Rhythm Pharmaceuticals (RYTM): Reassessing Valuation After an 87% Year-to-Date Biotech Rally

Rhythm Pharmaceuticals (RYTM) has quietly turned into one of this year’s stronger biotech performers, with the stock up about 87% year to date and roughly doubling over the past year.

See our latest analysis for Rhythm Pharmaceuticals.

That move has come with real momentum behind it, with a roughly 10% 1 month share price return feeding into an almost 87% year to date gain and a standout 1 year total shareholder return just over 100%.

If Rhythm’s run has you rethinking your biotech exposure, it might be a good moment to explore other specialised opportunities across healthcare stocks and see what else fits your strategy.

With revenue growing fast but profits still elusive, and the share price already near, though not at, analyst targets, is Rhythm Pharmaceuticals now a compelling entry point, or has the market largely priced in its future growth?

Most Popular Narrative: 18.8% Undervalued

With the most followed narrative placing Rhythm Pharmaceuticals’ fair value well above the recent 112.14 close, the story leans heavily on future obesity indications and margin expansion.

Upcoming potential regulatory approvals and launches for setmelanotide (IMCIVREE) in new indications like acquired hypothalamic obesity and Prader Willi syndrome, alongside expansion into younger age groups, are set to materially grow Rhythm's commercial opportunity and topline over the next several years.

Curious how aggressive revenue ramps, rising margins, and a punchy future earnings multiple can all coexist in one model? Unpack the full blueprint behind this valuation call.

Result: Fair Value of $138.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in setmelanotide trials or tougher global reimbursement and pricing decisions could quickly challenge the growth and valuation assumptions baked into today’s narrative.

Find out about the key risks to this Rhythm Pharmaceuticals narrative.

Another Angle on Valuation

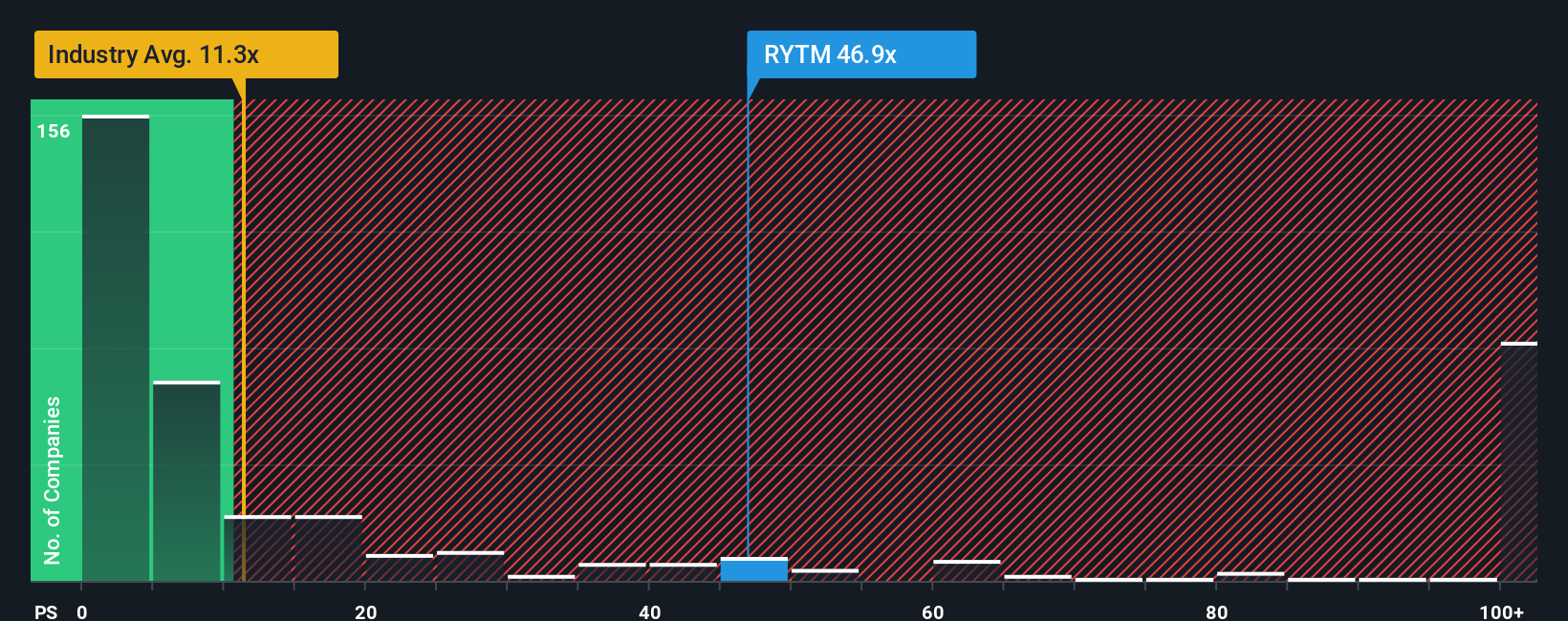

While the narrative model sees Rhythm as 18.8% undervalued, the market’s current price to sales of 42.9 times looks rich against biotech peers at 12.1 times and even its own fair ratio of 23.2 times. This raises the question of whether execution can truly sustain such a premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rhythm Pharmaceuticals Narrative

If you see the story differently or prefer to test your own assumptions against the numbers, you can build a custom view in under three minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Rhythm Pharmaceuticals.

Ready for more investment ideas?

Instead of stopping at one compelling story, use the Simply Wall St Screener to spot your next moves before the rest of the market catches on.

- Capitalize on mispriced opportunities by targeting these 899 undervalued stocks based on cash flows that could offer outsized long term returns as sentiment catches up to fundamentals.

- Position yourself for the next wave of innovation by zeroing in on these 24 AI penny stocks pushing the boundaries of automation, data, and intelligent software.

- Strengthen your income stream by focusing on these 12 dividend stocks with yields > 3% that can potentially add stability and cash flow to a growth oriented portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal