Deere (DE): Taking Stock of Valuation After a Recent Pullback in Shares

Deere (DE) has quietly slipped about 3% over the past month, even as its year to date return still sits in the low teens. That disconnect is exactly where the valuation story starts to get interesting for long term investors.

See our latest analysis for Deere.

The latest pullback comes after a strong run, with Deere still posting a double digit year to date share price return and a robust five year total shareholder return. This suggests momentum is pausing rather than breaking as investors reassess growth and cyclical risk.

If Deere’s recent moves have you thinking about where else value might be building, it could be worth exploring auto manufacturers as another way to gain exposure to machinery and mobility trends.

With Deere trading at a discount to both analyst targets and some intrinsic value models despite steady revenue and sharply rising earnings, investors now face a key question: is this a genuine buying opportunity, or is future growth already priced in?

Most Popular Narrative Narrative: 10.4% Undervalued

With Deere last closing at $470.57 against a narrative fair value near $525, the story leans toward upside as long term earnings power builds.

Rapid adoption of Deere's precision agriculture and automation solutions (for example, JDLink Boost, Precision Essentials bundles, See & Spray tech, and new automation features) is driving higher value product sales and increased software engagement globally, positioning Deere to benefit from shifts toward high efficiency, technology enabled farming; this should lift both future revenue and net margins through higher margin recurring software and data services.

Curious how modest top line expectations can still justify a richer future earnings multiple and higher fair value? The narrative leans heavily on margin expansion, subscription scale, and disciplined capital returns to bridge that gap. Want to see exactly how those moving parts add up in the model?

Result: Fair Value of $525.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising tariffs and a deeper than expected North American equipment downturn could squeeze margins and delay the earnings recovery built into this valuation.

Find out about the key risks to this Deere narrative.

Another Angle on Valuation

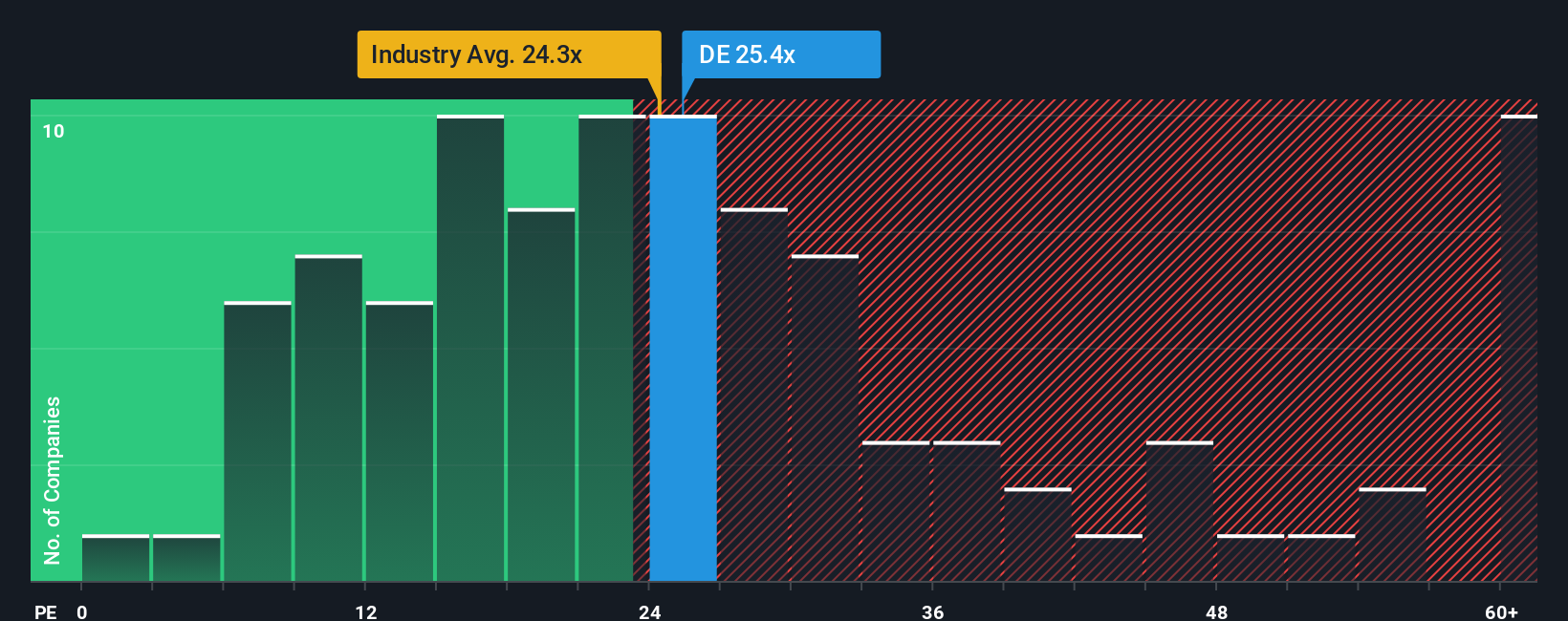

On a simple price to earnings lens, Deere looks less generous. The shares trade around 25.3 times earnings, slightly richer than peers at 23.9 times but still below a fair ratio of 34.4 times. This suggests some potential upside but also less of a margin for error if the cycle disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Deere Narrative

If you see the story differently, or prefer to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Deere research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Deere in context by comparing it with other compelling opportunities, so you do not miss what the broader market is quietly pricing in.

- Target long term compounding potential by reviewing these 898 undervalued stocks based on cash flows that pair strong cash flow support with prices the market has not fully appreciated yet.

- Tap into the next wave of innovation by scanning these 24 AI penny stocks riding structural shifts in automation, data infrastructure, and intelligent software adoption.

- Strengthen your income stream by focusing on these 12 dividend stocks with yields > 3% that combine attractive yields with balance sheets that can sustain payouts through cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal