Bridgestone (TSE:5108): Reassessing Valuation After a Strong Run and Recent Pullback

Bridgestone (TSE:5108) has had a strong run this year, and with the stock still trading below some valuation estimates, investors are asking whether the recent pullback offers a fresh entry point.

See our latest analysis for Bridgestone.

After a strong year of gains, including a solid double digit year to date share price return, the recent dip around ¥7,170 looks more like a pause than a trend reversal, especially given Bridgestone's robust multi year total shareholder returns.

If Bridgestone's momentum has you reassessing the auto space, it is worth exploring other auto manufacturers that could offer similar long term compounding potential.

With earnings still climbing faster than revenues and the shares trading at a sizable discount to some intrinsic value estimates, investors now face the key question: is Bridgestone a mispriced compounder, or is the market already discounting its future growth?

Most Popular Narrative: 6.2% Undervalued

With Bridgestone last closing at ¥7,170 against a narrative fair value near ¥7,646, the current pullback sits in clear focus for valuation driven investors.

The Fair Value Estimate has risen slightly to approximately ¥7,646 per share from about ¥7,629 per share, reflecting a modest upward revision in intrinsic value.

The future P/E has risen slightly to about 10.9x from roughly 10.6x, suggesting a marginally richer valuation multiple on forward earnings.

Curious how modest revenue growth, fatter margins and a lower discount rate can still justify a richer future multiple for a tire maker, not a tech giant? The most popular narrative quietly stacks these assumptions into a valuation bridge that might surprise you. Want to see exactly how those moving parts add up to that fair value call? Read on and test whether the story behind this price really holds up.

Result: Fair Value of ¥7,646 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer North American aftermarket demand and restructuring costs in Europe and Latin America could cap margin expansion and delay the earnings ramp that analysts expect.

Find out about the key risks to this Bridgestone narrative.

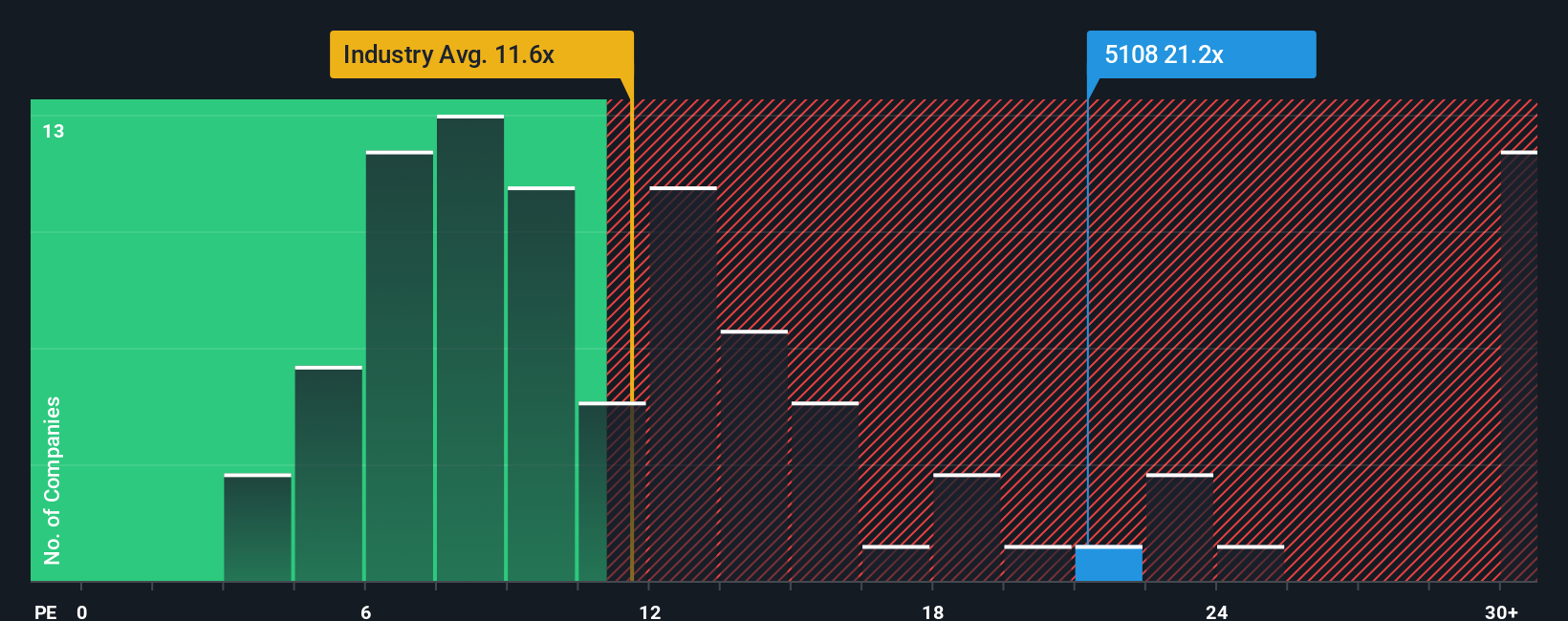

Another View: Market Multiple Sends a Different Signal

While the narrative fair value suggests Bridgestone is about 6 percent undervalued, the market ratio tells another story. At roughly 19.5 times earnings versus about 16.5 times peers and a fair ratio of 16 times, the shares look fully priced, leaving less room for error if growth underdelivers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bridgestone Narrative

If this perspective does not quite align with your own view, or you would rather dig into the numbers yourself, you can build a custom narrative from scratch in just a few minutes: Do it your way.

A great starting point for your Bridgestone research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall Street, where data backed ideas can keep you one step ahead.

- Capture potential bargain entries by targeting companies trading below intrinsic value through these 901 undervalued stocks based on cash flows that flag discounted cash flow opportunities.

- Ride powerful innovation trends by focusing on these 24 AI penny stocks positioned to benefit from adoption of artificial intelligence across industries.

- Strengthen your income stream by zeroing in on these 10 dividend stocks with yields > 3% that can support portfolio yield while maintaining quality fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal