IPO News | Frontera Therapeutics Shares Hong Kong Stock Exchange Committed to Self-Development of Innovative Recombinant Adeno-Associated Virus (rAAV) Gene Therapy

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 23, Frontera Therapeutics submitted a listing application to the main board of the Hong Kong Stock Exchange, with UBS Securities HongKong Limited and Haitong International Capital Co., Ltd. as co-sponsors. According to the prospectus, since its establishment in 2019, the company has been committed to independently developing innovative recombinant adeno-associated virus (“rAAV”) gene therapy. The company has developed a differentiated and clinically advanced pipeline with the best global potential, particularly for ophthalmology and cardiovascular diseases.

Company profile

According to the prospectus, Frontera Therapeutics is a clinical-stage gene therapy company that focuses on the research and development of innovative therapeutics, has an international business layout, and is committed to providing safe, effective, and affordable gene therapy solutions to patients around the world.

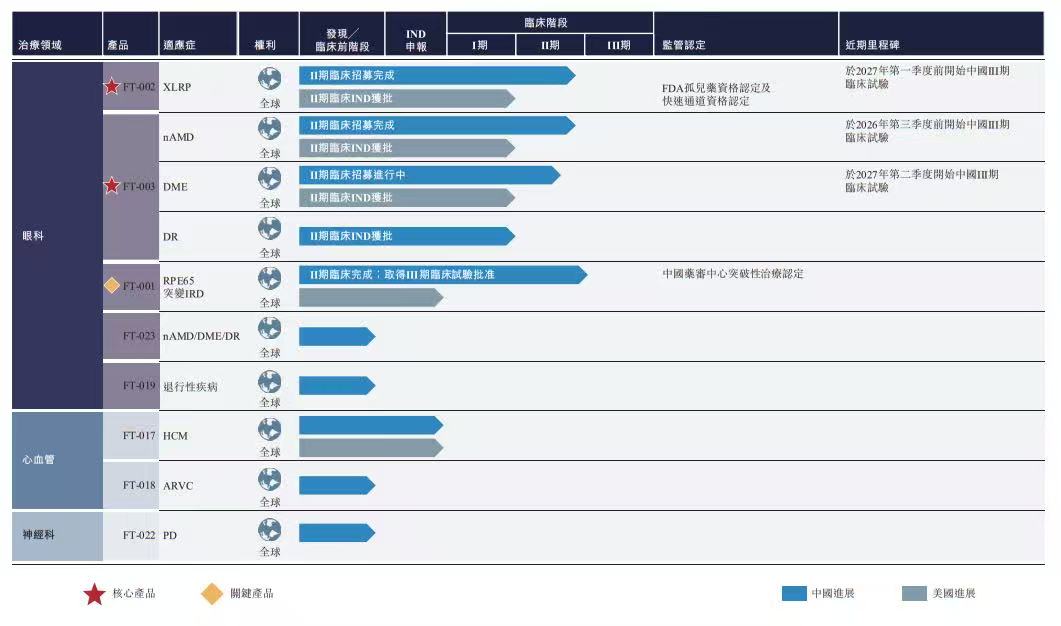

As of the last practical date (December 16, 2025), Frontera Therapeutics' product pipeline includes eight self-developed RAAV gene therapy candidates, including (i) two core products, namely FT-002 (a potential global best-in-class drug candidate being studied to treat X-linked retinitis pigmentosa (“XLRP”)) and FT-003 (a potential global best-in-class drug candidate, which is being studied to treat neovasculous senile macular degeneration through intravitreal injections (” “NaMD”) and diabetic macular edema (“DME”); (ii) a key product, namely FT-001 (a gene therapy candidate for treating hereditary retinal diseases (“IRD”) (“RPE65miRD” or “RPE65 mediated IRD”) due to RPE65 gene double allele mutations); and (iii) five other pre-clinical and early-stage gene therapy candidates for the treatment of ophthalmic, cardiovascular and neurological diseases.

The image below shows the gene therapy pipeline that the company is developing:

Frontera Therapeutics' competitive advantages are as follows: a differentiated gene therapy pipeline supported by robust clinical data and with the best potential in the world; AAVANCE TM, the company's Bac/Sf9 production platform to achieve safe, scalable and cost-effective high-quality production; using the advantages of an international layout, it has strong translational medicine and clinical operation capabilities; EXACTE TM's proprietary rAAV gene therapy R&D platform supports Innovative product development protected by global intellectual property rights; deep gene therapy expertise in research, transformation, clinical and production disciplines.

Frontera Therapeutics has built an agile and well-coordinated R&D team. As of September 30, 2025, the company's internal R&D team consists of 37 efficient members, spread across China and the US. Early innovation and preclinical research can be seamlessly advanced to clinical trials with minimal delays. Through cooperation with leading hospitals and research institutions, Frontera Therapeutics has been able to achieve efficient center start-up and program deployment. This infrastructure supports faster participant enrollment and more clinical data, which is critical to speeding up development. It only took the company 11 months to advance a drug candidate from lead identification to IND approval.

To date, Frontera Therapeutics has obtained 12 IND approvals from the National Drug Administration and FDA. According to Frost & Sullivan data, it has become the RAAV gene therapy development company with the highest number of IND approvals in China. Since its inception, the company has successfully advanced three drug candidates to phase II clinical trials.

As of the last practical date, Frontera Therapeutics has not obtained marketing approval for any drug candidates, nor has it generated any revenue from product sales.

Financial data

R&D expenses

The company's R&D expenses for 2023, 2024, and the nine months ending September 30 in 2025 were approximately US$27.585 million, US$20.576 million, and US$10.969 million.

Annual/period loss

For the nine months ended September 30 in 2023, 2024, and 2025, the company lost approximately US$35.86 million, US$26.464 million, and US$13.311 million during the year/period.

Industry Overview

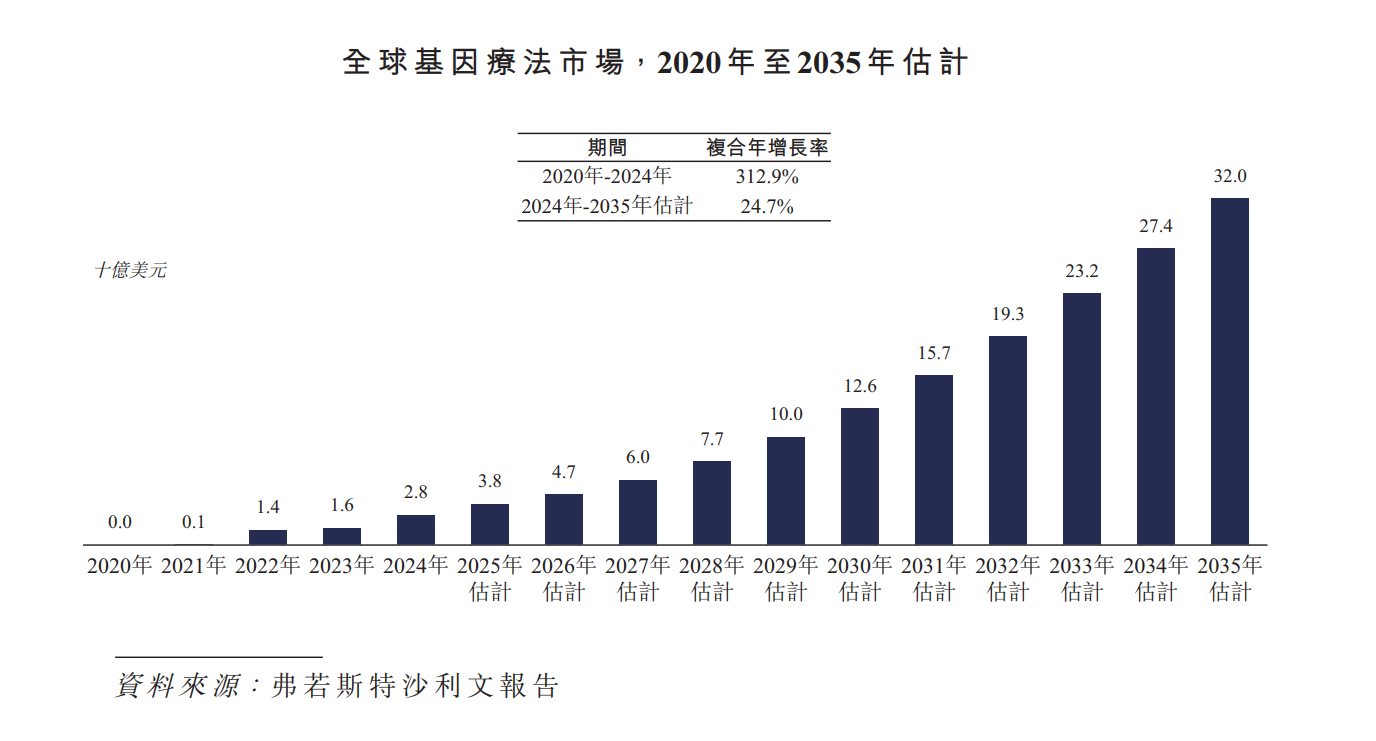

The global gene therapy market has recorded rapid growth over the past few years, reaching a market size of 2.8 billion US dollars in 2024. From 2020 to 2024, the market experienced a period of exponential growth, with a compound annual growth rate of 312.9%. Looking ahead, the global market is expected to grow at a CAGR of 24.7% from 2024 to 2035, and reach a market size of 32 billion US dollars by 2035.

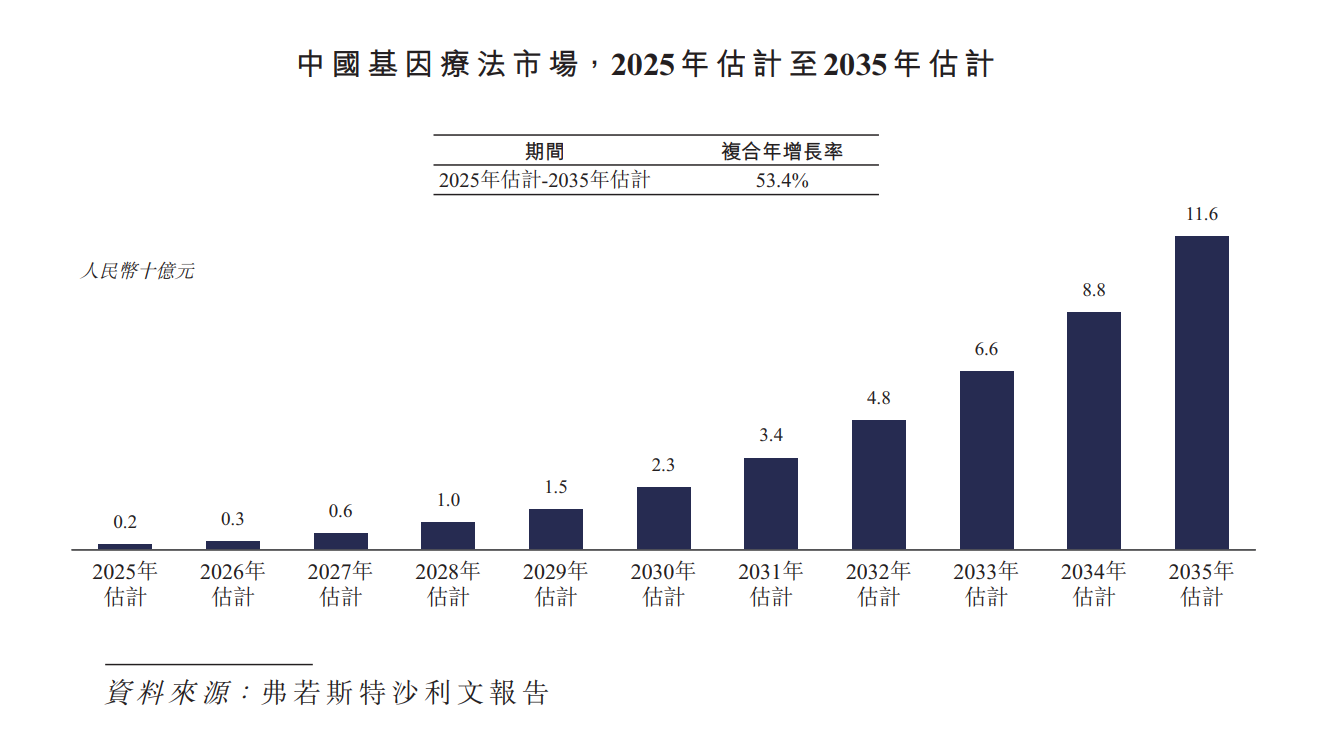

China's gene therapy market is also poised to enter a period of rapid growth. In 2024, China's gene therapy market is extremely small. The market is expected to grow at a CAGR of 53.4% from 2025 to 2035, and reach a market size of RMB 11.6 billion by 2035.

rAAV gene therapy uses rAAV carriers to deliver target genes to target cells, and transcribe and translate them into functional proteins in target cells. As of the last practical date, a total of nine rAAV gene therapy drugs have been approved worldwide. These drugs usually focus on rare diseases and are expensive to produce and treat. Six approved drugs were produced using the HEK293 system, and three were produced using the Bac/Sf9 system. There are more than 200 rAAV gene therapy drugs under development worldwide. However, most of these drug candidates are still in early clinical exploration. About 57% are in phase I/II combined clinical trials, and 22% are in independent phase I clinical trials. The number of drugs entering advanced clinical stages is increasing, but the quantity is still relatively limited. About 6% of this pipeline are in phase II clinical trials; about 10% are in phase III clinical trials; about 3% are in phase II/III clinical trials; and only four drugs have reached the biological product license application stage.

In recent years, rAAV gene therapy has become a promising treatment option for a number of ophthalmic diseases (especially fundus neovascularization diseases).

The global ophthalmic drug market grew from US$33.5 billion in 2020 to US$41.6 billion in 2024, with a CAGR of 5.6%. It is expected to continue growing at a compound annual growth rate of 4.2% from 2024 to 2035, and reach a scale of 65.6 billion US dollars by 2035. In contrast, the Chinese ophthalmic drug market is growing faster and is expected to maintain its growth momentum. China's ophthalmic drug market grew from RMB 18.8 billion in 2020 to RMB 29.5 billion in 2024, with a compound annual growth rate of 11.9% from 2020 to 2024. The market is expected to reach RMB 91.2 billion in 2035, with a CAGR of 10.8% from 2024 to 2035.

Board Information

Frontera Therapeutics' board of directors consists of nine directors, including one executive director, five non-executive directors, and three independent non-executive directors. According to the Articles of Association, the company's directors serve for a term of three years and are eligible for re-election. The company's board of directors is responsible for and has general powers to manage and handle the business.

Shareholding structure

As of the last practical date, the general partner of OrbiMed Asia Partners III, L.P. (“Aobo Asia”) is Orbi Med Asia GP III, L.P., and OrbiMed Advisors III Limited is its general partner. As of the last practical date, the general partner of OrbiMed Private Investments VII, LP (“Aobo America”) is OrbiMed Capital GP VII LLC, and OrbiMed Advisors LLC is its managing member. OrbiMed Advisors LLC is Aobo Asia's consulting company and has voting rights under its advisory agreement with Aobo Asia. OrbiMed Advisors LLC also has controlling voting rights over Aobo America. As a result, Aobo Asia and Aobo America are jointly controlled by OrbiMed Advisors LLC.

Intermediary team

Co-sponsors: UBS Securities HongKong Limited, Haitong International Capital Limited

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Co-Sponsors and Legal Advisors: Smith & Phil, Global Law Offices

Company Legal Advisors: Shida International Law Firm and Affiliates, Wilson Sanzini Gucci Rosaldi Law Firm, Zhong Lun Law Firm, Hengli Law Firm

Auditor and reporting accountant: Deloitte Guan Huang Chen Fang

Compliance Advisor: Dongren Finance Co., Ltd.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal