Does StoneCo’s (STNE) $26.8 Million Settlement Clarify Past Risks Or Reshape Its Capital Priorities?

- In December 2025, Labaton Keller Sucharow LLP announced that StoneCo and lead plaintiff Indiana Public Retirement System reached a proposed US$26,750,000 settlement to resolve securities litigation covering investors who bought StoneCo shares between May 27, 2020 and November 16, 2021, with a court hearing set for February 27, 2026.

- The proposed settlement, which StoneCo accepts without admitting wrongdoing, could reduce legal uncertainty for investors while formalizing the scope of past alleged disclosure issues.

- Next, we’ll examine how resolving this securities case and the planned payout may influence StoneCo’s capital allocation and broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

StoneCo Investment Narrative Recap

To own StoneCo, you need to believe in Brazil’s ongoing shift to digital payments and in StoneCo’s ability to grow profitably while managing credit and competition risks. The proposed US$26,750,000 securities settlement looks manageable relative to the business and, if approved, mainly helps clear a legal overhang without changing the key near term catalysts or the biggest current risks around credit quality and slower TPV growth.

The recent acceleration in share buybacks, with BRL 652.56 million spent to repurchase 2.89% of shares by Q3 2025 under the current program, is the most relevant backdrop to this settlement. Together, they highlight how StoneCo is using its balance sheet, both to address legacy legal issues and to concentrate future returns among remaining shareholders, while investors watch whether earnings growth can keep up with higher expectations.

Yet, while legal uncertainty may ease, investors should be aware that StoneCo’s expanding credit portfolio still...

Read the full narrative on StoneCo (it's free!)

StoneCo's narrative projects R$17.4 billion revenue and R$5.0 billion earnings by 2028. This requires 8.2% yearly revenue growth and an earnings increase of about R$6.3 billion from R$-1.3 billion.

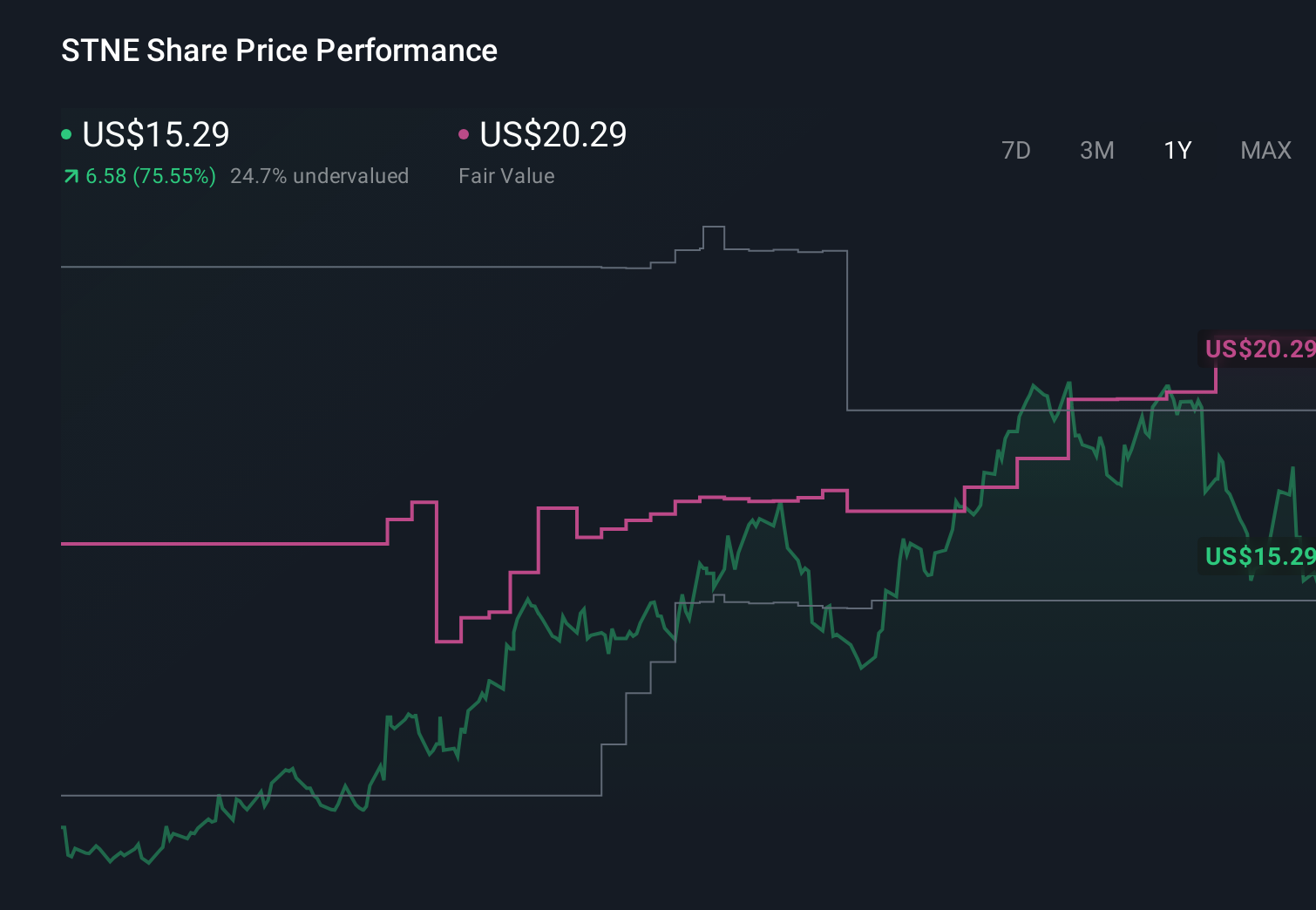

Uncover how StoneCo's forecasts yield a $20.29 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly US$15.52 to US$33.60, showing how far apart individual views can be. Against that backdrop, the legal settlement’s limited financial impact but meaningful reduction in uncertainty may shape how you weigh StoneCo’s growth catalysts against its ongoing credit and TPV risks.

Explore 8 other fair value estimates on StoneCo - why the stock might be worth over 2x more than the current price!

Build Your Own StoneCo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StoneCo research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free StoneCo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StoneCo's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal