Deutsche Post (XTRA:DHL) Valuation Check After 46% One-Year Gain and Recent Pause in Share Price

Deutsche Post (XTRA:DHL) has been quietly rewarding patient investors, with the stock up roughly 24% over the past 3 months and around 46% over the past year, outpacing many European peers.

See our latest analysis for Deutsche Post.

That strength has come despite a slightly softer 7 day share price return of around negative 1 percent, which looks more like a breather than a reversal when you set it against the roughly 46 percent 1 year total shareholder return and improving profit profile.

If Deutsche Post's momentum has you thinking about what else is working in transport and logistics, this could be a good moment to explore fast growing stocks with high insider ownership.

With earnings still growing and the shares trading above consensus targets, yet at a sizable discount to some intrinsic estimates, is Deutsche Post a clear value opportunity or is the market already pricing in its next leg of growth?

Most Popular Narrative: 4.3% Overvalued

Compared with Deutsche Post's last close at €46.58, the most followed narrative pegs fair value slightly lower, hinting at modest overenthusiasm in the current price.

Structural growth in e commerce remains intact, with Deutsche Post maintaining targeted investments in its eCommerce division and logistics automation, positioning the company to benefit from the continued global shift to online retail supporting long term revenue growth.

Curious how steady revenue growth, margin rebuild and a lower discount rate can still point to limited upside at today’s price? See how the narrative connects every assumption into one tight valuation story and what it really implies for long term earnings power.

Result: Fair Value of €44.66 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting regulation on low value shipments and persistent global trade weakness could still weigh on Express volumes and delay the anticipated earnings recovery.

Find out about the key risks to this Deutsche Post narrative.

Another Angle on Valuation

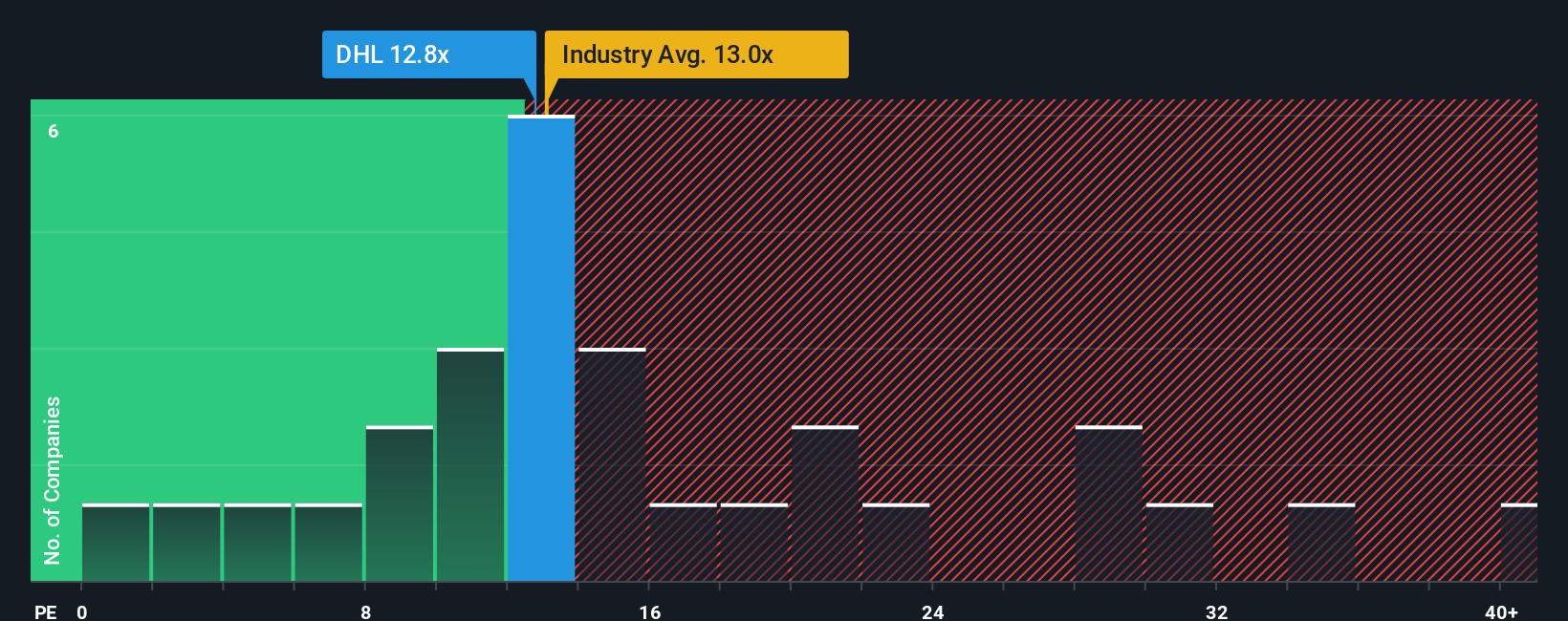

On our numbers, Deutsche Post looks much cheaper when you step back from narrative fair value and focus on the price to earnings ratio. At 14.8 times earnings versus a fair ratio of 16 times, the stock screens as good value rather than stretched.

Compared with both the European logistics group at 14.8 times and peers nearer 19.9 times, that gap suggests more of a margin of safety than the most popular narrative implies. Is the market underestimating DHL's earnings resilience, or are analysts being too cautious with their targets?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Deutsche Post Narrative

If this perspective does not quite fit your view, or you prefer to dive into the numbers yourself, you can build a fresh narrative in just minutes, Do it your way.

A great starting point for your Deutsche Post research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next move?

Before momentum shifts again, lock in your next set of opportunities using the Simply Wall St Screener, built to surface ideas most investors overlook.

- Capture mispriced potential by targeting companies trading below intrinsic value with these 898 undervalued stocks based on cash flows before the broader market catches on.

- Ride powerful emerging themes by zeroing in on innovation leaders through these 24 AI penny stocks while their growth stories are still building.

- Strengthen your portfolio income by focusing on reliable payouts using these 11 dividend stocks with yields > 3% rather than waiting for yields to compress.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal