Reassessing Keurig Dr Pepper (KDP) Valuation After a Recent Share Price Slip and Earnings Outlook Shift

Keurig Dr Pepper (KDP) has been grinding out steady growth, but the stock’s recent slip this year contrasts with improving revenue and net income trends, raising fresh questions about how investors are valuing its long term cash generation.

See our latest analysis for Keurig Dr Pepper.

At around $28.24, Keurig Dr Pepper’s recent share price return has been weak year to date, but the 90 day share price return of 7.58 percent hints that sentiment toward its cash generation story may be stabilizing rather than collapsing.

If KDP’s steady fundamentals have you rethinking the staples side of your portfolio, this could be a good moment to explore fast growing stocks with high insider ownership as potential next wave candidates.

With revenue and earnings still grinding higher and the stock trading at a notable discount to analyst targets and some intrinsic value estimates, is Keurig Dr Pepper quietly offering a buying window or simply reflecting all future growth?

Most Popular Narrative Narrative: 18.7% Undervalued

With Keurig Dr Pepper last closing at $28.24 against a narrative fair value of about $34.73, the spread implies investors are heavily discounting its future earnings path.

The analysts have a consensus price target of $37.333 for Keurig Dr Pepper based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the more bullish ones expecting earnings as high as $3.6 billion and the more bearish ones expecting earnings as low as $2.9 billion.

Want to see how modest revenue growth, expanding margins and a lower future earnings multiple still add up to potential upside? Unlock the full valuation playbook behind this fair value call.

Result: Fair Value of $34.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer U.S. Coffee trends and lingering uncertainty around the JDE Peet integration could easily stall those upbeat earnings and margin assumptions.

Find out about the key risks to this Keurig Dr Pepper narrative.

Another View: Earnings Multiple Sends a Different Signal

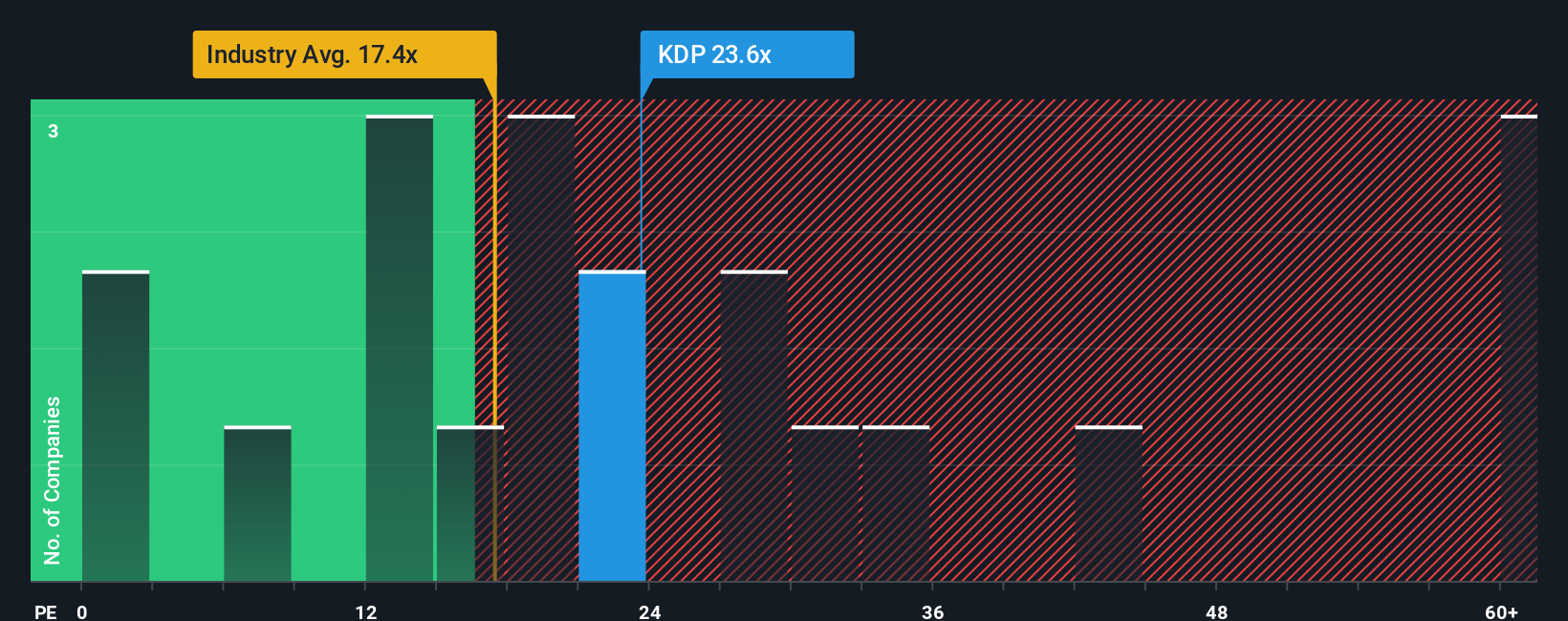

Zooming out from narrative fair value, the current 24.3 times earnings tells a different story. Keurig Dr Pepper looks pricey against the global beverage average of 17.6 times, yet cheaper than its peer group at 27.6 times and below a fair ratio of 27.8 times. In practice, that mix hints at limited margin for error, but also room for rerating if execution improves. Which side of that line do you think the market will choose?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Keurig Dr Pepper Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Keurig Dr Pepper research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street’s powerful Screener to work so you do not miss opportunities that could meaningfully upgrade your portfolio’s future.

- Capture high-potential value opportunities early by scanning these 902 undervalued stocks based on cash flows that strong cash flow analysis suggests the market is mispricing.

- Boost your income strategy by targeting these 10 dividend stocks with yields > 3% that can strengthen total returns with reliable yield above 3 percent.

- Position yourself ahead of structural disruption by researching these 79 cryptocurrency and blockchain stocks at the intersection of blockchain innovation and listed equities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal