Asian Growth Stocks With Strong Insider Confidence December 2025

As the Asian markets navigate a complex landscape marked by Japan's significant interest rate hike and China's mixed economic signals, investors are increasingly focused on companies with robust growth potential and strong insider ownership. In this environment, stocks that demonstrate both high growth prospects and substantial insider confidence can be particularly appealing, as they may indicate alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 116.4% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Let's uncover some gems from our specialized screener.

Focuslight Technologies (SHSE:688167)

Simply Wall St Growth Rating: ★★★★★☆

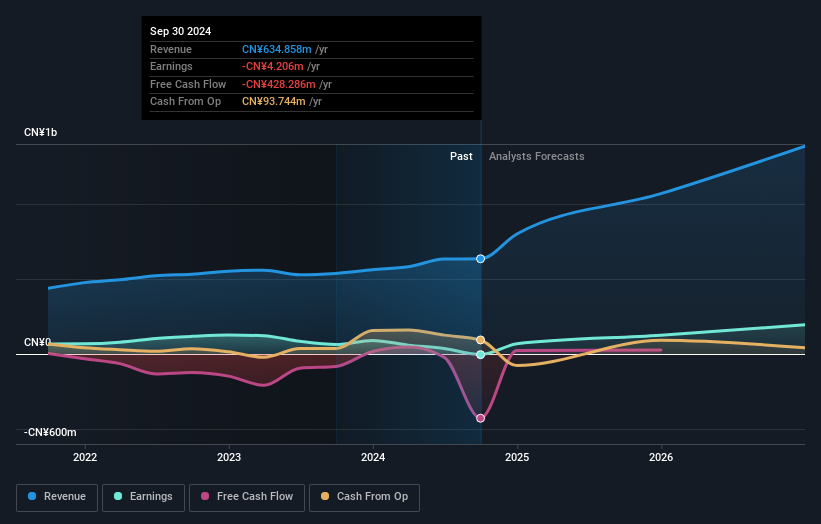

Overview: Focuslight Technologies Inc. is involved in the R&D, production, sale, and lease of semiconductor laser and optics components both in China and internationally, with a market cap of CN¥15.73 billion.

Operations: Focuslight Technologies Inc. generates revenue through its activities in the research, development, production, sale, and leasing of semiconductor laser components and laser optics components across domestic and international markets.

Insider Ownership: 17.6%

Focuslight Technologies has demonstrated significant revenue growth, reporting CNY 613.36 million for the first nine months of 2025, up from CNY 458.15 million a year prior. The company turned profitable with a net income of CNY 2.25 million compared to a previous loss. Despite high share price volatility and low forecasted return on equity, its revenue is expected to grow over 21% annually, outpacing the broader Chinese market's growth rate projections.

- Delve into the full analysis future growth report here for a deeper understanding of Focuslight Technologies.

- Our valuation report here indicates Focuslight Technologies may be overvalued.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

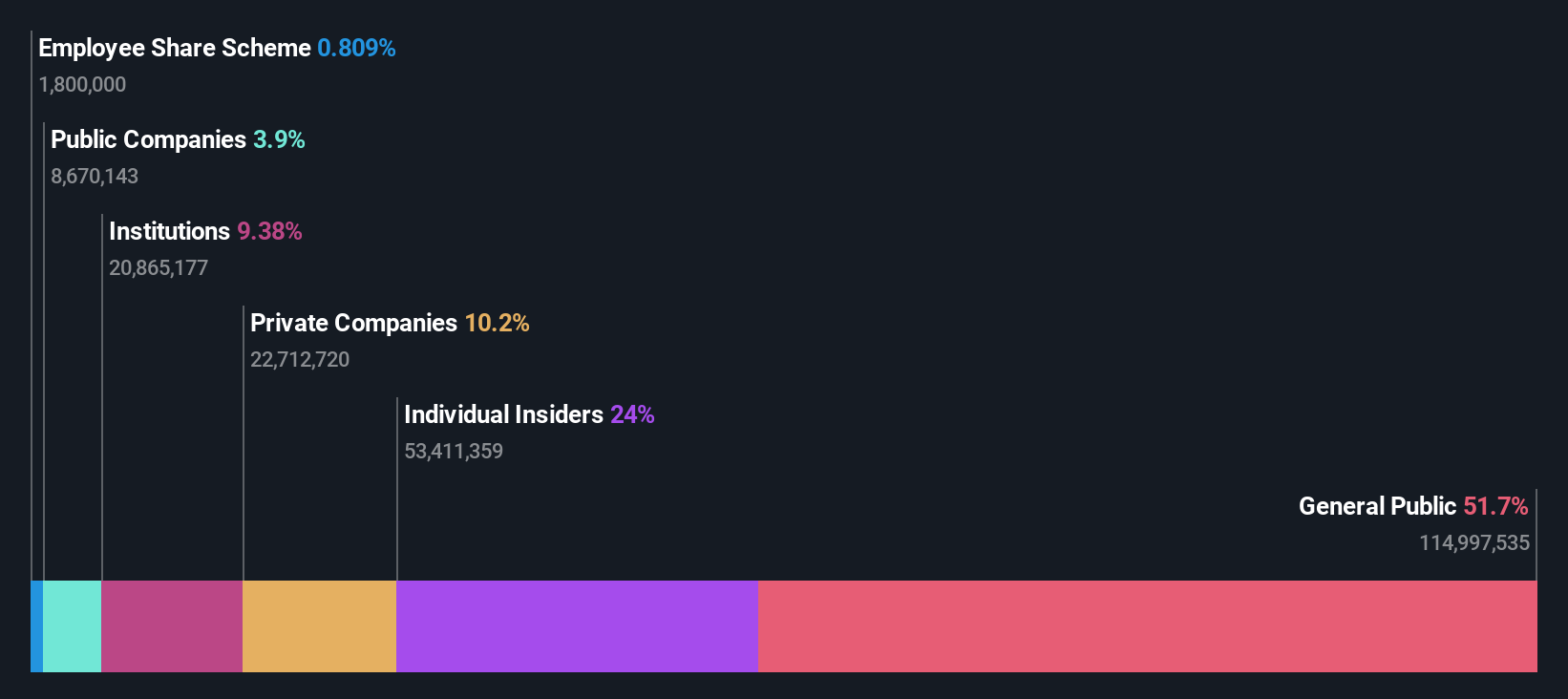

Overview: T&S Communications Co., Ltd. develops, manufactures, and sells fiber optics communication products in China with a market cap of CN¥26.43 billion.

Operations: The company generates revenue primarily from Optical Communication Components, amounting to CN¥1.67 billion.

Insider Ownership: 23.5%

T&S Communications Ltd. has shown robust growth, with revenue reaching CNY 1.21 billion for the first nine months of 2025, up from CNY 915.87 million the previous year. Earnings also increased significantly to CNY 260.33 million from CNY 145.81 million a year earlier. Despite high share price volatility and a low dividend yield not covered by free cash flows, its earnings and revenue are expected to grow substantially faster than both industry peers and the broader Chinese market over the next three years.

- Click here to discover the nuances of T&S CommunicationsLtd with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that T&S CommunicationsLtd is trading behind its estimated value.

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★☆☆

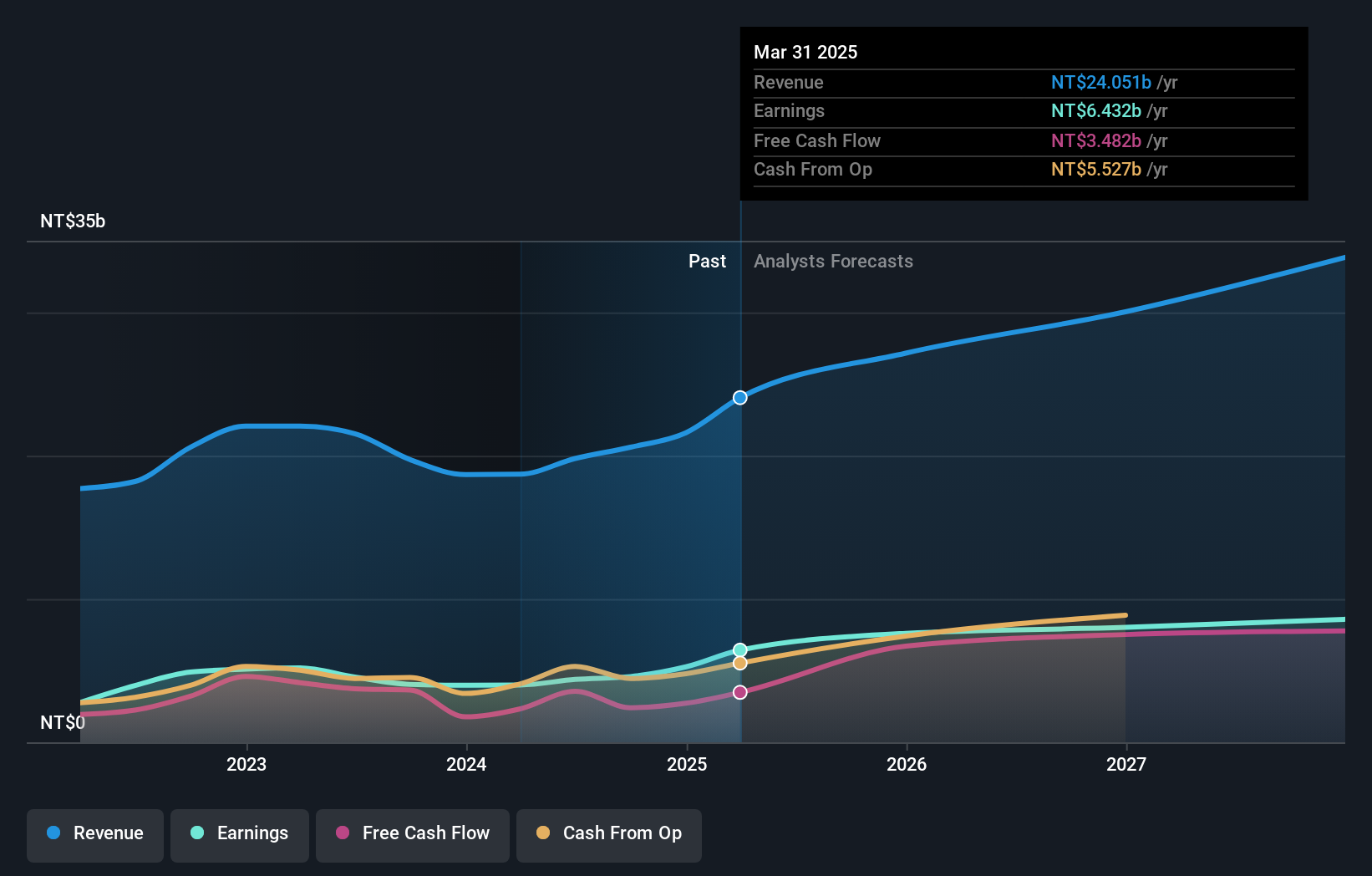

Overview: Chroma ATE Inc. is engaged in the design, assembly, manufacturing, sale, repair, and maintenance of software and hardware for various electronic testing systems and power supplies across Taiwan, China, the United States, and internationally with a market cap of approximately NT$323.26 billion.

Operations: The company's revenue segments include NT$41.96 billion from the Measuring Instruments Business and NT$1.09 billion from Automated Transport Engineering.

Insider Ownership: 14.5%

Chroma ATE has demonstrated strong financial performance, with Q3 2025 net income surging to TWD 5.07 billion from TWD 1.43 billion a year ago, despite a volatile share price. Revenue growth is robust and expected to outpace the Taiwanese market at an annual rate of 21.1%. While earnings are forecasted to grow at a slower pace than the market, insider ownership remains stable with no significant buying or selling activity in recent months.

- Navigate through the intricacies of Chroma ATE with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Chroma ATE is priced higher than what may be justified by its financials.

Seize The Opportunity

- Unlock more gems! Our Fast Growing Asian Companies With High Insider Ownership screener has unearthed 629 more companies for you to explore.Click here to unveil our expertly curated list of 632 Fast Growing Asian Companies With High Insider Ownership.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal