Interest rate cut or rate hike? The minutes of the Bank of Canada meeting show that there is a high degree of uncertainty about the direction of policy adjustments

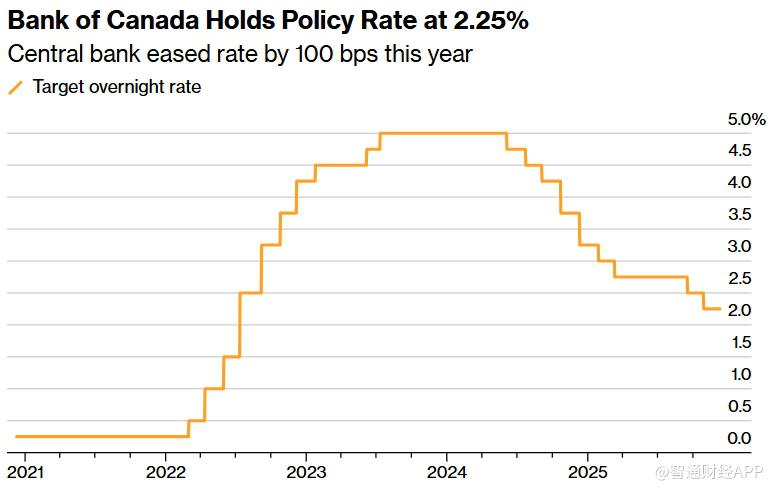

Bank of Canada officials agreed to keep the overnight interest rate unchanged at 2.25% earlier this month, but there is still a high degree of internal uncertainty about the direction of the next policy adjustment, whether to cut interest rates again or raise interest rates instead.

The Zhitong Finance App learned that according to the minutes of the December 10 interest rate resolution meeting announced by the Bank of Canada on Tuesday, policymakers pointed out that the current “highly uncertain environment” makes it “difficult to predict the timing and direction of the next policy interest rate adjustment.” The central bank reiterated that it is ready to respond if there is a significant change in economic activity or the outlook for inflation.

The minutes show that the seven-member central bank management committee also focused on the impact of the future of the US-Mexico-Canada agreement on the Canadian economy. Central bank officials believe that if the trade agreement finally breaks down, it will have a serious impact on the Canadian economy; however, if relevant negotiations can progress and provide some stability to North American trade policy, it is expected to boost corporate investment.

In terms of macro data, the central bank pointed out that recent quarterly gross domestic product (GDP) data has fluctuated greatly, which “highlights the challenges faced in judging potential economic trends.” Officials expect that weak economic performance in the fourth quarter, and growth in consumption, real estate activity, and government spending will offset the drag caused by weak corporate investment and net exports to a certain extent.

According to newly released preliminary data, Canada's GDP grew slightly in November, reversing the 0.3% contraction in October. However, the central bank believes that from a quarterly perspective, the overall economic growth may still be negative.

Analysts pointed out that the Bank of Canada is currently in a “wait-and-see model”. Against the backdrop of weak domestic economic momentum and rising uncertainty in the external trade environment, the future monetary policy path is still highly dependent on data performance and progress in North American trade negotiations.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal