3 European Dividend Stocks To Consider With At Least 3% Yield

As European markets see a positive trend with the STOXX Europe 600 Index rising by 1.60% amid steady economic growth and looser monetary policies, investors are increasingly eyeing dividend stocks for their potential to provide consistent income. In this environment, focusing on stocks that offer at least a 3% yield can be an effective strategy for those looking to balance growth with income stability.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.07% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.00% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.32% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.88% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.14% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 10.12% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.30% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.22% | ★★★★★★ |

Click here to see the full list of 196 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

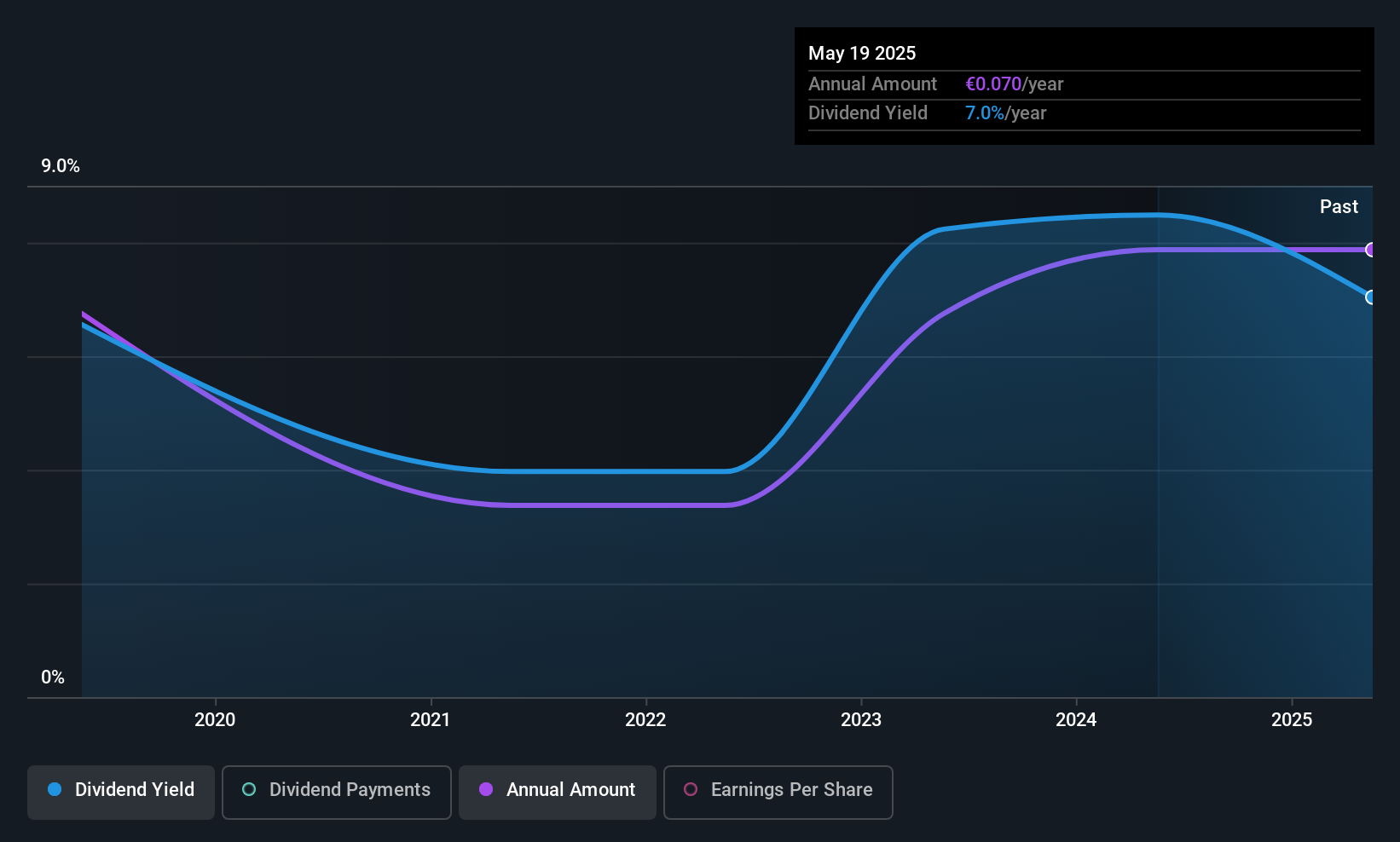

RCS MediaGroup (BIT:RCS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: RCS MediaGroup S.p.A. is a multimedia publishing company operating in Italy, Spain, and internationally, with a market cap of €496.17 million.

Operations: RCS MediaGroup S.p.A. generates revenue through its segments: Magazines Italy (€63.30 million), Newspapers Italy (€358.60 million), Unidad Editorial (€208.80 million), and Advertising and Sport (€280.10 million).

Dividend Yield: 7.3%

RCS MediaGroup's dividend payments have been volatile over the past seven years, yet they remain covered by earnings and cash flows, with payout ratios of 58.2% and 32%, respectively. Despite a high dividend yield in the Italian market, shareholder dilution occurred recently. Earnings grew slightly by 0.3% last year, but recent nine-month results showed declining sales and revenue to €234.2 million and €583 million, respectively, which may impact future payouts.

- Navigate through the intricacies of RCS MediaGroup with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that RCS MediaGroup is trading behind its estimated value.

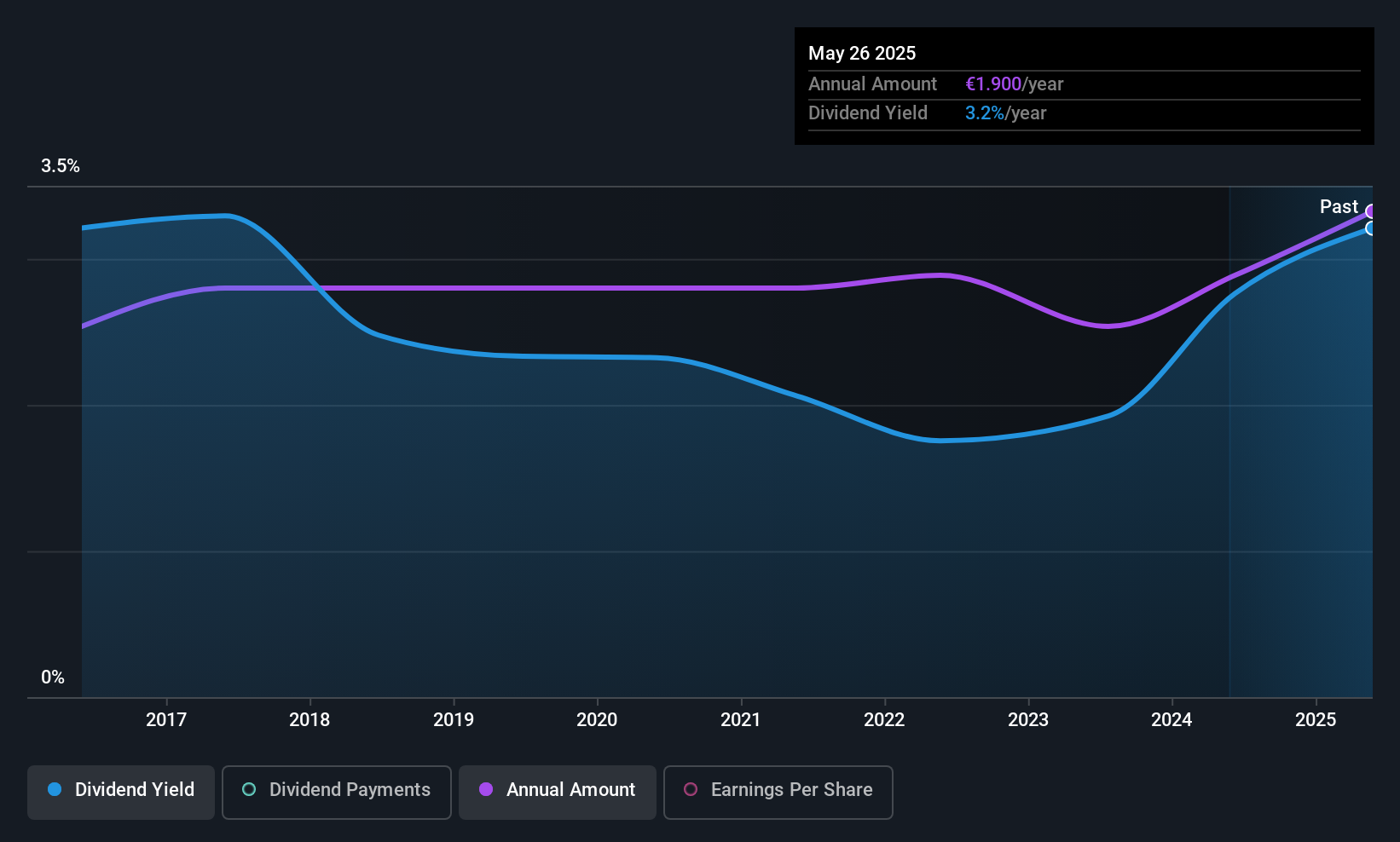

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Südwestdeutsche Salzwerke AG, along with its subsidiaries, is engaged in the mining, production, and sale of salt across Germany, the European Union, and internationally with a market cap of €625.20 million.

Operations: Südwestdeutsche Salzwerke AG generates revenue primarily from its Salt segment, amounting to €280.27 million, and Waste Management segment, contributing €65.48 million.

Dividend Yield: 3%

Südwestdeutsche Salzwerke's dividends have shown consistent growth and stability over the past decade, supported by a reasonable payout ratio of 66.6%. However, the dividend yield of 3.02% is below the top quartile in Germany, and high cash payout ratios suggest dividends are not well covered by free cash flows. This raises concerns about long-term sustainability despite reliable earnings coverage.

- Get an in-depth perspective on Südwestdeutsche Salzwerke's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Südwestdeutsche Salzwerke's current price could be inflated.

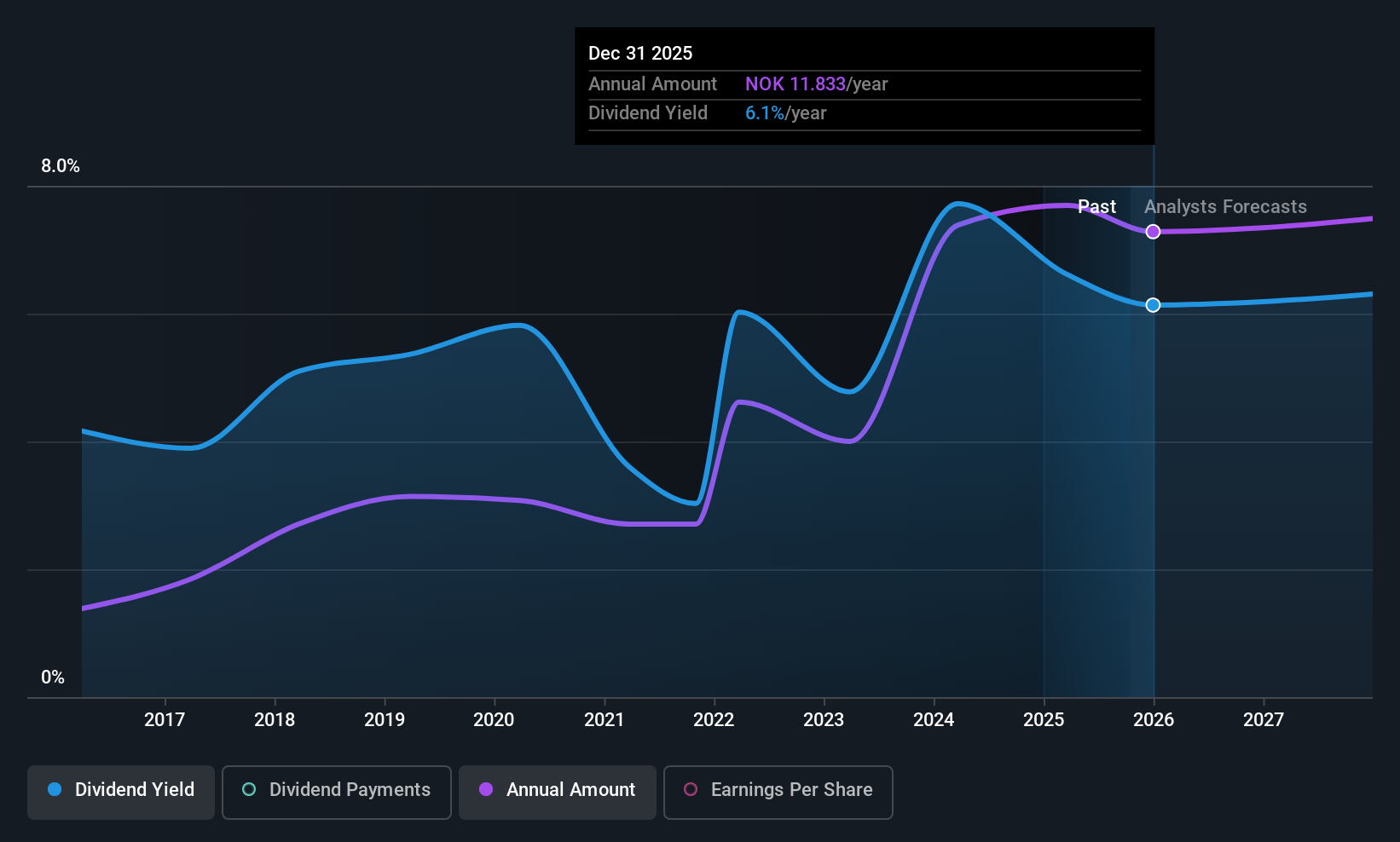

SpareBank 1 SMN (OB:MING)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 SMN, along with its subsidiaries, offers a range of banking, accounting, and real estate services to individuals and businesses in Norway and internationally, with a market cap of NOK29.48 billion.

Operations: SpareBank 1 SMN generates revenue primarily from its Retail Market segment (NOK3.21 billion), Corporate Market segment (NOK2.06 billion), Eiendoms Megler 1 (NOK561 million), Sparebank 1 Finans Midt-Norge (NOK433 million), and Sparebank 1 Regnskapshuset SMN (NOK846 million).

Dividend Yield: 6.1%

SpareBank 1 SMN offers a reliable dividend yield of 6.11%, though it lags behind the top quartile in Norway. The payout ratio is a reasonable 65.7%, indicating dividends are well-covered by earnings and expected to remain so in three years at 66.1%. Dividends have been stable and growing over the past decade, but recent earnings showed a decline, with net income for Q3 down to NOK 1,154 million from NOK 1,418 million year-on-year.

- Dive into the specifics of SpareBank 1 SMN here with our thorough dividend report.

- Our valuation report here indicates SpareBank 1 SMN may be undervalued.

Turning Ideas Into Actions

- Embark on your investment journey to our 196 Top European Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal