How Investors May Respond To Quanta Services (PWR) Rapid Backlog And EPS Growth Outpacing Peers

- Quanta Services recently reported that its project backlog has grown at an average rate of 16.7% over the past two years, while earnings per share compounded at 24.3% annually, highlighting a solid pipeline of contracted work and strong profitability trends.

- This combination of sustained backlog expansion and faster earnings growth than peers points to a company that is increasingly converting demand into higher-quality, higher-margin business.

- Next, we'll examine how Quanta's rapid backlog expansion reshapes its investment narrative and what this might mean for future expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Quanta Services Investment Narrative Recap

To own Quanta Services, you need to believe that long term demand for grid, renewable, and data center related infrastructure will keep translating into profitable work. The recent update that backlog has grown 16.7% annually while EPS compounded at 24.3% supports that thesis, but it does not remove near term risks around large project delays or potential slowdowns in utility and data center spending.

Against this backdrop, the expanded long term agreements with American Electric Power, tied to a US$72,000,000,000 capital plan for high voltage transmission and grid equipment, look particularly relevant. Together with the growing backlog and raised 2025 guidance, this kind of multi year commitment reinforces Quanta’s role as a partner of choice for complex grid work, while still leaving investors exposed to execution risks on increasingly large and politically sensitive projects.

However, while backlog growth looks reassuring, investors should still be aware of how dependent Quanta remains on multi year utility and data center spending cycles and...

Read the full narrative on Quanta Services (it's free!)

Quanta Services’ narrative projects $37.5 billion revenue and $1.7 billion earnings by 2028.

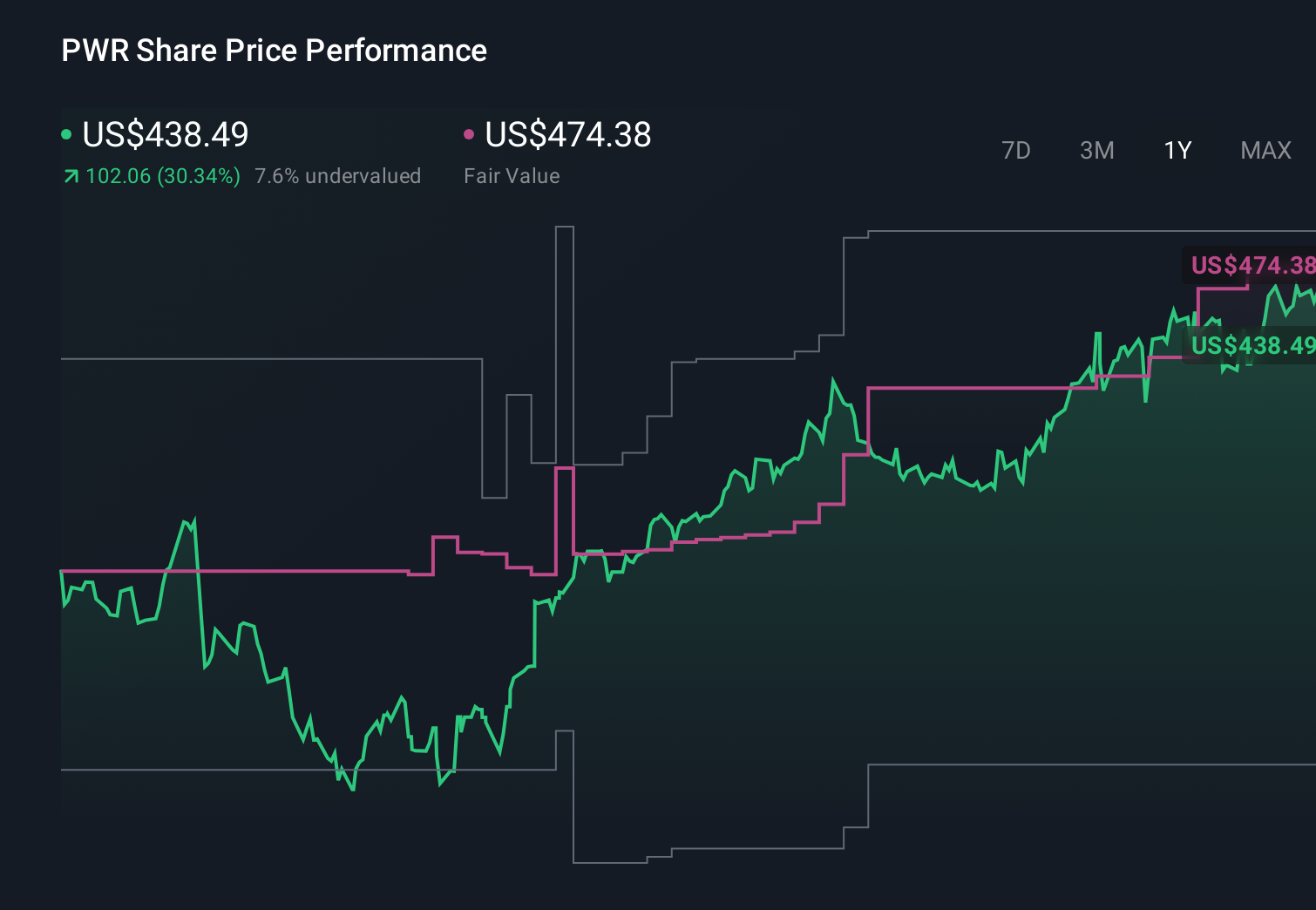

Uncover how Quanta Services' forecasts yield a $474.38 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$300 to US$474 per share, showing how far apart individual views can be. You can weigh that range against the risk that large, politically sensitive grid and renewable projects face delays or cancellations, which could affect how reliably Quanta converts its record backlog into future earnings.

Explore 4 other fair value estimates on Quanta Services - why the stock might be worth as much as 10% more than the current price!

Build Your Own Quanta Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quanta Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Quanta Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quanta Services' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal