3 Reliable Dividend Stocks Yielding Up To 4.5%

As the U.S. stock market continues its upward trajectory with major indexes nearing record highs, investors are increasingly looking for stability amidst the tech-driven rally. In such a dynamic environment, dividend stocks offer reliable income and potential for steady growth, making them an attractive option for those seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.64% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.30% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.71% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.21% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.91% | ★★★★★★ |

| Ennis (EBF) | 5.49% | ★★★★★★ |

| Dillard's (DDS) | 5.09% | ★★★★★★ |

| Columbia Banking System (COLB) | 4.96% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.35% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.69% | ★★★★★☆ |

Click here to see the full list of 115 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Smithfield Foods (SFD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Smithfield Foods, Inc. is a company that produces packaged meats and fresh pork both in the United States and internationally, with a market cap of approximately $8.96 billion.

Operations: Smithfield Foods, Inc. generates revenue through its key segments of Fresh Pork at $8.30 billion, Hog Production at $3.37 billion, and Packaged Meats at $8.65 billion.

Dividend Yield: 4.4%

Smithfield Foods recently affirmed a quarterly dividend of US$0.25 per share, marking its commitment to shareholder returns despite being new to dividend payments. The company's dividends are well-covered by earnings with a payout ratio of 33.6%, although cash flow coverage is tighter at 84.4%. While the dividend yield stands in the top quartile among U.S. stocks, it remains too early to assess long-term stability or growth trends in their payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Smithfield Foods.

- Our expertly prepared valuation report Smithfield Foods implies its share price may be lower than expected.

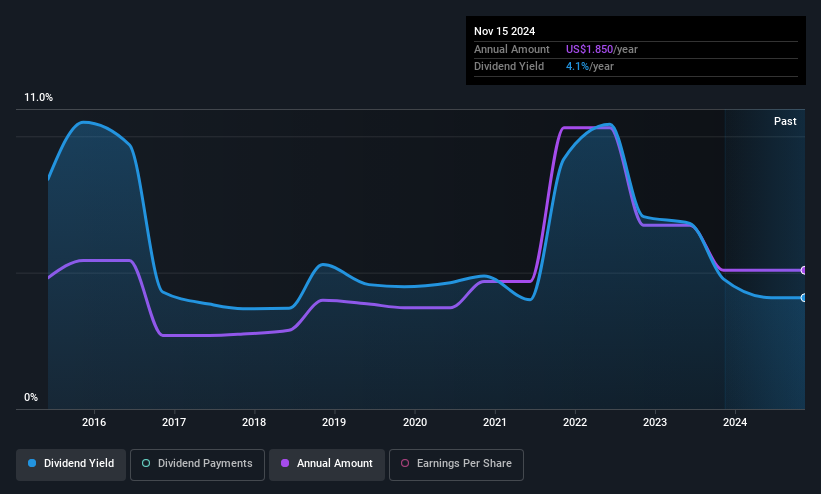

Central Securities (CET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Central Securities Corp. is a publicly owned investment manager with a market cap of $1.46 billion.

Operations: Central Securities Corp. generates revenue of $27.06 million from its Financial Services - Closed End Funds segment.

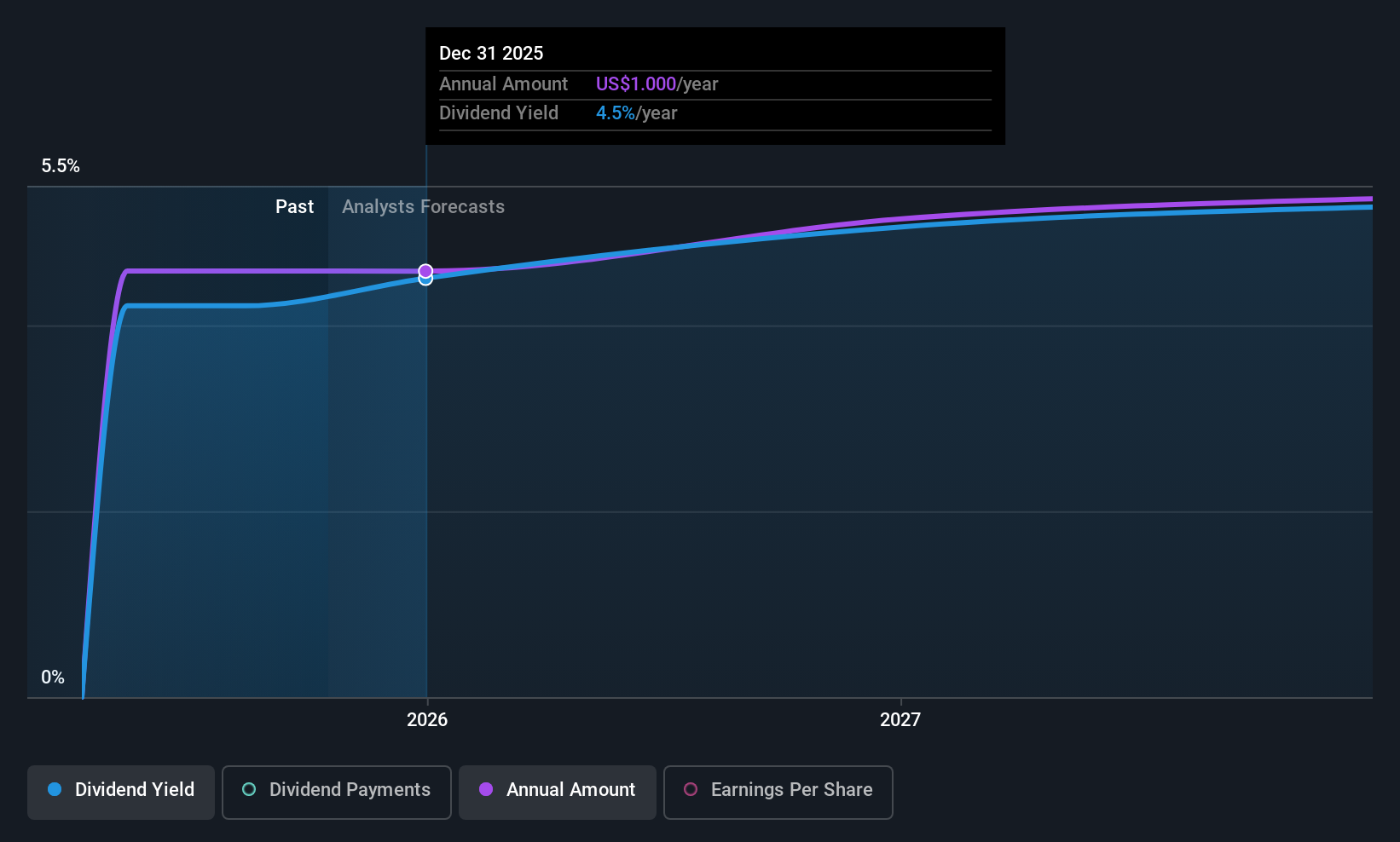

Dividend Yield: 4.5%

Central Securities declared a dividend of US$2.45 per share, payable in stock or cash, but its high cash payout ratio of 166% indicates dividends are not well-covered by free cash flows. Despite being in the top 25% for yield at 4.52%, the company's dividends have been volatile and unreliable over the past decade. Trading significantly below estimated fair value, CET's dividend payments remain a concern due to sustainability issues linked to earnings coverage.

- Delve into the full analysis dividend report here for a deeper understanding of Central Securities.

- Our valuation report here indicates Central Securities may be undervalued.

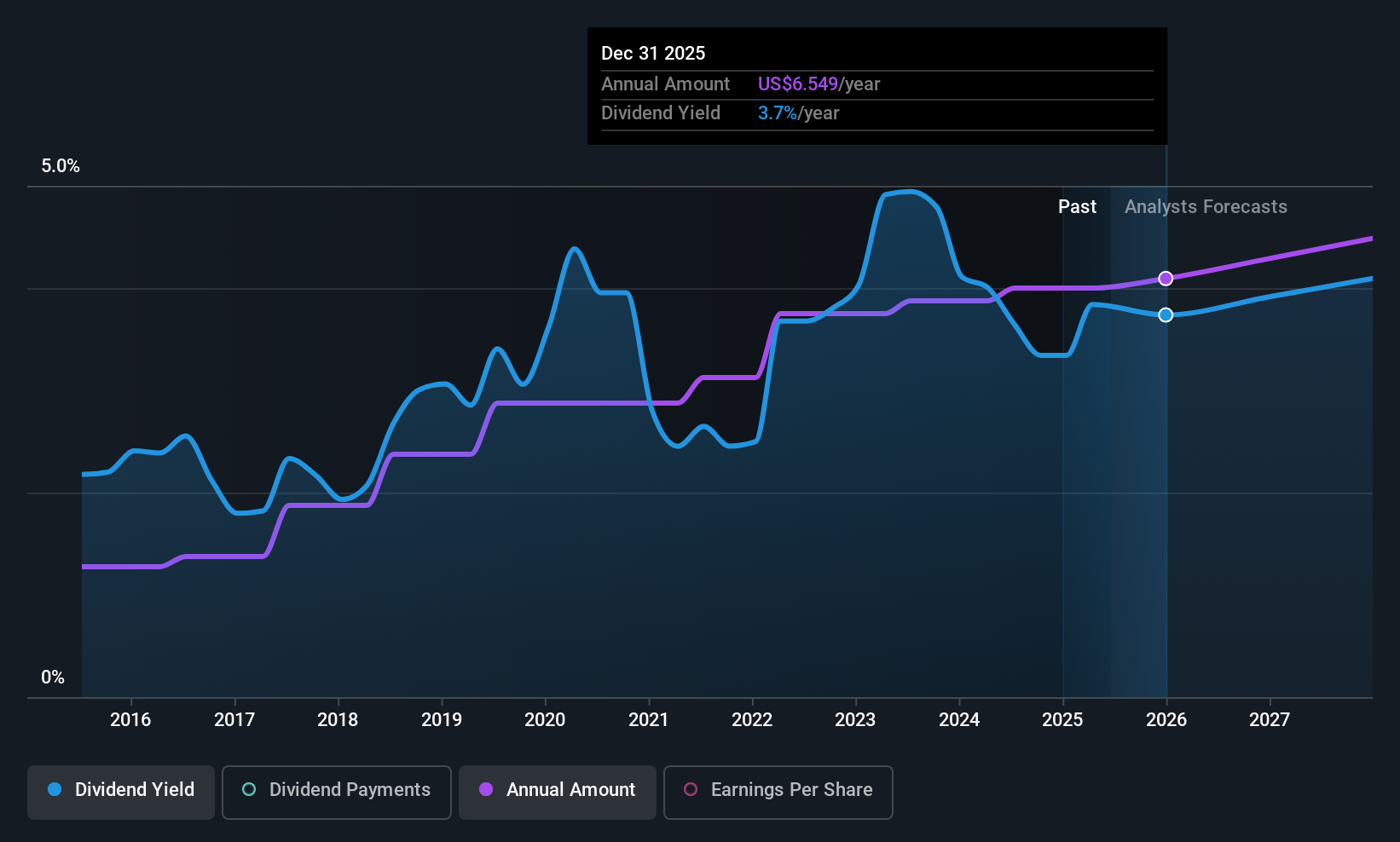

PNC Financial Services Group (PNC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The PNC Financial Services Group, Inc. is a diversified financial services company operating in the United States with a market capitalization of approximately $82.43 billion.

Operations: PNC Financial Services Group generates revenue through its Asset Management Group ($1.72 billion), Corporate & Institutional Banking ($10.60 billion), and Retail Banking including Residential Mortgage ($14.13 billion) segments.

Dividend Yield: 3.2%

PNC Financial Services Group offers a stable dividend yield of 3.19%, supported by a low payout ratio of 41.9%, ensuring dividends are well-covered by earnings and expected to remain sustainable in the future. Despite trading at approximately 33.7% below its estimated fair value, PNC's dividend yield is lower than the top tier in the US market. Recent strategic expansions, including branch openings and acquisitions, aim to enhance its national presence and potentially bolster long-term financial performance.

- Get an in-depth perspective on PNC Financial Services Group's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of PNC Financial Services Group shares in the market.

Key Takeaways

- Investigate our full lineup of 115 Top US Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal