Has Warner Bros. Discovery’s 175% Rally in 2025 Already Reflected Its Streaming Ambitions?

- If you are wondering whether Warner Bros. Discovery is still a bargain or if most of the upside is already priced in, you are not alone. That is exactly what this breakdown aims to unpack.

- After a volatile few years, the stock has surged with a 24.1% gain over the last month and an eye catching 175.4% return over the past year, even after a 3.2% pullback in the last week.

- That momentum has come as investors refocus on the long term potential of Warner Bros. Discovery's streaming strategy and the value of its extensive content library, along with ongoing cost cutting and integration efforts that have shifted sentiment about its balance sheet and execution risk. At the same time, industry wide debates over the future of traditional TV, streaming profitability, and content spending are keeping the stock firmly in the spotlight.

- Despite the rally, Warner Bros. Discovery only scores 1 out of 6 on our undervaluation checks, which raises the question of whether traditional valuation metrics are missing something important here. Next we will walk through those valuation approaches in detail, and then finish with a more nuanced way to think about what this stock might really be worth.

Warner Bros. Discovery scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Warner Bros. Discovery Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, DCF, model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today.

For Warner Bros. Discovery, the latest twelve month Free Cash Flow is about $4.1 billion. Analysts expect this to grow steadily, with Simply Wall St extrapolating those forecasts beyond the typical five year window. Under the 2 Stage Free Cash Flow to Equity model, projected annual FCF rises to roughly $7.3 billion by 2035, reflecting moderate, slowing growth as the business matures.

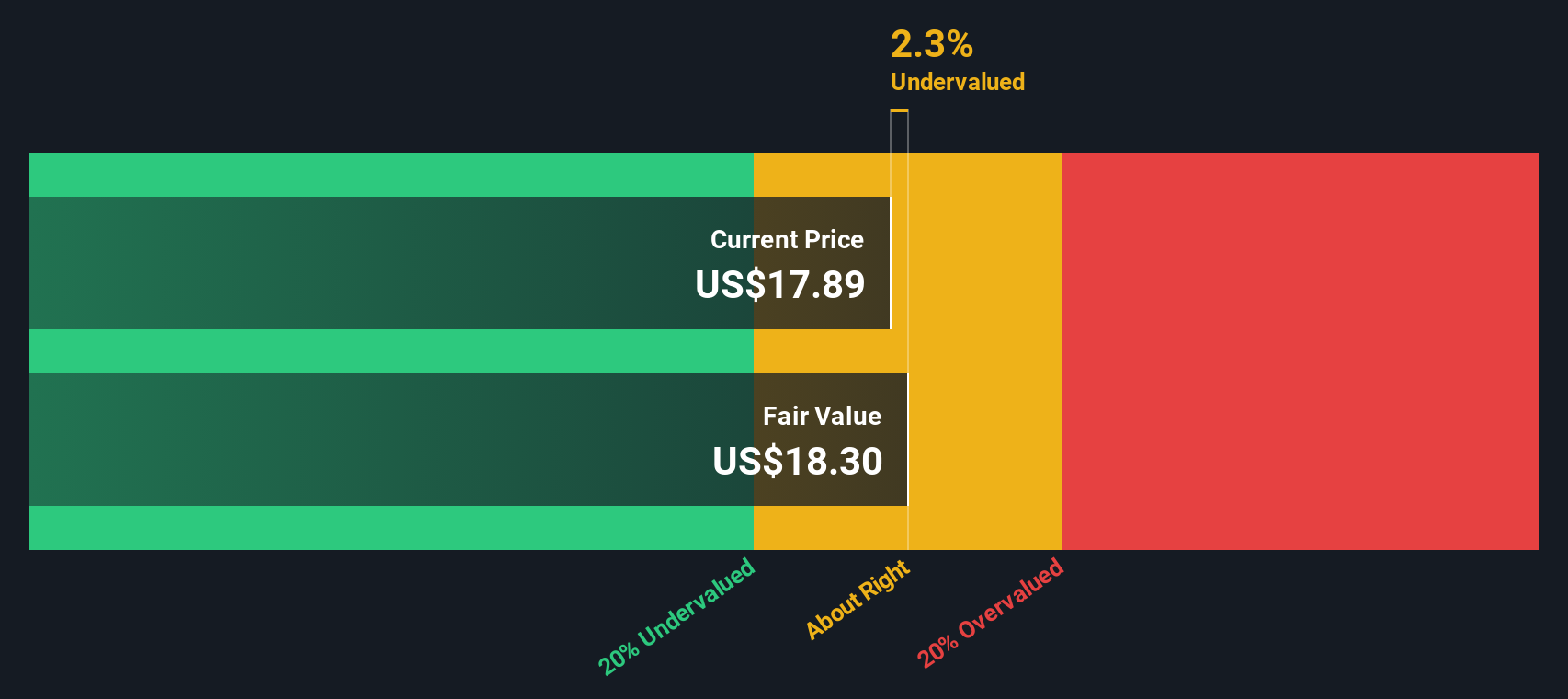

When all those future cash flows are discounted back to today, the model arrives at an intrinsic value of about $29.01 per share. Compared with the current share price, this implies the stock is only around 0.9% undervalued, which is effectively in line with the market’s view.

Result: ABOUT RIGHT

Warner Bros. Discovery is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Warner Bros. Discovery Price vs Earnings

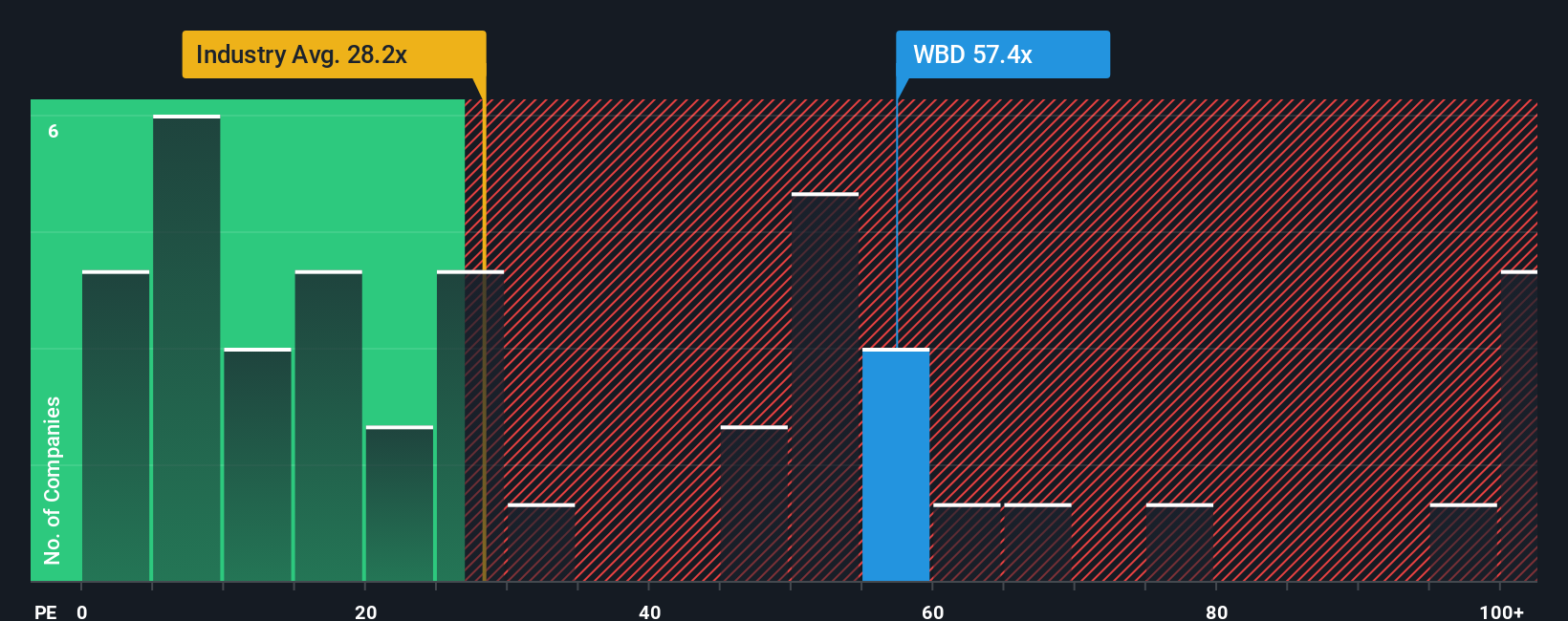

For profitable companies like Warner Bros. Discovery, the Price to Earnings (PE) ratio is a useful yardstick because it links what investors are paying directly to the profits the business is generating today. In general, faster growth and lower risk justify a higher PE ratio, while slower growth or higher uncertainty usually call for a lower, more conservative multiple.

Right now, Warner Bros. Discovery trades on a PE of about 145.78x, which is far richer than both the Entertainment industry average of roughly 20.90x and the broader peer group at around 52.20x. To put that into context, Simply Wall St calculates a proprietary “Fair Ratio” of 17.12x for Warner Bros. Discovery. This Fair Ratio is designed to reflect the multiple the company should reasonably command once you factor in its earnings growth outlook, profit margins, industry positioning, market cap and key risks.

Because the Fair Ratio embeds those fundamentals, it is a more tailored benchmark than a simple comparison with peers or sector averages. Comparing it with the current 145.78x multiple suggests the stock is trading well above what its risk and growth profile would normally warrant.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Warner Bros. Discovery Narrative

Earlier we mentioned that there is an even better way to understand valuation, and on Simply Wall St this takes the form of Narratives. These let you turn your view of Warner Bros. Discovery into a simple story that links its business drivers to a financial forecast and then to a Fair Value. You can then easily compare that Fair Value to today’s price to decide whether to buy, hold or sell. The platform automatically updates the Narrative when new earnings or deal news arrives and surfaces the range of community views. These range from very optimistic investors who might see Fair Value closer to around $24 per share if streaming expansion, IP monetization and a successful bidding outcome play out, through to more cautious investors who anchor closer to the low analyst targets near $10 per share because they worry that deal risk, franchise fatigue and linear TV headwinds could cap growth and compress margins.

Do you think there's more to the story for Warner Bros. Discovery? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal