Cui Dongshu: In January-November, China's automobile exports reached 7.33 million vehicles, an increase of 25% year-on-year

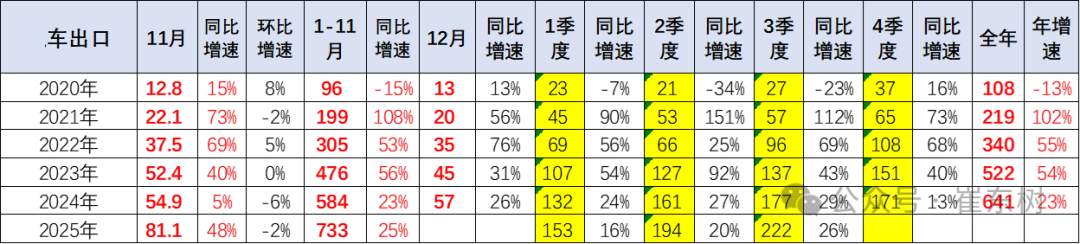

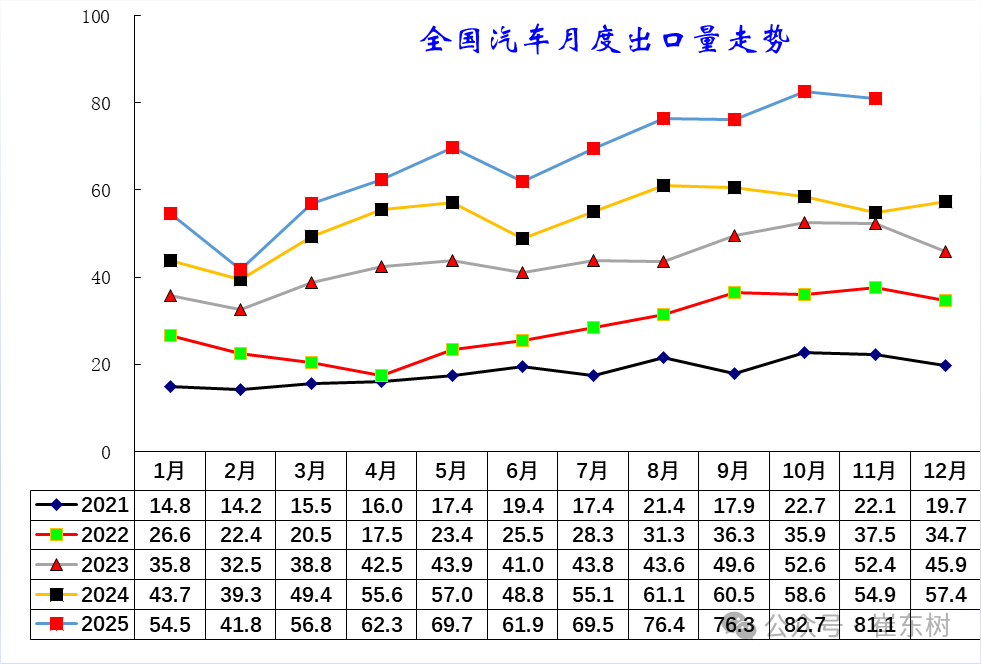

The Zhitong Finance App learned that Cui Dongshu, Secretary General of the Passenger Transport Association, published an article stating that in November 2025, China exported 810,000 vehicles, up 48% year on year, down 2% month on month. From January to November, China exported 7.33 million vehicles, a 25% increase compared to January to November 2024, which is generally strong. In November 2025, China exported 350,000 new energy vehicles, up 156% year on year, showing good performance; from January to November 2025, exports of new energy vehicles were 3.01 million units, up 62% year on year, and the growth rate was very high recently.

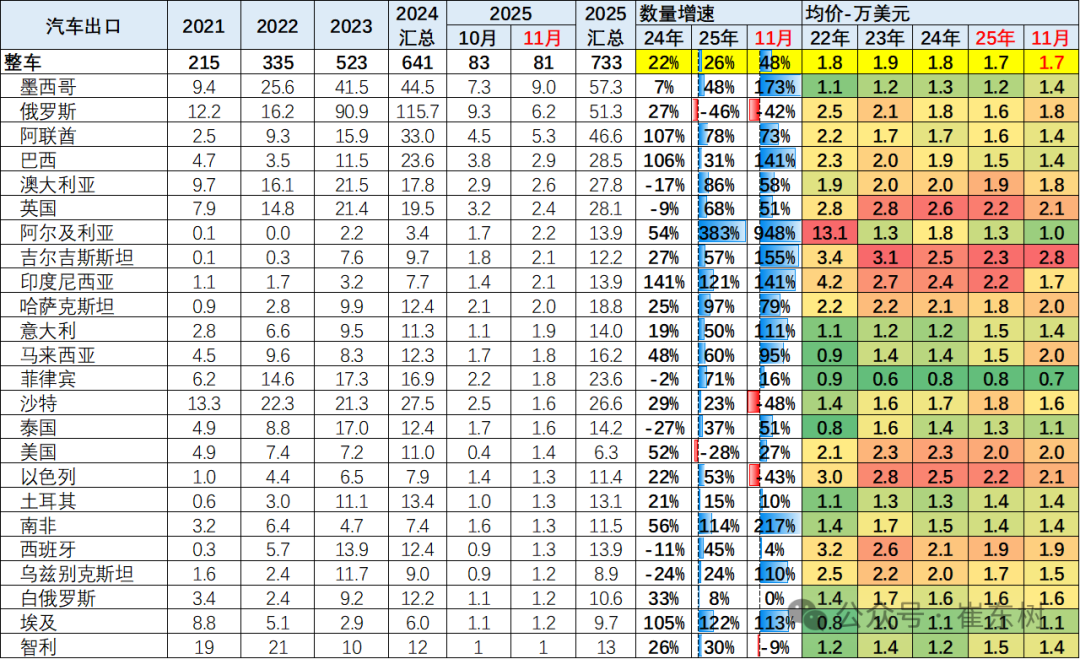

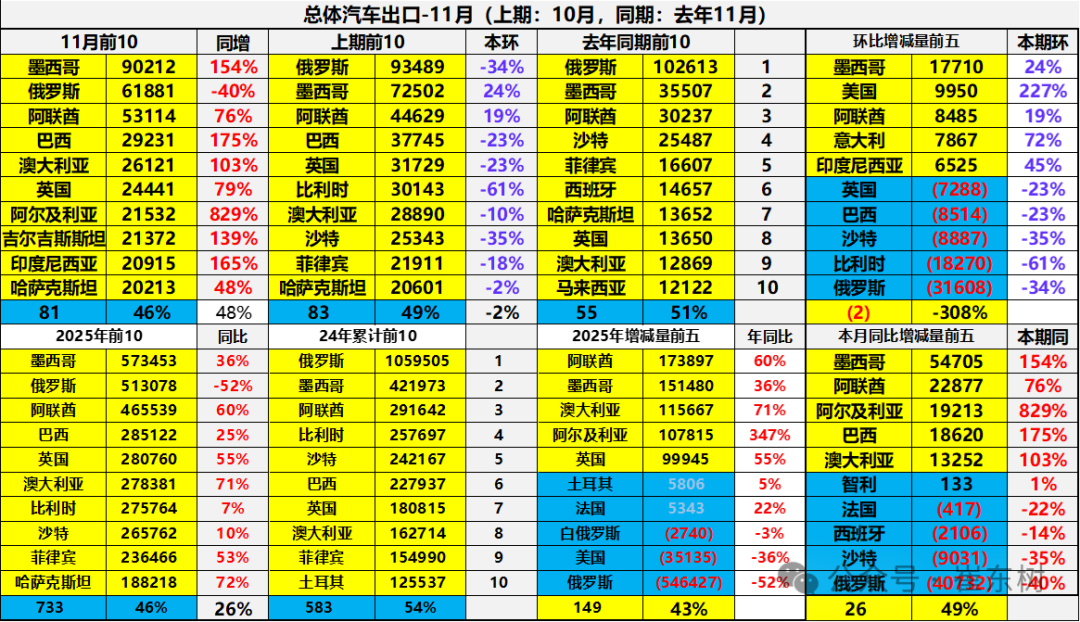

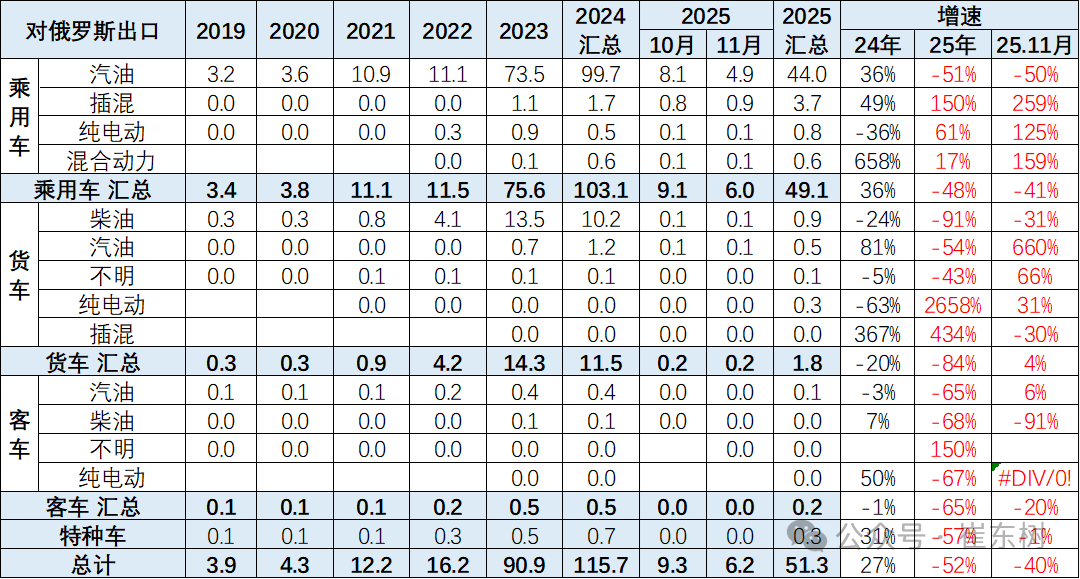

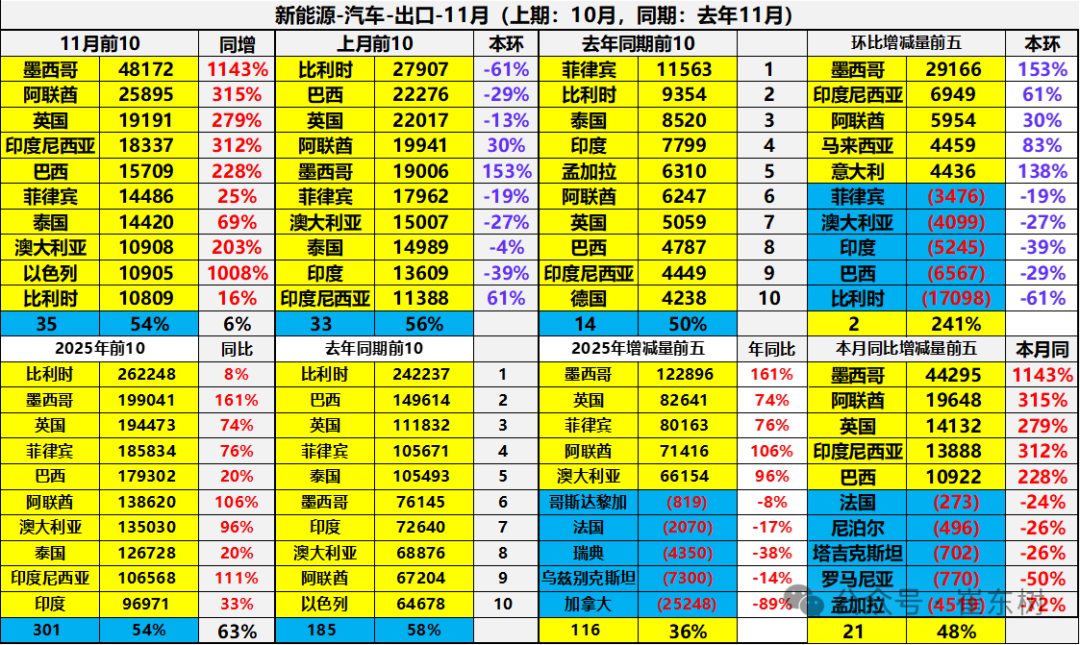

The top 10 countries of China's total automobile exports in November 2025: Mexico 90,212, Russia 6,181, UAE 53114, Brazil 29,231, Australia 26,121, United Kingdom 24,441, Algeria 21,532, Kyrgyzstan 21,372, Indonesia 20,915, Kazakhstan 20213. Among them, the top five that increased over the same period were: Mexico 54705, UAE 22877, Algeria 19,213, Brazil 18,620, Australia's 13,252 vehicles. In the Russian market, Chinese car companies' awareness of risk prevention has increased. Although domestic sales in Russia did not decline much from January to November, exports to Russia declined significantly from January to November 2025. The top 10 countries with cumulative total vehicle exports in 2025: Mexico 573,453, Russia 51,3078, UAE 46,5539, Brazil 28,512, UK 280,760, Australia 278,381, Belgium 27,5764, Saudi Arabia 26,5762, Philippines 23,6466, Kazakhstan 188,218. Among them, the top five that increased over the same period were: the UAE 17,3897, Mexico 151,480, Australia 115,667, and Algeria 10,7815, UK 99,945.

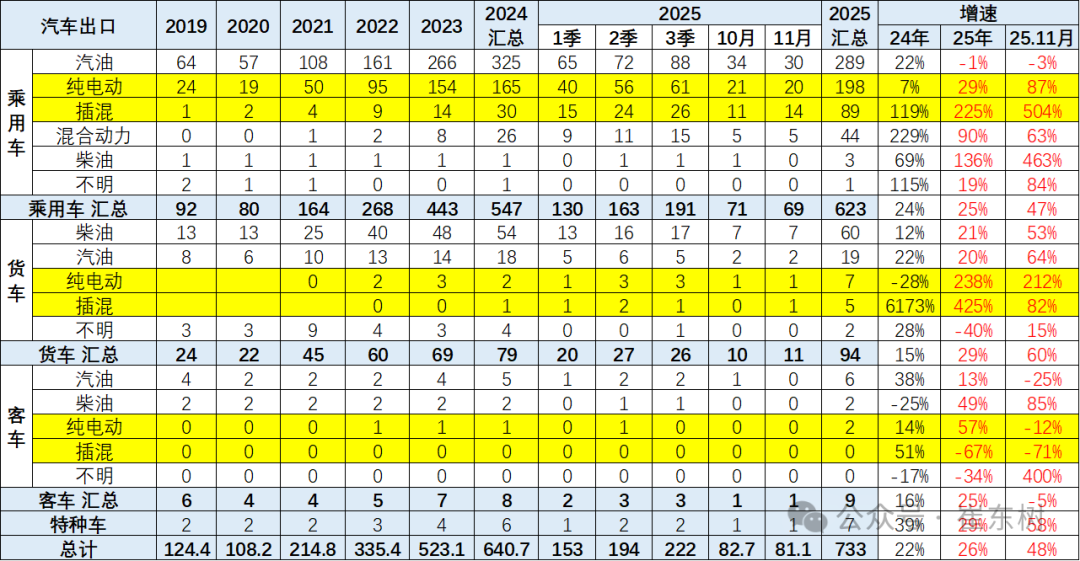

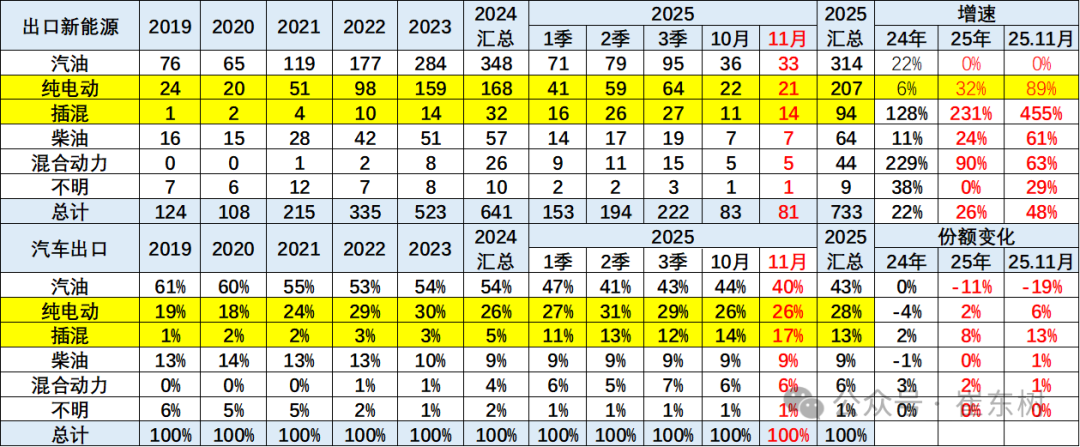

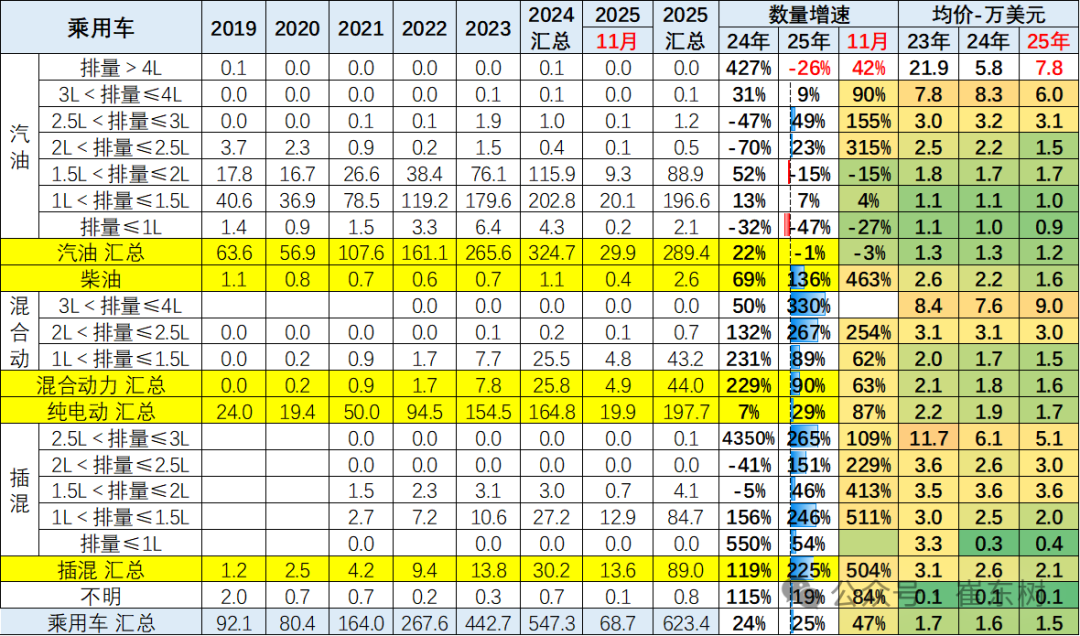

In November 2025, pure electric vehicles accounted for 26% (6% YoY), plug-in hybrid accounts for 17% (YoY +13%), hybrid accounts for 6% (+1% YoY), and pure fuel vehicles accounted for 40% (-19% YoY).

From January to November 2025, pure electric vehicles accounted for 28% (2% YoY), hybrid accounts for 13% (YoY +8%), hybrid accounts for 6% (+2% YoY), and pure fuel vehicles accounted for 43% (-11% YoY).

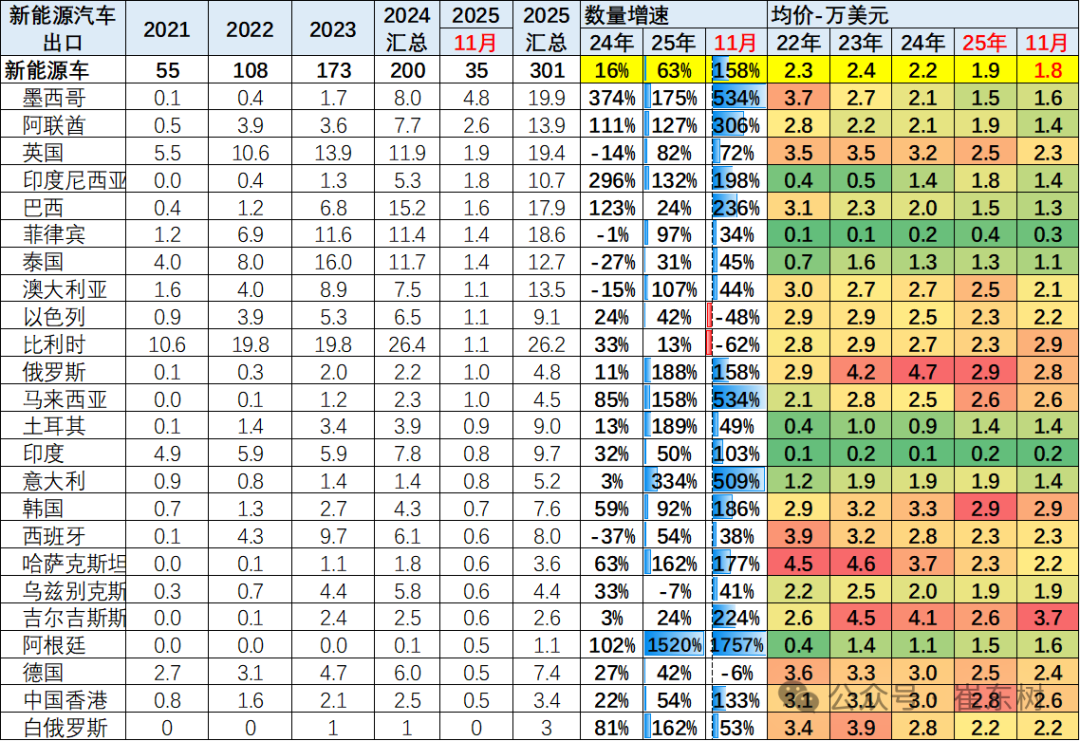

The top 10 countries with total NEV exports in November 2025: Mexico 48,172, UAE 25,895, UK 19,191, Indonesia 18,337, Brazil 15,709, Philippines 14,486, Thailand 14,420, Australia 10,908, Israel, 10905, Belgium, 1,0905, Belgium. The top five that increased over the same period were: Mexico 44295, UAE 19648, UK 14,132, Indonesia 13,888, Brazil 10,922 vehicles. The top 10 countries with total NEV exports from January to November 2025: Belgium 262,248, Mexico 199041, UK 19,4473, Philippines 18,5834, Brazil 179302, UAE 138,620, Australia 13,5030, Thailand 12,6728, Indonesia 106568, India 96971. Among them, the top five that increased over the same period were: Mexico 12,2896, UK 82641, Philippines 80,163, UAE 71,416, Australia 66,154.

China's NEV export performance from January to November 2025 was better than expected. Mainly, plug-in hybrid and hybrid vehicles replaced pure electric vehicles as a new growth point for export growth. In particular, plug-in pickup trucks showed strong export performance and became the highlight of commercial vehicle NEV exports. China's NEV exports are showing high quality development to the Middle East and developed markets, mainly to Western Europe and Asia. Russia's decline in the fuel vehicle market was fully reflected, while the monitored decline in retail sales volume in the Russian market was small. Among them, major car companies such as Geely (00175), Changan (000625.SZ), Chery, and BYD (002594.SZ) performed very well.

I. Overall trend of China's automobile exports

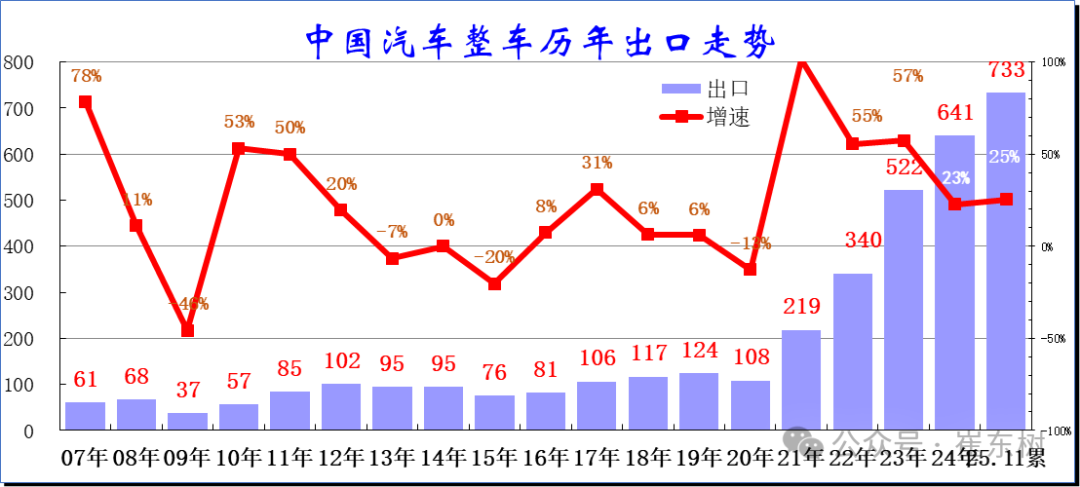

1. Trends in automobile exports over the years

China's automobile exports achieved a breakthrough in 2021 after years of multi-million platform periods. In the context of the downturn in the world economy from 2013 to 2016, automobile exports declined sharply. From 2017 to 2020, the export growth rate gradually stabilized and improved, and the annual export volume remained at around 1 million vehicles. The export volume reached 1.08 million vehicles in 2020, a year-on-year decrease of 13%, and then entered a period of high growth since 2021.

China's automobile exports have continued to grow at a high rate since breaking through the millionth level in 2021 (up 102% in 2021, 50% + in 2024-2023, and falling back to around 20% in 2024-2025), and 7.33 million vehicles were exported from January to November 2025 (up 25% from January to November 2024), continuing the growth trend. Recently, China's automobile exports have shown a rapid growth trend. In the future, as long as the international market environment is stable, there is still huge room for development of Chinese automobile exports.

From January to November 2025, China achieved exports of 7.33 million vehicles, a growth rate of 25% from January to November 2024. In November, China achieved exports of 810,000 vehicles, up 48% year on year, down 2% month on month. The overall trend is strong year on year. The main driving force this year is still the increase in the competitiveness of Chinese products and a slight increase in the global market in southern countries, but the impact of the downturn in the Russian car market is significant.

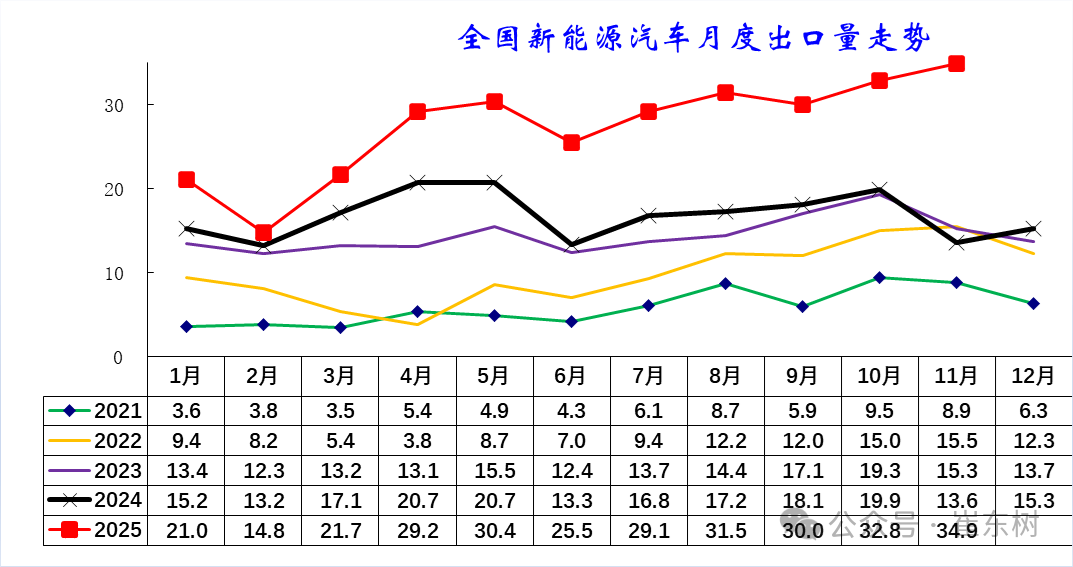

Judging from the monthly trend, China's automobile exports in recent years are still showing seasonal characteristics, which are characterized by a trend that contrasts with the rise in summer and domestic trends. Export growth was relatively strong in January 2025, then disrupted by Trump's imposition of tariffs. Exports were sluggish in February-April, and growth resumed in May-November. Due to market fragmentation, the growth rate of China's automobile exports is less affected by the external environment.

2. Monthly trend of vehicle exports

Judging from monthly trends, China's automobile exports in recent years are still showing seasonal characteristics, showing the contrast between rising summer and domestic trends. The export growth rate was relatively strong in January 2025. Due to potential external trade policy disruptions, it was sluggish in February-April, and growth resumed in May-November. Due to market fragmentation, the growth rate of China's automobile exports was less affected by the external environment and continued to rise since September.

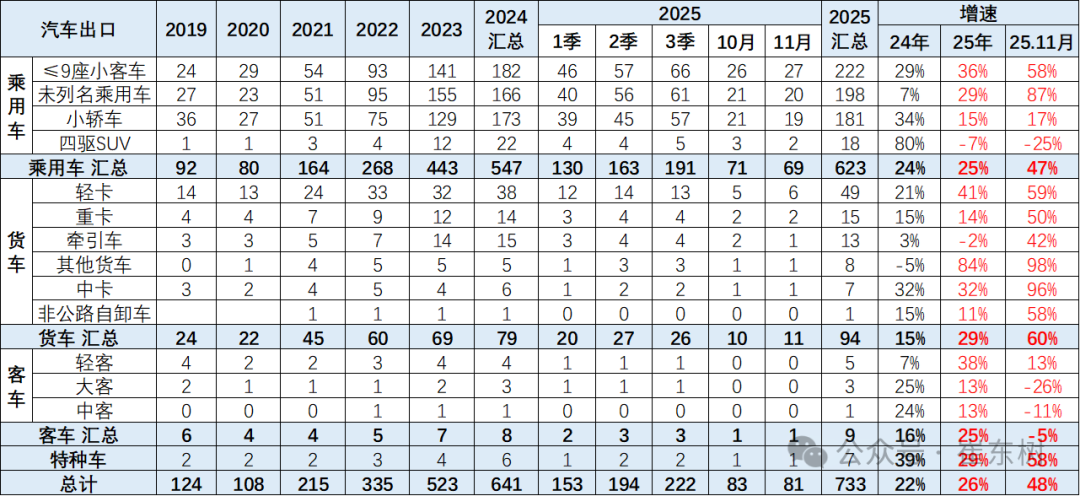

3. Structural characteristics of automobile exports

China's automobile exports remained at the scale of one million until 2020, and then continued to grow rapidly to 6.41 million vehicles in 2024. Passenger car exports continued to strengthen, and truck and bus exports also continued to grow well.

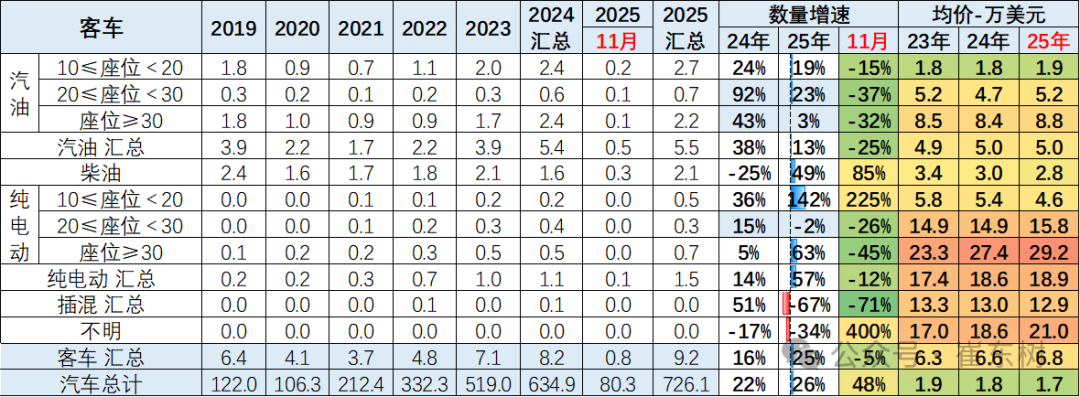

From January to November this year, the growth rate of all types of customs models diverged, and the growth rate of passenger cars gradually picked up. The growth rate of trucks and buses was better than in 2024. In particular, truck exports increased by 29%, and bus exports increased by 25%. Compared with the steady trend of domestic fuel trucks, exports of light trucks and medium trucks have been relatively good recently.

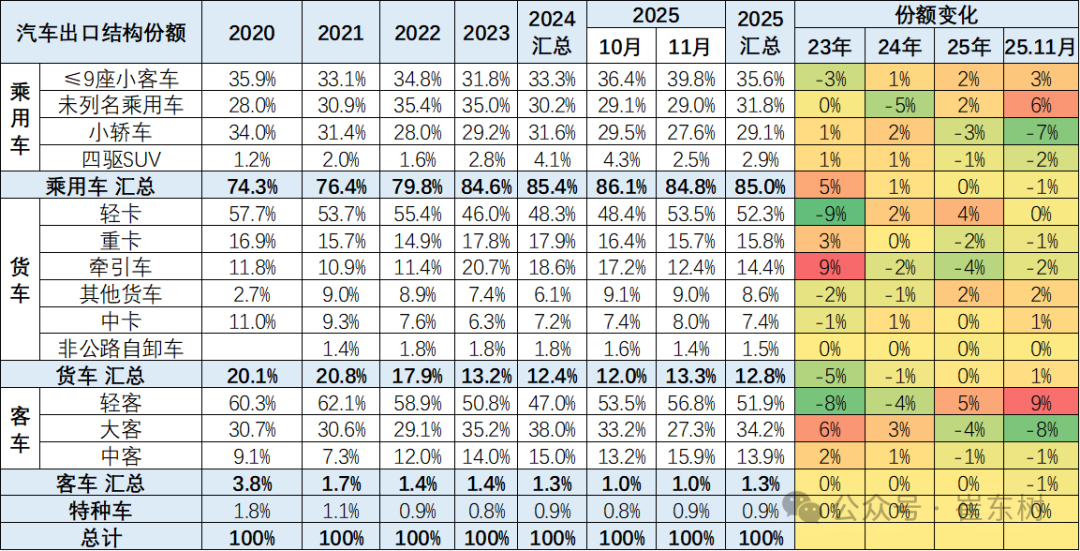

In terms of structure, the share of passenger car exports continued to rise, reaching 85% by 2023, and was relatively stable thereafter. The share of exports of trucks and buses continued to fall to a low level. Since passenger cars are the focus of trade, the proportion of trucks and buses exported is still slightly higher than that of domestic commercial vehicles.

The performance of several major models within passenger cars was more balanced. The improvement in performance in 2025 was the export of unlisted passenger cars. Although the decline in Tesla exports at the end of the quarter had a big impact, autonomous small and mini electric vehicles grew better. Buses with 9 seats or less will account for 36% in 2025, of which 40% will be reached in November.

The share of trucks performed well in November compared to October. Among them, pickup trucks increased in November, and the export performance of heavy trucks declined. Among buses, the performance of large and medium-sized buses was average, while exports of light buses were slightly stronger.

4. Structural characteristics of export dynamics

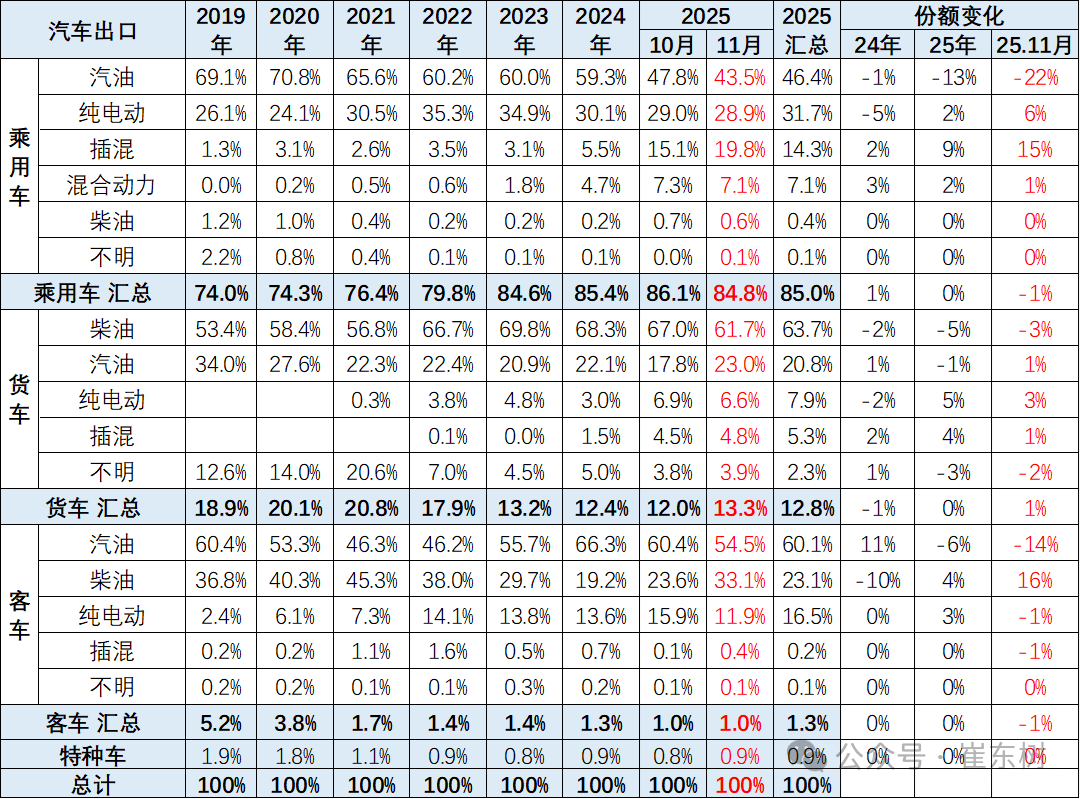

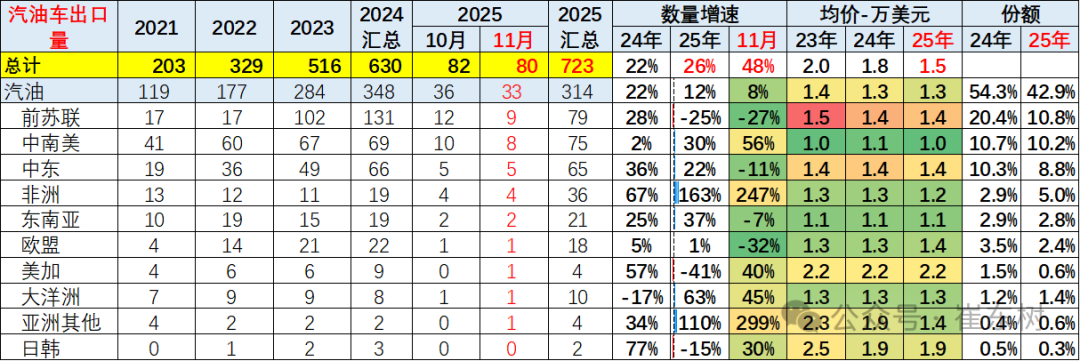

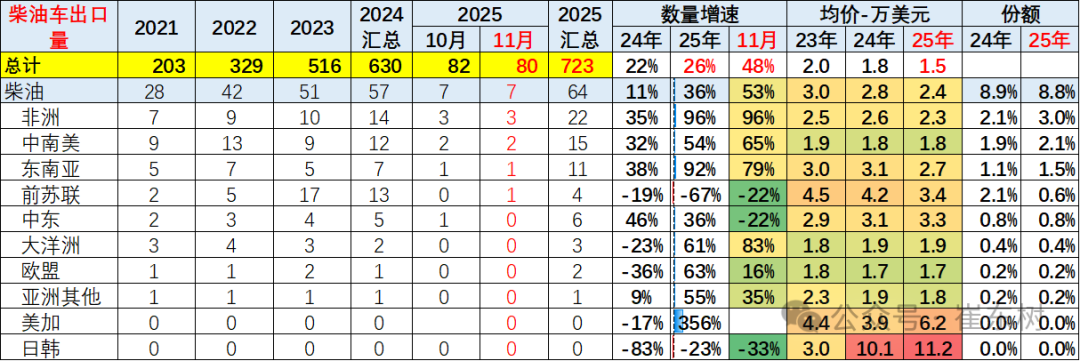

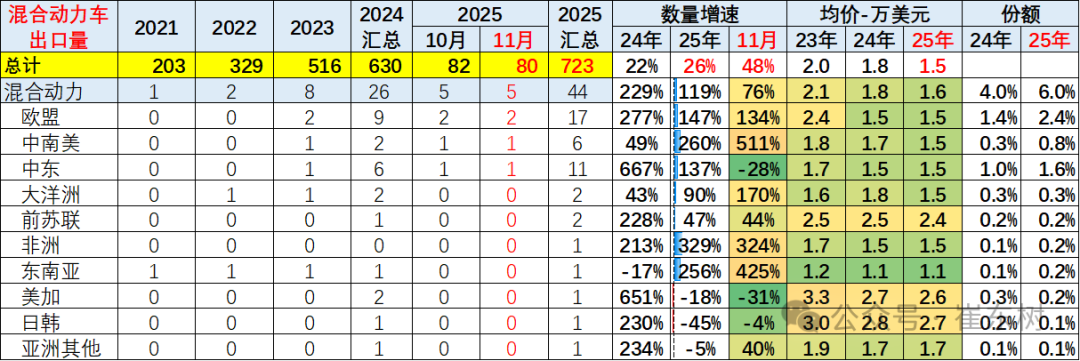

In terms of the export power structure, the export growth rate of passenger cars declined significantly in 2025. Among them, gasoline vehicle exports all grew at a low rate. This year, exports of hybrid passenger cars were very strong, and the export growth rate of plug-in passenger cars was the strongest. Truck and bus exports have been stable this year, and fluctuations in passenger car exports to Russia and Europe are the core volatile variables.

From January to November 2025, the share of pure electric passenger cars picked up, and exports of gasoline passenger cars, diesel trucks, and gasoline buses dropped significantly. Exports of plug-in hybrid passenger cars, plug-in hybrid pickups, and hybrid passenger cars grew relatively well in November.

II. The pattern of the automobile export market

1. Domestic regional characteristics of export manufacturers

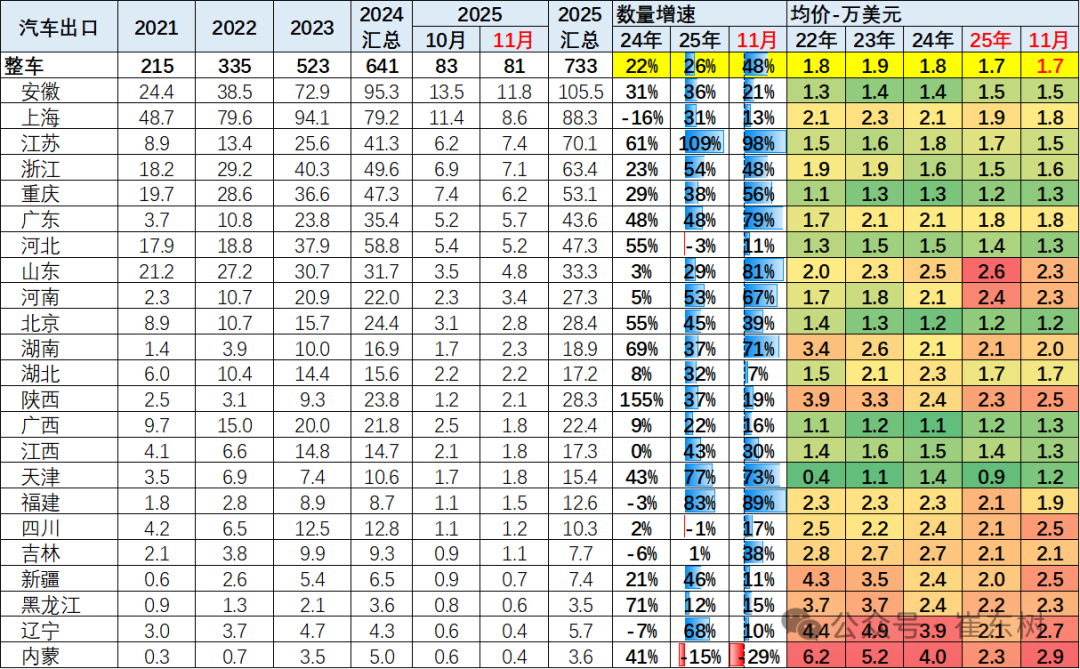

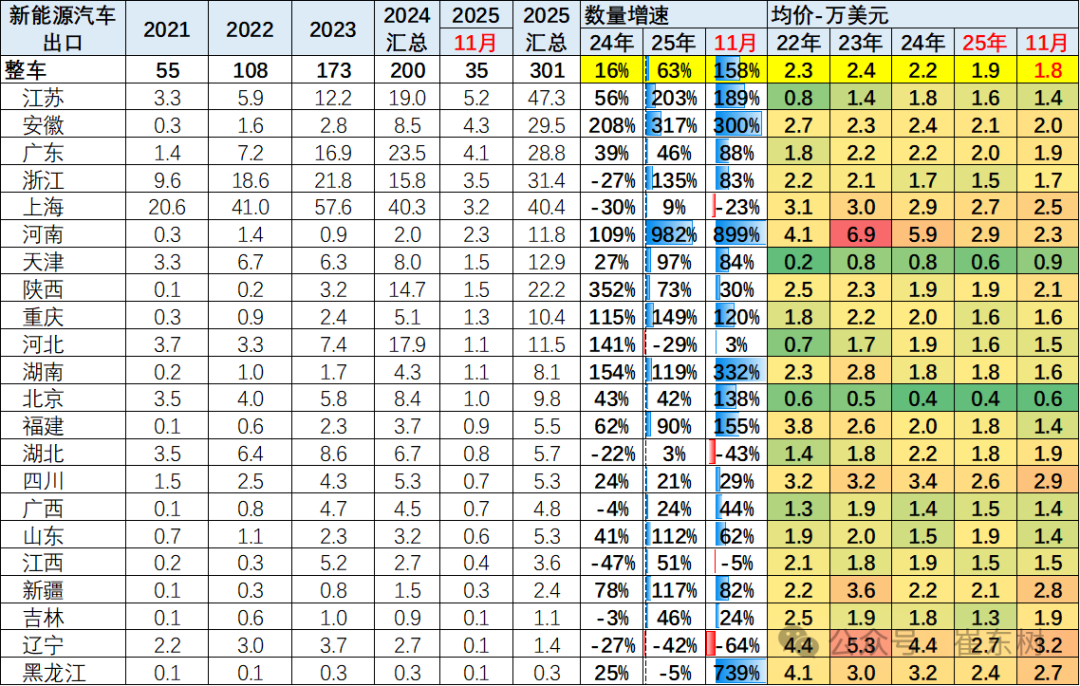

In 2024, the leading position of automobile exports from Shanghai was replaced by Anhui, and in 2025, Anhui will maintain the number one export position. The importance of Shanghai's exports to China is extremely obvious. From January to November 2025, Anhui exported 1.06 million vehicles, mainly due to the relatively excellent local enterprises in Anhui. The export grade of Shanghai companies is high, and the average export prices of SAIC Motor and Tesla companies have declined.

Anhui's export performance has been relatively strong in the past two years. Mainly, the export performance of Chery and JAC is relatively strong, but the Russian market risk is huge, so Anhui's export diversification is good. The contribution of automobile exports from Jiangsu, Zhejiang, and Henan increased significantly in 2025.

2. Export area characteristics

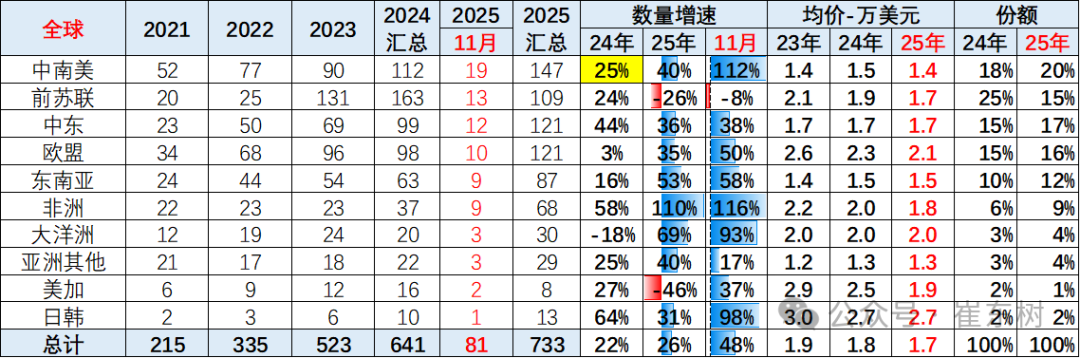

The overall performance of China's automobile exports is strong. Among them, exports to the Middle East, Africa, and Oceania have performed relatively well. Meanwhile, there is a lot of pressure on export performance from the former Soviet Union region, the US and Canada.

China's automobile exports in the early stages were relatively high in Central and South America, and the performance was strong in other regions of Asia, such as Southeast Asia and South Asia. Currently, it is gradually shifting to the characteristics of relatively strong performance in Central and South America and Europe. Especially recently, the Middle East, Central and South America have all performed relatively well compared to last year, and the main decline was in the former Soviet Union region, which dropped from 25% last year's share to 15% this year.

3. Analysis of vehicle export trends by country

The average price of automobile exports was 18,000 US dollars in 2022; it rose to 19,000 US dollars in 2023, showing continuous upward characteristics; the average export price was 18,000 US dollars in 2024; 17,000 US dollars in 2025. The average export price continues to fall, and the decline in Tesla's share of exports has led to a decline in the average price of bicycles.

The Russian market changed dramatically in the early stages, and other foreign investors withdrew, so China's exports to Russia have also been high since 2023. In 2024, the Russian performance of Chinese car companies was still strong, and this year they went back to full competition. Last year, more cars were exported to Belgium. Relations with Europe have improved this year, and export performance has also improved.

The Mexican market has shown strong performance recently. Auto markets in Chile, Peru, Thailand, etc. plummeted earlier, but have recovered this year. Asia is still a better market for Saudi Arabia and the UAE.

4. Monthly trend of increase or decrease in vehicle exports

The top 10 countries of China's total automobile exports in November 2025: Mexico 90,212, Russia 6,181, UAE 53114, Brazil 29,231, Australia 26,121, United Kingdom 24,441, Algeria 21,532, Kyrgyzstan 21,372, Indonesia 20,915, Kazakhstan 20213. Among them, the top five that increased over the same period were: Mexico 54705, UAE 22877, Algeria 19,213, Brazil 18,620, Australia's 13,252 vehicles.

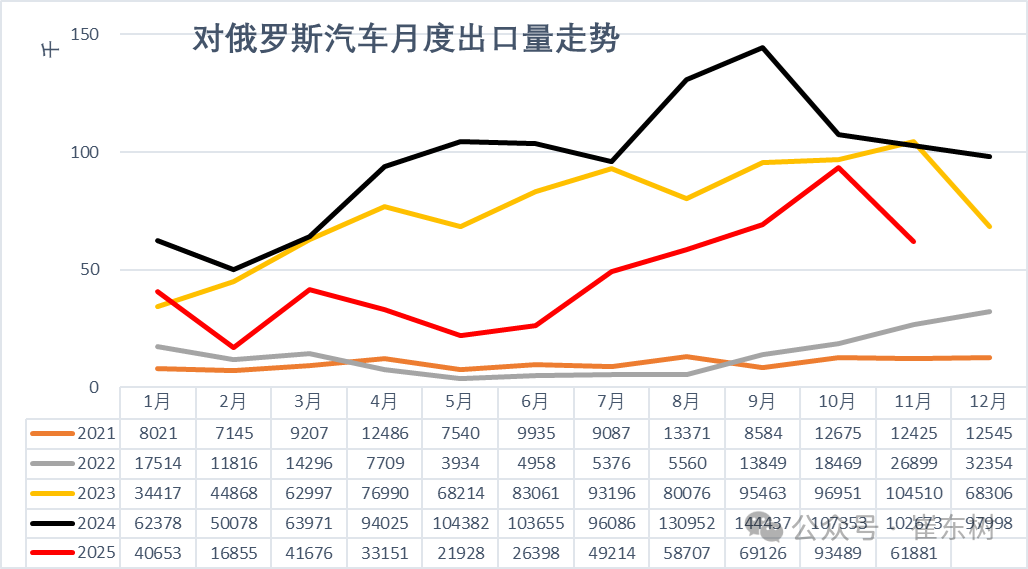

In the Russian market, Chinese car companies' awareness of risk prevention has increased. Although domestic sales in Russia did not decline much from January to November, exports to Russia declined significantly from January to November 2025.

The top 10 countries with cumulative total vehicle exports in 2025: Mexico 573,453, Russia 51,3078, UAE 46,5539, Brazil 28,512, UK 280,760, Australia 278,381, Belgium 27,5764, Saudi Arabia 26,5762, Philippines 23,6466, Kazakhstan 188,218. Among them, the top five that increased over the same period were: the UAE 17,3897, Mexico 151,480, Australia 115,667, and Algeria 10,7815, UK 99,945.

5. Analysis of changes in major exporting countries over the years

The results of overseas bases for automobile exports in the early stages were not ideal, and the main market fluctuated greatly. The main markets for automobile exports from 2023 to 2024 are from Russia, Mexico, Belgium, Australia, Saudi Arabia, the United Kingdom, etc., with strong trends in the European and American markets. Recently, the performance of relatively developed countries such as Australia, the United Arab Emirates, and the United Kingdom has improved.

The structure of automobile exports changed from January to November 2025, Mexico rose to the top export position, and the UAE's exports increased. Exports to Mexico recovered to first place in November. Australia's exports were better, the British market was better, and Brazil's exports declined year on year.

6. Analysis of changes in exports to Russia

Due to the recent withdrawal of automobile companies from other countries from Russia, Chinese car companies quickly guaranteed Russia's vehicle supply demand in 2023. Early Chinese car companies should be safe in Russia for the time being.

Russia's import rules are continuously adjusted according to supply and demand. Russian car sales in 2024 are already at the highest level in recent years, so a decline in 2025 is inevitable. China's exports of new energy vehicles to Russia have fluctuated sharply since 2024. Domestic demand in Russia gradually stabilized from January to November this year, and China's automobile exports are gradually picking up.

Since 2023, Russia has suddenly become the largest market for Chinese automobile exports. This is another dramatic change in Chinese automobile exports after a lapse of 15 years. China's own brands entered the Russian market in 2008 and performed well, but with Russia's policy of imposing huge tariffs on Chinese cars, Chinese car companies left Russia on a large scale back then. The decline in the first half of this year was somewhat similar to 2009, but there are improvements now.

III. Export trends of new energy vehicles

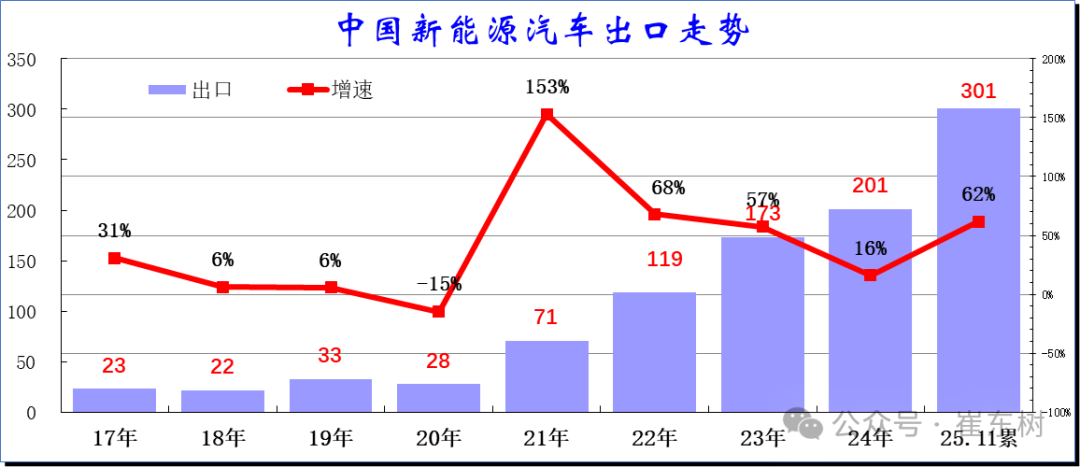

1. Characteristics of NEV exports over the years

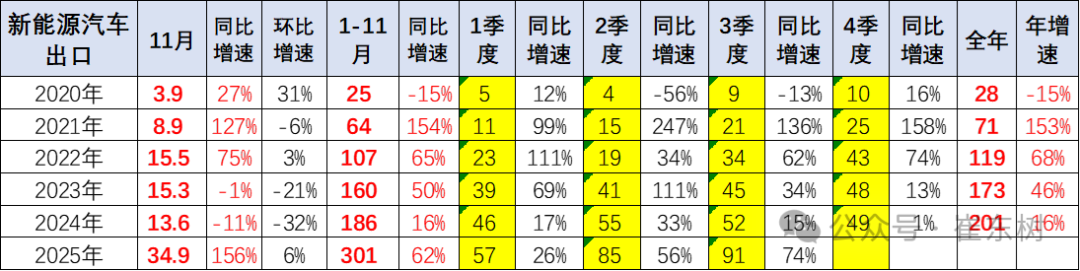

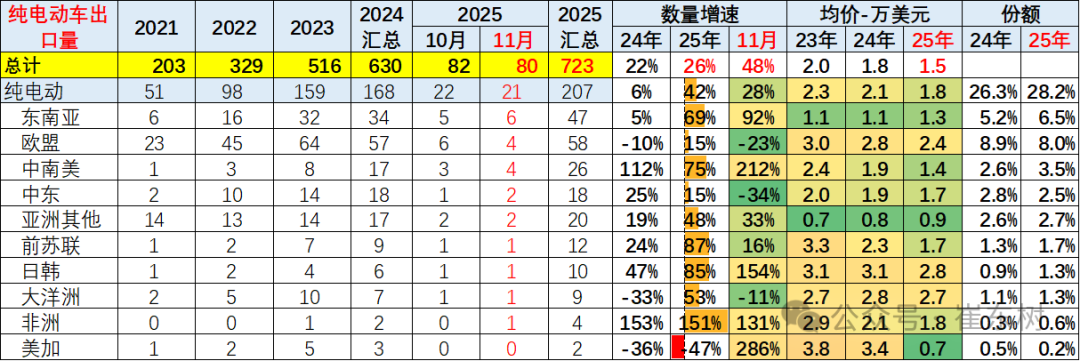

With the transformation of China's domestic NEV market from subsidy-driven to market-driven, China's NEV market competitiveness has increased dramatically. China's NEV exports have exploded since 2021, then entered a continuous high growth range. Despite being disrupted by the EU's NEV export policy in 2024, China's NEV exports still reached 201 million units in 2024, an increase of 16% over the previous year. From January to November 2025, exports of 3.1 million new energy vehicles were exported, an increase of 62% over the previous year, and the performance was good.

2. Monthly export characteristics of new energy vehicles over the years

Due to the imposition of tariffs by the European Union, the trend of China's new energy exports was sluggish in the second half of 2024, and market pressure was strong, and there was an abnormally negative growth situation in November.

NEV exports surged in January this year, sluggish in February-March, and continued to be historically high in April-November, laying the foundation for continued growth in 2025.

After continuous high growth, the cumulative export volume of new energy vehicles in 2024 was 201 million units, an increase of 16% over the previous year. In November 2025, China exported 350,000 new energy vehicles, up 156% year on year, which is a good performance; from January to November 2025, exports of new energy vehicles were 3.01 million units, up 62% year on year, and the growth rate was higher than 16% from January to November 2024.

3. Changes in the structure of automobile exports

In November 2025, pure electric vehicles accounted for 26% (6% YoY), plug-in hybrid accounts for 17% (YoY +13%), hybrid accounts for 6% (+1% YoY), and pure fuel vehicles accounted for 40% (-19% YoY).

From January to November 2025, pure electric vehicles accounted for 28% (2% YoY), hybrid accounts for 13% (YoY +8%), hybrid accounts for 6% (+2% YoY), and pure fuel vehicles accounted for 43% (-11% YoY).

4. Analysis of regional changes in new energy exports

As Tesla entered China, China's automobile export pattern changed. In previous years, Shanghai ranked first for a long time. With the rise of domestic cars, autonomy has become the core of new energy exports. Shanghai's exports have fluctuated sharply recently. Jiangsu, Anhui, Guangdong, and Zhejiang have performed well in new energy exports in November.

Regions with strong NEV exports in 2025 include Jiangsu, Zhejiang, and Anhui. Average export prices from Tianjin, Beijing, etc. are low; models without VIN codes should be the main ones.

5. National characteristics of NEV passenger vehicle exports over the years

In 2025, the year-on-year growth of NEV exports diverged. Exports of new energy vehicles are mainly in Europe and Asia. Among them, the Asian market also has good low-end demand.

The main markets for NEV exports have basically grown well this year, and the American market is gradually rising. Only the Israeli market showed poor growth performance. The Mexican market is strong. The trend of new energy vehicles in the Indonesian market is also strong, forming a new energy growth point in Southeast Asia.

6. Analysis of changes in NEV exports in 2025

The top 10 countries with total NEV exports in November 2025: Mexico 48,172, UAE 25,895, UK 19,191, Indonesia 18,337, Brazil 15,709, Philippines 14,486, Thailand 14,420, Australia 10,908, Israel, 10905, Belgium, 1,0905, Belgium. The top five that increased over the same period were: Mexico 44295, UAE 19648, UK 14,132, Indonesia 13,888, Brazil 10,922 vehicles.

The top 10 countries with total NEV exports from January to November 2025: Belgium 262,248, Mexico 199041, UK 19,4473, Philippines 18,5834, Brazil 179302, UAE 138,620, Australia 13,5030, Thailand 12,6728, Indonesia 106568, India 96971. Among them, the top five that increased over the same period were: Mexico 12,2896, UK 82641, Philippines 80,163, UAE 71,416, Australia 66,154.

In 2025, exports to Southeast Asia such as Belgium, Brazil, and the Philippines are some of the main directions. Recently, exports to markets around Russia and Canada have been weak. Markets such as Brazil and the Philippines performed well.

7. Analysis of changes in fuel vehicle exports by power vehicle

In 2024, China exported 3.48 million gasoline models, an increase of 22%; from January to November 2025, China exported 3.14 million gasoline vehicles, an increase of 12%. China's fuel vehicle market to Russia, the US, Japan, and South Korea has declined dramatically this year. Other markets are still very good. In particular, there are many fuel vehicle exports to markets such as Africa, the Middle East, and Southeast Asia, and the characteristics of joint venture exports and resale are obvious.

Diesel vehicle exports are better than gasoline vehicles this year, achieving strong growth in diesel vehicles in Africa, Central and South America, and Southeast Asia.

This year, the increase in hybrid models in Europe, Central and South America was strong, reflecting the overall increase in the competitiveness of passenger cars in China. Hybrids performed well in the former Soviet Union.

8. Analysis of changes in pure electric vehicle exports in 2025

In 2024, China exported 1.68 million pure electric models, an increase of 6%; from January to November 2025, China exported 2.07 million units of pure electric vehicles, an increase of 42%, compared with the export growth rate in 2024.

Currently, the EU market for pure electricity is still the absolute main market, and demand in markets such as Southeast Asia and the Middle East fluctuates relatively greatly. In particular, as the development of new energy sources is slowing down, and China's pure electric vehicles pursue high end, and large-scale characteristics are obvious, small electric vehicles lack good products, and the export pressure for pure electric vehicles is high.

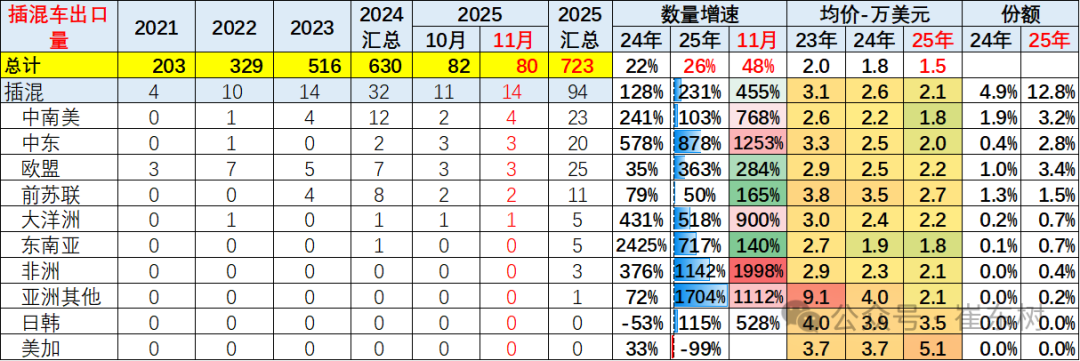

From January to November 2025, China exported 940,000 hybrid vehicles, an increase of 231%. Of these, 140,000 plug-in vehicles were exported in November, an increase of 455%. Apart from the US, Canada and other regions, where demand for mixing is declining rapidly, China's mixed performance in other regions is outstanding. Meanwhile, demand for hybrid models from China in the European Union has increased, and hybrid exports from Turkey and the Middle East have become a new highlight of growth.

IV. Export trends by passenger car category

1. Export of passenger cars by emission

Passenger car exports are mainly in the 1 liter to 1.5 liter range. This is also a comprehensive advantage of China's autonomous passenger car products. The 1.5-2 liter model in 2025 declined sharply. Exports of 1.5-2 liter models grew rapidly in the early stages, indicating that Russia and others are more in demand for high-end, high-priced SUV models from China, but after the Russian market was saturated, the pressure on the high-end was even greater.

However, with the product grade differentiation of electric vehicle models, exports of high-end electric vehicles have improved greatly, while entry-level plug-in hybrid exports have grown relatively well.

2. Structural characteristics of passenger vehicle exports

China's largest fuel passenger vehicle exports in November 2025 were Russia with 48,749 vehicles, Mexico with 20,755 units, UAE with 15,915 units, Algeria with 13,431 units, Saudi Arabia with 12,833 units, Kazakhstan with 11,172 vehicles, US 10,938 units, Australia 9845, and Egypt with 9270 units. Among them, the top five that increased over the same period were: Algeria 14,508, Mexico 8,249, Kyrgyzstan 7427, UAE 5519, Brazil 4510 cars.

China's largest fuel passenger vehicle exports from January to November 2025 were Russia with 4,40,577 vehicles, Mexico with 278,380 units, UAE 221,289 units, Saudi Arabia with 208,304 units, Kazakhstan with 130,341 units, Algeria with 118,349 units, Australia with 99,606 vehicles, Malaysia 98898, Kyrgyzstan 79042, and Egypt with 76,753 units. Among them, the top five that increased this year over the same period last year were: 99,436 units from Algeria, 60,696 vehicles from the United Arab Emirates, and 50,948 vehicles from Kazakhstan , Australia 36,452, Egypt 34,467.

China's exports of pure electric passenger vehicles in November 2025 were mainly Mexico's 19,344, Indonesia 17,503, Thailand 13517, the Philippines 12,562, Malaysia 9626, Turkey 9292, the United Kingdom 9096, Belgium 8953, Brazil 8504, and India's 8,288. The top five that increased over the same period were: Mexico 18,560, Indonesia 13,154, Turkey 8162, Malaysia 7047, and Thailand 5,396.

From January to November 2025, China's exports of pure electric passenger vehicles were mainly 195,309 to Belgium, 156,251 to the United Kingdom, 119835 to Thailand, 97267 to Indonesia, 96,427 to India, 96194 to Australia, 85514 to South Korea, and 70,828 to Brazil. Among them, the top five that increased this year over the same period last year were: Mexico 57750, Philippines 55763, Indonesia 47,409, Turkey 41,169, South Korea 35,648 vehicles.

In November 2025, exports of hybrid passenger cars were mainly 26,238 vehicles from Mexico, 24,193 from the United Kingdom, 8879 from Russia, 6792 from Brazil, 5,341 from Israel, 5007 from Kazakhstan, 4,752 from Spain, 4507 from Kyrgyzstan, and 4,449 from Argentina. Among them, the top five vehicles that increased over the same period were: Mexico 25,300, the United Arab Emirates 23,604, the United Kingdom, 6403, and Brazil 5426.

From January to November 2025, the exports of hybrid passenger cars were mainly 106,443 in Brazil, 93015 in Mexico, 92,849 in the United Arab Emirates, 68235 in the UK, 60,639 in Belgium, 57,171 in Israel, 40,679 in Spain, 36,843 in Russia, 25,679 in Australia, and 25,189 in Kazakhstan. Among them, the top five that increased this year over the same period last year were: the UAE 8,7928, Mexico 63264, the United Kingdom 55,970, Israel 53335, and Belgium 48,523 .

In November 2025, the export of passenger car ordinary hybrids was mainly 5330 in Italy, 5134 in Spain, 4474 in the United Arab Emirates, 4175 in Brazil, 2712 in the UK, 2,295 in Australia, 2267 in Israel, 2,178 in Argentina, 2126 in Poland, and 1,880 in the Netherlands. Among them, the top five that increased over the same period were: Italy 4520, Brazil 3179, Argentina 2,178, Spain 2,047, and Israel 1915.

From January to November 2025, the main passenger car common hybrids exported were the UAE's 82190, the UK's 42437, Italy's 32,278, Spain's 30,771, Brazil's 23,645, Australia's 19,331, Israel's 17,941, Mexico's 17,469, and France's 13,917. Among them, the top five that increased this year over the same period last year were: the UAE 34,969, Italy 23,873, the United Kingdom 17,306, Brazil 16,833, and Spain 1,607.

5. Export trends by truck category

1. Truck exports

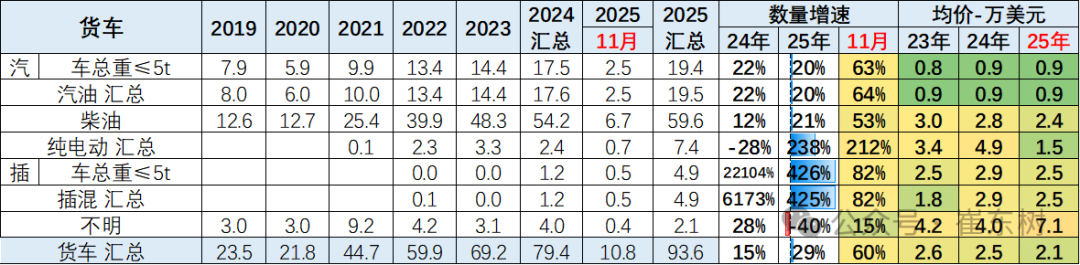

Export growth in the truck market has not been strong in recent years. The share of the automobile export market continued to shrink slightly, but in 2025, the performance was strong due to pure electric and plug-in hybrid performance.

The main force in the truck market is gasoline and diesel trucks under 5 tons. Overall, there is also strong demand for heavy diesel trucks over 20 tons.

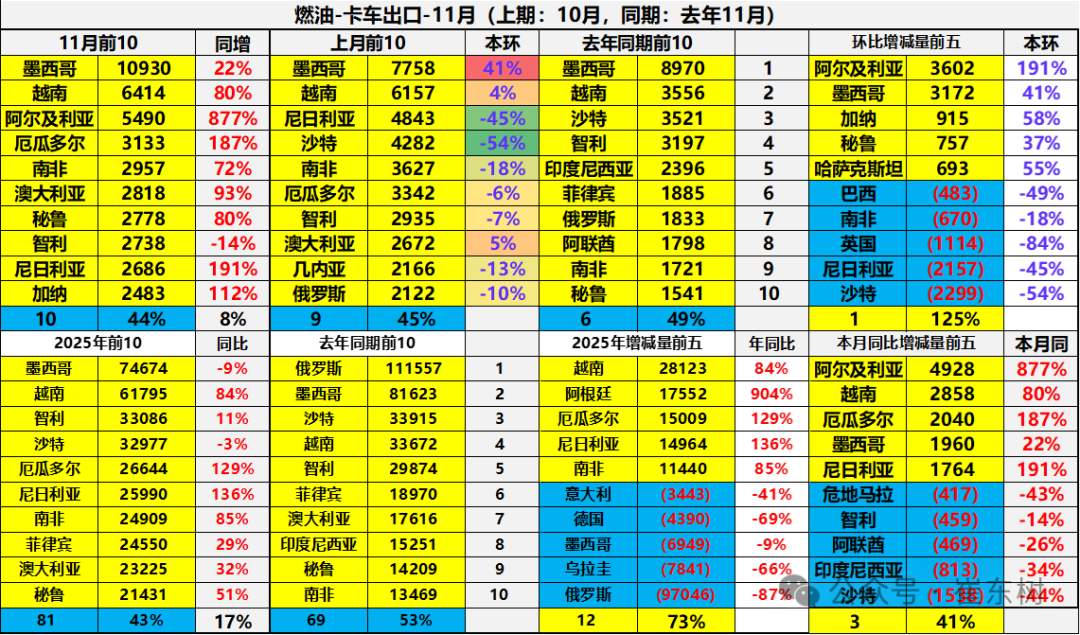

2. Characteristics of changes in the truck export market

The overall performance of the top few fuel truck export markets was stable. In November 2025, the main export markets were Mexico 10,930 vehicles, Vietnam 6414, Algeria 5490, Ecuador 3133, South Africa 2,957, Australia 2,818, Peru 2,778, Chile 2,838, Nigeria 2686, and Ghana 2,483 vehicles. Among them, the top five increased units over the same period were: Algeria 4928, Vietnam 2,858, Ecuador 2040, Mexico 1960, and Nigeria 1,764.

From January to November 2025, the main export markets for fuel trucks were Mexico 7,4674, Vietnam 61,795, Chile 3,3086, Saudi Arabia 3,2977, Ecuador 26,644, Nigeria 25,990, South Africa 24,909, the Philippines 24,550, Australia 23225, and Peru 2,1431. Among them, the top five that increased this year over the same period last year were: Vietnam 2,8123, Argentina 17552, Ecuador 1,5009, Nigeria 14,964, and South Africa 11,440.

The mixed truck export market has recently surged. This is mainly due to the sharp increase in the passenger car attributes of pickup trucks, creating a superior hybrid scenario convenience and cost advantage in overseas markets.

Currently, in the November export market, there are 2,399 Mexican vehicles, 1,058 Australian vehicles, 257 Brazil, 228 Chile, 204 Pakistan, 203 New Zealand, 140 Turkey, 72 South Africa, 70 Saudi Arabia, and 54 Ecuadorian vehicles. Among them, the top five that increased in the current period over the same period are: Australia 906, Mexico 465, Brazil 255, Pakistan 204, and Chile 178.

From January to November, a total of 22,506 vehicles were exported to Australia, 8,633 to Mexico, 4,370 to the Philippines, 1,840 from Chile, 1,572 from New Zealand, 1,513 from South Africa, 1,095 from Brazil, 838 from Pakistan, 753 from Colombia, and 735 from Ecuador. Among them, the top five that increased this year over the same period last year are: Australia 21,937, the Philippines 4112, Mexico 3,278, Chile, and 1,410 South Africa.

The export market for pure electric trucks has recently surged. This is mainly due to a sharp increase in the attributes of special vehicles, creating a strong scenario convenience and cost advantage in overseas markets.

Currently, 395 vehicles were exported to Japan, 386 to Belgium, 371 to the US, 358 to the Philippines, 347 to Uzbekistan, 300 from the Netherlands, 261 from Tanzania, 253 from Australia, 234 from the UK, and 215 from Indonesia. Among them, the top five vehicles that increased over the same period were: the US 371, Japan 359, Uzbekistan 345, the Philippines 317, and Belgium 303.

From January to November, a total of 6,458 vehicles have been exported from Uzbekistan, 5,832 from the US, 5824 from the UK, 3,899 from Russia, 2,827 from Thailand, 2,599 from Indonesia, 2,275 from the Philippines, and 2,064 from South Korea. Among them, the top five vehicles that increased this year over the same period last year are: 6,389 vehicles from Uzbekistan, 5612 from Belgium, 5016 from Russia, and 2,629 from Germany.

6. Export trends by passenger car category

1. Overall bus exports

Recently, world demand for buses has declined to a certain extent, causing China's bus exports to continue to shrink in the previous two years, from 64,000 vehicles in 2019 to 48,000 units in 2022.

World demand has recovered since 2023, with China reaching 82,000 buses for the full year of 2024, an increase of 16%.

The performance of pure electric bus exports increased by 57% from January to November 2025. Diesel bus exports increased significantly, and gasoline light passenger exports were strong.

2. Characteristics of changes in the bus export market

China's main fuel bus export market is scattered, mainly from underdeveloped countries. The market is complex, making it difficult to continue exporting in an orderly manner.

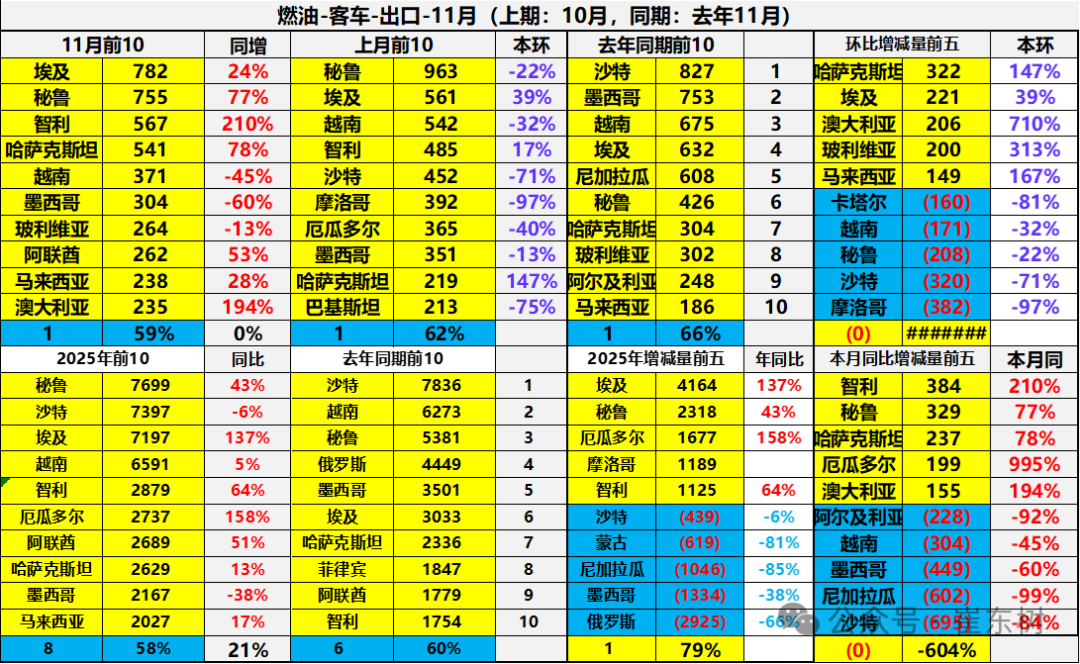

The main fuel bus exports in November this year were: Egypt 782, Peru 755, Chile 567, Kazakhstan 541, Vietnam 371, Mexico 304, Bolivia 264, UAE 262, Malaysia 238, and Australia 235. Among them, the top five that increased over the same period were: Chile 384, Peru 329, Kazakhstan 237, Ecuador, and 155 Australia.

The main fuel bus exports from January to November this year were: Peru's 7699 vehicles, Saudi Arabia's 7397, Egypt's 6591, Vietnam's 2,879 vehicles, Ecuador's 2,637, UAE's 2,689, Kazakhstan's 2,629, Mexico's 2,167, and Malaysia's 2027 vehicles. Among them, the top five that increased this year over the same period last year were: Egypt 4164, Peru 2,318, Ecuador 1677, Morocco 1,189, Chile 1,125.

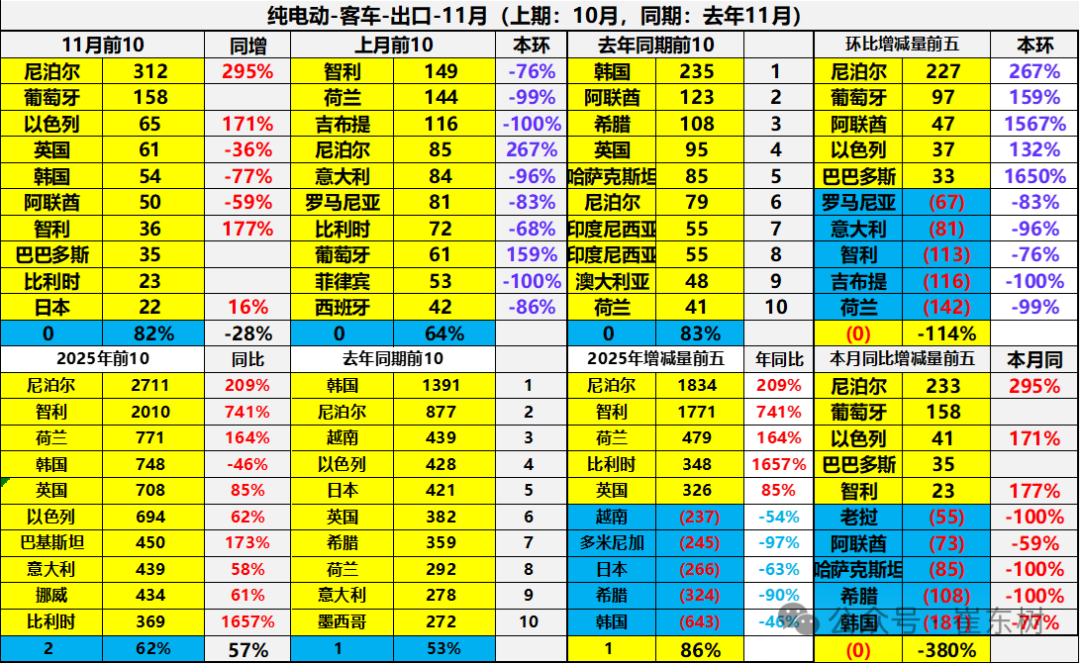

The export market for pure electric buses is small, and the data fluctuates greatly. The main export forces in November this year were: Nepal 312, Portugal 158, Israel 65, the United Kingdom 61, South Korea 54, the United Arab Emirates 50, Chile 36, Barbados 35, Belgium 23, and Japan 22. Among them, the top five that increased over the same period were: Nepal 233, Portugal 158, Israel 41, Barbados 35, Chile 23.

The main exporters of pure electric buses from January to November this year were 2,711 in Nepal, 2010 in Chile, 771 in the Netherlands, 748 in South Korea, 708 in the UK, 694 in Israel, 450 in Pakistan, 439 in Italy, 434 in Norway, and 369 in Belgium. Among them, the top five that increased this year over the same period last year were: 1,834 in Nepal, 1,771 in Chile, 479 in the Netherlands, 348 in Belgium, and 326 in the UK.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal