3 Asian Growth Companies With Insider Ownership And Up To 53% Earnings Growth

Amidst a backdrop of mixed economic signals and monetary policy shifts in Asia, investors are increasingly focused on identifying growth opportunities within the region's evolving market landscape. In this context, companies with high insider ownership and significant earnings growth potential can offer compelling prospects, as insider stakes may indicate confidence in the company's future trajectory.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.9% | 54.3% |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Underneath we present a selection of stocks filtered out by our screen.

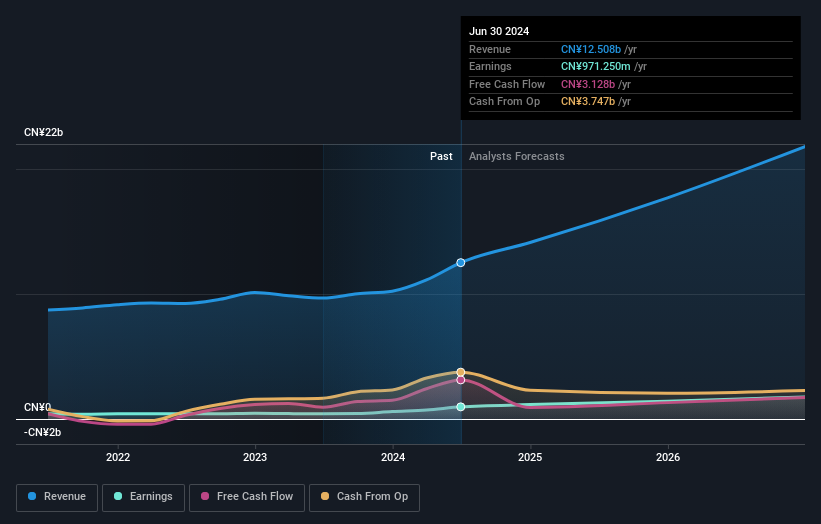

Ninebot (SHSE:689009)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ninebot Limited is involved in the design, R&D, production, sale, and servicing of transportation and robot products globally with a market cap of CN¥42.43 billion.

Operations: Ninebot Limited's revenue is primarily derived from its transportation and robot product segments.

Insider Ownership: 14.4%

Earnings Growth Forecast: 25.9% p.a.

Ninebot's earnings grew by 60% over the past year, with sales for the nine months ending September 2025 reaching CNY 18.39 billion, up from CNY 10.91 billion a year earlier. Despite trading at a significant discount to its estimated fair value and analysts expecting a price rise of nearly 40%, its forecasted revenue growth of 18.9% per year lags behind market expectations. Earnings are projected to grow significantly but slower than the CN market rate.

- Dive into the specifics of Ninebot here with our thorough growth forecast report.

- According our valuation report, there's an indication that Ninebot's share price might be on the cheaper side.

Guangzhou Tinci Materials Technology (SZSE:002709)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Tinci Materials Technology Co., Ltd. is involved in the research, development, production, and sale of fine chemical materials both in China and internationally, with a market cap of CN¥77.34 billion.

Operations: The company generates revenue of CN¥14.50 billion from its fine chemical industry segment.

Insider Ownership: 39.7%

Earnings Growth Forecast: 53.5% p.a.

Guangzhou Tinci Materials Technology has shown strong growth, with earnings rising by 18.7% over the past year and revenue reaching CNY 10.84 billion for the first nine months of 2025, up from CNY 8.86 billion a year ago. Analysts forecast significant annual profit growth of over 53%, outpacing the Chinese market's average, while revenue is expected to grow at an impressive rate of 27.2% annually despite recent share price volatility.

- Click here and access our complete growth analysis report to understand the dynamics of Guangzhou Tinci Materials Technology.

- The valuation report we've compiled suggests that Guangzhou Tinci Materials Technology's current price could be inflated.

Guangdong Create Century Intelligent Equipment Group (SZSE:300083)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangdong Create Century Intelligent Equipment Group Corporation Limited, with a market cap of CN¥15.94 billion, is involved in the research, development, production, and sale of high-end intelligent equipment in China.

Operations: Revenue segments for Guangdong Create Century Intelligent Equipment Group Corporation Limited are not provided in the given text.

Insider Ownership: 17.9%

Earnings Growth Forecast: 28.7% p.a.

Guangdong Create Century Intelligent Equipment Group demonstrates robust growth, with earnings increasing by 63.9% over the past year and revenue reaching CNY 3.83 billion for the first nine months of 2025, up from CNY 3.28 billion previously. Analysts predict annual earnings growth of 28.7%, surpassing market averages, while revenue is expected to grow at a steady rate of 15% annually. The company's insider ownership remains significant, supporting its strategic direction amidst recent governance changes and shareholder meetings.

- Navigate through the intricacies of Guangdong Create Century Intelligent Equipment Group with our comprehensive analyst estimates report here.

- The analysis detailed in our Guangdong Create Century Intelligent Equipment Group valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Gain an insight into the universe of 634 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal