Undiscovered Gems in the United Kingdom for December 2025

As the United Kingdom's FTSE 100 index faces downward pressure following weak trade data from China, small-cap stocks may present unique opportunities for investors seeking growth in a challenging market environment. In this context, identifying undiscovered gems with robust fundamentals and potential for resilience becomes crucial, especially as broader market sentiments remain cautious.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 282.42% | 9.69% | 21.24% | ★★★★★☆ |

| Law Debenture | 15.39% | 21.17% | 19.12% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| Foresight Environmental Infrastructure | NA | -24.80% | -27.25% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

James Halstead (AIM:JHD)

Simply Wall St Value Rating: ★★★★★★

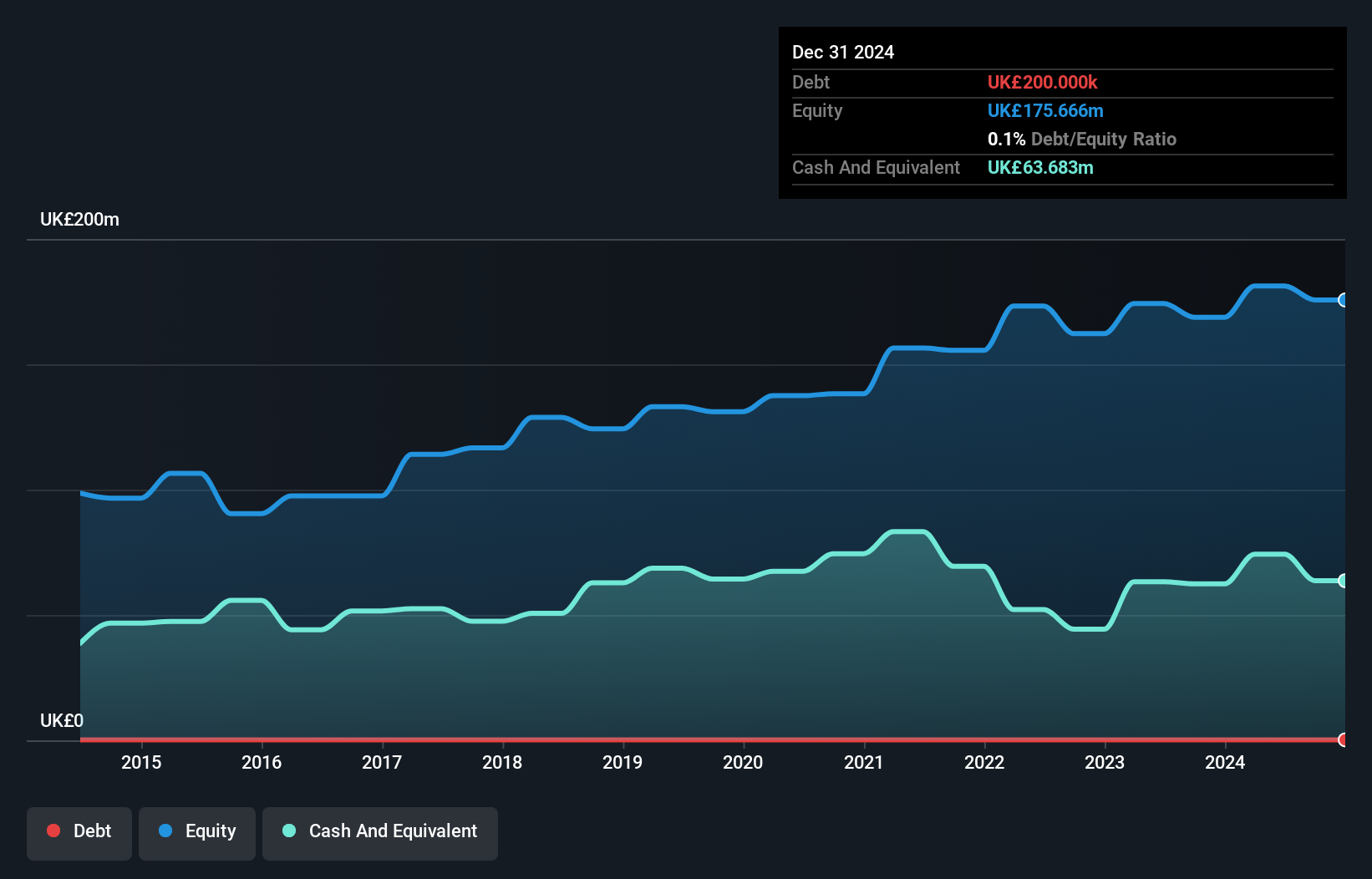

Overview: James Halstead plc is a company that manufactures and supplies flooring products for both commercial and domestic uses across various international markets, with a market cap of £568.91 million.

Operations: The company generates revenue primarily through the manufacture and distribution of flooring products, amounting to £261.97 million.

James Halstead, a notable player in the UK market, reported sales of £261.97 million for the year ending June 2025, down from £274.88 million previously. Despite this dip and a slight earnings contraction of 2.2%, the company continues to offer high-quality earnings and trades at 4.6% below estimated fair value. Its financial health is robust with cash exceeding total debt and positive free cash flow reaching £46 million as of June 2024. The board proposed a record dividend increase to 8.80 pence per share, marking nearly five decades of consistent growth in shareholder returns, underscoring its commitment to investors despite industry challenges.

Serabi Gold (AIM:SRB)

Simply Wall St Value Rating: ★★★★★☆

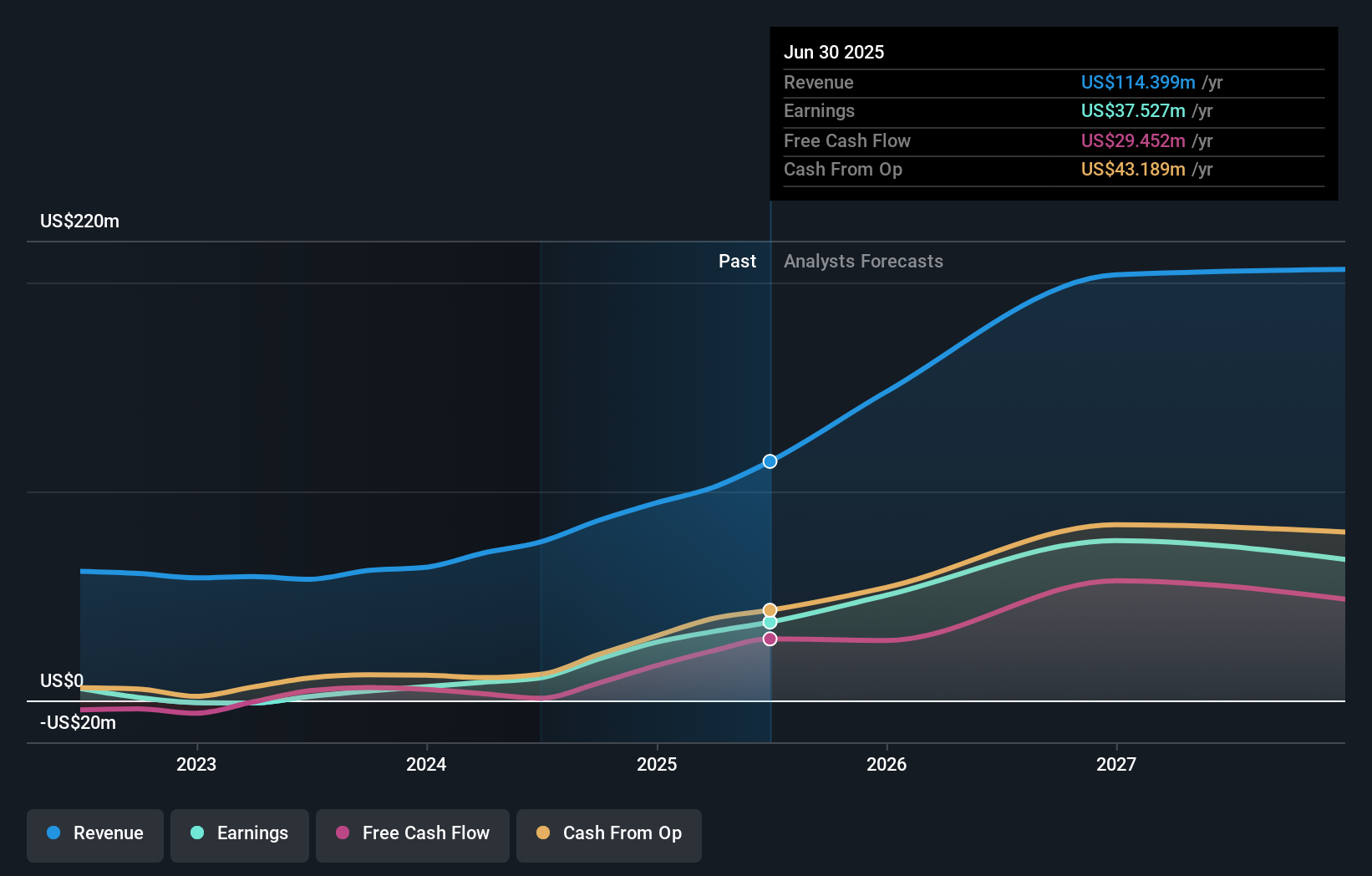

Overview: Serabi Gold plc is involved in the evaluation, exploration, and development of gold and other metals mining projects in Brazil, with a market capitalization of £232.51 million.

Operations: Serabi Gold generates revenue primarily from its gold mining and exploration activities, amounting to $128.77 million. The company's financial performance is reflected in its net profit margin, which has shown variability over recent periods.

Serabi Gold, a UK-based mining company, is making waves with its gold projects in Brazil. The ramp-up of the Coringa mine is expected to boost production from 30,000-40,000 ounces to about 60,000 ounces annually. This expansion should enhance revenue and lower capital expenditures by integrating ore processing with the Palito mine. Recent earnings show sales of US$42 million for Q3 2025 compared to US$27.63 million last year, while net income rose to US$15.99 million from US$8.62 million previously. However, reliance on vein mining and regulatory challenges in Brazil's Para state could pose risks to stability and growth prospects.

Greencore Group (LSE:GNC)

Simply Wall St Value Rating: ★★★★★☆

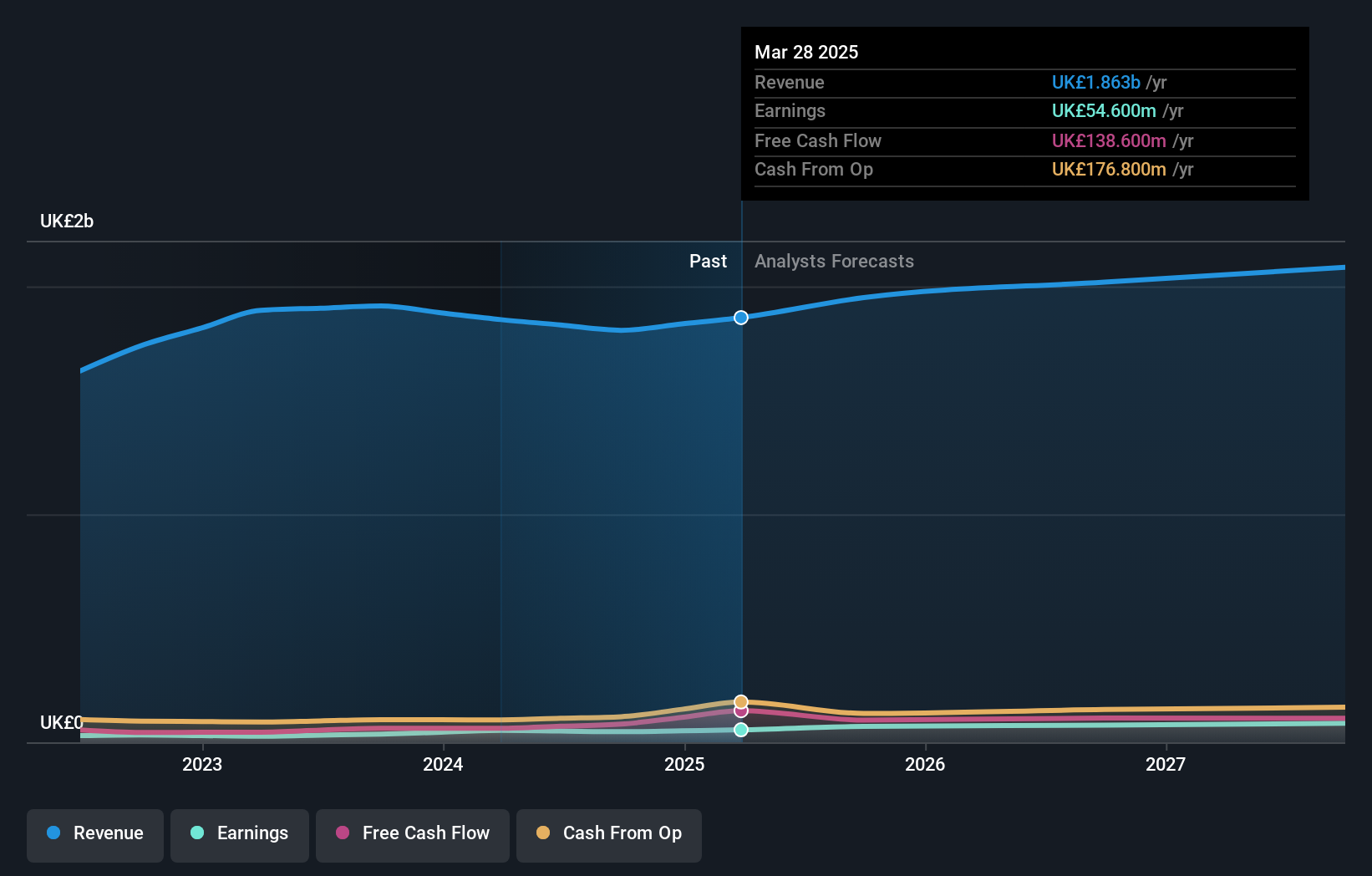

Overview: Greencore Group plc, along with its subsidiaries, specializes in the manufacturing and sale of convenience food products across the United Kingdom and Ireland, with a market capitalization of £1.09 billion.

Operations: Greencore generates revenue primarily from its Convenience Foods segment in the UK and Ireland, totaling £1.95 billion. The company's net profit margin shows notable trends that can be of interest to investors analyzing financial performance.

Greencore Group, a notable player in the UK food sector, has shown resilience with earnings growth of 24.3% over the past year, outpacing the industry's 22.6%. The company reported sales of £1.95 billion for the year ending September 2025, up from £1.81 billion previously, while net income rose to £57.6 million from £46.3 million. Despite a significant one-off loss of £28.1 million impacting recent results, Greencore's debt situation seems manageable with a net debt to equity ratio at 14.4%, and interest payments are well covered by EBIT at 6.7 times coverage level.

- Click here and access our complete health analysis report to understand the dynamics of Greencore Group.

Assess Greencore Group's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Discover the full array of 55 UK Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal