Societe Generale Securities: What are the rules of historical bull market turbulence?

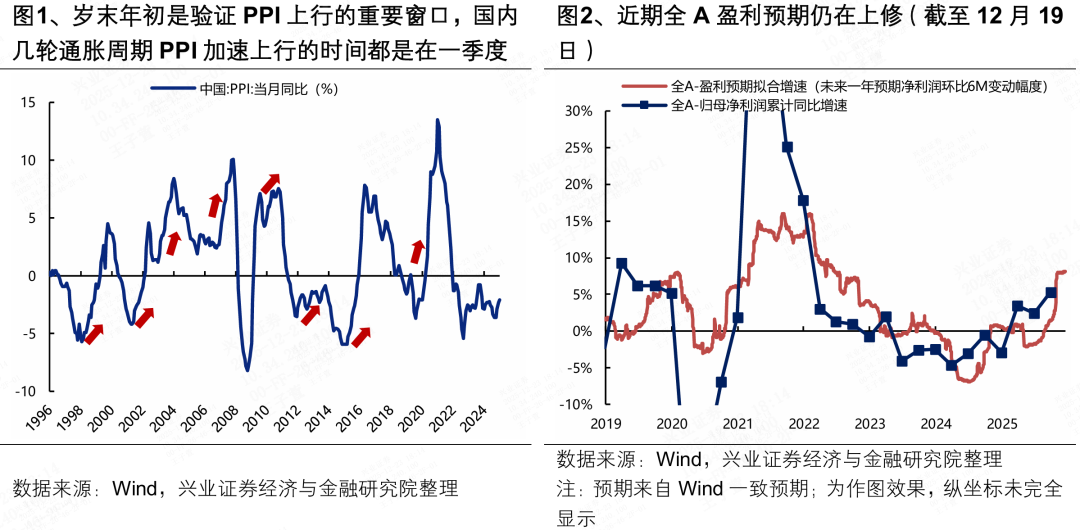

The Zhitong Finance App learned that Societe Generale Securities released a research report saying that judging from the turbulent bull market, it already has a good foundation: 1) The economic work conference continues the positive trend of last year's expansion; 2) The data is expected to continue to verify improvements in domestic fundamentals: at the macro level, the end of the year is expected to be an important window for verifying the rise in this round of PPI; at the micro level, profit expectations for the full A are still improving recently. After the fourth quarter of last year's results “hit the pit”, there is little pressure to verify the fundamentals of this year's annual report performance forecast; 3) The domestic macro liquidity is sufficient, and interest rate cuts have been cut; 3) The domestic macro liquidity is sufficient, and interest rate cuts have been cut; 3) The domestic macro liquidity is sufficient, and interest rate cuts have been cut; It is still a policy option; at the micro level, the return of two financing funds and insurance It is worth looking forward to the “good start” of capital and the acceleration of residents' “deposit movements” to support stock market liquidity.

Looking at this round, after a series of overseas uncertainties that have suppressed the market since November came to fruition, focus on the next signs that may further catalyze the restless market, including: 1) the possibility that interest rate cuts will be implemented at the end of the year and the beginning of the year; the next observation window is in January; 2) the boost from key data on improvements in fundamental expectations, including PPI, PMI, M1, Social Finance and Credit, and annual report forecasts of listed companies.

Societe Generale Securities's main views are as follows:

What are the rules of the historical bull market's restless market, starting point, and leading upward structure?

Reviewing the turbulent market since 2008, judging from the start time and catalytic factors, it can be broadly divided into the following three categories:

Launched in November (marked yellow): A clear shift in strong macroeconomic policies is needed, such as 2008, 2014, and 2022;

Launched in December (red): Market performance has been strong since the beginning of the year, but disturbances occurred towards the end of the year. Restlessness began after the disturbances abated, typically in 2017, 2019, and 2020;

January-February launch (blue): The time when most of the restless markets in history started.

Therefore, judging from the starting point, one rule that can be obtained is that the restless market in the bull market year (2017, 2019, and 2020) may lack the catalyst for a strong macroeconomic policy shift, but after early disturbances have abated, the restless market can often start ahead of time. Further review of the factors that led to the restless market in 2017, 2019, and 2020:

2017: The “Spring Festival Limited Edition Downgrade” began a restless market. In November-December, factors such as new asset management regulations, “deleveraging” policies such as bank liquidity management, and shared interest rate hikes between China and the US continued to disrupt the market. On December 29, the central bank established a “temporary reserve utilization arrangement”, which was interpreted by the market as a “Spring Festival limited edition downgrade”, which became a starting signal for the restless market. In January of the following year, as PMI and GDP data verified that domestic fundamentals were stable, moderate and positive, the Federal Reserve's monetary policy “remains on hold” driving the RMB exchange rate appreciation, and “temporary reserve utilization arrangements” compounded by a targeted downgrade in late January and abundant liquidity, A-shares emerged from the “11 Lianyang” market.

2019: A restless market begins as trade frictions between China and the US ease. In November, overseas PMIs fell sharply, and expectations of a global recession heated up, and the continuous rise in domestic CPI became a hindrance to monetary easing, and the market fluctuated and fell. On November 27, the Ministry of Finance issued a “trillion additional special debt amount” ahead of schedule for the first time, and the manufacturing PMI once again rebounded to more than 50% in November to ease concerns about the decline in fundamentals, and the market began to rise steadily. On December 13, China and the US reached an agreement on the text of the “First Phase Economic and Trade Agreement”, which became an official start signal for the restless market. The restless market continued with factors such as the release of policy warmth at an important conference in December, improvements to the capital market system in late December, and a downgrade at the beginning of 2020.

2020: Overseas uncertainty lays the foundation for the start of a restless market, and the continuous issuance of public funds drives the market to a climax. In October, the domestic reintroduction of “managing the general floodgates of money supply”, the re-spread of the overseas epidemic, and the US election entering a sprint period all suppressed market risk appetite. Since November, as benefits such as Biden's confirmation of election and smooth progress in vaccine research and development have continued to be unleashed, overseas uncertainty has successively boosted market risk appetite; the domestic economy has continued to recover, policy setting has not taken a sharp turn, and monetary policy has shifted to marginal easing. In January of the following year, under the “bottom” of the economy, policies, and risk appetite, the daily issuance of public funds provided sufficient liquidity to the market and pushed the restless market to a climax.

First, why can a restless bull market usually start ahead of time? In addition to “people's thoughts,” the summary has the following three important factors: 1) the year-end conference was positive in setting policy settings to support risk appetite; 2) economic fundamentals were stable, moderate and positive, corporate profits entered an upward channel, and there was no significant disturbance in economic data and annual report forecasts of listed companies; 3) loose monetary policy and abundant macro-micro liquidity effectively supported the market.

Looking at this round, the above favorable conditions already have a good foundation: 1) The Economic Work Conference continues the positive trend of last year's expansion; 2) The data is expected to continue to verify improvements in domestic fundamentals: at the macro level, the end of the year is expected to be an important window for verifying the upward trend in this round of PPI; at the micro level, the profit forecast for all A is still improving recently. After the results for the fourth quarter of last year “hit the pit”, there is little pressure to verify the fundamentals of this year's annual report performance forecast; 3) Domestic macro liquidity is abundant, and interest rate cuts are still policy options; at the micro level, the return of insurance capital flows and insurance is still a policy option; at the micro level, the return of insurance capital flows and insurance Funding “got off to a good start” It is worth looking forward to the acceleration of residents' “deposit moving” to support stock market liquidity.

Secondly, what iconic events could be a sign of the start of a restless market? In summary, there are three main categories: 1) the implementation of uncertain factors that suppressed the market in the early stages is the foundation for starting a restless market; 2) easing policy catalysts such as interest rate cuts can often effectively ignite the restless market; 3) verifying the fundamentals of key data to drive an increase in the willingness of capital to participate is the key to the continuation of the restless market.

Looking at this round, after a series of overseas uncertainties that have suppressed the market since November came to fruition, focus on the next signs that may further catalyze the restless market, including: 1) the possibility that interest rate cuts will be implemented at the end of the year and the beginning of the year; the next observation window is in January; 2) the boost from key data on improvements in fundamental expectations, including PPI, PMI, M1, Social Finance and Credit, and annual report forecasts of listed companies.

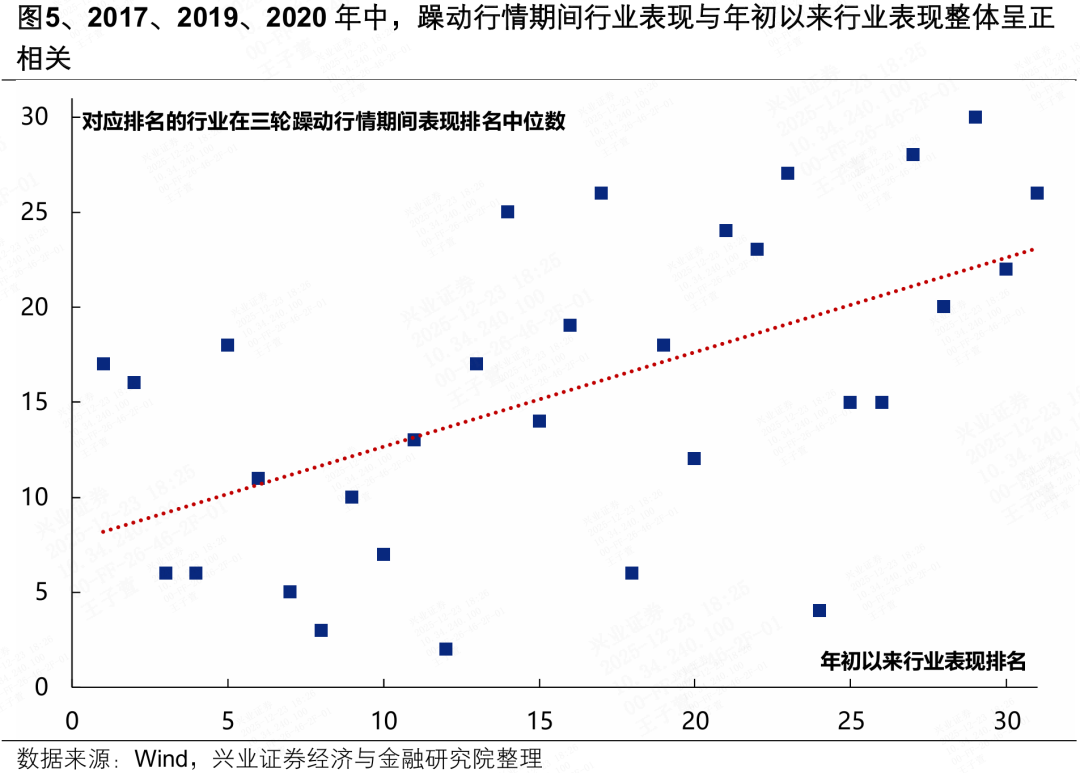

Third, what are the characteristics of the performance structure during a volatile bull market? Will there be a systematic “high cut low”? In the three rounds of the 2017 and 2019-2020 turbulent market, the overall main line remained strong since the beginning of the year, and there were no obvious structural changes: 1) In 2017, under the leadership of the ROE recovery drive valuation system switching and supply-side structural reforms of listed companies, undervaluation value+white horse blue chips were the main line throughout the year, and the pattern where the traditional pro-cyclical industry dominated the market did not change significantly in the restless market; 2) At the end of 2019, the main line of the TMT boom continued, and the rise of the new energy industry trend superimposed liquidity and risk appetite showed a more favorable growth style, new The energy industry chain replaced consumption as a phased main line; 3) The 2020 New Year's Eve market continued the main line of the “high-end manufacturing+consumption” boom, and some upstream resource products rotated upward due to the easing of domestic and foreign monetary policies and positive economic expectations.

Judging from the industry's performance, there was no clear shift in the leading industry in the volatile bull market: in 2017, 2019, and 2020, the industry's performance during the restless market was positively correlated with the overall performance of the industry since the beginning of the year.

Risk Alerts

Economic data fluctuated, policy easing fell short of expectations, the Fed cut interest rates fell short of expectations, etc.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal