European Dividend Stocks Featuring Three Noteworthy Picks

As European markets show resilience with the STOXX Europe 600 Index rising by 1.60% amid signs of steady economic growth and supportive monetary policies, investors are increasingly turning their attention to dividend stocks as a potential source of reliable income. In this environment, selecting dividend stocks that offer consistent payouts and align with broader economic trends can be a prudent strategy for those seeking stability in their investment portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.11% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.58% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.42% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.02% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.84% | ★★★★★★ |

| Evolution (OM:EVO) | 4.89% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.13% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.30% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.26% | ★★★★★★ |

| Afry (OM:AFRY) | 4.14% | ★★★★★☆ |

Click here to see the full list of 200 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Banca Generali (BIT:BGN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banca Generali S.p.A. provides financial products and services to high net worth, affluent, and private customers in Italy through a network of financial advisors, with a market cap of €6.57 billion.

Operations: Banca Generali S.p.A. generates revenue by distributing financial products and services to high net worth, affluent, and private clients in Italy through its network of financial advisors.

Dividend Yield: 4.9%

Banca Generali's dividend yield of 4.86% places it in the top 25% of Italian dividend payers, offering an attractive income stream despite a volatile track record over the past decade. The company's payout ratio is currently at 78.4%, indicating dividends are covered by earnings, with similar coverage expected in three years (79.3%). Recent guidance confirms stable net interest income projections around €320 million for 2025 and 2026, supporting potential dividend sustainability.

- Click here to discover the nuances of Banca Generali with our detailed analytical dividend report.

- Our valuation report unveils the possibility Banca Generali's shares may be trading at a premium.

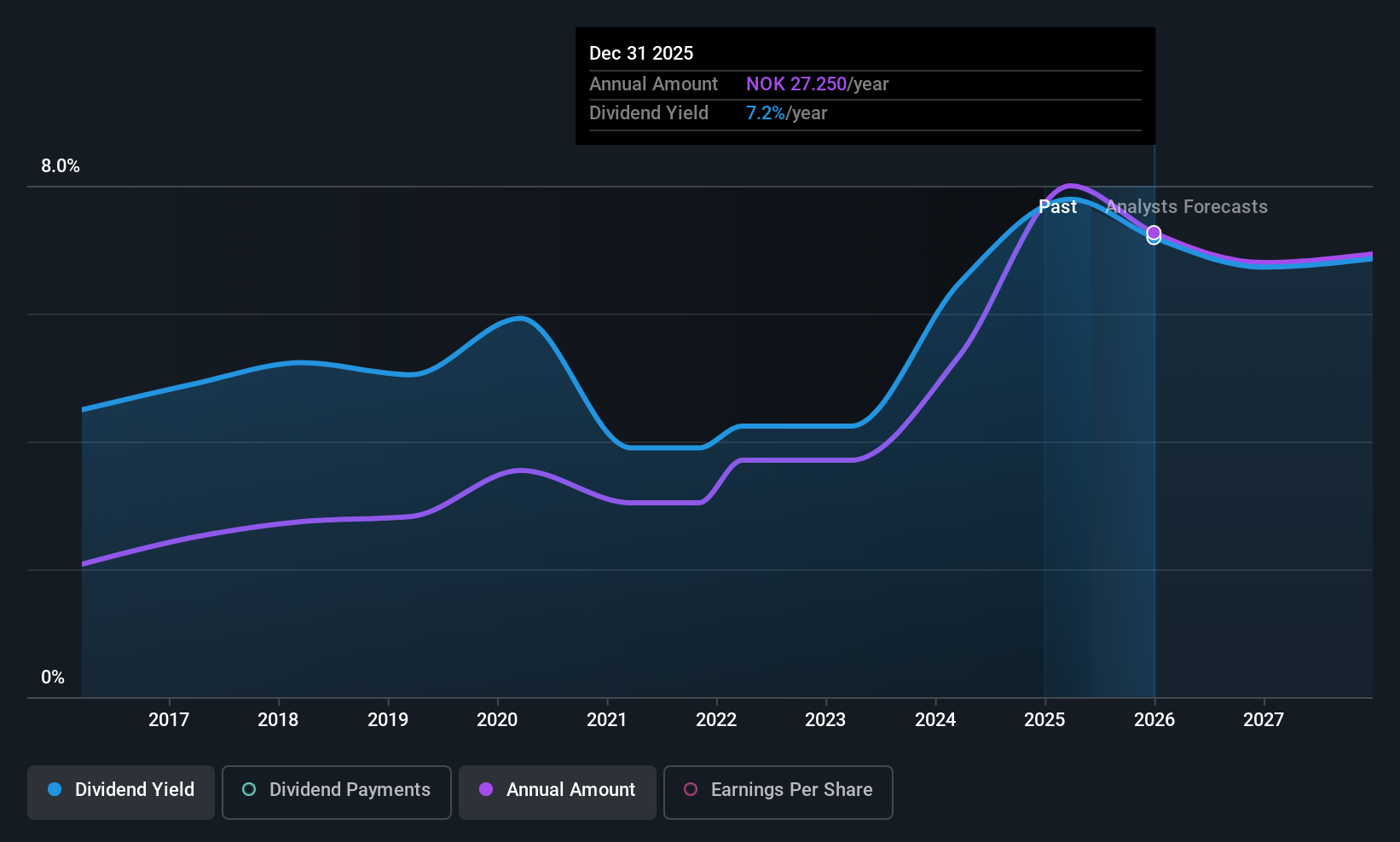

SpareBank 1 Ringerike Hadeland (OB:RING)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 Ringerike Hadeland is a financial institution offering a range of banking products and services to both private and corporate customers in Norway, with a market cap of NOK6.34 billion.

Operations: SpareBank 1 Ringerike Hadeland generates revenue from several segments, including the Private Market (NOK469 million), Corporate Market (NOK378 million), Real Estate Brokerage (NOK68 million), and IT and Accounting Services (NOK93 million).

Dividend Yield: 7.4%

SpareBank 1 Ringerike Hadeland offers a reliable dividend yield of 7.41%, though it trails the top Norwegian payers. Its dividends have shown consistent growth and stability over the past decade, supported by a sustainable payout ratio of 66.9%. Despite recent earnings pressure, with third-quarter net income declining to NOK 159.8 million from NOK 248.9 million last year, dividends remain covered by earnings and are expected to stay sustainable in the near term.

- Unlock comprehensive insights into our analysis of SpareBank 1 Ringerike Hadeland stock in this dividend report.

- According our valuation report, there's an indication that SpareBank 1 Ringerike Hadeland's share price might be on the cheaper side.

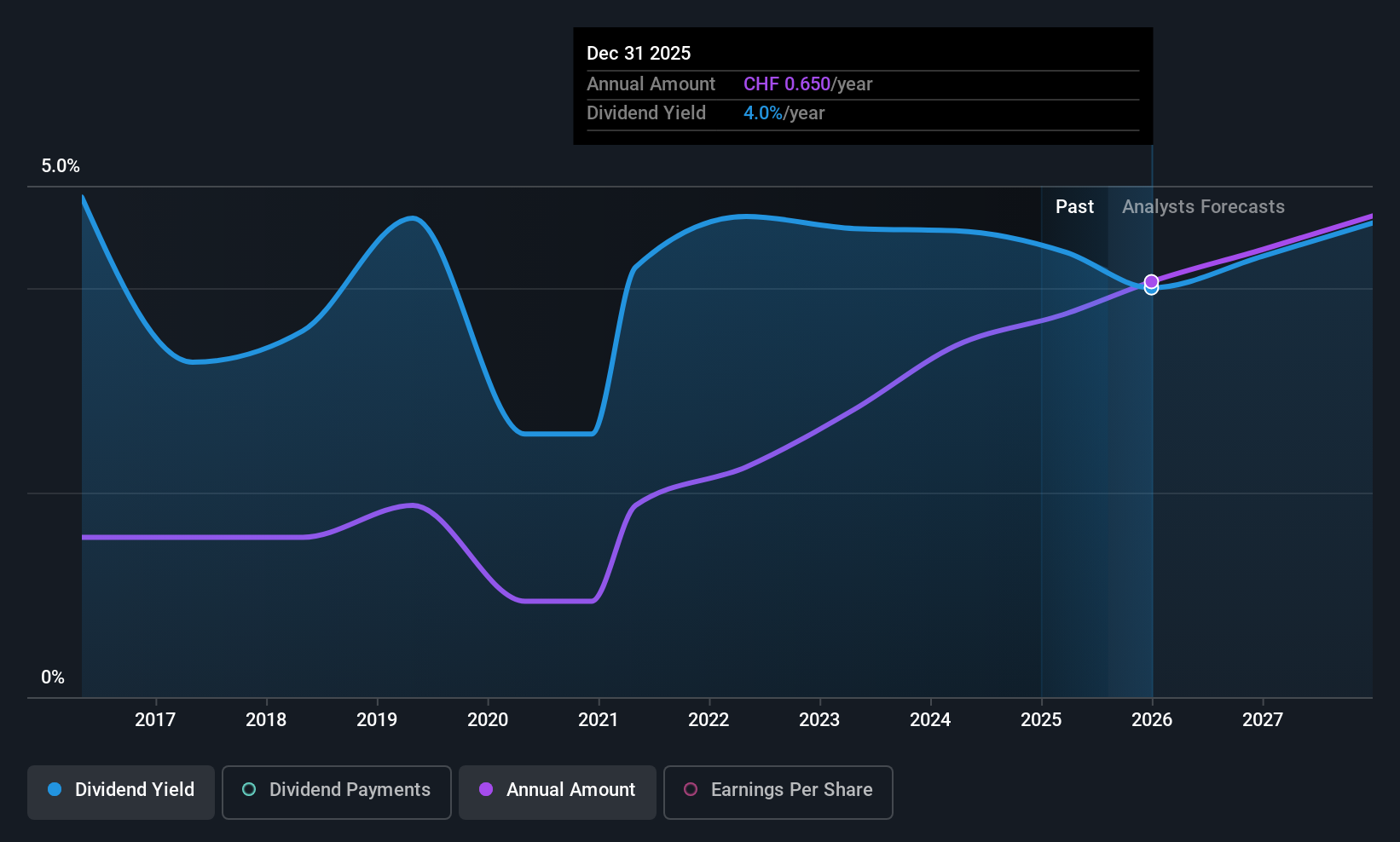

EFG International (SWX:EFGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EFG International AG, with a market cap of CHF5.73 billion, operates through its subsidiaries to offer private banking, wealth management, and asset management services.

Operations: EFG International's revenue segments include Corporate (CHF112.20 million), Global Markets & Treasury (CHF173.40 million), Investment and Wealth Solutions (CHF124.20 million), and various Private Banking and Wealth Management divisions: Americas (CHF126.80 million), Asia Pacific (CHF204.90 million), United Kingdom (CHF175.30 million), Switzerland & Italy (CHF448.80 million), and Continental Europe & Middle East (CHF236.10 million).

Dividend Yield: 3.2%

EFG International's dividend yield of 3.15% is modest compared to top Swiss payers, but its payout ratio of 49.9% indicates dividends are well covered by earnings and expected to remain so in three years with a 70.4% forecasted payout ratio. While dividends have grown over the past decade, their volatility makes them less reliable for consistent income seekers. Recent executive appointments in Asia may enhance strategic growth, potentially impacting future financial stability positively.

- Take a closer look at EFG International's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of EFG International shares in the market.

Taking Advantage

- Investigate our full lineup of 200 Top European Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal