Shenglong Co., Ltd. Shenzhen Stock Exchange Main Board IPO Meeting 2024 will produce 10,600 tons of molybdenum metal

Zhitong Finance App learned that on December 23, Luoyang Shenglong Mining Group Co., Ltd. (Shenglong Shares) Shenzhen Stock Exchange's main board IPO passed the Listing Committee meeting. The sponsor is SDIC Securities, which plans to raise 1.53 billion yuan.

According to the prospectus, Shenglong Co., Ltd. is a leading domestic molybdenum company. It is committed to the comprehensive development and utilization of non-ferrous metal mineral resources. During the reporting period, it was mainly engaged in the production, processing and sales of products related to molybdenum, an important strategic resource. The main products were molybdenum concentrate and ferromolybdenum. The company is the cornerstone supporting the safe and stable operation of China's molybdenum industry chain, a strong supporter of the country's strategic mineral resource production and supply, and an active practitioner of the mission of maintaining national industrial safety. The company held molybdenum metal volume at the end of 2024 and accounted for more than 9% of domestic molybdenum metal production in 2024, giving full play to the key role of raw material supply, actively improving the tight supply and demand situation of molybdenum resources, and effectively promoting the continuous development of the molybdenum industry chain.

The company is deeply integrated into the domestic molybdenum industry chain. Longyu Molybdenum, a subsidiary of the company, is a key supporting unit of the key industrial chain in Henan Province - tungsten, molybdenum, titanium and magnesium industry chain. It has many independent research and development core technologies in important parts of the molybdenum industry chain, participates in the formulation of various industry standards, and ranks at the forefront of the industry in many core indicators such as collection and recovery rate. The company actively promotes the high-quality development of the molybdenum industry chain by improving the development efficiency, comprehensive utilization level of mineral resources and cultivating new quality productivity in the mining industry.

Shenglong's main business has outstanding production capacity. According to data from the US Geological Survey (USGS), China's molybdenum metal production in 2024 was about 110 million tons, and the company's molybdenum metal production in 2024 was 10,600 tons, accounting for 9.64% of China's molybdenum metal production. It is one of the important molybdenum suppliers in China.

The company has excellent mine endowments. The Nannihu Molybdenum Mine and the Songxian Angou Molybdenum Polymetallic Mine are all open pit mines, with the advantages of high mining efficiency, low production cost, and good safety conditions. Among them, the Nannihu Molybdenum Mine is an oversized molybdenum and tungsten deposit with a certified production scale of 16.5 million tons/year. It is the largest single molybdenum mine in China. It has large reserves, shallow burial, easy harvesting, high degree of mechanization, and high safety factor. It is an important energy resource supply base and strategic mineral exploration in China. Base; the mine under construction, the Angou molybdenum polymetallic ore in Songxian County has good mineralization conditions, associated The recyclable value of lead metal is high; currently, the company's various capacity expansion and production expansion projects are in full swing, and it will have a molybdenum ore mining capacity of 55,000 tons/day in the future.

The company has rich resource reserves. As of the end of 2024, Shenglong Co., Ltd. has 5 large and medium-sized molybdenum ore rights (including 4 mining rights and 1 prospecting right). The company holds 710,500 tons of molybdenum metal, accounting for 9.10% of the country's molybdenum resource reserves (according to the “2024 China Natural Resources Bulletin” published by the Ministry of Natural Resources). The resource reserves are huge, and the mines it belongs to are in the early stages of mining. They can be mined for a long time in the future, which has great economic benefits.

The company's products are of good quality, have the characteristics of few impurities and high potential for deep processing. The main sales customers include China Baowu, Shandong Steel, Valin Steel, CITIC Special Steel, etc. At the same time, the company plans to build a high-performance molybdenum material project with an annual output of 20,000 tons to promote chain extension and repair in the molybdenum industry, optimize the product structure, and further enhance industry competitiveness and brand influence.

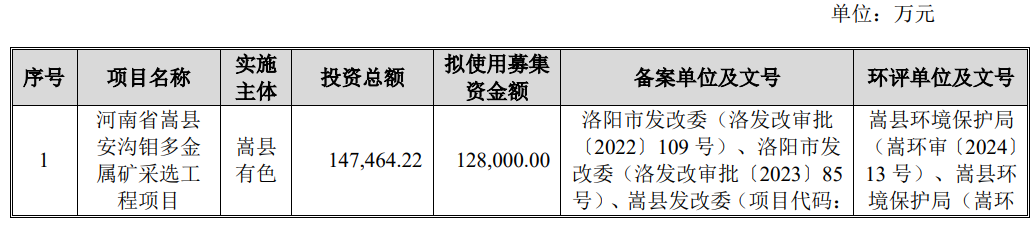

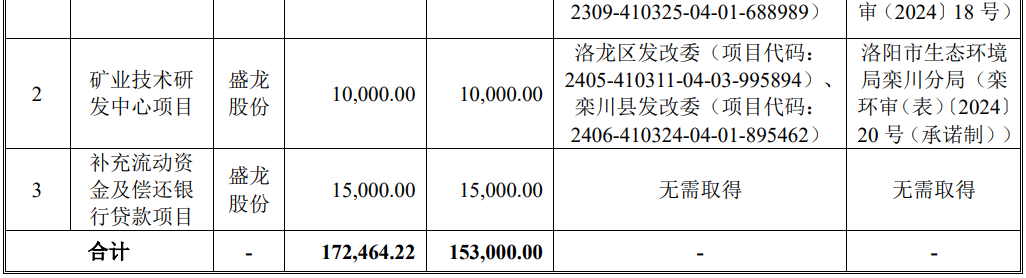

The capital raised this time is invested in the company's main business, which will enhance the company's overall competitiveness and meet the interests of the company and all shareholders. After deducting the issuance fee, the funds raised in this issuance and listing will be invested in the following projects in order of priority:

On the financial side, in 2022, 2023, 2024, and January-June 2025, Shenglong Co., Ltd. achieved operating income of approximately RMB 1,911 million, RMB 1,957 million, RMB 2,864 million, and RMB 2,289 million, respectively. In the same period, net profit was approximately RMB 452 million, RMB 725 million, RMB 754 million and RMB 602 million, respectively.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal