.

Xinji Pharmaceutical's first core product, dexmedetomidine hydrochloride microneedle patch, was developed to calm pediatric patients and adult patients before surgery. The product aims to address the limitations of intravenous sedatives, including pain, anxiety, and operational burden, through an easy-to-apply transdermal form, thereby improving patient comfort and clinical efficiency. Combined with the company's proprietary “three effects” and “two essences” technology, the patch can deliver the drug to the surface layer of the dermis to achieve rapid systemic absorption. Its pharmacokinetic properties are comparable to subcutaneous injections, while avoiding needle-type procedures.

As of December 18, 2025, dexmedetomidine hydrochloride microneedle patches have entered phase IIa clinical trial for pediatric patients in China. The NMPA has approved the commencement of phase II clinical trials for adult patients, and related clinical trials are expected to begin in the first quarter of 2026.

The company's second core product, XJN010, was developed based on the company's proprietary nasal inhalation formulation platform. It aims to deliver active pharmaceutical ingredients through the nasocerebral route and bypass the gastrointestinal tract and blood-brain barriers. This method is designed to work quickly without reliance on swallowing or pulmonary inhalation, so it is particularly suitable for patients who have a sudden onset during the “off” period or face difficulties due to traditional administration routes. This product is a liquid nasal spray with penetration enhancers and targeted olfactory delivery technology to support efficient and stable drug delivery to the brain. As of December 18, 2025, XJN010 has entered phase II clinical trials in China.

In addition, XJN1102 is a soluble microneedle transdermal patch developed in-house by the company and is in the preclinical stage to treat adult type 2 diabetes and long-term weight control. It uses GLP-1 receptor agonists once a week, and their safety and efficacy have been confirmed, and can be used as a minimally invasive alternative to injectable therapy. The company plans to simultaneously submit IND applications to the NMPA and FDA in the fourth quarter of 2026.

XJN2503 is a pre-clinical 5-HT3 receptor antagonist nasal inhalation preparation developed in-house by the company. It is intended to rapidly relieve and prevent nausea and vomiting associated with chemotherapy, radiotherapy, and post-operative recovery in adults and pediatric patients aged 4 and above. This product is a quick-acting non-oral and non-injectable treatment option, and the company plans to submit an IND application to the NMPA in the fourth quarter of 2026.

Financial data

R&D expenses

The company spent about 18.428 million yuan, 16.413 million yuan, and 11.624 million yuan in 2023, 2024, and the six months ending June 30 in 2025.

revenue

The company achieved revenue of about 54.088 million yuan, 49.026 million yuan, and 28.139 million yuan in the six months ended June 30 in 2023, 2024, and 2025.

Industry Overview

Pre-operative sedation refers to the administration of sedatives before surgery or diagnostic procedures to reduce patient anxiety and promote anesthesia induction, thereby improving the patient's perioperative experience. This treatment is often used in combination with pain relievers or anesthetics, and is tailored to the patient's physical and mental state.

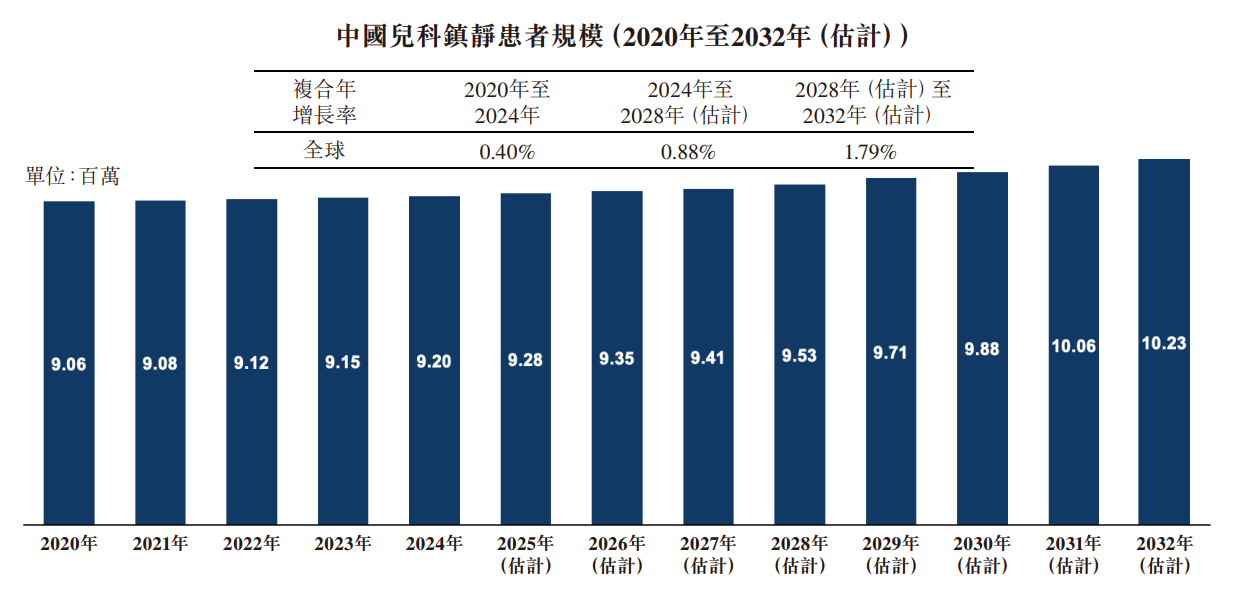

The number of pediatric sedation patients in China is expected to rise from 9.06 million in 2020 to 10.23 million in 2032. The compound annual growth rate increased from 0.40% (2020 to 2024) to 1.79% (2028-2032). The main driving force for growth comes from the continued strengthening of policies such as “painless medical care” and “child-friendly hospitals” to stimulate medical institutions to expand sedation service capabilities, thereby improving patient dependency and clinical efficiency.

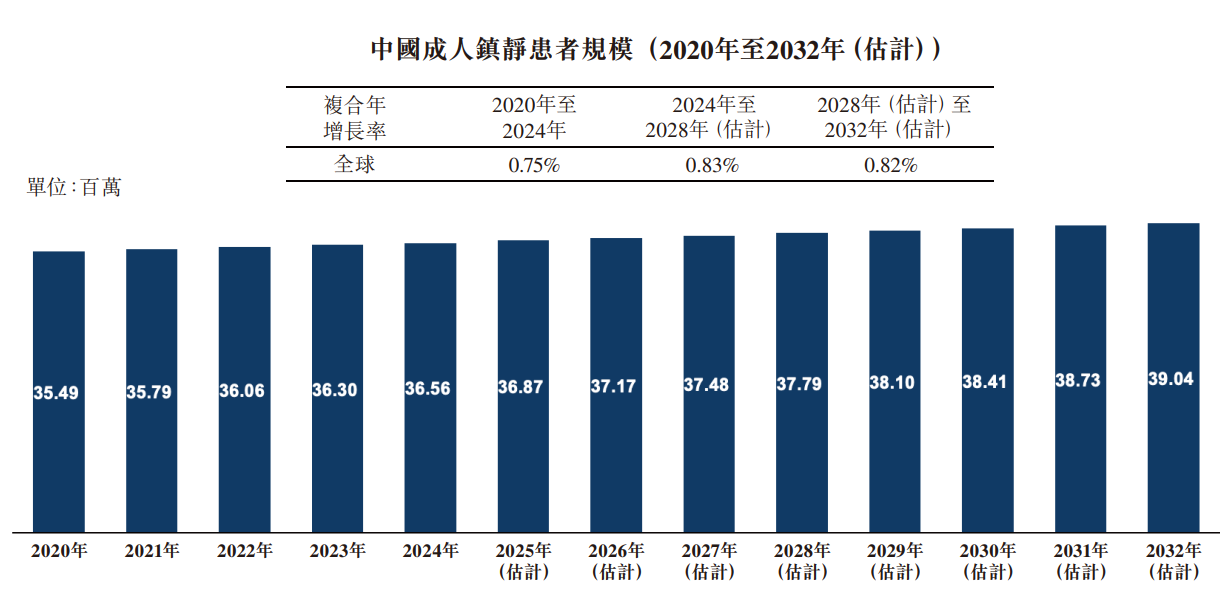

Between 2020 and 2032, the number of adult sedation patients in China is expected to increase from 35.49 million to 39.04 million, showing a moderate but steady growth trend. The compound annual growth rate is expected to rise slightly over time — from 0.75% from 2020 to 2024 to 0.82% from 2028 to 2032 — indicating a gradual saturation of the market. Although this steady trend shows stable clinical demand, it also indicates that there is limited room for rapid expansion, prompting stakeholders to focus on value-added services, quality improvement and innovation in sedation practices.

The pre-operative sedation market in China is steadily expanding. In 2020, the overall market size reached approximately RMB 7.36 billion, including approximately RMB 6.43 billion for adult sedatives and RMB 930 million for children. Benefiting from the increase in the number of surgeries, increased demand for comfort-oriented medical services, and the expansion of sedative indications, the market size is expected to exceed RMB 7.6 billion by 2024, reach RMB 7.90 billion by 2028, and grow to approximately RMB 8.24 billion by 2032. The compound annual growth rate from 2028 to 2032 is about 1.07%. The pediatric sedation segment is growing significantly faster than the adult segment. The compound annual growth rate is expected to be 2.66% from 2028 to 2032 (estimated), which is the core driving force for overall market expansion.

The global market for sedatives is in a steady expansion phase. From 2020 to 2024, the overall market size grew from US$8.64 billion to US$9.11 billion, with a compound annual growth rate of 1.33%; it is expected to accelerate to 1.58% from 2024 to 2028, further grow to 1.73% from 2028 to 2032, and the overall market size is expected to reach US$10.39 billion by 2032. Among them, adult sedation is still the most important segment. The market size in 2024 was about US$8.26 billion, while the pediatric sedation market reached US$850 million during the same period. However, children's sedatives are growing at a higher rate than adult sedatives, reflecting a smaller baseline, but demand is being released at an accelerated pace.

Board Information

The Board of Directors currently consists of nine directors, including three executive directors, three non-executive directors, and three independent non-executive directors. The initial term of the board of directors is three years and is responsible for and has general powers to manage and operate the company's business.

Shareholding structure

On December 18, 2025, Dr. Wu personally held 4,712,584 shares (accounting for about 23.15% of the issued shares) and is regarded as (1) holding an interest in the 1,104,362 shares (accounting for about 5.43% of the issued shares) owned by Minji Investment. Minji Investment is a company with 99% and 1% of the shares owned by Dr. Wu and his spouse, Dr. Pan Xin, respectively; (2) According to his role as a general partner of Sian Chay Investments, 1,766,980 shares (accounting for approximately 8.68% of the issued shares) Equity; (3) According to its role as a general partner of Deji Investment, it has an interest in 1,104,362 shares (accounting for about 5.43% of the issued shares) owned by Deji Investment; (4) it has an interest in 466,930 shares (accounting for about 2.29% of the issued shares) owned by Baekje Investment according to its role as a general partner of Guangji Investment (the company's employee incentive platform); and (5) 1,227,690 shares (accounting for 1,227,690 shares) owned by Jiguang Investment according to its role as a general partner of Guangji Investment (the company's employee incentive platform) Issued share agreements 6.03%) has an interest in it. Since Dr. Wu and Dr. Pan Xin are presumed to have an interest in shares owned by the other party, Dr. Wu, Dr. Pan Xin, Sian Chay Investment, Minji Investment, Deji Investment, Baekje Investment, and Guangji Investment together held about 51.01% of the total number of issued shares on December 18, 2025.

Intermediary team

Sole sponsor: Guotai Junan Finance Co., Ltd.

Company Legal Adviser: Hong Kong Law: Chen Qinren Law Firm; Related Chinese Law: Cinda Law Firm

Sole Sponsor's Legal Adviser: Related to Chinese Law: Han Kun Law Firm

Reporting Accountant and Auditor: Ernst & Young

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Compliance Advisor: Guotai Junan Finance Co., Ltd.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal