Reassessing GCL Technology Holdings (SEHK:3800)’s Valuation After New Coal Supply Deal and Updated ESG Rating

GCL Technology Holdings (SEHK:3800) has landed back on investor radars after refreshing its 2026 to 2028 coal supply framework with Jiangsu Zhongneng and securing an updated ESG rating from Sustainable Fitch.

See our latest analysis for GCL Technology Holdings.

The HK$1.10 share price has seen a modest 7 day share price return of 2.8 percent, but a weaker 90 day share price return of negative 12.7 percent and a three year total shareholder return of negative 42.5 percent suggests momentum is still rebuilding despite the latest supply and ESG updates.

If GCL’s story has you reassessing the energy transition, it could be worth exploring high growth tech and AI stocks for other innovators that might be earlier in their growth runway.

With revenues growing but profits under pressure and the share price still well below analyst targets, is GCL an overlooked clean energy enabler at a discount, or is the market already pricing in any recovery and future growth?

Price to Sales of 2.8x: Is it justified?

On a price to sales basis, GCL Technology Holdings trades at 2.8x, which makes the HK$1.10 share price look demanding relative to several benchmarks.

The price to sales multiple compares the company’s market value to its annual revenue, a common way to value high growth or loss making semiconductor names where earnings are volatile or negative.

In GCL’s case, investors are paying more per unit of sales than the broader Hong Kong semiconductor industry, where the average multiple sits at around 2.1x. The SWS fair price to sales ratio suggests an even lower level of about 1.4x could be a more reasonable anchor if sentiment or growth expectations cool.

That said, the stock screens cheaper than a narrower peer set on the same metric. Its 2.8x price to sales ratio is below the peer average of roughly 3.3x, highlighting how the market is still assigning a revenue premium versus the wider industry while not fully matching the optimism embedded in closer comparables.

Explore the SWS fair ratio for GCL Technology Holdings

Result: Price to Sales of 2.8x (OVERVALUED)

However, steep recent losses, ongoing net income pressure, and a sizable discount to analyst targets could reflect structural challenges rather than a temporary setback.

Find out about the key risks to this GCL Technology Holdings narrative.

Another View: DCF Points to Deep Value

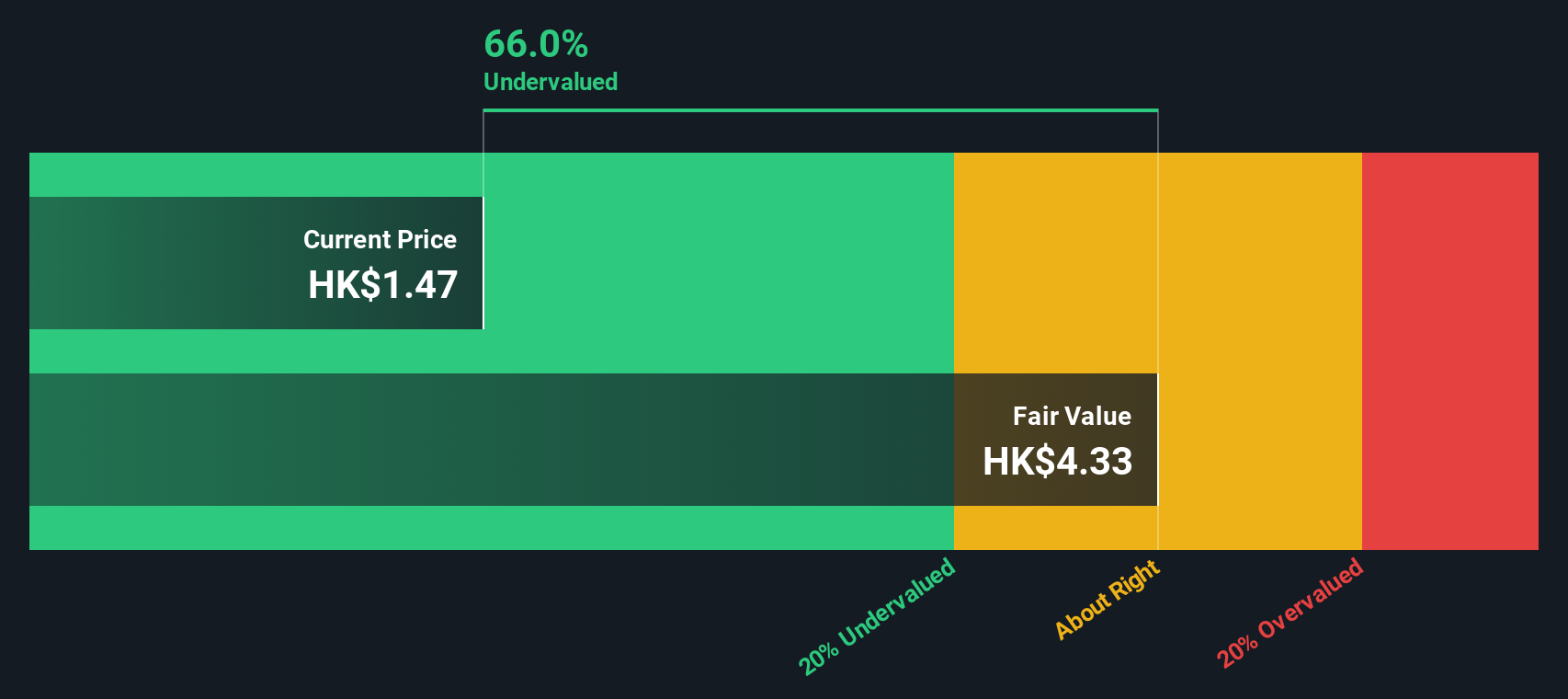

While the 2.8x price to sales ratio looks stretched, our DCF model implies far more upside, with a fair value around HK$3.91 per share, roughly 72 percent above the current HK$1.10 price. Is the multiple rich, or is the market missing the cash flow story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GCL Technology Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GCL Technology Holdings Narrative

If you see the numbers differently or prefer your own deep dive, you can craft a complete, personalised view in minutes: Do it your way.

A great starting point for your GCL Technology Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, explore your next opportunities with targeted stock ideas built from hard numbers, not hype, to help you stay aligned with the market.

- Identify potential multi baggers early by scanning these 3628 penny stocks with strong financials where financial strength helps separate fragile stories from genuine up and comers.

- Position your portfolio in the center of intelligent automation by focusing on these 24 AI penny stocks linked to the growth of AI spending globally.

- Use market pessimism to your advantage by examining these 899 undervalued stocks based on cash flows that trade below their cash flow characteristics, regardless of current sentiment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal